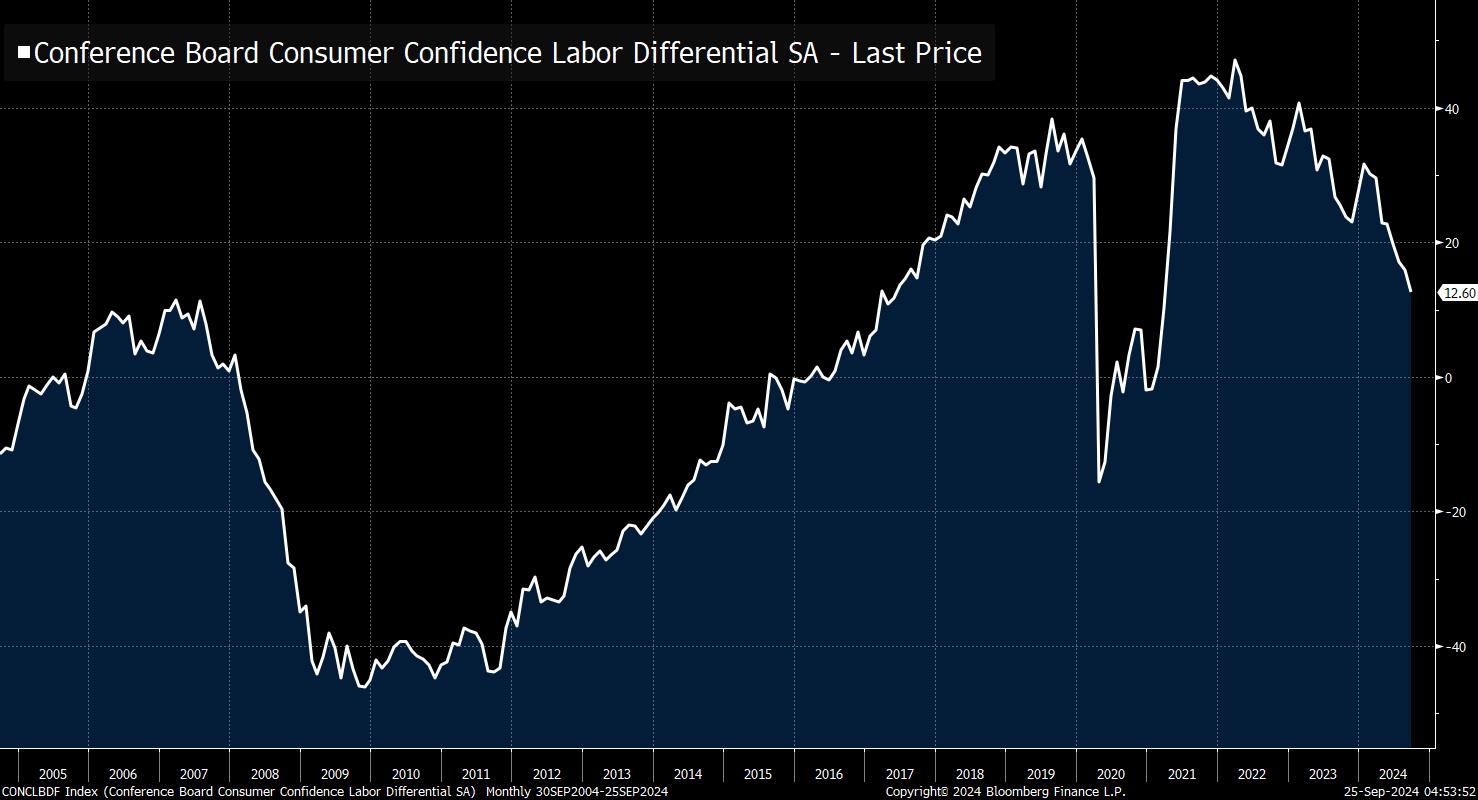

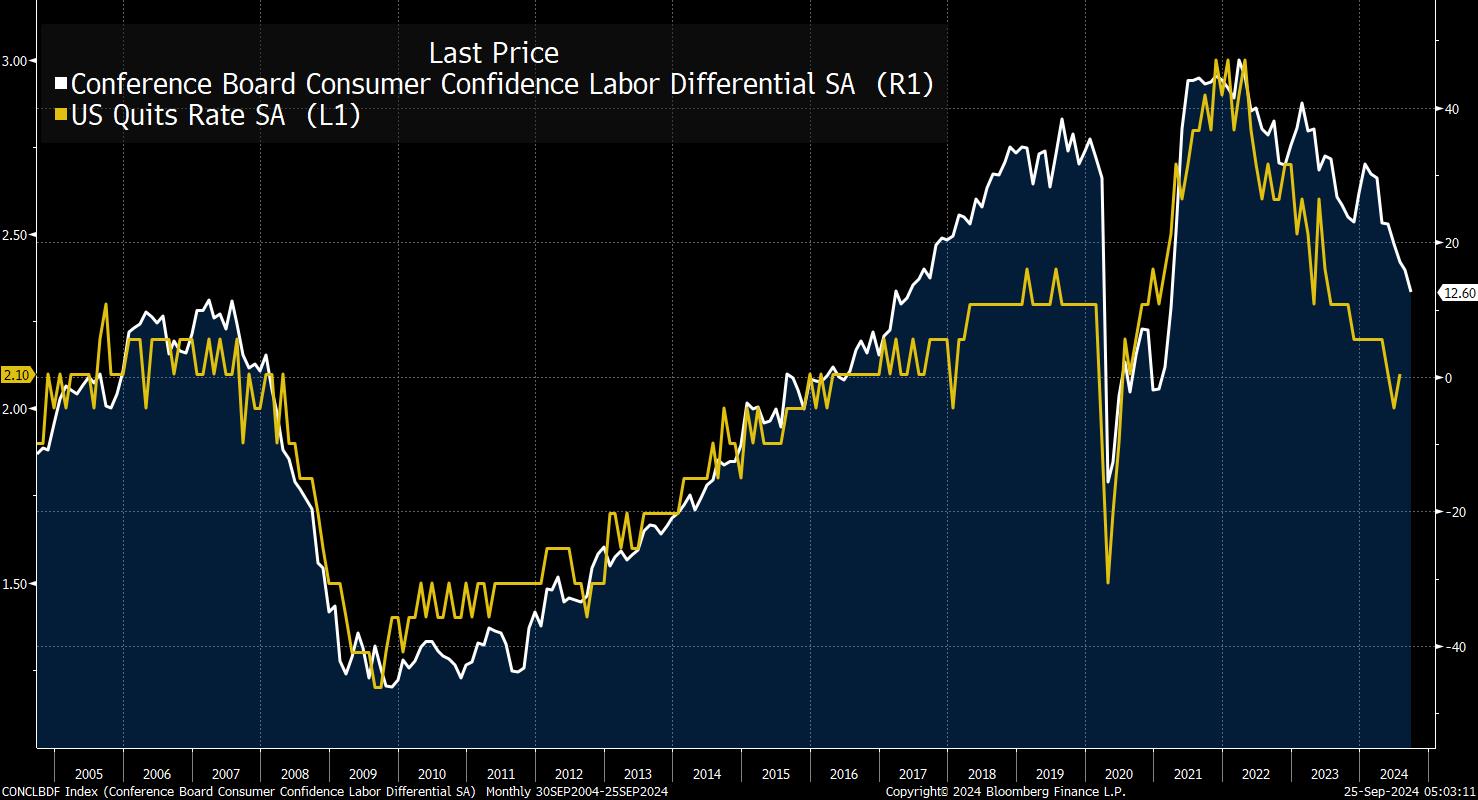

| Good morning. US Stocks look set to slip after the S&P 500 posted its 41st record of the year, Asian shares get a boost from China and Gold hits another all-time peak. Here's what traders are talking about. — David Goodman Want to receive this newsletter in Spanish? Sign up to get the Five Things: Spanish Edition newsletter. US stock futures edged lower on Wednesday after the S&P 500 finished the previous day with its 41st record-high close of the year. Futures contracts pointed to a drop of 0.3% for the benchmark index today, while Europe's Stoxx 600 gauge edged lower. Treasuries and the dollar steadied. It was a different story in Asia, where stocks got a boost from China's moves to stimulate the economy. The nation's central bank lowered the interest rate charged on its one-year policy loans by the most on record on Wednesday, backing up Tuesday's broad package that amounted to an adrenaline shot. The yuan rallied past the 7 per dollar milestone for the first time in 16 months, while gains for the onshore benchmark CSI 300 Index left it on track to wipe out all of its losses for 2024. Gold hit a fresh record on Wednesday as the precious metal continues to draw strength from bets on deeper rate cuts. Bullion climbed to an all-time high of $2,670.57 an ounce earlier on Wednesday, before paring gains. The metal has surged 29% this year, while silver has risen 34% — with the rallies gaining momentum after the Fed's half-point cut last week. Lower rates tend to benefit both gold and silver as they don't offer interest, while a weaker dollar makes the metals cheaper for many buyers. German software developer SAP tumbled in Frankfurt after Bloomberg reported that the firm, along with product reseller Carahsoft Technology and other companies, are being probed by US officials for potentially conspiring to overcharge government agencies over the course of a decade. The civil investigation poses a legal risk to a top technology vendor to the US government and to Germany's most valuable company. The OECD sounded an upbeat note on the global economy in its latest update, saying the world is settling into a newfound stability as the stress of strong inflation eases, allowing central banks to keep cautiously loosening policy. Price increases will be at target in most Group of 20 nations by the end of 2025, it said, while cautioning that major central banks should depend on data and take a "prudent" approach to cutting interest rates. This is what's caught our eye over the past 24 hours. Employment expectations are deteriorating. Yesterday we got the latest Conference Board consumer sentiment number, and it showed a continued slide in the Labor Differential Index (the gap between the number of respondents who say that jobs are plentiful vs. those that say jobs are hard to get.) Back in August, after Powell's Jackson Hole speech, I wrote about the under-discussed concept of Employment Expectations. The basic idea is that if people perceive the job market to be worsening, they're likely to save more and spend less. That means less business revenue, which means less need to hold onto workers (or hire). And that means higher unemployment. It works from the business side as well. If companies expect the unemployment rate to rise, there's less desire to hold onto workers, because firms can feel safe with the knowledge that next time demand quickens, there will be unemployed workers for them to hire back. People talk a lot about inflation expectations and how they represent a kind of self-fulfilling prophecy, which is why central bankers talk all the time about keeping them stable. Employment expectations get relatively less airplay, but the logic is roughly similar. I think part of the reason the Fed went 50 earlier this month was to keep employment expectations in check. Well... yesterday's news would suggest that on that front there's more work to do. BTW, all survey data is fraught. So yes, grain of salt and all that. But as I've been observing for years now, this particular survey measure aligns very nicely with the hard data of quits that we get in the JOLTS report. So I'd say it's a series worth taking seriously. Joe Weisenthal is the co-host of Bloomberg's Odd Lots podcast. Follow him on X @TheStalwart Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

No comments:

Post a Comment