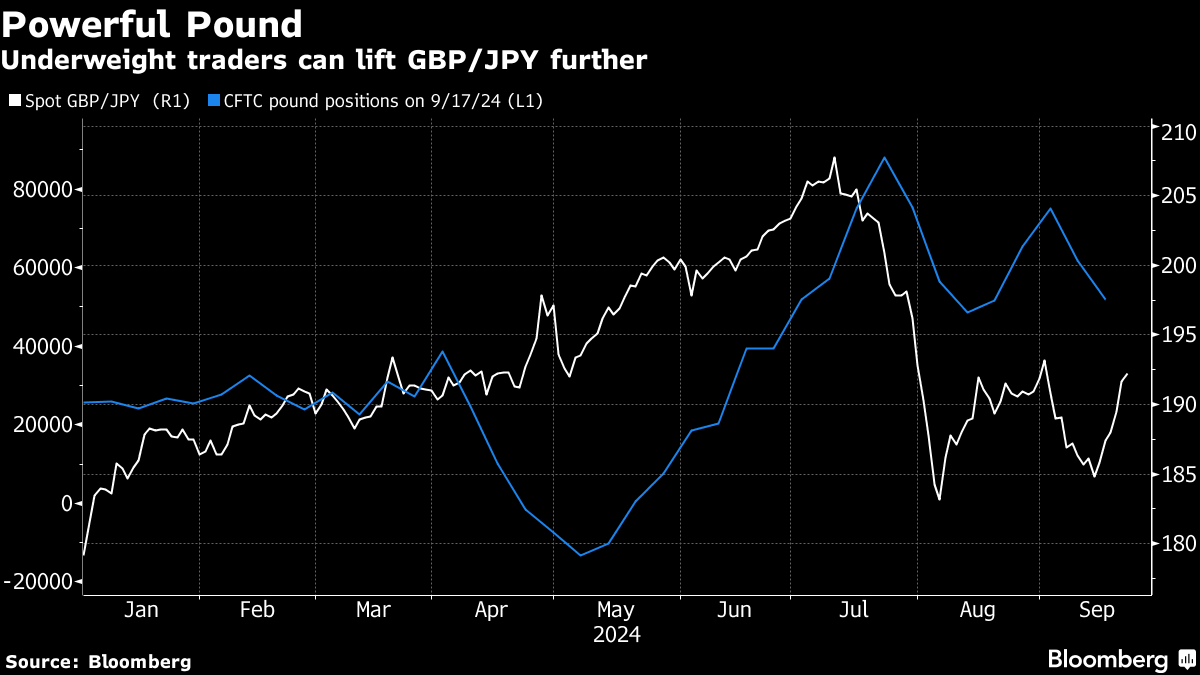

| The British pound's advance against the yen can run further as investors adjust to Bank of England interest rates staying higher for longer while the Bank of Japan appears to be deferring its next hike by several months. The pound was already gaining traction as an outperformer in the G-10 currency space due to downward pressure on euro-pound after the European Central Bank lowered rates for a second time in this cycle. That momentum will be amplified as the BOJ has dampened the outlook for a rate increase in October, with January becoming a more likely candidate for the next move. Even if the BOE does cut the official rate again before the BOJ increases, traders will be cautious about turning aggressively bullish on the yen until Governor Kazuo Ueda clearly reverts to a hawkish tone. Meanwhile, leveraged accounts recently reduced net long sterling exposure, leaving room for traders to rebuild positions amid broad US dollar weakness. In contrast, yen positioning is close to neutral after bears were squeezed out of the market during the August turmoil. That will likely tilt pound-yen further to the upside should upcoming economic data support the outlook. The first test this week will be a reading of Tokyo inflation which is forecast to show core CPI falling to 2%, a level even lower than where it was at the end of last year. Then that would be a catalyst for fresh yen selling, especially against major peers such as the pound. Mark Cranfield is a macro strategist for Bloomberg's Markets Live team, based in Singapore. |

No comments:

Post a Comment