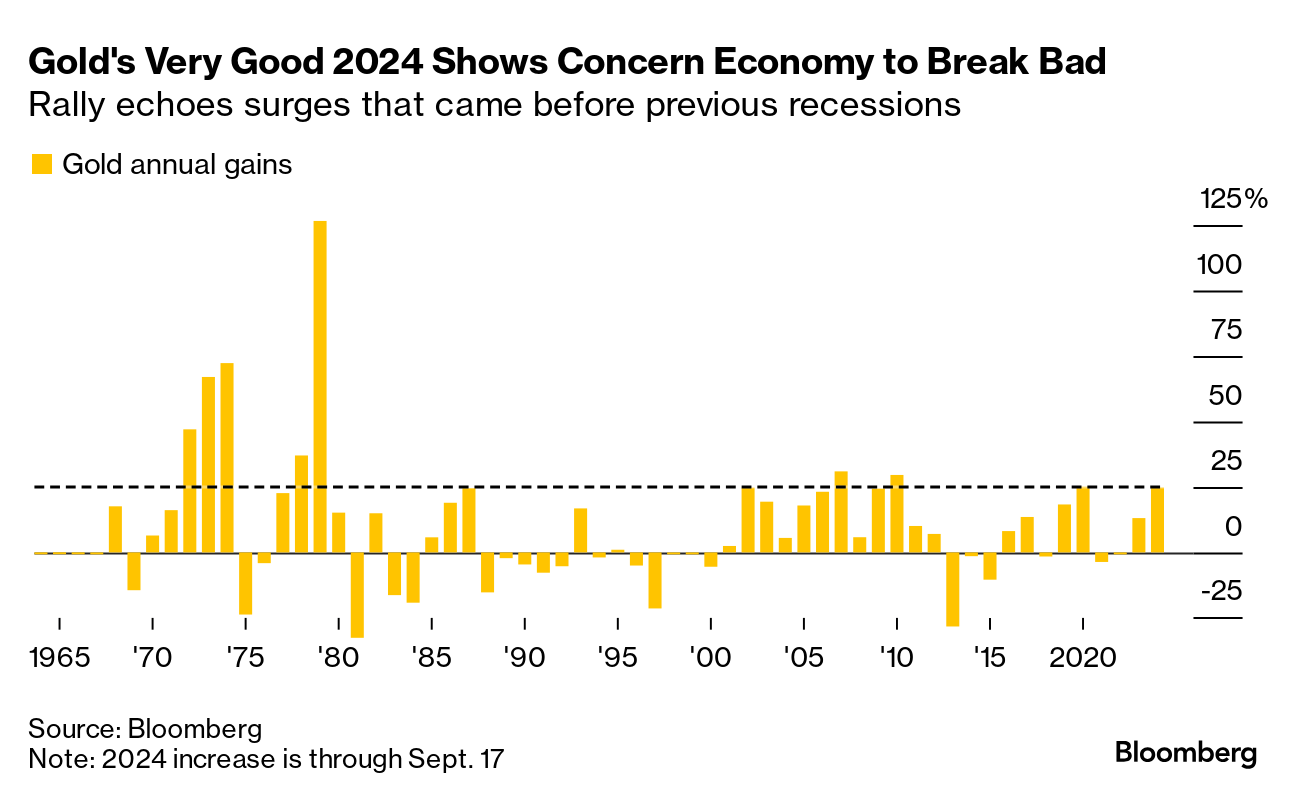

| Gold's impressive gains this year have had a number of drivers but its recent strength owes much to concerns the US is heading for a recession. That makes the precious metal a vital lodestone for investors after the Federal Reserve delivers its decision on Wednesday, as they seek guidance on whether the soft economic landing Chairman Jerome Powell has target remains achievable. Bullion's surge in the first half of 2024 owed less to US economic concerns, coming as it did at a time when traders were frantically winding back bets on Fed rate cuts. Instead, demand came from central banks seeking to diversify their reserves, along with strong retail interest out of China amid a property market downturn. Simmering geopolitical concerns also helped. While all of those drivers retain some strength, recent advances are being accompanied by a revival in ETF holdings backed by bullion that coincides with the Fed's definitive pivot toward rate cuts. That shows investors becoming anxious that the landing for the US economy will be a hard one. Gold normally outperforms equities into and during recessions. And it has also showed a tendency this century to rise in the lead-up to presidential elections, so it's no real surprise to see it showing such strength this year. There's some scope for gold to climb even before the Fed decision if Middle East tensions escalate after Hezbollah blamed Israel for an attack that killed a number of people and left almost 3,000 wounded across Lebanon. But the time to keep a closer eye on the yellow metal will come when the FOMC reveals its immediate decision and its summary of economic projections. Those guidelines will have the potential to ramp up or cool down recession fears -- seeing gold bust above $26,000 would be a clear sign that the economic angst levels are intensifying. As things stand bullion's 25% surge this year puts it on track for the sort of annual gains seen in 2007, 2020 and other periods when the economy was headed for a very hard landing indeed. Garfield Reynolds leads Bloomberg's Markets Live blog in Asia and is based in Sydney. |

No comments:

Post a Comment