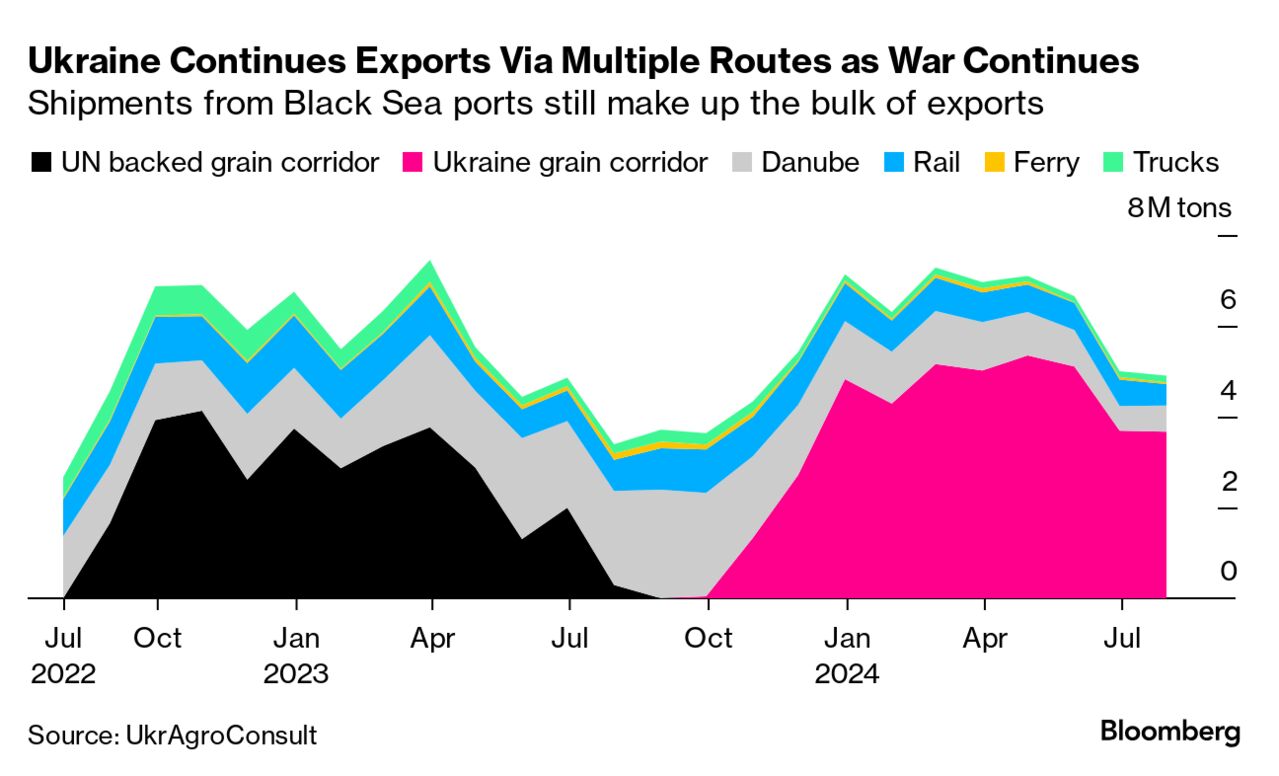

| When Russia's invasion blocked Ukraine's Black Sea ports, grain traders turned to river, rail and road routes to keep crop exports flowing. Fast forward to today, and crucial deep-sea ports are again shipping out hefty amounts. Yet major merchant Nibulon plans to keep exporting large volumes via much more expensive river routes. While river cargoes barely turn a profit for the company, its CEO says it's important to have a ready-to-use alternative in case Russian attacks cripple Odesa's ports again. He also expects it to have the knock-on effect of discouraging Russian strikes on Black Sea terminals as it makes such attacks less debilitating to the export industry. "The very fact that we have alternatives provides protection for Odesa ports," Nibulon CEO Andriy Vadaturskyy said in an interview. That's "because Russia will understand that its spending for missile strikes will not deliver the effect they look for and the shipments will not stop." Ukraine is a key grain supplier, sending staples like wheat and corn around the world, most of which traditionally goes via the Black Sea. Using whatever export routes are available since the war began has helped to keep a lid on global prices and bring in vital income for Kyiv. The country's deep-sea ports have continually been attacked by Russia. River operations that send smaller ships to destinations such as Europe or Egypt, or to Romania for transshipment, have also been attacked. A missile hit a Louis Dreyfus facility in Odesa on Wednesday, though the company said there should be no material disruptions to terminal operations. Half of Nibulon's shipments currently go through the Black Sea and half via the Danube River, where export costs are about $6-$7 a ton higher. Nibulon's Danube routes are currently operating at about a third of capacity, Vadaturskyy said. The unused capacity could be crucial if traders need to suddenly switch more volume away from Black Sea terminals. "We should not think that exports through Odesa ports are guaranteed," the CEO said. "This is the right time to prepare for any challenges and have alternatives when the economy suffers." —Kateryna Chursina in Kyiv and Áine Quinn in London |

No comments:

Post a Comment