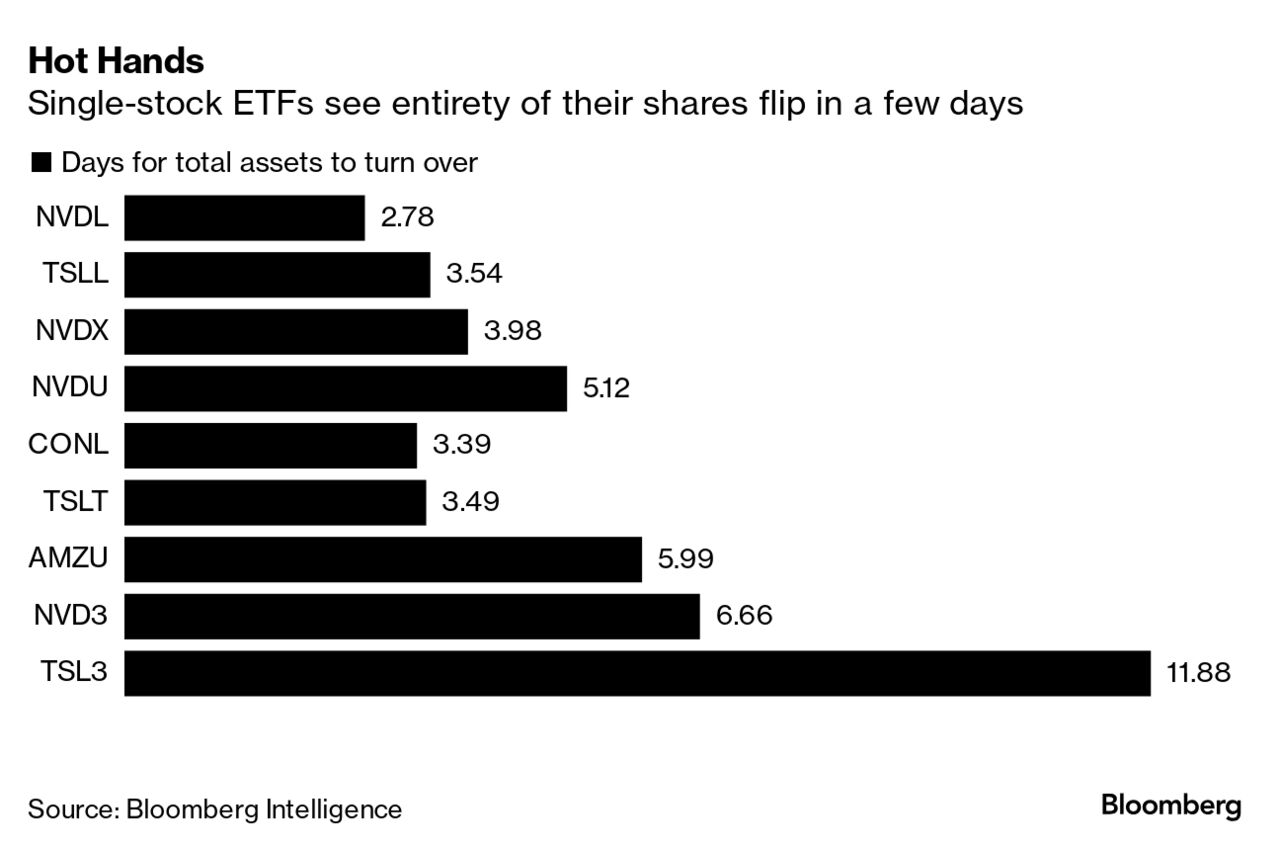

| Two weeks ago, this newsletter meditated on the existence of one-day-only ETFs — leveraged funds that track just a single stock, amplified several times over. The only realistic holding period for such products is just a single day, as the nature of the options rebalance means that long-term performance is often devastating. Good news: a closer look at the trading dynamics of the most-popular single-stock funds shows that traders are seemingly using them as intended. Take the largest such fund, the $4.8 billion GraniteShares 2x Long NVDA Daily ETF (ticker NVDL): dividing its average trading volume by its average market cap produces a turnover rate of about 35.9%, meaning that it takes just under three days for all of its shares to change hands, Bloomberg Intelligence data show. That compares to about 185 days for the $503 billion Vanguard S&P 500 ETF (VOO), which is popular among buy-and-hold investors. So that metric, used as a very rough proxy for a fund's average holding period, suggests that traders are rotating in and out of these ETFs with stunning velocity. Still, someone's probably getting smoked. "Inevitably, there are going to be unsuspecting victims of these products, for whatever reason — there aren't adequate guardrails in place to prevent them from using them without adequate knowledge of how to," said Ben Johnson, Morningstar Inc.'s head of client solutions. The mere existence of single-stock funds and the various other breeds of high-octane derivatives ETFs speaks to the cultural shift underway in the $10 trillion US ETF industry. The first ETFs were born in the early 1990s, the offspring of index funds. The late Jack Bogle — father of the first index fund — famously loathed them, saying that ETFs only encourage trading among "fruitcakes, nut cases and lunatic fringe." And that was years before the first such US product launched. "For people stuck in the 1990's and the 2000's, when ETFs were all about tracking an index fund, this stuff bums them out, but it's an evolution of the technology," said Eric Balchunas, Bloomberg Intelligence's senior ETF analyst and the author of The Bogle Effect. "Bogle didn't like that ETFs tempted you to trade and he didn't like the mutations and marketing. A leveraged, single-stock ETF has both of those in spades." |

No comments:

Post a Comment