| I'm Chris Anstey, an economics editor in Boston, and today we're looking at the Fed's new policy outlook. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - The Bank of England cut interest rates in 5-4 vote, but offered no timing on its next move.

- China's manufacturing activity unexpectedly shrank for the first time in nine months in July and the residential real estate slump deepened.

- Every year, a random drawing determines which skilled foreigners get permission to work in the US, but the game is rigged. Read the BigTake.

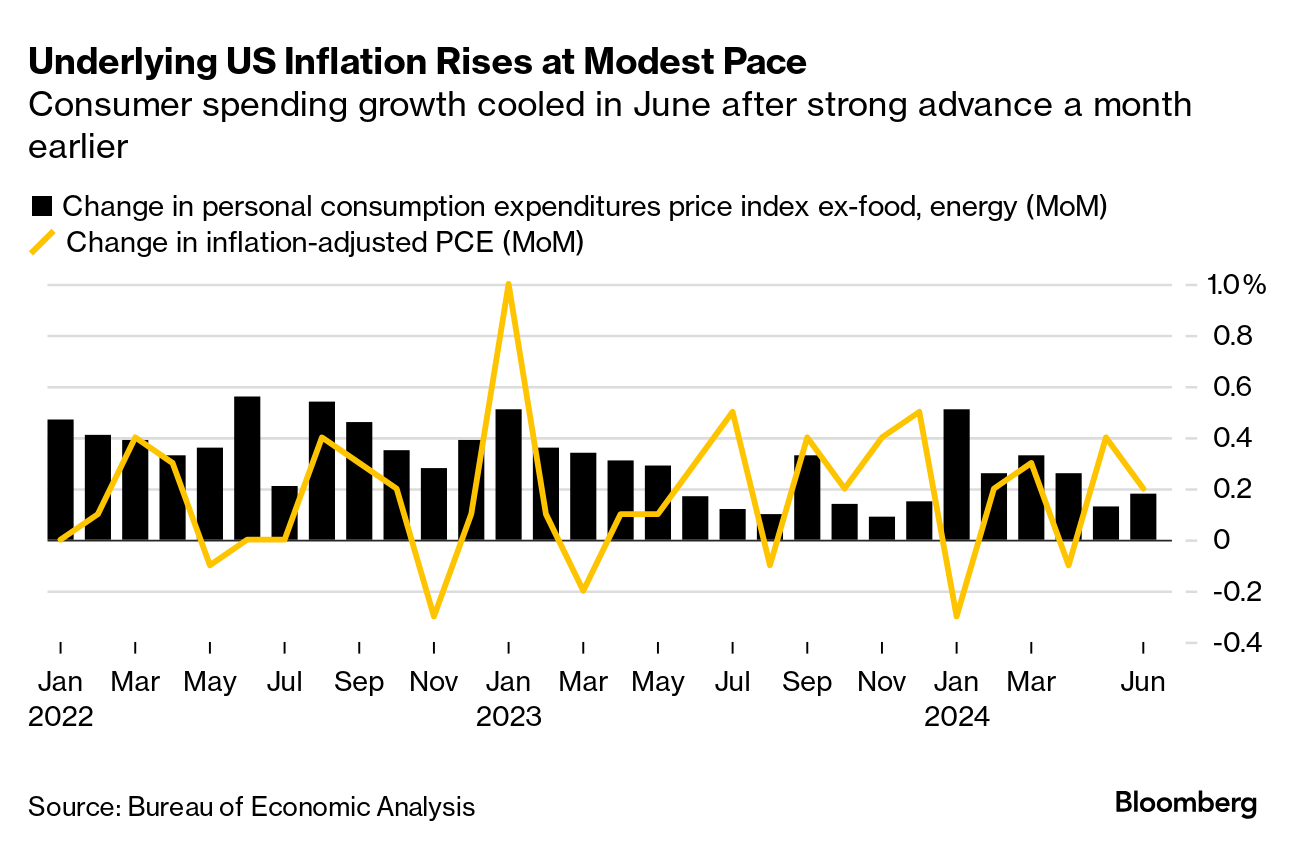

After the Federal Reserve's policy statement Wednesday unlocked the door to a potential rate cut in September, Chair Jerome Powell flung it wide open during his press conference. In its statement, the Fed elevated the importance of concerns about the job market in its policy calculus, saying it was "attentive" to risks to both of its mandated objectives — stable prices and full employment. As of June, the central bank was "highly" attentive to just one thing: "inflation risks." Powell then made clear that the time for cutting rates "is approaching," and that "if we get the data that we hope we get, a reduction of policy rate could be on the table at the September meeting."  A television station broadcasts Fed Chair Jerome Powell on the floor of the New York Stock Exchange on July 31, 2024. Photographer: Michael Nagle/Bloomberg He also noted that "there was a real discussion, back and forth, of what the case would be for moving at this meeting." There was a "strong majority" that supported not cutting at this point, he said — which of course suggests that some had tended toward a move. The Fed chief reiterated that the metric he's using now to measure inflation progress is the 12-month rate of change. Last week, the Fed's preferred inflation gauge showed a 2.5% rise, with a 2.6% pace for the core reading, which excludes food and energy. So, not quite back to 2%, but policymakers have long said they didn't need to get all the way to 2% before cutting. Powell also said that, with the US job market now essentially back to where it was before the pandemic — "strong but not overheated" — he "would not like to see material further cooling in the labor market." Former New York Fed President Bill Dudley, who had advocated for a rate reduction this week, said that "the changes in the statement and the press conference today basically tell you that September is going to happen unless the economic outlook changes materially." Dudley, who is a Bloomberg Opinion columnist, said it's not impossible that there's a string of bad inflation readings between now and the Sept. 17-18 Fed meeting, with the economy looking like it's running hot. But is the outlook really going to change so materially? "I doubt it," he said. Which takes us to Friday's job report, and the inflation readings due for July and August that will be out before the next scheduled Fed gathering. "It would take a major reversal in the inflation data to take September off the table,'' said KPMG Chief Economist Diane Swonk said. - Coming up: Czech central bankers are facing a dilemma on the size of Thursday's rate cut.

- The US is considering unilateral restrictions on China's access to AI memory chips and equipment capable of making those semiconductors.

- Risks lie ahead for the Bank of Japan's quest to continue normalizing rates amid the fragile transformation of Japan's economy.

- Australian house-price growth slowed in July as elevated borrowing costs and stubbornly sticky inflation weighed on demand.

- Thailand began signing up millions of beneficiaries for a $14 billion cash-handout program to revitalize growth.

- China's Robotaxi experiment leaps past the West as locals fret job losses.

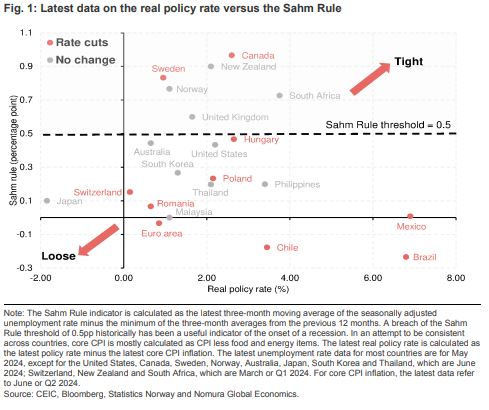

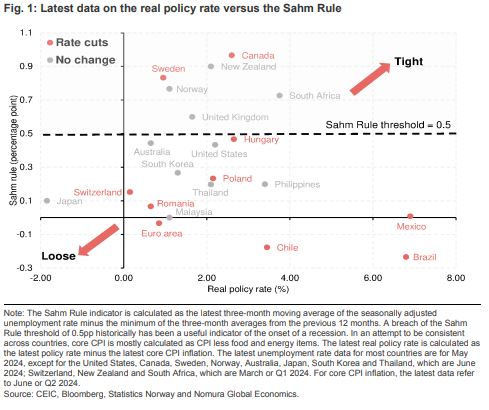

With inflation on its way to being tamed across most developed economies, central banks are shifting focus to the jobs market — as noted above. To that end, Nomura economists let by Rob Subbaraman have examined the interplay between real policy rates and the Sahm Rule for 21 economies. First, a refresher: The Sahm Rule identifies that, when the three-month moving average of the unemployment rate moves 0.5 percentage points above its low point of the previous 12 months, a recession often follows.  Source: Nomura Of the six countries that have breached the Sahm Rule, only the central banks of Canada (-50bp) and Sweden (-25bp) have been cutting rates, the Nomura economists wrote in a July 31 note. The standouts: New Zealand's RBNZ and South Africa's SARB, both of which have clearly breached the Sahm Rule and also have relatively high real policy rates, they conclude. |

No comments:

Post a Comment