| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. Also, a programming note: There will be no Industrial Strength next week; look for the next one on Jan. 24. To get Industrial Strength delivered directly to your inbox, sign up here. Manufacturers have finally found a technology bandwagon that makes sense for them, and there's no sign (yet) of it breaking down.

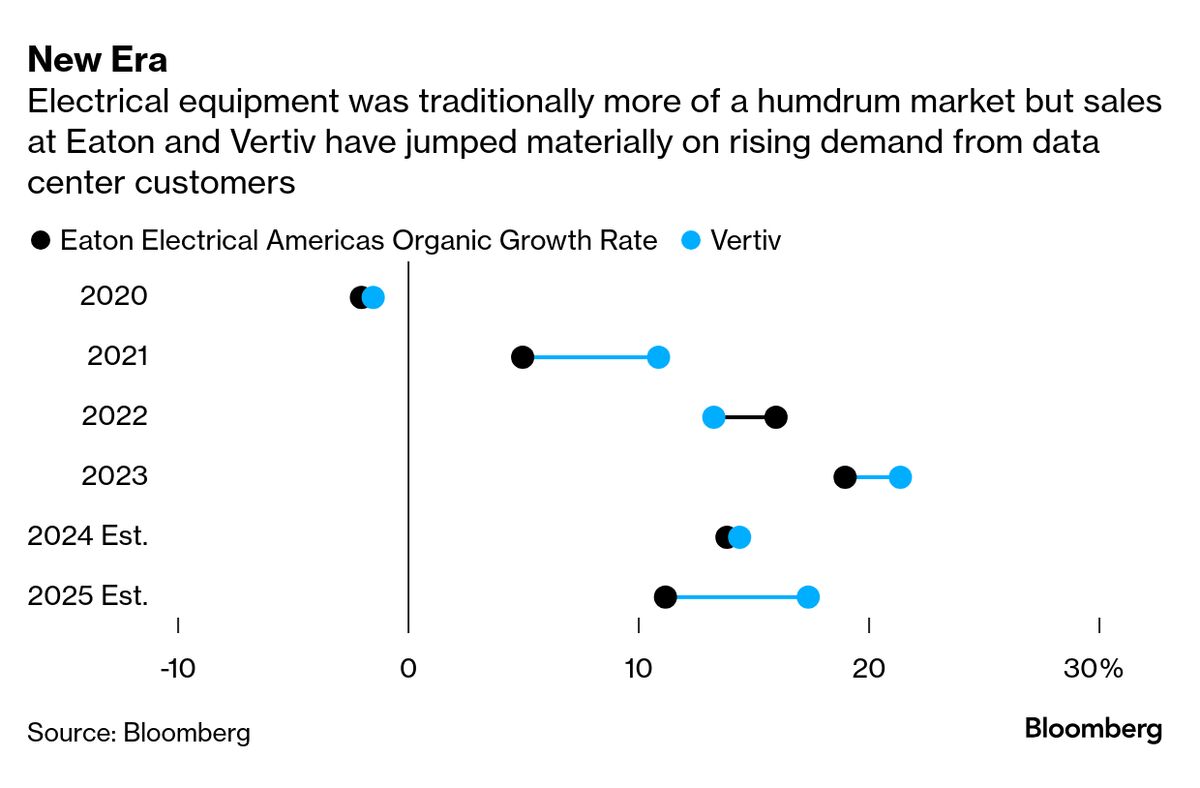

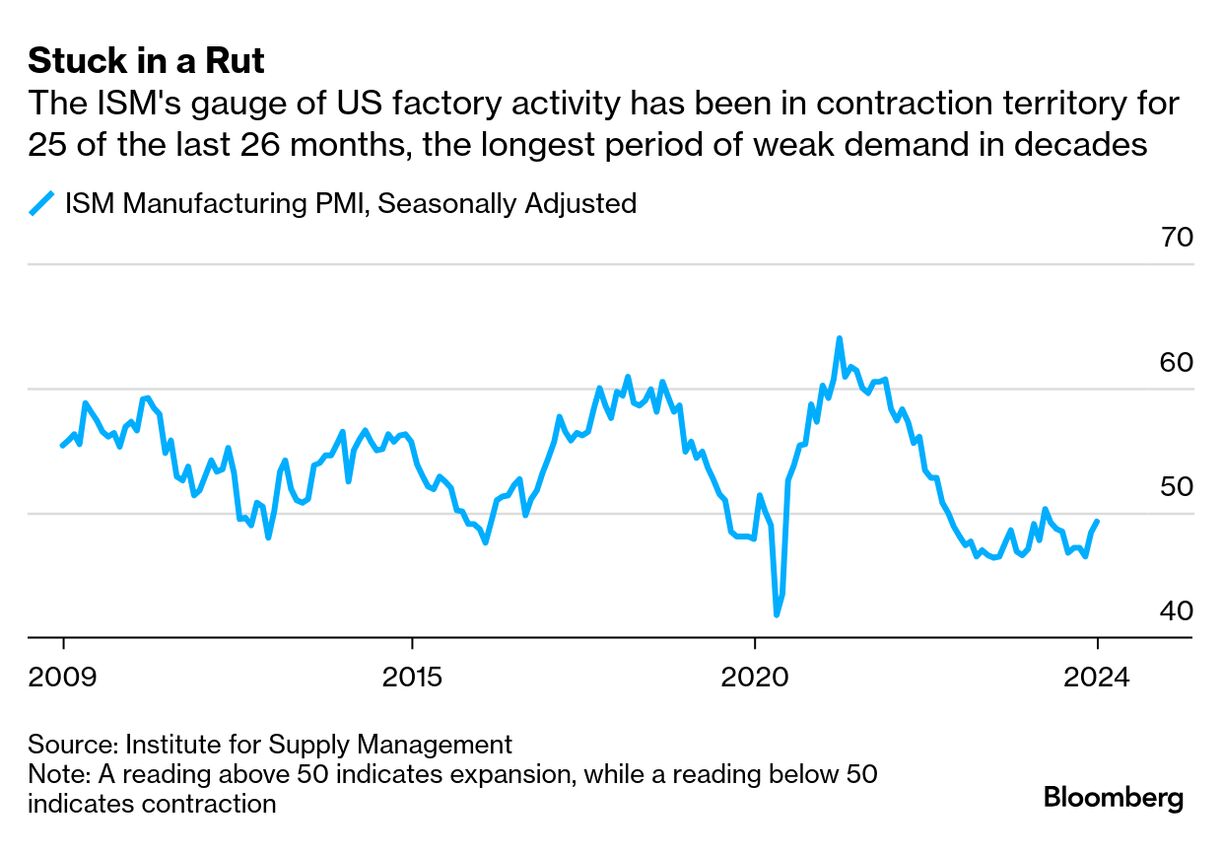

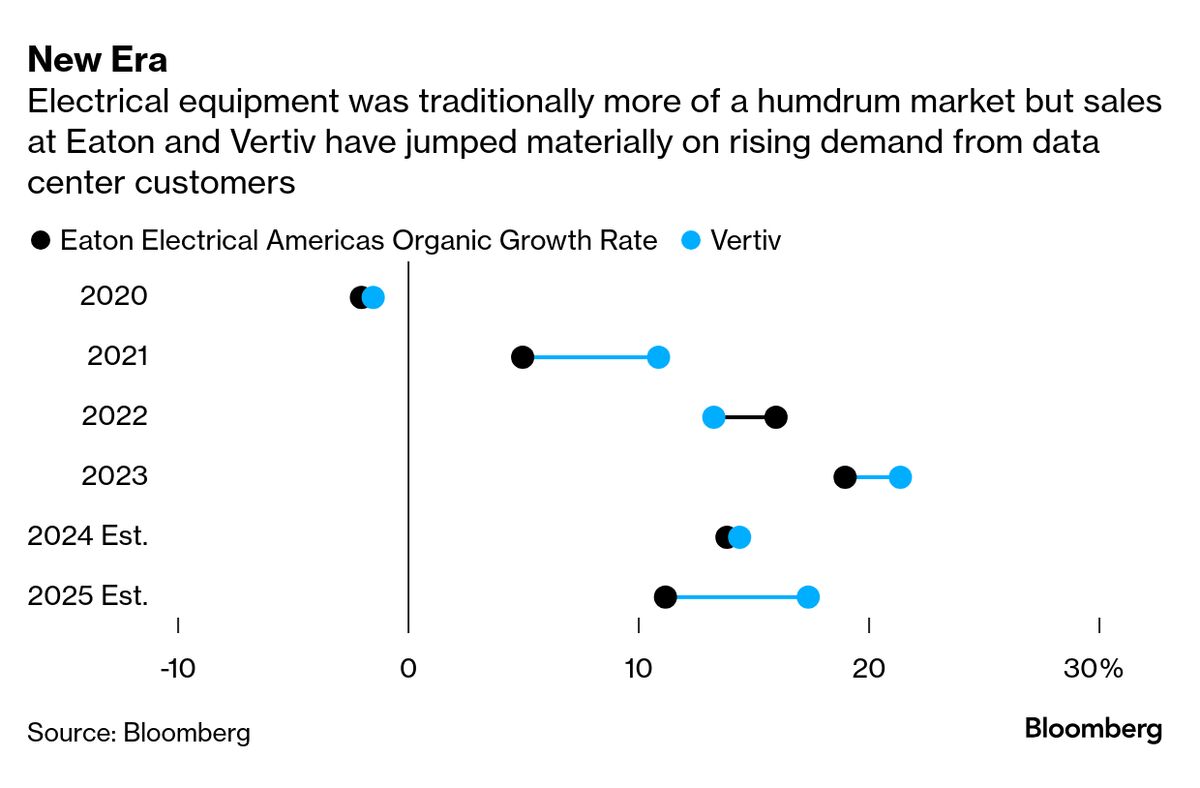

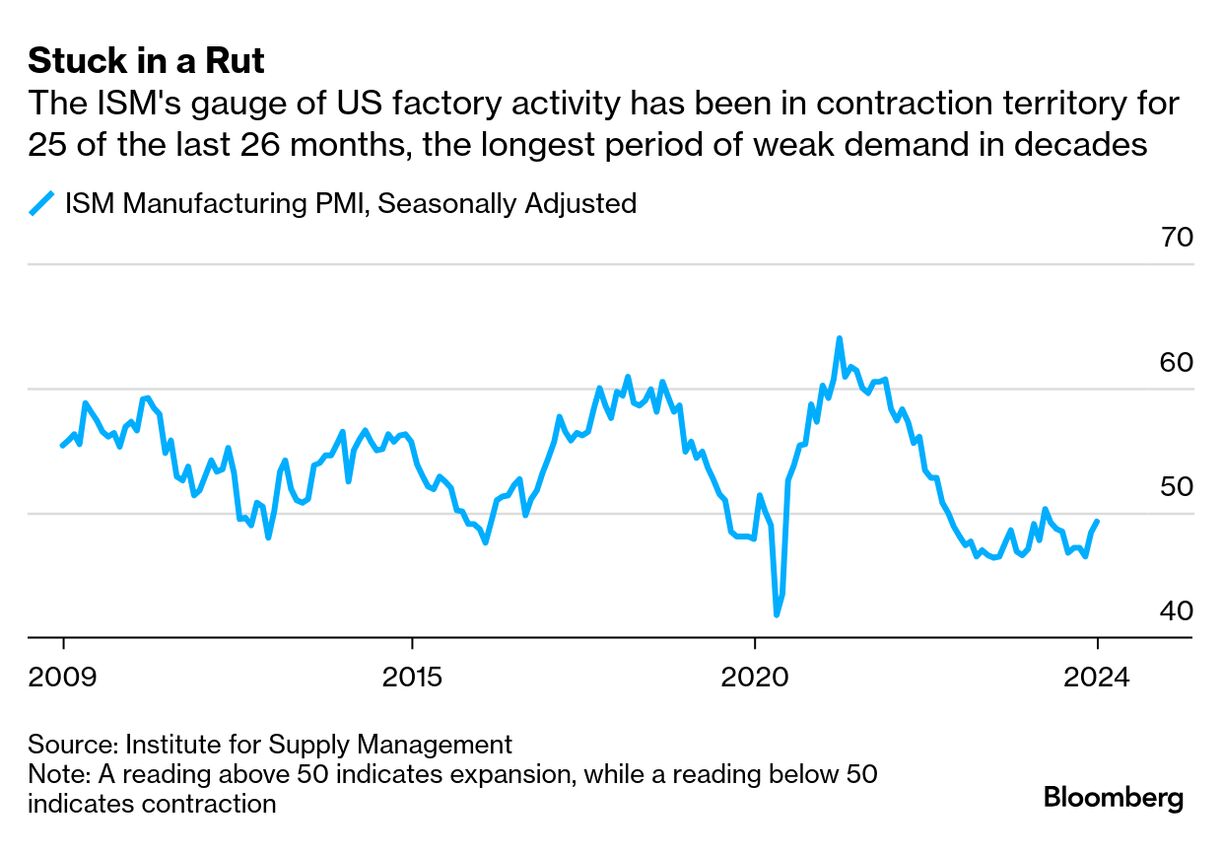

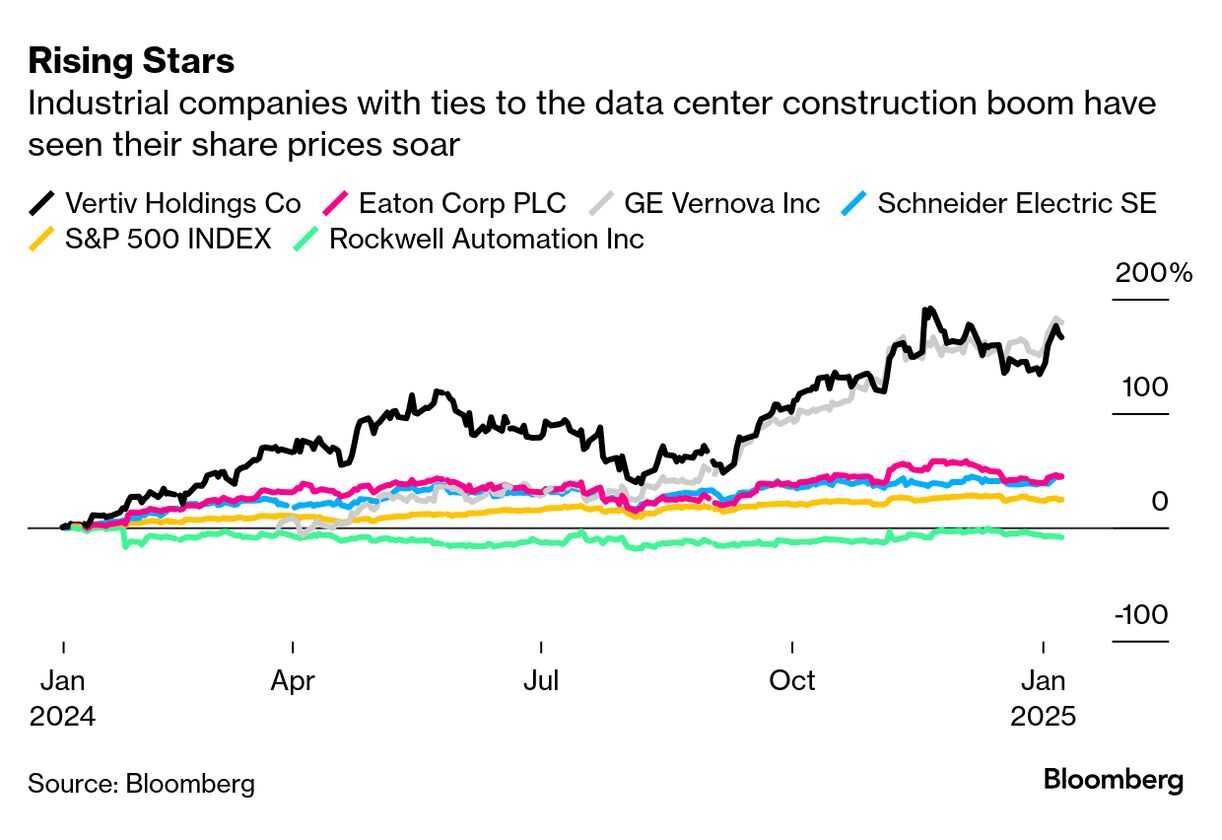

The migration of more digital assets to the cloud and the onset of artificial intelligence is driving a data center construction boom that's funded by technology giants and real estate investors, but powered by industrial manufacturers. AI doesn't exist without an influx of electrical equipment, specialized cooling, water treatment tools and power generation resources to keep up with the technology's awe-inspiring energy demands. Out of all the narratives that industrial companies have pushed in recent years to try to convince investors that they're due for a growth resurgence — and there have been many, from software to reshoring, megaprojects and a stimulus-fueled manufacturing super-cycle — this is the one that has manifested in the most tangible and widespread way. Read more: AI Powers $100 Billion Eaton Growth Spurt Vertiv Holdings Co., a manufacturer of data-center cooling equipment and uninterruptible power supplies, in November forecast annual average sales growth of as much as 14% through 2029. That's up from a previous estimate for as much as 11% over a comparable time period. Sales to data center customers grew 35% in the third quarter at electrical equipment manufacturer Eaton Corp.  Meanwhile, GE Vernova Inc., which is benefiting from a data-center driven surge in demand for its power grid and gas turbine products, in December said it's expecting to generate about $10 billion of additional revenue by 2028 — even after accounting for the current weakness in its wind energy business. In just one month, the company signed 9 gigawatts of reservation agreements for gas turbine production for US customers, with data center developers driving a significant portion of the demand, Chief Executive Officer Scott Strazik said in a December interview. The company expects to book 20 gigawatts of global gas turbine orders in each of the next four years, essentially double the 11 gigawatts it recorded in 2023. Revenue in Cummins Inc.'s power systems and distribution businesses grew by 17% and 16%, respectively, in the most recent quarter on demand from data center customers, a bright spot in what was an otherwise gloomy revenue quarter for the maker of heavy-duty truck engines and components. Caterpillar Inc. has said order wait times stretch as long as two years for its reciprocal generator sets because of their appeal to data center customers seeking continuous power. By comparison, Rockwell Automation Inc. — a company that should benefit from a resurgence of factory investment in the US, to the extent such a thing is taking place — has said sales could drop as much as 4% this year on an organic basis after a 10% slide in fiscal 2024. Sales at Schneider Electric SE's industrial automation business fell 6% in the third quarter, whereas revenue in its energy management unit that includes electrical and cooling equipment for data center customers jumped by 12% in the same period. Read more: Factory Recovery Looms And So Do Tariffs By contrast, the average US multi-industrial company is expected to grow sales by a mere 4% this year, according to estimates by Barclays Plc analyst Julian Mitchell. And that's with a recovery in non-data center related manufacturing after a prolonged slump in demand.  The growth spurt in the data-center adjacent corners of the industrial market has fueled some heady stock performances and sky-high valuations. Not long ago, Vertiv was considered a black eye for its former owner Emerson Electric Co., which took a significant writedown on the acquisition that created the business before selling it off to private equity firm Platinum Equity for $4 billion. Investors are now willing to pay more for each dollar that Vertiv is set to earn this year than they are for Nvidia Corp., the leading developer of the chips whose immense processing capabilities enable artificial intelligence applications. Today, Vertiv has a market value of more than $48 billion, bigger than Delta Air Lines Inc. or Hershey Co. GE's gas turbine business nearly sunk its former parent company after the manufacturer chased market share with lax pricing discipline and an ill-fated acquisition just as demand peaked. GE Vernova, which separated from GE's aerospace business last April, was the best performing industrial stock on the S&P 500 last year. Eaton, meanwhile, has added more than $40 billion in market value since this time last year. It's a remarkable transformation, and yet these are still industrial manufacturers. The business of fashioning hunks of metal into something useful — even if that something is electrically inclined — has long been a volatile one, with sales rising and falling with the economy and whatever investment fad is en vogue at the moment. Too often those market crashes have been timed almost perfectly to occur after manufacturers have rushed to build up additional capacity for demand that then fails to materialize, setting up painful swings in cash flow and profitability. And so the obvious question for investors is whether this time is truly different, or if the data center construction boom will some day turn into a bust. At a certain point, unless we want data centers popping up like Starbucks Corp. outposts on every street corner, the building bonanza will have to slow down. More philosophically, there are some budding niggles of skepticism as to whether the practical use cases for artificial intelligence will be as money-making as investors and technology companies currently expect. It's worth remembering that industrial manufacturers also thought they could rake in high-margin profits from standalone software businesses, and there's not much evidence of that yet.

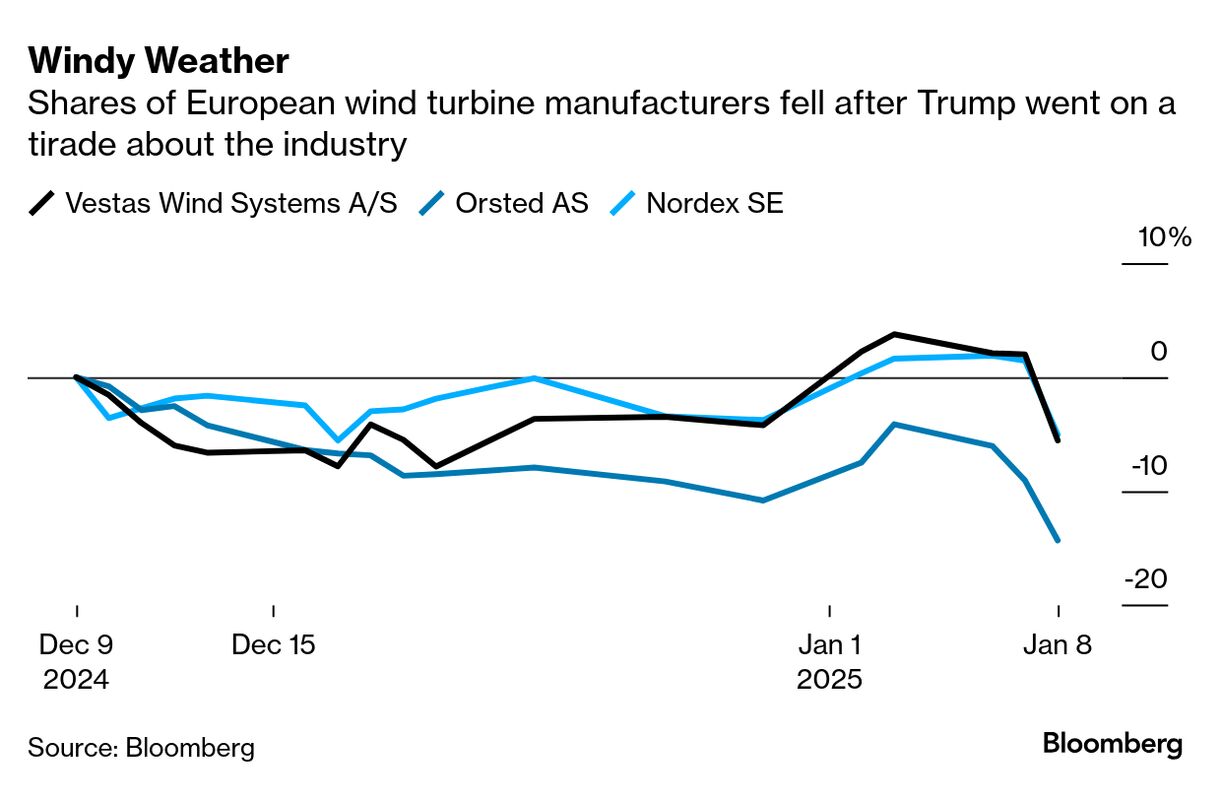

But for now, there aren't any signs of a material pullback in demand for new data center construction. Microsoft Corp. this week announced it will spend $80 billion to build out data center capacity in the fiscal year that runs through June, with more than half of the spending earmarked for the US. President-elect Donald Trump separately announced that Damac Group, a Dubai-based real estate developer run by billionaire Hussain Sajwani, will spend $20 billion to build data centers in Texas, Arizona, Oklahoma, Louisiana, Ohio, Illinois, Michigan and Indiana. "The spending levels in Big Tech are just too high to ignore, so we see no reason to jump off that trade yet," despite crowded bets on companies with exposure to the electrical and utility markets, Melius Research analyst Scott Davis wrote in a note. It's hard to argue that valuations for associated manufacturers should rise much higher but it's also difficult to envision a scenario in which they sharply contract, with data center and electric utility related capital spending likely to continue at robust levels this year, said Mitchell of Barclays. "In the absence of obvious factors to derail the momentum of these narratives, it is tough to bet when they will stop," he said. There are structural changes in how equipment manufacturers are approaching the data center business that could add credibility to the idea that this time is in fact different. Constraints in energy supply and equipment bottlenecks are already limiting the extent to which new infrastructure can be built and brought online, giving manufacturers the upper hand in pricing power and allowing for more introspection on which deals are worth signing and which are more speculative. Eaton and Schneider Electric have said they're signing more longer-term supply agreements with data center customers that should help guarantee demand to support their planned capacity expansions. "We're basically investing in capacity in line with commitments from customers and there are protections in place for us in the event that they change their mind or the world turns out to be somewhat different," Eaton CEO Craig Arnold said in a May interview. "That is a new dynamic." Those 9 gigawatts of reservations that GE Vernova recently booked were at higher price points than the orders the company is currently filling. It's charging even more now because that demand allowed the company to crank up its pricing yet again, Strazik said at the company's investor day in December. GE Vernova is expanding its production capacity to be able to deliver as many as 80 heavy duty gas turbines a year starting in 2026, up from a recent annual average of about 55. That growth will happen within its existing factories as the company leans on productivity tools to free up floor space and improve output. "We're not adding new cranes. We're not adding a new building," Strazik said. "That makes a huge difference." Industrial suppliers also insist that much of the growth they're seeing today isn't actually tied to the expected AI investment boom and is rather a reflection of demand for more traditional data centers — meaning that plenty more electrical and power equipment will be needed to accommodate technology giants' plans. "Very little of this today is a result of specific investments in AI. It's coming. We're quoting a lot of projects," Eaton CEO Arnold said on the company's earnings call in August. "If you think about this massive increase in data that we're all generating, consuming and storing, that's really what's driving the growth in data centers today. In AI, I would tell you, it's still largely a future" source of demand. "We are going to have a policy where no windmills are being built." — President-elect Donald Trump Trump made the comments at a press conference this week that started with the announcement of the $20 billion US data center spending boom by an Emirati real-estate developer and then veered off into threats to use economic force to pressure Canada into merging with the US and Denmark into handing over Greenland. The proposed wind farm ban marks an escalation of Trump's longstanding criticism of the energy source. He unsuccessfully fought the construction of a wind project that was in view of his golf course in Aberdeen, Scotland, and has said that the turbines produce noise that causes cancer and makes whales crazy, neither of which is supported by scientific evidence. He repeated the whale allegations this week, specifically singling out Massachusetts, and also said wind turbines "litter our country." Most of Trump's criticism has focused on offshore wind developments, an industry that is already challenged by the difficult economics of constructing and maintaining turbines with blades bigger than the Statue of Liberty in the middle of the ocean. GE Vernova hasn't booked a new offshore wind order in about three years and has no plans to do so until pricing dramatically improves, CEO Strazik said in a December interview. Read more: GE Vernova Expects More Trouble for Struggling Offshore Wind It's less clear if Trump's rage against windmills also extends to the more profitable onshore variety that are quite popular as a source of cheap electricity in Republican-led states such as Texas and Iowa. In 2023, Texas was the US's largest generator of wind-powered electricity, accounting for 28% of the energy source, according to the US Energy Information Administration. While data center operators are increasingly favoring the 24/7 reliability of natural gas to help satiate their growing energy needs, wind will play at least some role in helping to power the construction boom that Trump was ostensibly seeking to trumpet at the press conference. Deals, Activists and Corporate Governance | US Dockworkers representing ports from Houston to Boston reached a tentative deal on a new labor contract with a group of ocean carriers and terminal operators, staving off the prospect of another strike that would have crippled the flow of goods in America. After a three-day work stoppage in October, the dockworkers negotiated a 62% wage increase over six years and agreed to return to their posts while talking through thornier issues such as the implementation of automation. This latest agreement with the US Maritime Alliance includes guarantees for union job protection when certain technologies such as semi-automated cranes are installed, Bloomberg News reported, citing a person familiar with the matter. The deal still must be ratified by members of the International Longshoremen's Association and the employers' group. The successful avoidance of a new port strike removes one potential headache for US trade and the economy, but the prospect of a fresh barrage of tariffs continues to loom large as Trump prepares to return to the White House, with Denmark just the latest country to face threats of high levies. Nippon Steel Corp.'s $14.1. billion acquisition of United States Steel Corp. was officially blocked by President Joe Biden earlier this month on national security grounds. The two companies subsequently filed a lawsuit to appeal a decision that they said was actually driven by political reasons. Nippon is based in Japan, a close US ally and the largest source of foreign direct investment in America. Nippon had pledged to invest $2.7 billion in unionized US Steel factories, before accounting for maintenance spending, and had also dangled the possibility of a US government veto over any reductions in production capacity. US Steel has said that without Nippon's financial backing, the company will need to pivot away from legacy blast furnaces, putting thousands of jobs at risk, and may even abandon its longtime headquarters in Pennsylvania. US Steel CEO David Burritt, speaking on CNBC this week, called for the Trump administration to take a fresh look at the transaction. The president-elect has frequently said that he too would kill the deal and his first term was marked by liberal interpretation of national security concerns to put tariffs on a wide array of goods, including steel imports from Japan. "There is no reason — or need — to give up on this deal," Eiji Hashimoto, chairman and CEO of Nippon Steel, told reporters in Tokyo this week. "I have no thoughts of alternative plans."

GFL Environmental Inc., the Canadian waste-hauler, agreed to sell a controlling stake in its environmental services division to private equity firms Apollo Global Management Inc. and BC Partners in a deal that values the business at C$8 billion ($5.6 billion). GFL intends to use as much as C$3.75 billion of the net proceeds to repay debt and as much as C$2.25 billion for share repurchases. GFL will retain a 44% stake in the environmental services business and has an option to repurchase it within five years. CEO Patrick Dovigi highlighted the tax-efficient structure of the deal and the ability to benefit from future value created by giving the unit more flexibility and independence. Such partial takeovers are also easier to manage for private equity firms facing stubbornly high interest rates. Emerson Electric and Roper Technologies Inc. are among the companies that have recently struck similar divestiture deals with private equity firms that were initially based on a transfer of majority control. - Trump's Panama, Greenland threats herald start of unchained new term

- "A divorce is never cheap": Mexico factory owners bet Trump is bluffing

- Factories are increasingly ditching dangerous forklifts

- German dream of becoming chip superpower fades with Intel woes

- Whirlpool squeezes out more profits by cutting unneeded parts, materials

- Deere expands driverless fleet to orchards, lawns and quarries

- UPS is building a health-care delivery empire to boost profit margins

- Chinese carmaker BYD is winning the global race for cheap EVs

- Musk's relationship with Trump can be good for other carmakers, too

- JetBlue hit with $2 million fine for chronic flight delays

- Cybertruck explosion response highlights troves of data collected by cars

- When did it become OK to not wear headphones at airports?

|

No comments:

Post a Comment