| Please note: Our email domain is changing, which means you'll be receiving this newsletter from noreply@news.bloomberg.com. Update your contacts to ensure you continue receiving it — check out the bottom of this email for more details. Amid much competition, the biggest financial news from Wednesday is that the Federal Reserve is doing nothing at all, and not committing to doing anything in future — but setting up all and sundry for a likely cut in the fed funds rate in September. One more risk of a nasty surprise has been removed, one more reason added to hope for and expect an imminent cut, and that's what mattered. This was a little like a return to the Alan Greenspan era, when there were no press conferences or dot plots. Instead, hours would be spent analyzing a few ambiguous words of a Fed communique usually written in gnomic and convoluted prose — that nevertheless prompted billions of dollars to change hands. The alterations to this statement since last month's version all undeniably point toward cutting rates, but could probably have gone further in that direction: - "Job gains have moderated [NOT "remained strong"], and the unemployment rate has moved up but remains low."

- "In recent months, there has been some further progress [NOT "modest further progress"] toward the Committee's 2 percent inflation objective."

- "The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate." [NOT "highly attentive to inflation risks".]

To balance this, the summation remained unchanged; the Federal Open Market Committee passed on the chance to offer clear guidance that it will be cutting in September: The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

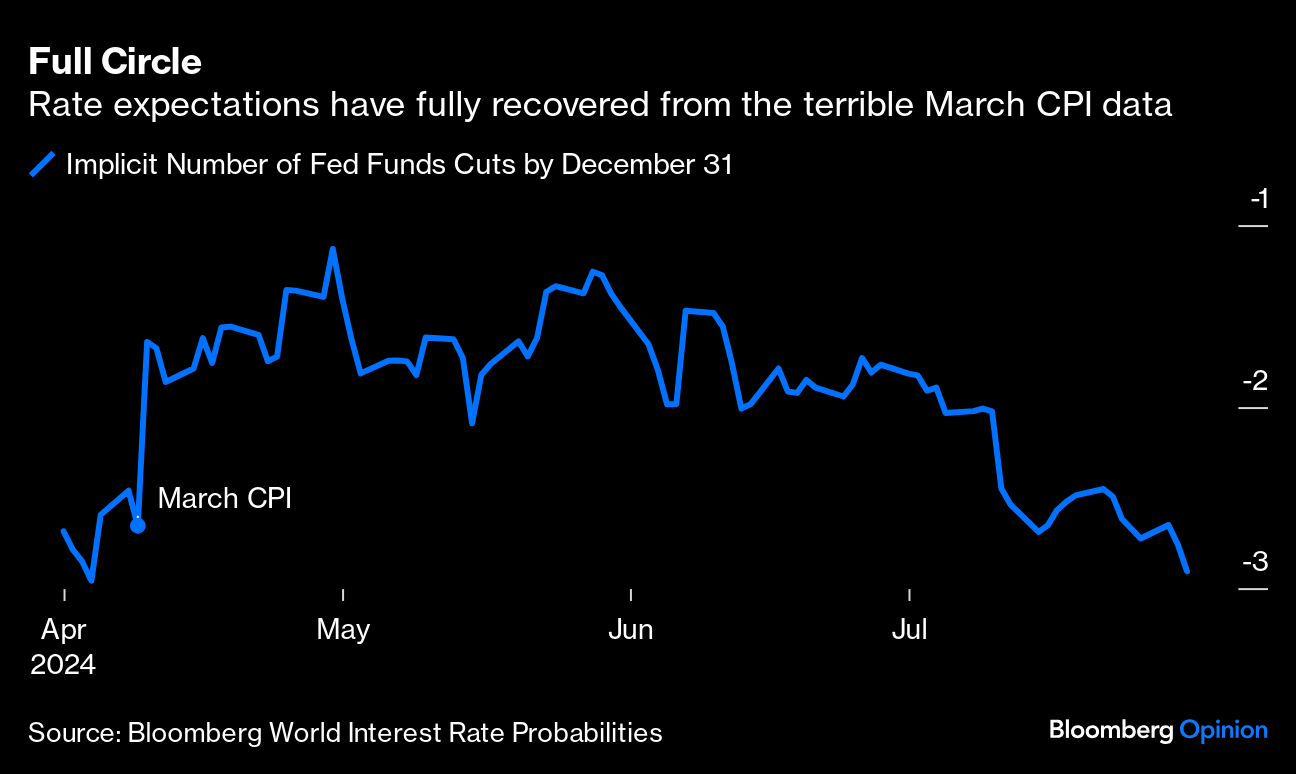

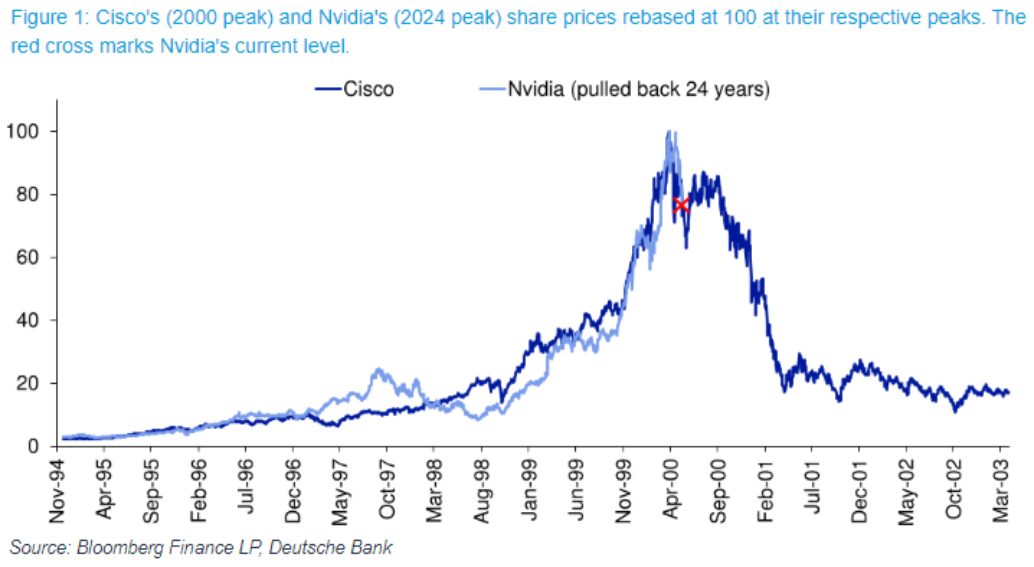

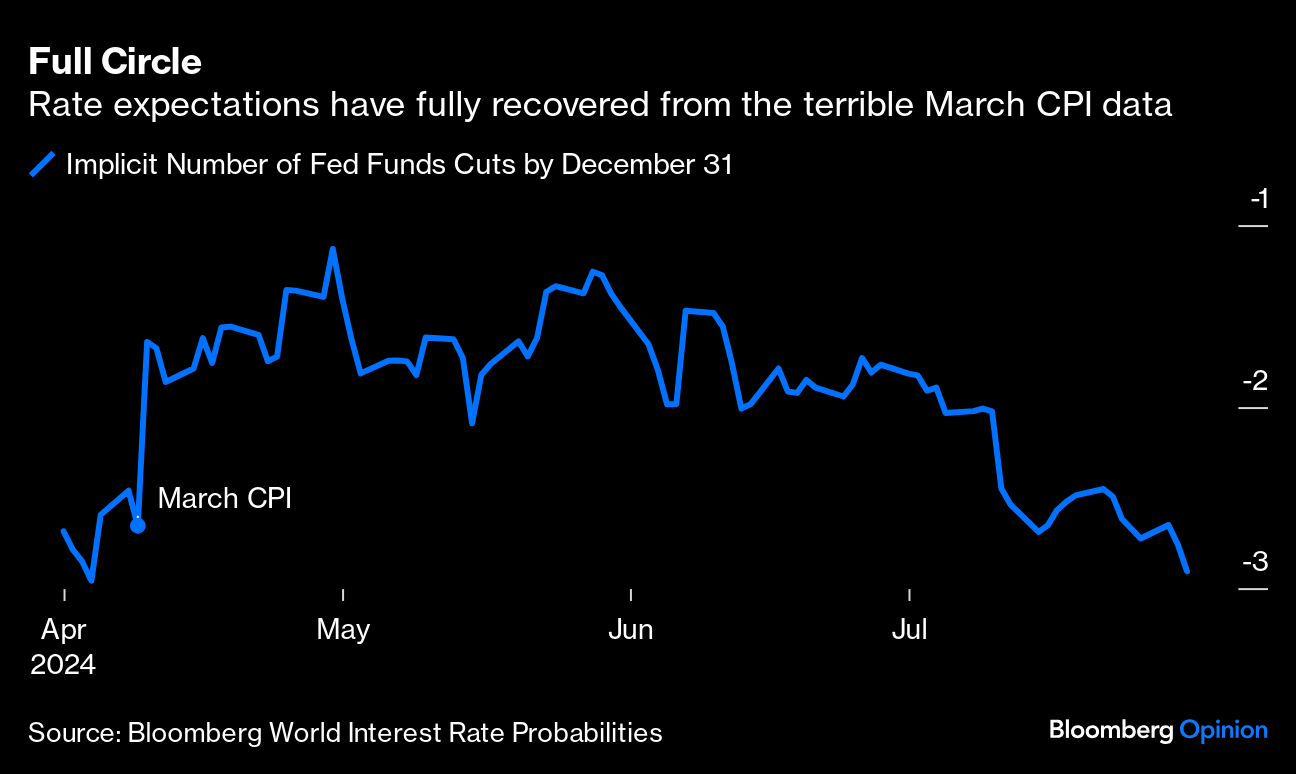

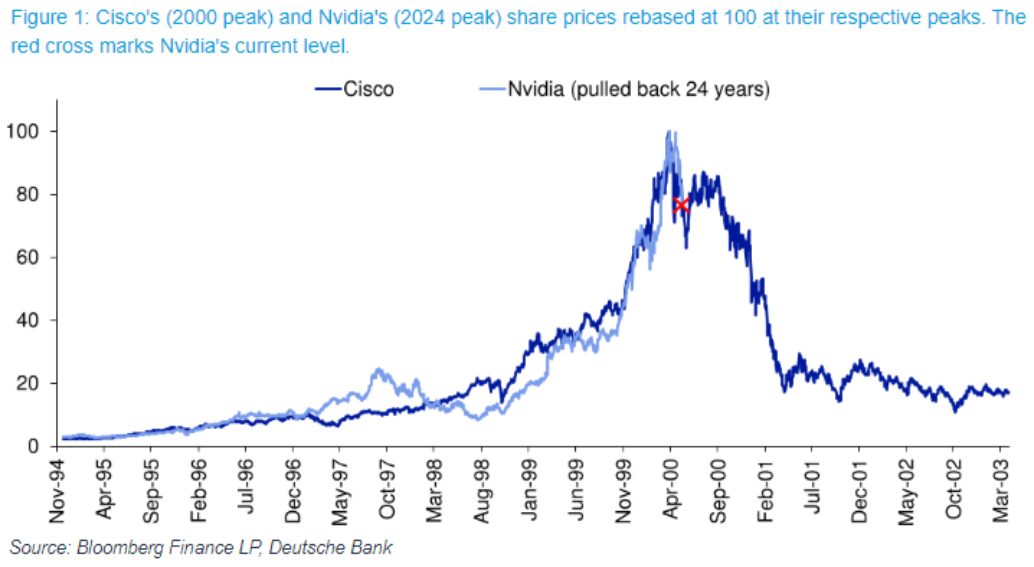

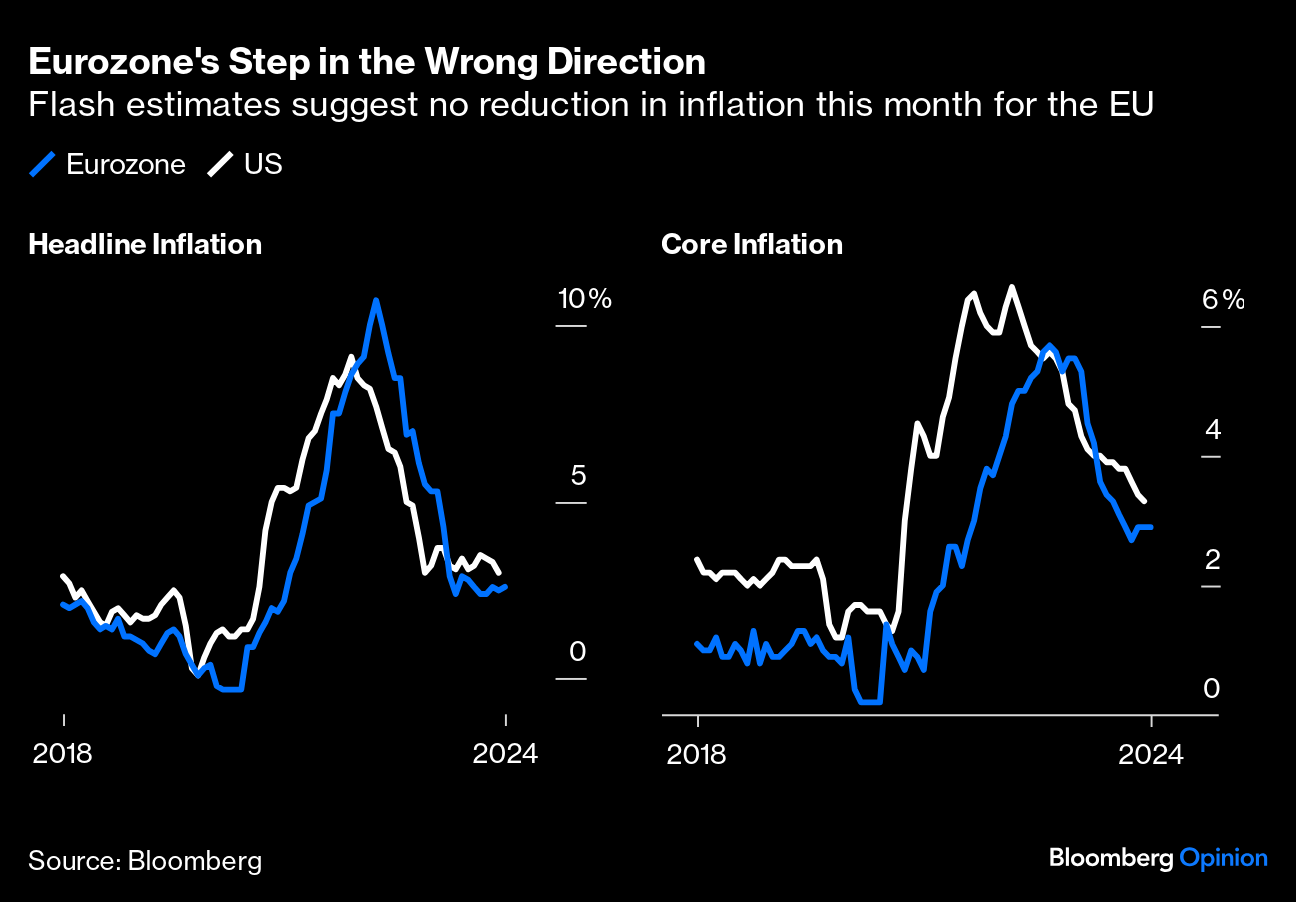

So the Fed didn't cut straight away as some advocated. Then Jerome Powell had the opportunity that wasn't open to Greenspan, his predecessor as chairman, to explain himself to the press. Without committing himself, he left his audience confident that he and his colleagues would indeed have the necessary "greater confidence" by the time they next meet.  About what was expected on the NYSE floor. Photographer: Michael Nagle/Bloomberg Powell did this by saying that "the sense of the committee is closer to cuts but we're not there yet," by freely conceding that "downside risks to the labor market are real," while adding that employment is "not a source of material inflationary pressure," by calling policy "restrictive, not extremely restrictive but restrictive," and by cheerfully describing the latest inflation data as "so much better" than 12 months ago. A cut will happen at the next meeting if inflation moves down "in line with expectations," which is a way of saying that we should expect a cut. Powell also strongly denied that politics would make it impossible to cut rates less than two months before the election, nixing one of the biggest arguments against a cut — but he did seem to rule out throwing caution to the wind and cutting by 50 basis points.  As for the stock market, Powell said nothing to derail it on a day when it was enjoying a big bounce. The perception of a Fed ready to ease helped consolidate the Nasdaq 100's best day since early last year as it gained more than 3%. The ongoing Magnificent Seven results are taking stocks on quite a random walk, with Microsoft Corp.'s announcement that it was already generating revenue from its investments in artificial intelligence, sparking a recovery from Alphabet Inc.'s admission last week that it wasn't. Nvidia Corp. gained $337 billion in market cap for the day — bigger than the current entire valuation the market currently puts on the whole of Bank of America Corp. The chipmaker's share price still uncomfortably resembles Cisco Systems Inc., which played a similar role in the development of the internet when it peaked during the dot-com bubble in 2000, as the following chart from Deutsche Bank AG's Jim Reid demonstrates. At least Nvidia is likely to have lower rates to cushion any fall:  The greatest risk confronting the Fed now would be an unpleasant surprise Friday from the payrolls data for July. Powell made clear that unemployment was now as much of a concern as inflation, but also said that the jobs market was merely "normalizing" rather than moving steadily toward a recession. Not all would agree with him, and — as Points of Return laid out earlier this week — there's a real risk that the jobs numbers could trigger a reliable indicator that a recession is getting underway. As it stands, though, Powell could point to the latest employment cost index, a very closely watched metric, as showing a clear reduction in inflationary pressure without suggesting that the jobs market was growing too weak: Beyond that, there's always the risk that disinflation grinds to a halt in the US over the next two months. The flash July inflation estimates for the eurozone, published a few hours before the FOMC decision, were an uncomfortable reminder that this could happen — although overnight index swaps still suggest that investors are expecting a September rate cut from the European Central Bank: After the Fed, the central banks of Brazil and Chile both announced that they were keeping their target rates unchanged, while the Bank of England has a close decision on Thursday over whether to cut its own Bank Rate. The Fed has made life a little easier for all of them by sounding so lenient. And meanwhile, Tokyo was the heart of the action... For real news on monetary policy, the Bank of Japan hiked its target interest rate by 15 basis points and halved its monthly purchases of bonds. This went beyond what the market had discounted, and came only after a marathon meeting of the board under Governor Kazuo Ueda. A big step in Japan's steady campaign to extricate itself from a decades-long deflationary morass, the hike will have ramifications far beyond the archipelago. Internationally, the most important point is that the extreme gap between Japanese government bond yields and everyone else is narrowing, after ballooning in 2022 when everyone bar Japan was hiking aggressively. This is the spread between 10-year Treasury and JGB yields since then: In combination, the two central banks have done what a series of interventions by the Japanese treasury have failed to do, and brought the yen back below Y152 per dollar, a line that authorities have tried to defend. It even briefly breached Y150: While Japanese rates are still radically cheaper than elsewhere, the "carry" — the extra income from borrowing in yen and parking elsewhere — has sharply reduced. That strengthens the yen, while inflicting pain on anyone who has bet on the so-called carry trade. That's an ominous development, as it has been a reliable moneymaker for the last few years. Carry traders often use leverage. Carry busts in the past have contributed to cascading losses in other markets. Thus the dramatic falls in a range of carry trades demand attention: So far, this carry trade bust has had few international repercussions. Meanwhile, the weak yen so far this year had fueled great returns in the Tokyo stock market for domestic investors, while deterring international traders. That is changing, with the Topix index return in dollars now far more competitive:  This could yet turn into a "double whammy" as Japanese repatriate their money, and in the process strengthen the yen further while boosting domestic stocks. More important is the impact that the return of monetary discipline might have on the economy. The veteran Japan analyst Jesper Koll suggests that "capitalism is coming back to Japan" now that the central bank is putting a price on money, while the stock exchange says that it will delist companies that cannot match their cost of capital. That offers the real chance of some much-needed Schumpeterian creative destruction. The problem is that that process could hurt, and will test political will, particularly when it comes to so-called "zombie companies" that earn only enough to pay interest, but not to pay off their debt. Koll said: The cost of debt and the cost of equity are rising. That's the catalyst for the pickup in Japan's corporate metabolism: record domestic capex, record M&A, record MBO — long-overdue industrial restructuring is accelerating. The big question: Is it "Sayonara Zombies?" On top of rising labor costs and surging input prices, the new reality of rising capital cost is putting unprecedented pressure on Japan's "Zombies." The real policy question is whether Kishida's LDP will actually allow the inevitable rise in bankruptcies.

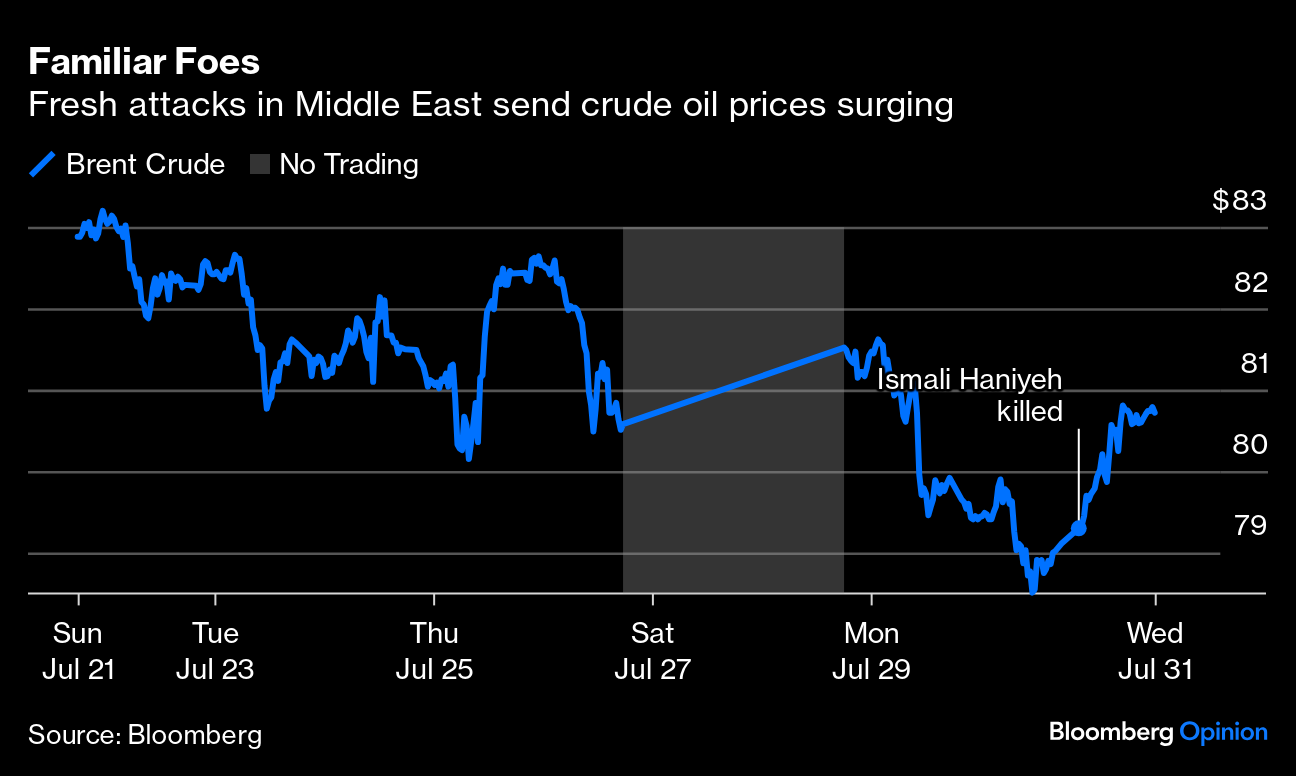

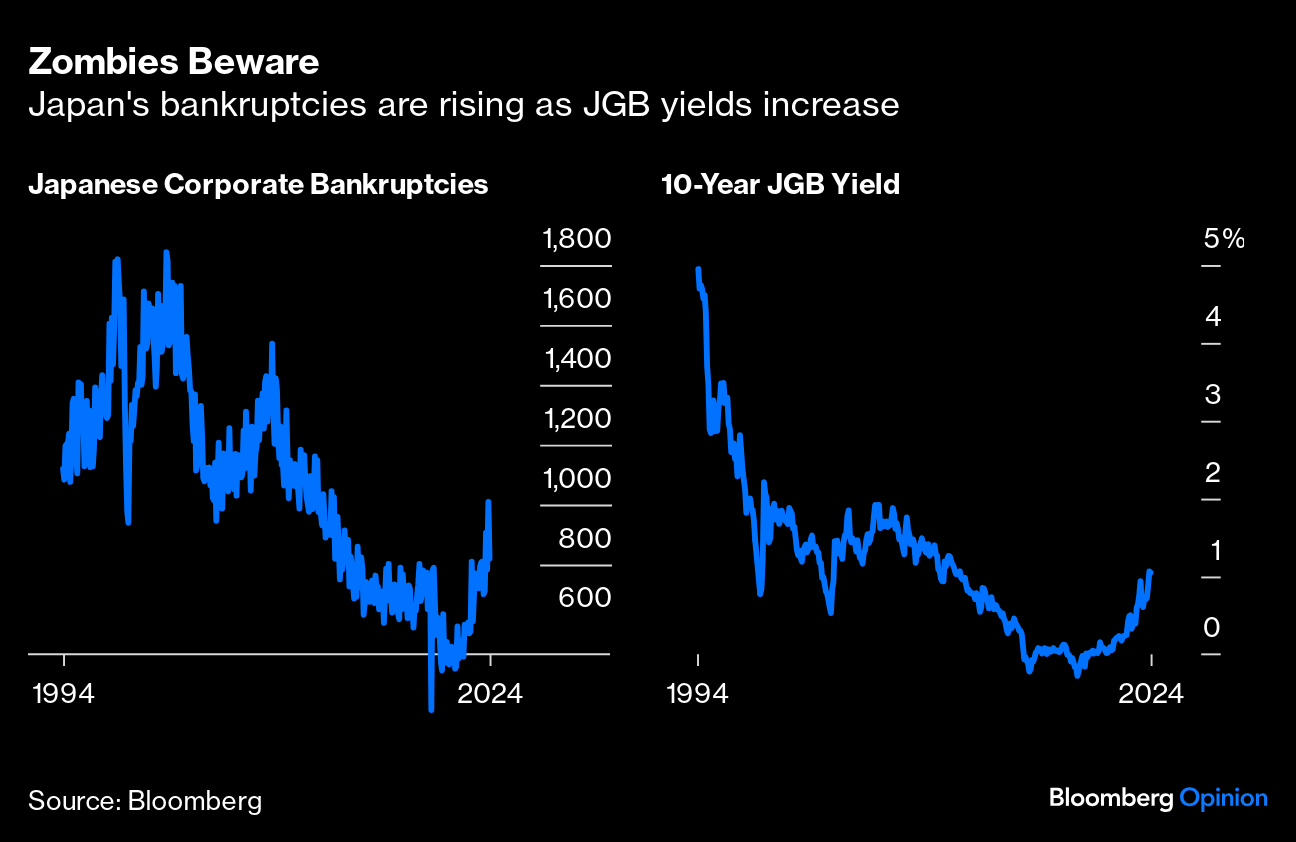

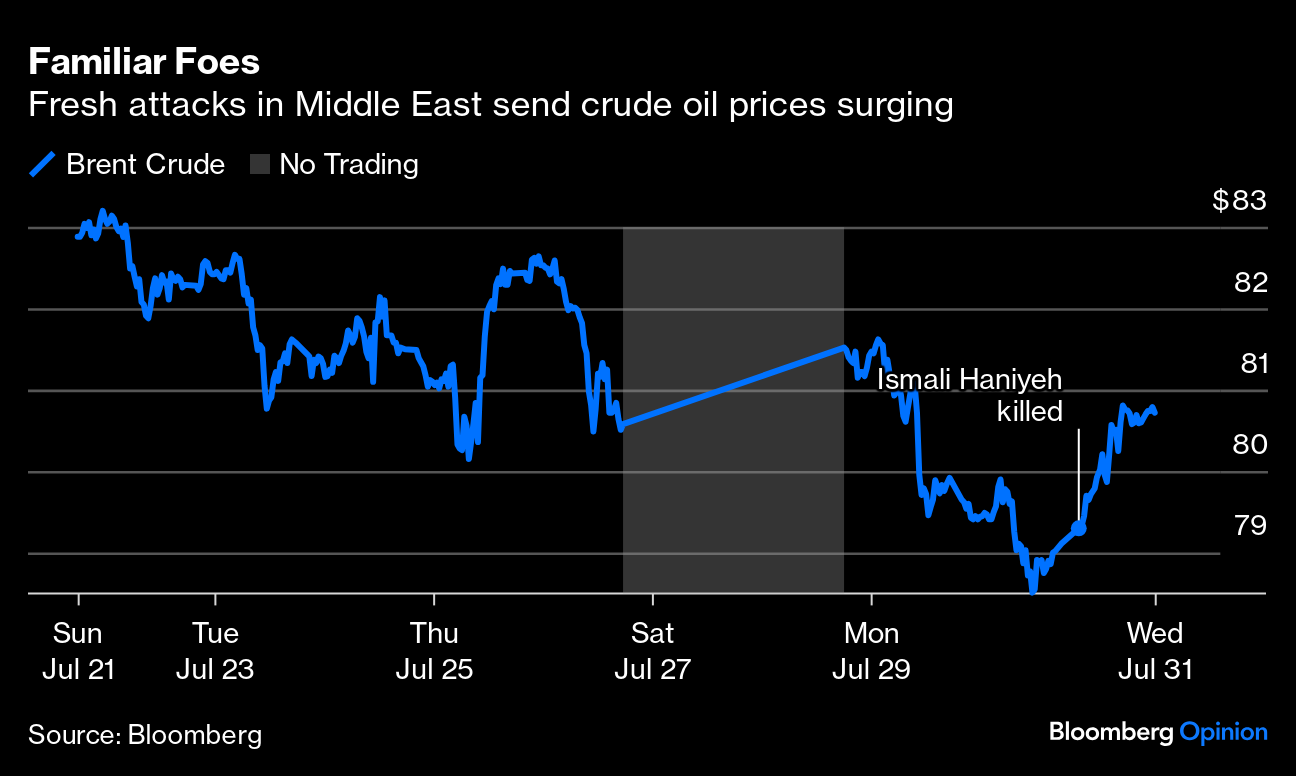

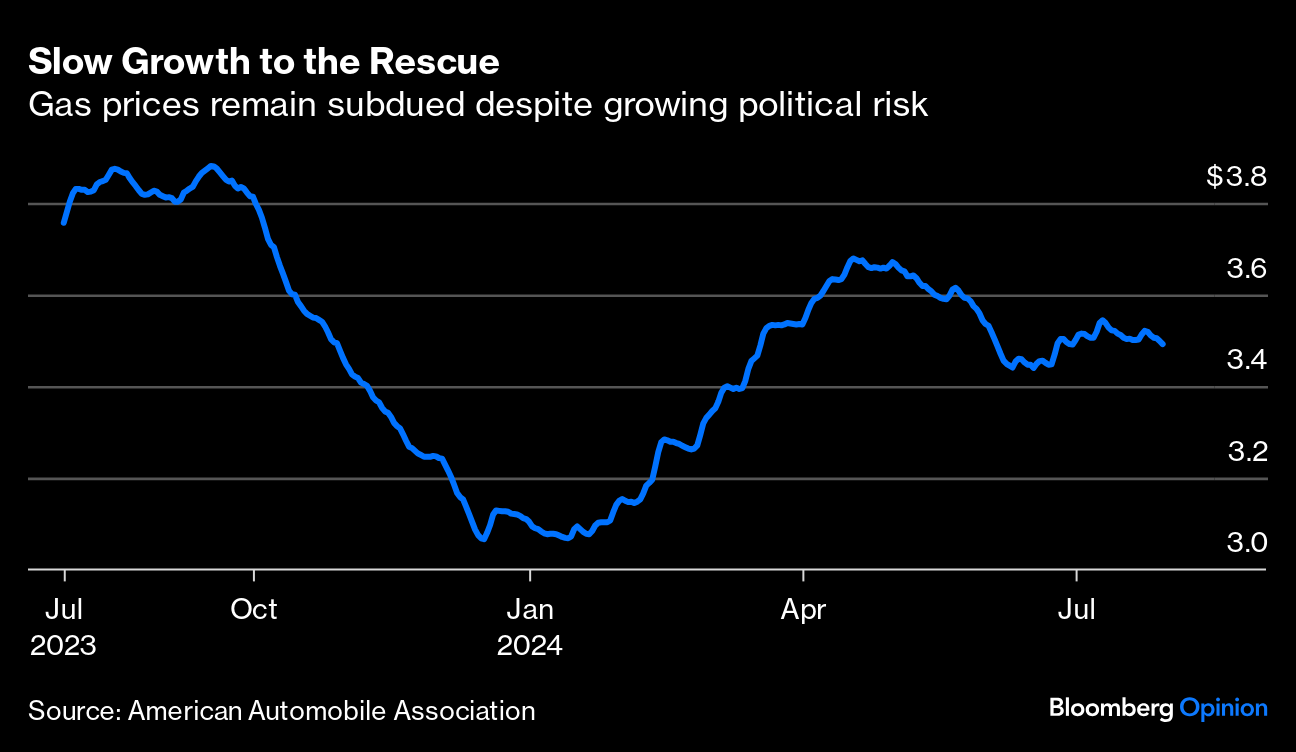

And indeed, even the muted rise in yields to date has overlapped with rising corporate bankruptcies: The process is likely to hurt — but that's part of capitalism. Oil prices are rising again. A rally following attacks and counterattacks involving Hamas, Hezbollah, Israel, and Iran isn't surprising. What's more startling is that the crude price has stayed relatively contained since the terror attacks last Oct. 7 and the subsequent invasion of Gaza and spillover to other theaters. While the dreaded overshoot in crude prices has so far not materialized, Israel's assassination of Hamas political chief Ismail Haniyeh in Tehran, swiftly after killing a Hezbollah commander in Lebanon, could stoke escalation. Retaliation by Iran now looks hard to avoid. As Bloomberg Opinion's Marc Champion sums it, the assassinations could spark a catastrophic regional war that would not be in the interests of either Israel or Iran. Meanwhile, Nicolas Maduro, the embattled president of Venezuela, is embroiled in civil unrest after disputed elections. The Latin American nation may have lost its shine among the elites of oil producers, but events there still matter. Brent Crude topped $80 per barrel Wednesday, rising by the most since February:  The potential for a shock to oil prices is obvious. The passthrough effects, just as central banks appeared to have beaten inflation, could be profound. BCA Research Chief Geopolitical Strategist Matt Gertken argues that the spike will subside only once Hezbollah and Iran have retaliated and the damage can be assessed. He assigns 51% odds that a minor supply shock can occur, in the event that Iran seeks to warn the US administration to restrain Israel. A major supply shock is estimated at 37% odds if Israel and Iran engage in direct hostilities, which would likely be far more damaging than their exchange of attacks in April. And US politics should exacerbate the risks thereafter: The odds of oil supply shocks will rise, not fall, after the US election because Biden is a lame duck and will need to cement his legacy, which may involve disciplining Iran for betraying his trust, expanding its nuclear program, and attacking Israel and international shipping. Either that or Trump will win, and Iran will face "maximum pressure" sanctions enforcement against its oil exports again, as in 2018-20.

So far, weakening economies in China and the US have constrained demand, and US consumers continue to see lower gas prices at the pump: If there's a risk to a September cut that the Fed can't control, it's the oil price. A Middle East escalation could also shift the US election. Gertken argues that Democrats will struggle to retain the White House if global instability is rising. A major reminder between now and November that the world is still a dangerous place would be the last thing they need. — Richard Abbey Returning to zombies, the Cranberries had a really good song about them. It's even been covered by Miley Cyrus. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Gearoid Reidy: Ueda's Big Day Was Lost in a Communication Black Hole

- Marc Champion: What Israel's Elimination of Ismail Haniyeh May Bring

- Aaron Brown: Pension Funds Are Hooked on Private Equity, No Matter the Risks

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment