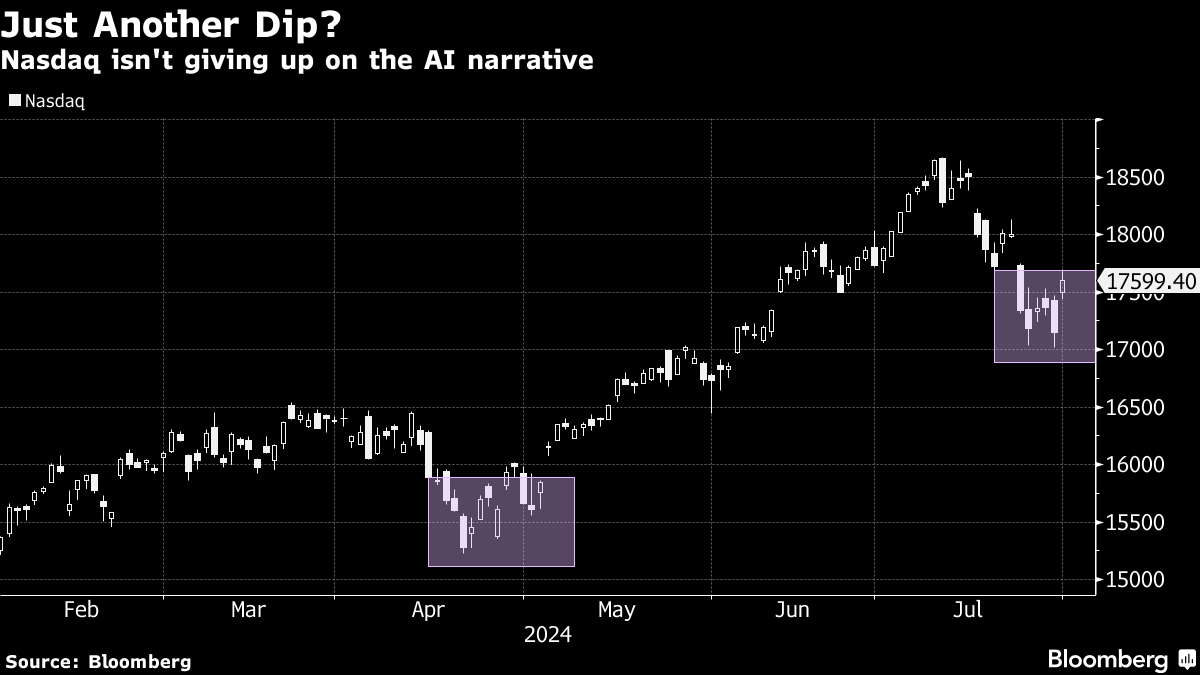

| Meta Platform shares surged in after-hours trading, following Nvidia's record $329 billion jump in value which suggests it is premature to be writing the obituary for AI-driven strategies. Indeed, the rotation into small cap stocks could be over before having a chance to gain serious traction. Investor jitters toward the tech sector crystalized last week when Tesla plunged after delivering a quarter of disappointing profit and postponing a highly anticipated unveiling of autonomous taxis. Since then, Tesla's share price has clawed its way higher and almost erased those losses. Then along comes Meta Platforms, which reported better-than-expected sales for the second quarter. Importantly, it offered evidence that the company's investments in artificial intelligence are helping it sell more targeted and personalized advertisements. All of which is making the most recent set back for the Nasdaq gauge look increasingly like another dip-buying window for investors who have been faithfully doing so since late 2022. That said, there is still hope for rotation plays to get new wings later this month, when Nvidia reports quarterly earnings. Although it's worth recalling the previous announcement in May was the trigger for the company's share price to soar and its market cap to reach $3 trillion. Mark Cranfield is a macro strategist for Bloomberg's Markets Live team, based in Singapore. |

No comments:

Post a Comment