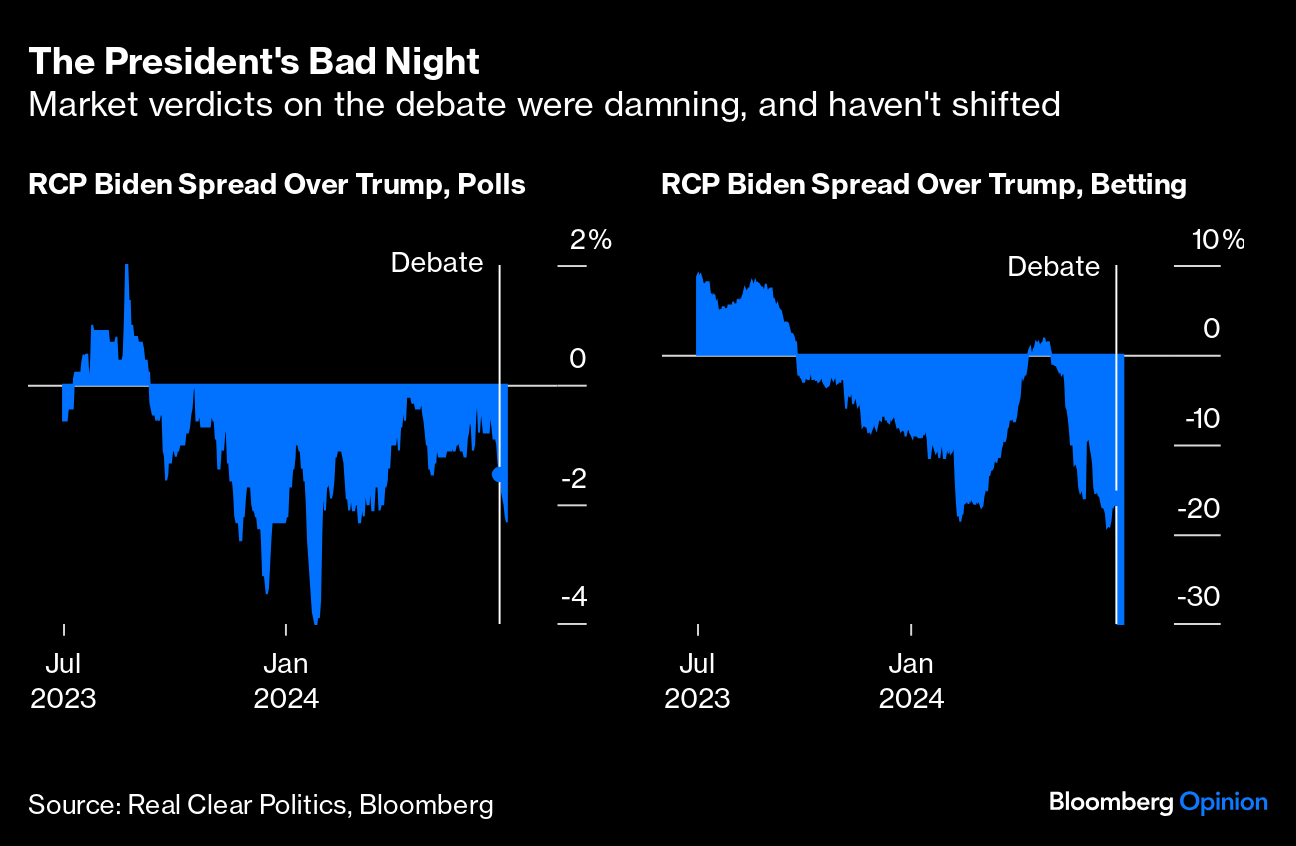

| This is a short week in the US as the nation pauses to celebrate Independence Day, but it should give us a blockbuster series of clues on the future for interest rates. Add the deafening volume of noise around the presidential race, after Joe Biden's alarming debate performance and the Supreme Court ruling that gave Donald Trump broad immunity from prosecution for acts while in office, and it begins to feel like an eventful, long week. It's tempting at times like this to view everything through a political lens. Certainly there's a clear perception that something big happened last Thursday that substantially weakened Biden's chances. Real Clear Politics averages show a slight but significant widening of Trump's polling lead, and a massive shift in the odds that he will win. Everyone knows that the losing candidate will likely get 45% or more of the vote, so the poll lead is still not that wide — but the chances that Biden can capture enough states to win the electoral college have tumbled:  Most will understand this. Biden's frailties had long been weaponized by his opponents, and the effects of aging were unmissable Thursday, casting fresh doubts on whether he would still remain in the race to the White House. It's also true that the incumbent party tends to do badly in the first debate. This chart from Barclays Plc shows that the only times when incumbents gained significantly in the first showdown (Gerald Ford in 1976, George H.W. Bush in 1992 and Hillary Clinton in 2016) came in campaigns they went on to lose : So it's not over. But more or less everyone agrees that the chance of Trump 2.0 has just risen very significantly. Does that show up in markets? The Dreaded Bear-Steepener The theory that's taken hold in the last few days is that Trump 2.0 is moving the bond market. The US yield curve has been inverted — meaning that short-dated bonds yield more than longer-dated ones — for a long time, but of late there has been what is known in bond market lingo as a bear-steepener. Yields have gone up (hence bearish), but that's almost all been about a rise at the long end (hence steepening). We shouldn't make too much of this. The curve is still inverted, and the 10-year yield is lower than only a few weeks ago. But the way it has jumped while the two-year has stayed in place is unusual, and there might be a political cause. If Trump goes through with tax cuts, the odds are that he will be very good for stocks, but not bonds. Larry McDonald, of the Bear Traps Report newsletter, puts it as follows: The curve steepens because a new Trump term would mean more tax cuts, higher budget deficits and, almost by definition, higher GDP growth. But if that is the case, the Russell needs to outperform. So either bond vigilantes are wrong or equity investors are wrong, but this divergence cannot last for long.

Certainly the main elements of the Trump economic platform — tariffs and unfunded tax cuts — look like a recipe for inflationary growth. This shouldn't all be loaded onto Trump, as Biden is adopting key parts of that agenda. McDonald quotes a portfolio manager who told him that in the debate, both candidates "tipped their radical protectionist hand, trying to out-trade-hawk each other." Saying that Biden was all in on Trump's protectionism: "This is far more inflationary. The long end of the yield curve took notice; we are bear steepening." If Trump's chances have clearly improved, how does this show up for stocks? Dan Clifton of Strategas Research Partners said that traders had put 50-50 odds on Trump for most of this year, but in the short run he had moved into the favorite column. He offered a list of assets that should benefit from Trump 2.0: financials, LNG exports, Medicare Advantage, for-profit education, India, and Israel should all outperform, while the victims would include anyone exposed to Mexico or China.  Inconvenient truth: Biden touts measures against extreme weather as a storm rages about his future. Photographer: Bonnie Cash/UPI However, there are reasons for caution. First, the relationship between share prices and political candidates isn't linear. Clean energy stocks boomed under Trump and fizzled under Biden, for example. And then there is the fact that Trump is still not that far ahead, while a Biden withdrawal could put the cat among the pigeons again. Anshul Pradhan of Barclays argues: Market participants are now wondering if President Biden could step aside. If that happens, yields would likely fall. Prediction markets are pricing in Trump to fare better against Biden than against other candidates, as reflected in the high probability of Biden being the nominee and low implied probability of him winning the election. Hence, there is an event risk where if President Biden steps aside, yields would quickly fall, but the move higher from this factor, if he stays on, would be grinding.

They also argue that a (very conceivable) victory for Marine Le Pen's Rassemblement National in France could prompt money to flow toward Treasuries as a haven. A final issue is that bear steepening isn't unique to the US. Marc Chandler of Bannockburn Global Forex commented that the failure of either candidate to address the unsustainable US fiscal position was "an important signal to the market." But he added: Even so, I'm looking at what's happened in the last five days. The US 10-year yield is up 18 basis points. The German yield is up 18 basis points. The Australian yield is up 20 basis points in the last five days. I think that there's a global move underway and trying to isolate it to these US factors, focuses on the trees and misses the forests.

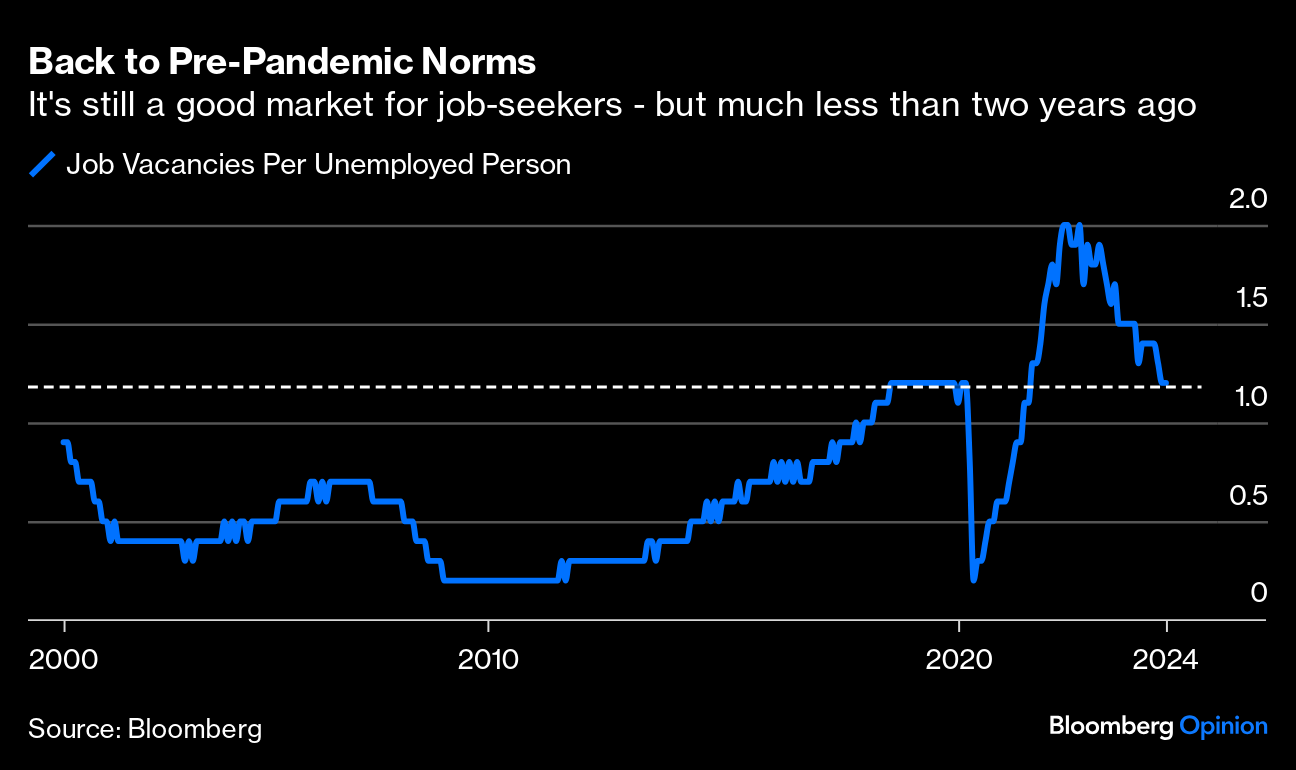

So we now need to look at the economy. It's less exciting than an election campaign between two presidents, but this week's data give ample cause for bond markets to move. So do the utterances emanating from the European Central Bank's annual retreat in the Portuguese town of Sintra. Federal Reserve Chair Jerome Powell said there that "what we'd like to see is more data like what we've been seeing recently" — which suggests a lack of urgency to cut rates, and therefore a reason for bond yields to rise. June's ISM Manufacturing PMI, however, points to a weakening in manufacturing conditions, which invariably translates into softer labor demand. And the JOLTS (the Bureau of Labor Statistics' Job Openings and Labor Turnover Survey), one of the Fed's preferred labor market indicators, is more ambiguous. The number of vacancies per unemployed people in the workforce is back to pre-Covid levels, but the May data, published Tuesday, didn't continue the downward trajectory for vacancies. Moreover, the official numbers still show more vacancies than potential applicants, which was highly unusual until the eve of the pandemic and implies that jobs might still be generating inflationary pressure:  Non-farm payrolls for June are due Friday morning, just as Americans get back to work after watching the fireworks. They might add clarity. The economists in the Bloomberg survey expect non-farm payrolls to gain 190,000 with an unchanged unemployment rate of 4%, which it makes sense to interpret as a cooling in labor demand. But Glenmede's Jason Pride and Michael Reynolds argue that there's more to the cooling seen on the labor front: There has been a marginal softening in labor market data over the last few months, but that softening has looked more like normalization than deterioration. Initial jobless claims... remain well below the 350,000 threshold, historically consistent with the recession. Likewise, the number of outstanding job openings has fallen by nearly 830,000 yet still sits well above pre-pandemic levels. The most likely scenario from this Friday's jobs report is further confirmation of normalization.

The following chart provides yet another indication of how the labor market is back at pre-Covid levels (as well as a reminder of just how extreme the pandemic was): Would cooling labor be enough to resurrect recession calls? Not quite. As SMBC Group's US chief economist Joseph Lavorgna points out, the pandemic's profound impact is still unraveling. In the following chart, he utilizes the so-called Beveridge Curve — which measures the relationship between job openings and unemployment — to illustrate this distortion. Lavorgna argues that a mismatch between labor demand and supply in the job market knocked the market far off its pre-Covid moorings, but it's slowly finding its way back to trend. The Beveridge Curve is now close to its fitted pre-2020 trendline: As the labor market normalizes, a sharp decline in job openings has occurred alongside a modest increase in unemployment, which seems to suggest that the lagging effect of restrictive monetary policy to tamp down inflation is finally catching up with jobs: Consequently, unemployment is likely to bear the brunt of a persistently high fed funds rate as job openings have now moved close to their pre-pandemic readings. If so, this means that the lagged effects of higher interest rates have simply been stretched out.

A recent Bank of America analysis of internal customer deposit data found that pay raises people receive for job changes have slipped below 2019 levels — signaling that bargaining power is shifting back toward employers. Viewed from another perspective, the bank's analysts add that this might indicate that overall pay growth in the economy can soften, even without a particularly significant rise in the unemployment rate, which is likely good news for consumers and the Fed: All of this should mean less inflationary pressure and lower rates ahead. Investors are aware of Powell's high bar for rate cuts, but will hope the Fed's descent will look more feasible after the non-farm payrolls. And if 10-year yields were to keep rising after a soft set of unemployment data, that might offer stronger evidence that the bond market really is worried about Trump 2.0. — —Richard Abbey, John Authers Getting back to politics and stocks. To bet on Trump, you should probably buy private prisons, while Biden could be good for clean energy. This is the only song I know about private prisons, and this is the only one I can think of about clean energy. But they're both among my all-time favorites. Any other songs out there to guide us through the political minefield? Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment