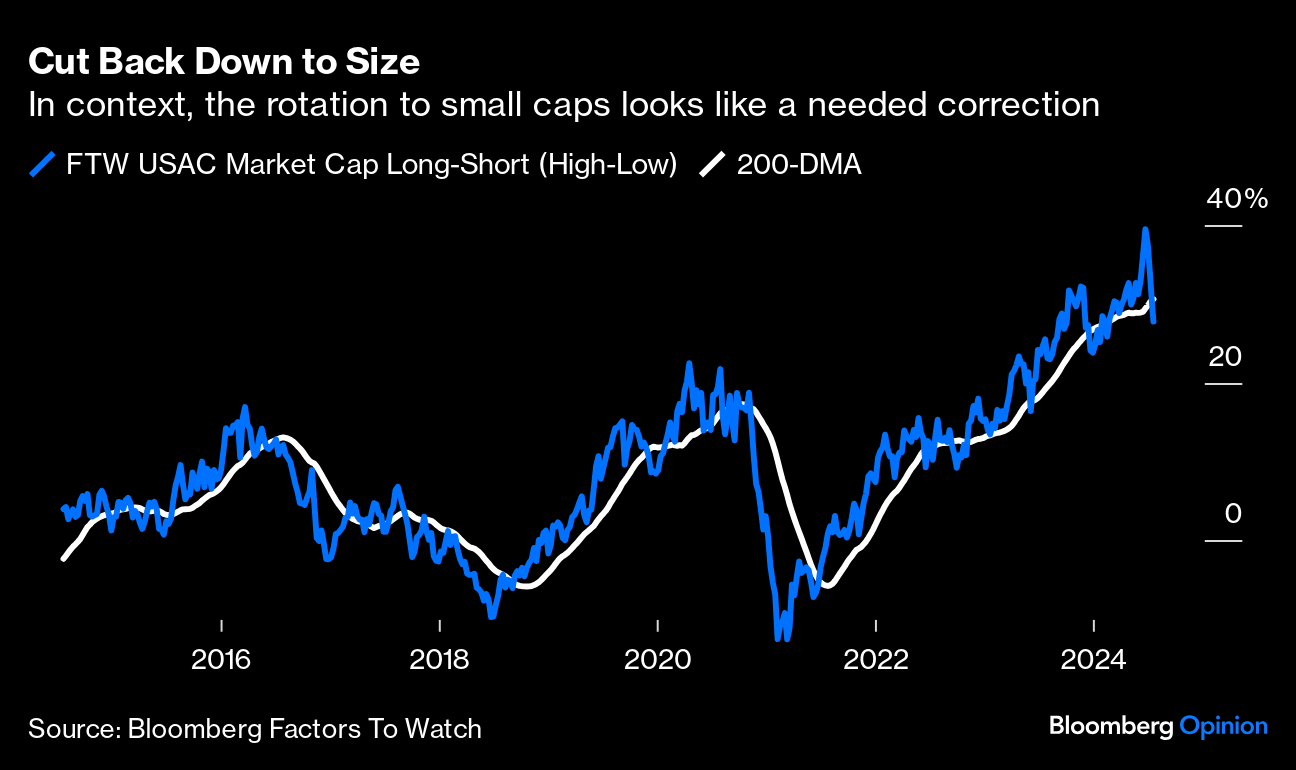

| The Magnificent Seven are back, but then they never went away. After Tuesday's market close, Tesla Inc. and Google-owner Alphabet Inc. became the first of the seven giant tech platforms to announce second-quarter results. They've come to take on the significance of a macro event in recent months as their dominance of the market has grown, and seem all the more important in the wake of this month's sudden and dramatic shift out of mega caps and into smaller stocks. Was this the end for the Magnificent Seven? Certainly the correction for large companies relative to small was spectacular. The Bloomberg Factors To Watch function offers a pure six return, which gauges how much stocks are moving thanks to being large rather than small. It had its worst week since the pandemic: On the first day of the rotation, which was triggered by publication of promising inflation data for June, the reaction against size for its own sake was quite startling. This chart from Societe Generale SA's quantitative strategist Andrew Lapthorne ranks companies by size on one scale, and their return that day on the other; the relationship is almost a straight line: But in many ways this looks like a much-needed correction to an extreme market position. This chart, also from Bloomberg Factors To Watch, shows how a strategy of going long the biggest stocks in the US and short the smallest has done over the last 10 years. Mega caps' performance earlier this year looked excessive and took their edge over smaller companies far ahead of the long-term trend. It's now back on course and bigger companies are still doing very well. It looks much more like a correction than a major change in direction:  So while the stock market has provided some drama, it looks like a necessary check that hasn't changed much. Earlier this week, Bloomberg Opinion's Jonathan Levin declared the Magnificent Seven Panic over and argued that the narrowing breadth of the market had been resolved in relatively painless fashion. While the Mag 7 dropped sharply, other stocks gained and the overall S&P 500 moved roughly sideways for a week or so. It's the cap-weighted S&P 500, of which those stocks still accounted for 32.1% at Tuesday's close, that matters most to people's portfolios, and it's fine. Jonathan's argument is correct. The Magnificent Seven continue to do a great job of making their shareholders richer. However, I would be careful about dismissing such a big shift. Internal upheavals on this scale tend to signal that something is amiss, even if the overall market carries on smoothly. And the breadth issue is growing extreme. Over time, smaller companies tend to outperform, and so the equal-weighted version of the S&P, in which each stock accounts for 0.2%, tends to beat it over time. The equal-weight can be viewed as a measure of the "average stock." The last time growth in the cap-weighted index was further ahead of the average stock than it is now came at the top of the dot-com bubble in 2000. Prior to the June CPI data, the S&P 500 was further ahead of the average stock than at any time since 2003. That doesn't harm holders of ETFs tracking the S&P, but it suggests something strange is afoot: Narrow breadth like this does create problems for investors because its effect is to make the index less diversified. Steve Fox of Capital Group produced a fascinating piece of research on the problem of "bad breadth" last year. He borrowed the concept of the Herfindahl-Hirschman Index, or HHI, which antitrust authorities use to gauge the degree of concentration in an industry: Let's say you wanted to create an equally weighted portfolio of stocks that would provide the same level of diversification as the market-cap weighted S&P 500 Index. How many stocks would there be in that hypothetical portfolio? This number is called the "effective number of constituents" (ENC) in an index, an inverse of the HHI. The answer is 60 stocks (as of 30 June 2023). Because the S&P 500 Index is so highly concentrated, it isn't providing any more diversification than a portfolio of 60 equally weighted stocks.

Since Fox wrote that, effective concentration has increased. Lapthorne of SocGen reckons that number has dropped below 50, while the FTSE World index effectively offers no more diversification than 150 stocks would: Bad breadth can be a problem, then. Meanwhile, there are longer-term problems with the Magnificent Seven's dominance. They all have exceptionally well-defended competitive positions, and are sucking capital and revenues from others. This, according to a remarkable essay by Charles Gave, one of the founders of Gavekal Research, is at the heart of US woes: Why has there been so little inflation in the US? Because instead of buying US Treasuries as they did in the past, the foreign holders of US dollars have bought the shares of these information oligopolies —otherwise known as the Magnificent Seven — so driving massive inflation in the share prices of these companies.

His suggested solution would be to emulate Theodore Roosevelt (ironically the vice president and successor to Donald Trump's favorite William McKinley) and "go after the Magnificent Seven and their like and break them up." If that happened, he argues, the dollar would depreciate (as Trump wants) and the US current account would improve. That, and not tariff walls, Gave says, would allow for creative destruction and the rebirth of US industry. There may still be a very much bigger Magnificent correction ahead — and to avoid it, investors might want to continue reallocating into smaller companies. Some are dropping Tesla from the Magnificent Seven as investor skepticism drives a fall in its share price. Earnings below expectations didn't help, and doubts appeared to intensify during the earnings call, presided over by omnipresent CEO Elon Musk. How investors felt about the earnings and Musk's comments is clear enough from this chart for the day, through to after-market trading: An 8% fall after market tells its own story. What was the problem? In part, the Musk schtick is beginning to wear thin. To cite two almost comical examples, he at one point said that "everyone on Earth" would want an Optimus robot, so the total addressable market for it was about 8 billion, and then answered a question about regulatory approvals for the robotaxi by saying: "Our solution would work anywhere, even a new Earth." That inspires Musk's legions of admirers but it falls flat with shareholders, particularly after a poor quarter. Then there was a lack of catalysts to prompt new investments. The day to introduce the robotaxi, on which Tesla is betting big, has been put back to October, and there was no other specific news. Most puzzling was the revelation that work on a new gigafactory in Monterrey, Mexico, is being suspended until after the US election because of the risk that a Trump administration would levy extra tariffs. Trump has also heavily criticized subsidies for electric vehicles. That makes it all the more mystifying that Musk last week decided to endorse him and send donations of $45 million each month — although he now seems to be backtracking on the financial commitment. Shareholders are being asked to pay Musk a huge executive package, and he plans to donate it to a politician whose agenda would directly damage their company. You can understand why they're miffed. Equities have long been regarded as great assets for pension funds. The S&P 500's AI-driven stellar performance since late 2022 further enhances that appeal. Unlike mutual funds, it's impossible to have anything close to a real-time measure of the performance of the big public pension funds based on their holdings, no matter how tempting the idea may be. But when they publish their fiscal year performance, typically between July and October, they provide valuable insights into their allocations and earnings. While we wait, an analysis by Markov Processes International using its proprietary model to project the performance of public pension funds managing more than $20 billion in the year from July 2023 to June 2024, came to one conclusion — funds with higher allocation in US equities are poised to outperform. No other asset comes close. Mega-cap technology companies powered the S&P 500's 24.6% return. US bonds snapped a string of losses, returning 2.6%. A range of alternative assets that pension funds have been urged to take on had a mixed time; private equity saw a 7.7% return by MPI's estimates, representing a rebound from the previous year's modest loss. Commodities or natural resources gained 5.0%, hedge funds returned 9.8%, and real estate lost -4.3%, the worst-performing asset class included. MPI's analysis comes with a bold asterisk — the projections are based on pension funds' last reported historical exposures and assumes there's not been any disruption in allocations (detailed methodology here). On that basis, the projected 16.3% returns from the Teachers Retirement System of Georgia, nearly 70% allocated to public equities, leads the pack slightly ahead of Kentucky Teachers at 16.1%: Measuring these returns against the old 60/40 (60% stocks and 40% bonds) is a good starting point to understand how impressive they are. Per MPI's analysis, a strict domestic 60/40 portfolio would have fetched 15.5%, while a global version yielded 12.5%. By those standards, the teachers of Georgia and Kentucky should be very happy. And they also enjoyed a strong performance in 2023: As we've seen, the Magnificent Seven phenomenon can breed fear of missing out, and managers are very much aware that making allocations based on such near-term performance carries its risks. MPI's Jeff Schwartz argues that market timing is among the scariest things pension fund managers could do. That's particularly relevant given the recent rotation out of the biggest stocks: I fear they're being pulled to be market timers because we all want to judge them over these short periods. We're living through a period where small caps are coming back, and foreign equity is coming back. Do we want to see these portfolios now showing huge allocations to small-cap and foreign? Is that what we're looking for?

As always, investment managers must make decisions strategically. The small-cap premium will continue to exist in the long term. As Schwartz puts it, there would be genuine cause for concern to see a portfolio change dramatically just because everybody was saying small caps were back on the march. All things being equal, MPI analysis projects an average pension fund return of 11.3%. Washington Public Employees' Retirement System claims the crown as the top-performing fund over the 10-year period through fiscal 2023 and is projected to achieve a return this year of 10.2% with similar reported allocations to public and private equity. That 2024 performance doesn't sound good until it's viewed in the longer-term context, which is always the most important for pensions. Washington's long-term performance should remind managers that piling into public equities isn't an easy way out. —Richard Abbey One more tip for Olympic preparation: Watch Chariots of Fire. It's a great movie and it holds up very well. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Justin Fox: McKinley Was a Game Changer, But His Tariffs Weren't

- Kathryn Anne Edwards: Conservative Fiscal Hawks Have Flown the Coop

- Jonathan Levin: I Gave Up a 2.6% Mortgage to Upgrade. Will I Regret It?

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment