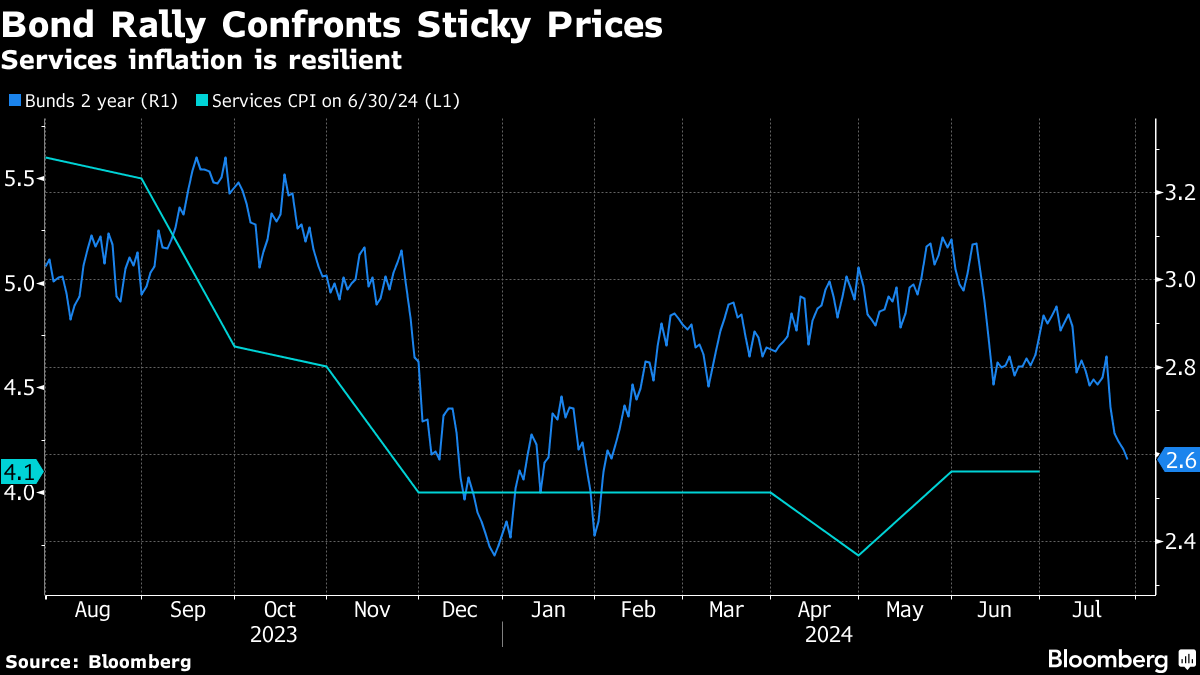

| European bonds may suffer a setback as the last inflation mile could prove stubborn. An impressive rally over the past month, in line with global debt, needs more than just momentum to continue. The market is pricing in about an 80% chance of an ECB rate cut at its September meeting. In this data-dependent world, the central bank needs more information to continue easing and it's about to receive both inflation and growth figures. The region's GDP should improve for Q2, but the expansion remains mediocre and may justify the need for more stimulus.

But then there's the bank's laser focus on inflation — which is moving closer to the 2% target after peaking at 5.8% just a year and a half ago — and on anchoring expectations. Eurozone 5y inflation swaps also dropped to the lowest level since October 2022. That means it's all moving in the right direction for the ECB, except for services inflation which is holding around 4% since the end of last year. With two inflation readings before the Sept. 12 meeting, the trend for resilience in service sector prices needs to show signs of cracking to convince the hawks that another cut is plausible. In the meantime, any CPI stickiness will force traders to question whether the likelihood of imminent easing is justified. Mary Nicola is a macro strategist for Bloomberg's Markets Live team, based in Singapore. |

No comments:

Post a Comment