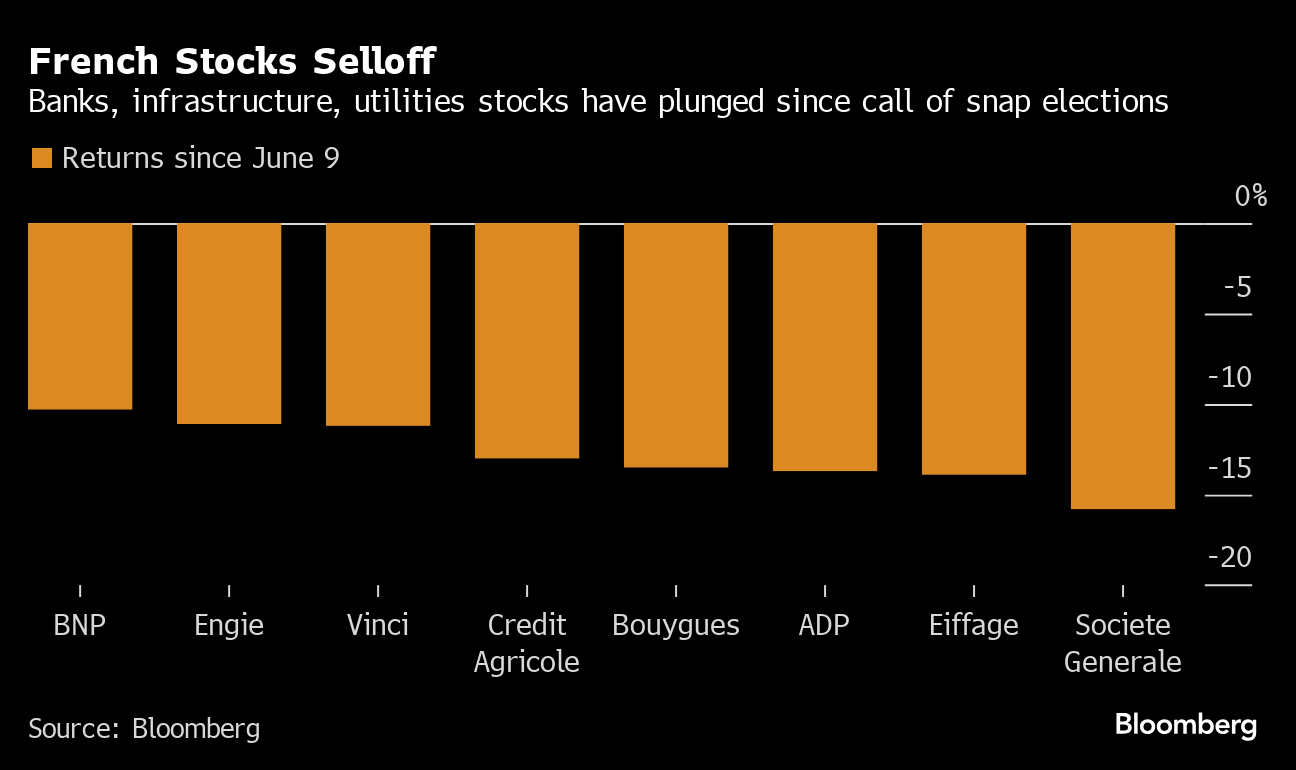

| Marine Le Pen's National Rally dominates the French election. Regulators in Asia crack down on trades popular with hedge funds. Joe Biden's campaign fights back. Here's what you need to know today. Marine Le Pen's National Rally dominated the first round of France's legislative election and set its sights on an absolute majority as President Emmanuel Macron and her other opponents began strategizing to keep the far-right party out of power. The National Rally was projected to get about a third of the vote, according to projections from five polling companies on Sunday, eclipsing the left-wing New Popular Front coalition and Macron's centrist alliance. Gains in the euro early Monday indicate investors anticipate Le Pen will fall short of an absolute majority in the next round of elections. Regulators in Asia have tightened the screws on trades popular among hedge funds as stocks slumped, an attempt to stabilize markets that some worry may end up stifling key strategies. Thailand's plan to increase scrutiny on high-frequency trades — in effect from Monday — follows steps from China, where programmed trading will soon be subject to real-time monitoring. While authorities expect the moves to enhance transparency, the growing control over certain trades has raised concern that liquidity may tighten and make those markets overall less attractive. President Joe Biden's campaign is going on the attack against a chorus of donors, consultants, officials and media voices calling on him to drop out of the 2024 race after his devastating debate performance. The strategy will be remembered as a display of either remarkable foresight or incredible hubris. Aides spent the weekend publicly dismissing suggestions that Biden reconsider his candidacy or take dramatic steps to overhaul his operation. They angrily denounced the suggestion Biden and his family might entertain a discussion of leaving the race as they traveled to Camp David for a private getaway. Global policymakers aren't about to let the Federal Reserve's delay in cutting interest rates distract them too much from their own easing efforts. Among the 23 of the world's top central banks featured in Bloomberg's quarterly guide, only the Bank of Japan won't end up lowering borrowing costs within the next 18 months. Most are already set to do so this year. Even the Fed itself, whose plans for cuts in borrowing costs went awry in the face of stubborn US inflation, will still end up delivering a couple of moves this year, the forecasts show. China's factory activity contracted for a second straight month in June, signaling weakness in an area that Beijing is betting on to drive the economy. The official manufacturing purchasing manager index was at 49.5, the National Bureau of Statistics said Sunday. That was the same reading as May, and in line with economists' prediction in a Bloomberg survey. Any number above 50 points to an expansion. China's economy has performed unevenly this year, with manufacturing at times a bright spot while consumption has been weighed down by a prolonged real estate crisis. Shares of French banks Societe Generale, BNP Paribas and Credit Agricole will be in the spotlight when the market reopens on Monday in the wake of the first round of the country's parliamentary elections. Watch also infrastructure and transport firms Eiffage, Aeroports de Paris SA, Bouygues, Getlink and Vinci. Equity investors have been slashing their exposure to French stocks in the past three weeks, concerned about potential risks of tax hikes, higher borrowing costs and possibly even nationalizations. The CAC 40 hit its lowest level since late January on Friday.  Bloomberg Since President Macron's surprise decision June 9 to call for snap elections, SocGen has lost 16%, BNP has fallen 10%, and Credit Agricole has dropped 13%, hurt by rising political risk and the drop in French sovereign bonds. French banks are major holders of French debt. Also watch Eiffage, ADP, Bouygues, Getlink and Vinci, which have been hit by concerns over increased control by the state of infrastructure concessions. Natural gas provider Engie and water and energy management company Veolia Environnement have also seen their share prices decrease as investors ponder policy changes. TV networks TF1 and M6 also have fallen recently after a member of the National Rally said his party was considering privatizing the country's state TV and radio group. Michael Msika covers European equity markets for Bloomberg News in London. |

No comments:

Post a Comment