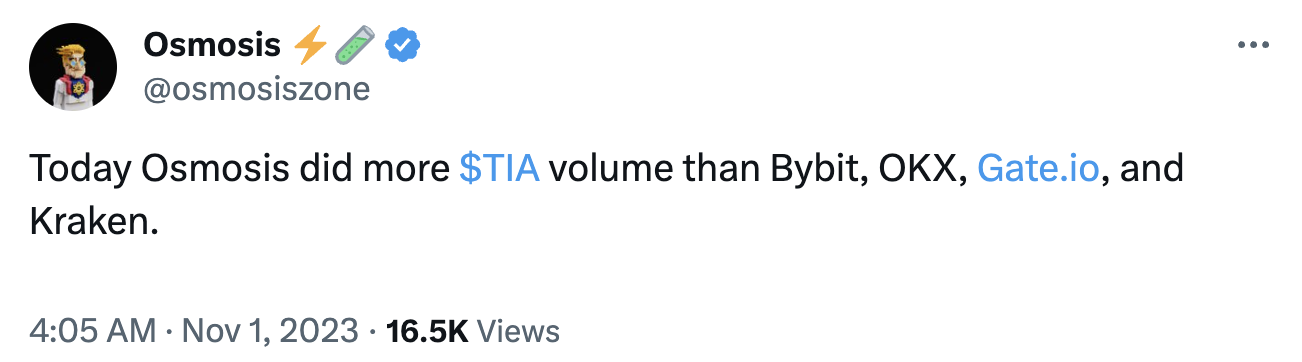

GM, say it back! Solana has continued to outperform the market, up ~25% in the past 7 days, while SOL/ETH has hit 0.02, the highest the figure has been since the end of 2022. I don't think I've ever seen this much talk about Solana on my timeline—once again proving that positive price action is the best marketing a project can have. Another token that has performed well in the past few weeks is ATOM. The token price has increased by ~20% within two weeks, however, this continued upside price action seems to have been short-lived, as the price is ~3% down today. The Cosmos ecosystem has been in the spotlight recently with the launch of Celestia's native token, TIA. Yesterday, a vast amount of users flocked to the ecosystem to trade their TIA airdrop, and it seems that Cosmos-native infrastructure wasn't able to handle the increased volume. Inter-Blockchain Communication ("IBC"), an interoperability protocol utilized within the Cosmos ecosystem, experienced congestion, causing transactions to fail, amongst other UX issues. Many users weren't happy with the experience and have pointed out that user onboarding and adoption won't be possible unless these issues are fixed. Speaking of IBC, it was announced that the protocol will be expanding to Avalanche. To pass arbitrary data between chains, both chains require a light client on their respective counterparts to authenticate their shared consensus state. Landslide Network, a subnet on Avalanche, is developing the IBC light client, which will enable interoperability between Avalanche and other IBC-enabled chains. Landslide will reportedly launch an incentivized testnet today. Some Cosmos community members have been showing their discontent with the decision to expand to Avalanche instead of fully focusing on the larger ecosystems such as Ethereum.

Lastly, Frax's domains were taken over yesterday. The issue didn't last long, though, as the project's Twitter account announced that the problem was solved six hours after the take-over was initially reported. These types of hacks involve redirecting users to a malicious site that is made to look identical to the original site in order to phish credentials. It's unclear whether any user funds were lost.

– Brick |

|

|

Curious who the winners and losers of the RWA narrative will be? You're in luck. Join Blockworks Research Analysts, Centrifuge, and Blocktower Capital on an exclusive webinar on "Decoding Real World Assets: Unlocking the Investible Opportunity". You don't want to miss this one for the insights from individuals who are on the ground. Sign up here! |

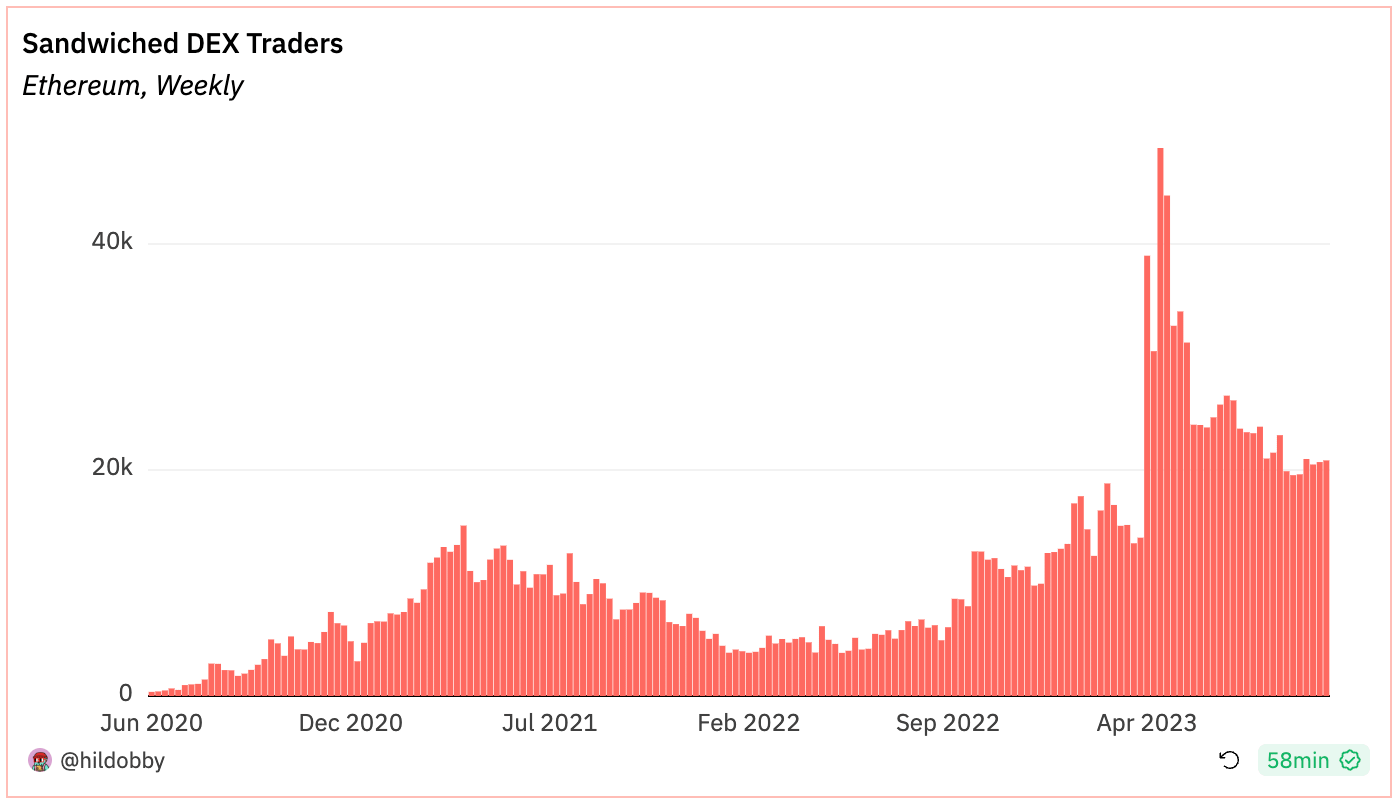

Currently, 20K addresses get sandwiched per week on Ethereum. At the peak of meme coin mania, the number was closer to 50K. Jaredfromsubway.eth, one of the best-known searchers, was truly eating. It's surprising to me that the number of sandwiched DEX addresses is 2x higher now than during the peak of the previous bull market. Perhaps it is a sign of how much the MEV market has developed, and how much more competitive and sophisticated it has become. If it's 50K addresses being sandwiched in the depths of the market, imagine what it would be during the peak of the next bull. Wouldn't be too surprised if it hits 1M. Unless, everyone starts using private RPCs such as MEV blocker or Flashbots Protect, which promise to not sandwich your trades, not revert your transactions, and in the best case scenario, you get paid for your order flow as MEV actors backrun your transaction. However, using such RPCs usually comes at a cost of inclusion speed, as your transaction gets sent to a limited number of builders who may not always be guaranteed to win the MEV-Boost auction. |

It's time for a little Avalanche shakeup. Previously, all Avalanche subnet validators had to validate the primary network, too. However, in a new community proposal, Patrick, VP of Engineering at Ava Labs, proposes a new type of staker. Subnet-Only Validators (SOVs) can validate an Avalanche subnet and participate in Avalanche Warp Messaging (AWM) without syncing or becoming a validator on the Primary Network. Rather than staking at least 2,000 AVAX to become a Primary Network validator, SOVs will only have to pay a refundable fee of 500 AVAX to register as a subnet validator. If this proposal passes, future changes may also include a pay-as-you-go fee structure for validation rather than a predetermined staking amount and AVAX augmented subnet security. Given that the requirement of a subnet node operator might reduce from staking 2,000 AVAX to paying a one-off 500 AVAX fee, this could potentially be a boost for subnet growth on Avalanche, albeit at the detriment of a larger supply sink for AVAX. |

Chainlink is a clear leader in the oracle market and adjoining verticals, but apart from its price data solutions, demand has been lackluster. To overcome this, the project is making changes to its operational model, together with betting on material adoption by financial institutions. |

ARB staking could act as a short-term catalyst for the ARB token and overall activity on the Arbitrum network. In the long term, it's a significant step towards transforming the ARB token from merely a governance token into a token with broader utility, at the cost of extra inflation. |

Sized for retail users, the futures contracts for bitcoin and ether "offer lower upfront capital requirements" |

The SEC needed to submit its controversial crypto accounting rule for Congressional review prior to publishing the bulletin, GAO says |

|

|

The insights, views and outlooks presented in the report are not to be taken as financial advice. Blockworks Research analysts are not registered broker/dealers or financial advisors. Blockworks Research analysts may hold assets mentioned in this report, further outlined in the Firm's Financial Disclosures. |

133 W 19th St, New York, NY, 10011 |

Manage your email subscription preferences here. |

|

|

|

No comments:

Post a Comment