| I'm Chris Anstey, a senior editor for economic policy in Boston, and today we're looking at the looming US government shutdown. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X (formerly known as Twitter) via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Euro-zone core inflation hits a 1-year low, backing an ECB pause.

- BOJ acts to slow rising bond yields with unscheduled buying.

- Today's BigTake looks at China's new smartphone and the US tech war.

Here we go again. Another political impasse in Washington is almost certain to force at least a partial shutdown of the federal government come midnight Saturday into Sunday. Much like with the showdown earlier this year on the federal debt ceiling, a hard-line group of Republicans in the House is holding must-pass legislation hostage in the effort to force cuts in government spending. The previous effort was far riskier as it ran the risk of the US defaulting on payment obligations. That's not what's at stake this time. With this one, it's about failure to appropriate funds to keep the federal government running. Debt payments can continue, and people who are deemed essential — think air-traffic controllers — still report to work. But many other functions will be on pause, as will many paychecks. And that will impose a short-term hit to the economy. A rule of thumb among Federal Reserve staff members is that each week of shutdown shaves off 0.2 percentage point from the annualized GDP growth rate, according to David Wilcox, who used to work at the Fed and is now at Bloomberg Economics. Typically, losses get made up in the next quarter. (Read Wilcox's analysis on the Bloomberg terminal here.) One immediate challenge for Fed policymakers will be a lack of key economic data that's collected and published by government statisticians, as Augusta Saraiva reported here. It's as if the pilots aiming for a soft landing suddenly lost instrumentation showing their altitude and pitch. There of course are private-sector data to look at. But Friday's release on the Fed's preferred inflation gauge may be the last official indicator for a while. It's forecast to show another tame monthly gain in core prices, which exclude food and energy costs, for August. "No data, no hike" has been the thinking in the bond market with regard to the Fed's Nov. 1 policy decision, as Ian Lyngen at BMO Capital Markets put it this week. What's different from the last shutdown in 2019 is this time none of the federal agencies have been funded for 2024. There's never been a comprehensive shutdown that lasted more than about a week, according to Ariana Salvatore, a Morgan Stanley researcher who's looked at the issue. As pressure on the economy and from the public starts to build beyond that timeframe, Republican holdouts will become more likely to bend. If they don't, that raises the odds of a bipartisan backup maneuver. But the blow to perceptions of US governance may take longer to recover from. - Senior US and Chinese officials held "candid" talks in Washington as a flurry of high-level diplomacy bolsters expectations President Xi Jinping will attend a major summit in California this year.

- Can you 'Trump proof' the Transatlantic relationship? Europe is trying.

- A public spending boom and tax cuts carried out by Argentina's Economy Minister Sergio Massa, who's also running for president in the October election, pose new setbacks to the country's $44 billion IMF program.

- Russia currently has 150,000 excess shipping containers that rail depots are struggling to manage, reflecting a surge in Chinese goods flowing into the country but much less moving out.

- The rising price of Singapore's humble Chicken Rice dish is causing angst over the rising cost of living in the island.

- Less than half of England's Black residents live in London for the first time since at least 1991 — a stark contrast to the record high 20 years ago, when about 70% of the country's Black population called the city home.

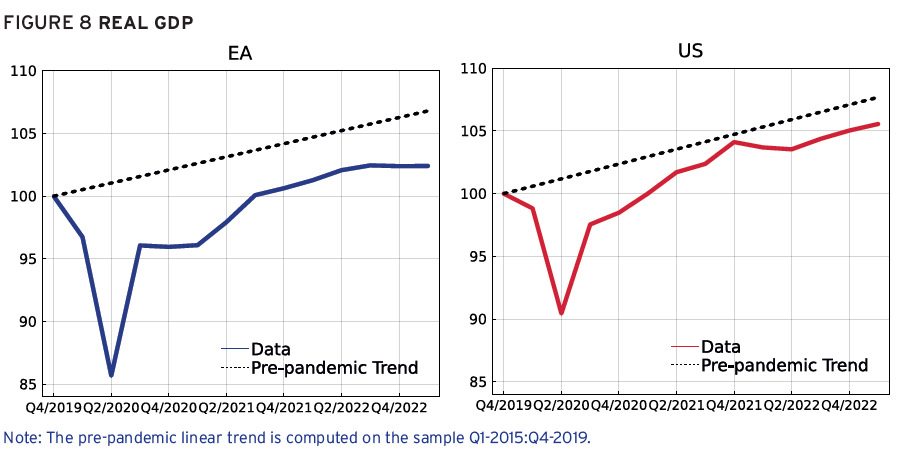

Get the Eastern Europe Edition newsletter, delivered every Tuesday, for insights from our reporters into what's shaping economics and investments from the Baltic Sea to the Balkans. It's time to call time on interest-rate hikes in the US and euro zone. So says a quartet of leading female economists warning about economic damage if policymakers keep going. "The benefits of more tightening will be small, when compared to the risks," the group concluded, after considering "the extraordinary size of the supply shock the economy has had to absorb and the fact that monetary policy operates with a material lag."  Source: Veronica Guerrieri, Michala Marcussen,Lucrezia Reichlin and Silvana Tenreyro, and Haver Analytics data "Accepting a degree of short-term inflation may be a necessary cost to allow for relative price movements that help obtain a better allocation of resources," the economists, who include former officials, said. "The lagged effects of monetary policy tightening are yet to make their way through the economies." Does it matter that the Fed is no longer making profits? Read more reactions on X The sixth annual Bloomberg New Economy Forum returns to Singapore Nov. 8-10 as the world's most influential leaders gather to address the critical issues facing the global economy. This year's theme — "Embracing Instability" — focuses on opportunities to better understand underlying economic issues such as persistent inflation, geopolitical tension, the rise of artificial intelligence and the precarious state of the world's climate. Request an invitation here. |

No comments:

Post a Comment