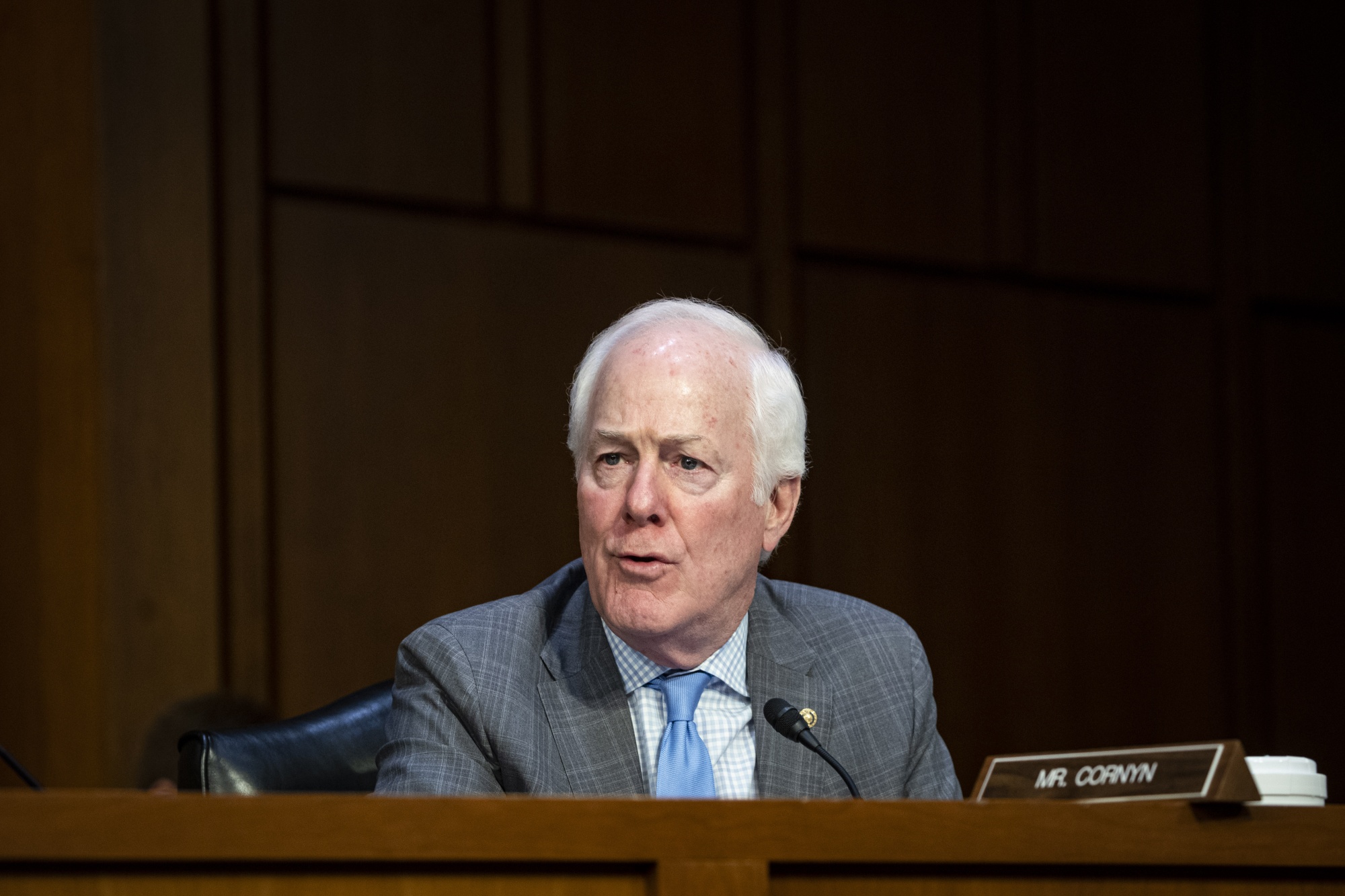

| By Tim Quinson For all of the Republican Party's furious opposition to ESG, its efforts to accomplish something on the legislative front have fallen short. At least that's the view of Cowen Inc. analyst John Miller, who closely tracks regulatory affairs for the firm's Washington Research Group. House Republicans held a series of hearings last month, which Miller monitored. At the meetings, the lawmakers called for squashing the Securities and Exchange Commission's efforts to enforce more transparent corporate disclosure requirements for environmental, social and governance factors. In addition to taking on the SEC, GOP lawmakers are pushing for stricter oversight of proxy advisory firms and also favor limiting—or even excluding—ESG-focused investments from Employee Retirement Income Security Act (ERISA) funds. "However, the reality is if you're expecting any meaningful legislation to emerge from all the Republicans' talking points, think again," Miller says. Of course, the big reason is that while a slim-GOP majority controls the House of Representatives, a similarly small majority of Democrats controls the Senate. Indeed, Miller says the Republican initiative to protect industries responsible for churning out fossil fuels will have little, if any, overall impact on investors. Money flows to clean energy and clean transportation companies will go on unaffected and most money managers will continue to invest anyway that they want, he says. "While Democrats are increasingly concerned that anti-ESG efforts will slow capital flows, we don't think so because no matter what happens in the Republican-controlled House, there's little chance the Democrat-controlled Senate will take up the issue," Miller says. The two areas where the Republicans may make headway, however, center on proxy advisory firms and ERISA, Miller says. Still, he adds that such efforts won't have any long-lasting impact on the financial markets. ERISA is a federal law that sets minimum standards for most voluntarily established retirement and health plans to provide protections for individuals who take part. The debate around it focuses on whether fiduciaries can consider the climate crisis and other ESG factors when selecting investments and exercising shareholder rights. While Democrats back this position, Republicans want to eliminate any connection between ERISA and ESG. They contend that fund managers should care only about generating the highest returns possible for investors, and nothing else. (This despite research showing ESG investing strategies can be equal to or more profitable than non-ESG strategies.) As for proxy advisory firms Institutional Shareholder Services and Glass, Lewis & Co., the GOP contends they are "an activist duopoly," Miller says. The party is calling for independent audits of the proxy advisers, arguing that they often back shareholder efforts it sees "as surrendering economic analysis in lieu of social and climate issues," he says. The party's professed concerns have emerged amid evolving rules from the Biden administration that have led to a larger number of ESG-linked shareholder resolutions. The Republicans want to reverse this trend. "We expect a full House vote on SEC disclosure rule-making and the proxy situation to occur in the fall, probably in October, but as mentioned, we don't expect the Senate to follow up, meaning nothing will really change," Miller says.  John Cornyn Photographer: Al Drago/Bloomberg The political infighting is occurring during a summer of record-setting wildfires and deadly heat waves across the globe. Scientists concur that the burning of fossil fuels is behind the growing number of environmental catastrophes human face all over the world. So far though, Republicans—whose attacks on ESG are being pushed by the very industries who make billions of dollars selling those fuels—remain largely unmoved. In fact, some are still pushing back against the science behind global warming and this summer's historic heat. GOP Senator John Cornyn of Texas, who serves as an adviser to Senate Minority Leader Mitch McConnell, said last week that drawing a correlation from recent heat waves and wildfires to climate change was "hubris." SEC Chairman Gary Gensler, however, appears to be feeling pressure from the GOP campaign against ESG. He has indicated that the commission's final climate disclosure rule, delayed for over a year now, will likely need a shift to make the regulation more palatable to the right, given considerable political pushback to date, according to analysts at Bloomberg Intelligence. The rule will require companies to report how they identify and manage climate risks, in addition to certain audited greenhouse-gas emissions data, and legal challenges are inevitable, given the sizable cost of implementation, BI says. Like always, the SEC will have to confront "increased policy volatility" as corporate disclosure requirements and various shareholder proposals shift between the Democrats and Republicans, Miller says. But at the moment, "other than the ERISA and proxy stuff, there's not a lot there," he says. As the Amazon hurtles toward a catastrophic tipping point that's eroding its status as a major carbon sink for the entire planet, a new study maps out which banks have pumped the most money into oil and gas extraction from the world's largest rainforest. JPMorgan Chase and Citigroup are at the top of the list. An analysis by Stand.earth, a nonprofit with offices in Canada and the US, lists the two Wall Street behemoths as the two banks that have dominated financial backing to atmosphere-warming fossil fuels in the Amazon basin over the past 15 years. In all, JPMorgan and Citigroup were behind $3.8 billion in loans and bonds for oil and gas production and infrastructure, the group says.  Scientists have found that parts of the Amazon have begun to emit more CO2 than they absorb. JPMorgan Chase and Citigroup were behind $3.8 billion in loans and bonds for oil and gas production and infrastructure in the South American river basin. Photographer: Mauro Pimentel/AFP/Getty Images - Intensifying global warming is poised to increase borrowing costs for cities, countries and companies as ratings firms struggle with climate risk in a $133 trillion market.

- A majority of investment bankers tasked with setting industry standards for calculating carbon footprints of capital-markets activities favor banks reporting only one third of emissions tied to stock and bond underwriting.

- Swift condemnations of missteps by top executives at NatWest Group Plc may have been fueled in part by growing UK conservative opposition to the bank's environmental and social advocacy.

For unlimited access to climate and energy news — and to receive the Bloomberg Green magazine — please subscribe. |

No comments:

Post a Comment