| Trump indicted in 2020 election probe. US stripped of AAA credit rating. Singapore PM to address graft probe. Here's what you need to know today. Donald Trump has been indicted in Washington on federal charges over his efforts to overturn the 2020 presidential election. Trump, 77, was charged with conspiracy to defraud the US, conspiracy to obstruct an official proceeding, obstruction of and attempt to obstruct an official proceeding, and conspiracy against the right to vote and have that vote counted, according to the indictment filed in federal court. The charges carry penalties of as much as 20 years in prison. Trump has been ordered to appear in court at 4 p.m. on Aug. 3. Here are all 78 charges — and the possible prison time — the former president now faces. The US has been stripped of its top-tier sovereign credit rating by Fitch Ratings, echoing a move made more than a decade ago by S&P. The credit assessor downgraded the US to AA+ from AAA — a ranking the nation has held at Fitch since at least 1994 — in the wake of major political battles over the nation's borrowing and repeated standoffs over raising the debt limit. While the most recent legislative impasse was resolved, it remains a potential issue of concern going forward. The assessor has a stable outlook on the country. Singapore's Prime Minister Lee Hsien Loong will today address the ongoing graft investigation involving Transport Minister S. Iswaran and property billionaire Ong Beng Seng. Lee's ministerial statement will also discuss the resignations of parliament speaker Tan Chuan-Jin and ruling party lawmaker Cheng Li Hui. A series of scandals — including the first to involve a senior minister since 1986 — is putting Singapore's image for clean governance to the test just as Lee prepares to pass the baton to new leaders. China's manufacturing and housing market continued to slump in July, with Beijing making fresh pledges to shore up the economy's recovery.

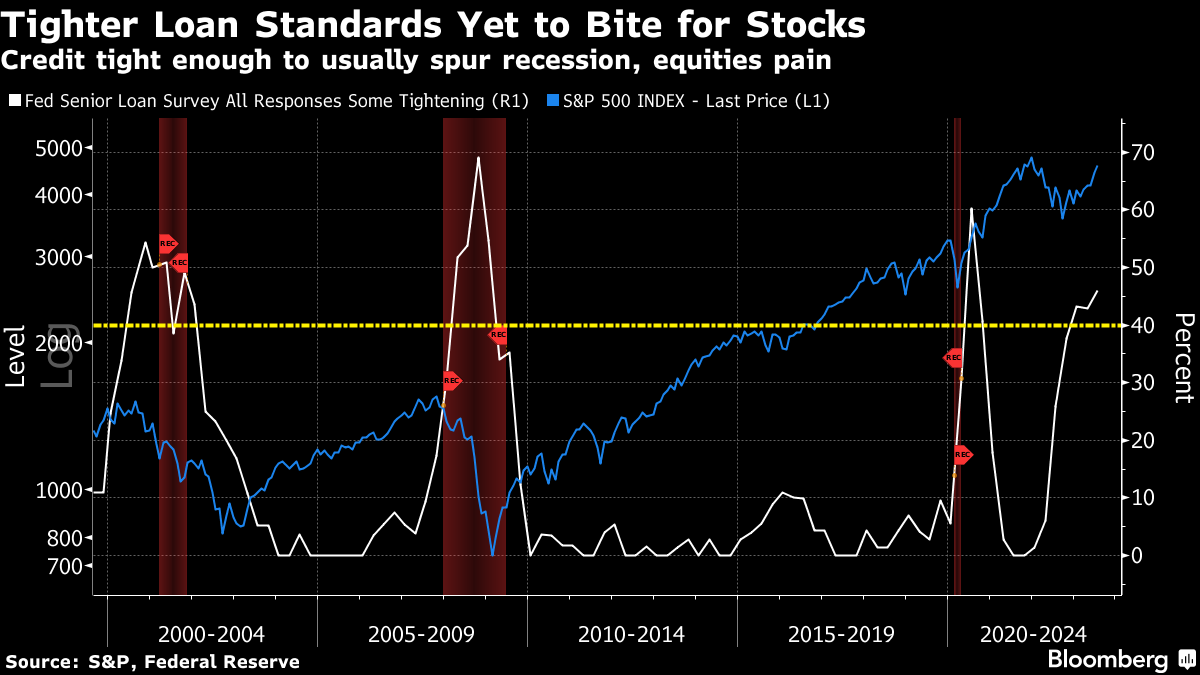

The Caixin index of manufacturing activity declined to a six-month low of 49.2 last month, pointing to a contraction in the sector as export demand slumped. A separate report showed home sales tumbled 33.1% in July, the most in a year. The government extended a raft of pledges made in recent days to bolster the economy, pledging to boost credit to private companies and extend other funding measures to small firms. Treasury futures rose while the dollar and contracts for the S&P 500 stocks benchmark declined after Fitch downgraded the US. The yen and the Swiss franc rose in a sign of demand for havens. Sentiment going into Wednesday had already been downbeat, with stock futures for Hong Kong, Japan and Australia all lower. The S&P 500 finished Tuesday's session with a small loss, while bonds fell, with the 30-year yield hitting its highest point since November. The recession warning signs continue to pile up and equities keep looking past them. The latest edition of the Federal Reserve's survey of senior loan officers at banks saw the ratio of those reporting some tightening of standards climb further above the 40% level that's usually been seen before or during a recession. The likelihood that this means a dramatic slowdown is coming for US the economy underpins Bloomberg Economics' conviction that a recession is coming, despite growing support for the soft-landing narrative.  Equities are marching higher meantime, signaling that investors are distinctly unimpressed by such concerns. That's another example of the way in which the Covid recession and the stimulus unleashed in response have made the current environment so hard to read. Back in 2000 and 2008 when the tightening gauge climbed past 40%, stocks were already on the way down and they stayed in their downtrend. This time round the S&P 500 did move down as lending tightened, but it then rebounded rapidly, even as banks became more reluctant to provide credits. Equity bulls may keep charging ahead unless lending gets substantially tighter still. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment