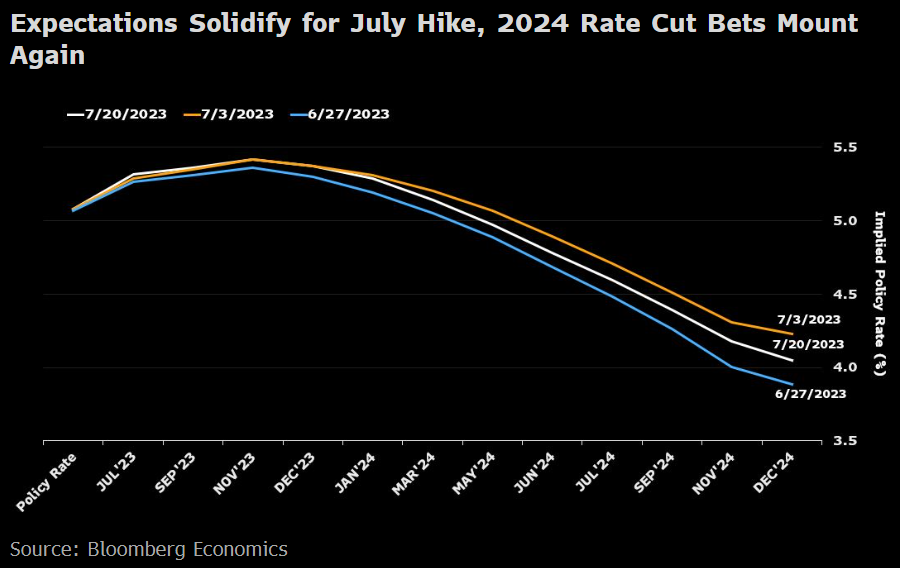

| In the closing years of the Second World War, the Big Three set out the shape of the postwar world and sowed the seeds of the next decades-long conflict. By comparison to Franklin D. Roosevelt, Winston Churchill and Joseph Stalin, the names of Jerome Powell, Christine Lagarde and Kazuo Ueda do not inspire the same awe or dread — but the leaders of the Federal Reserve, European Central Bank and Bank of Japan are the Big Three of modern central banking, and all will preside over monetary policy decisions this week, just as the hope has taken hold that easier money is close at hand. Here's what to expect: Kicking it off is the Fed, which meets in the midst of a surge of earnings results from 165 companies in the S&P 500 — amounting to nearly $15 trillion in market cap. What the central bank will do Wednesday is almost a certainty. Traders and economists have a near-unanimous agreement that Powell & Co. will hike by 25 basis points — their 11th such increase since early last year — and bring the benchmark rate to a range of 5.25% to 5.5%. The question is what it says about the future. Many are expecting a unanimous decision by the Federal Open Market Committee. George Mateyo, chief investment officer at Key Private Bank, sees the the outcome as "preordained… The Federal Reserve is not done and I think what they've been trying to signal this year is that a pause might be likely, but a pivot is not. So the Fed is not going be taking off the brakes anytime soon and potentially, they might actually have to raise rates even further this year." As Bloomberg's model of fed funds expectations shows, markets are still positioned for a gradual loosening that doesn't get going in earnest until next year, with a slight possibility of one more hike after this one:  Guiding on the future could be difficult, given the absence of a dot plot at this meeting. After the unanimous decision to leave policy unchanged in June, the minutes revealed disunity, with some favoring interest-rate increases. Mixed economic data in the last month, largely supporting the doves on the committee, has further blurred the picture. In the US, inflation has since cooled but remains persistent. For Bloomberg Economics, the central bank still has room for one more quarter-point hike this year, though "June's soft inflation data may have weakened their conviction." Further, the doves may soon strengthen their position. "The internal dynamics on the FOMC may be changing in favor of the doves," Anna Wong of Bloomberg Economics wrote, referring to the plans of St. Louis Fed President James Bullard to resign effective Aug. 15. Their latest sentiment spectrometer, she said, "shows that many FOMC members have moved away from the hawkish end of the spectrum since last year, with many now clustered around the center."  The Fed is clear that its goal is reining in inflation even at the expense of kneecapping the economy. The 2% target is still a long way off, but it certainly helps that recession fears have started to abate. Wall Street shops have pushed back their calls for a downturn, or changed tone altogether. Barclays is the latest. The firm pushed back its projected mild recession to 2024 and forecasts a shallower downturn than before, which would probably qualify as a "soft landing." It expects the Fed's rate hikes to have limited traction in slowing the still-strong labor market and expects core inflation to remain in a "stubbornly elevated range" of around 2.7% year-on-year at the end of 2024. Thus, even though more confident about economic growth, Barclays thinks the Fed needs to keep a hawkish stance: We expect the FOMC and Powell to signal a tightening bias for future meetings. Softer-than-expected June CPI prints reduce the urgency for an additional hike, but the FOMC will remain skeptical that conditions are in place for a sustained return to the 2% inflation target absent appreciable slowing in the labor market and wages.

As there are hopes that the Fed will instead signal an indefinite hiatus, or even that its hiking campaign is over, such an outcome might not go down well. It's not where the market is positioned. After some exceptional switchbacks over the last 12 months, the fed funds futures market has for the last month settled with some confidence at 5.33% for the effective rate expected for the end of the year: In theory, this should make the market more vulnerable to a "hawkish" surprise on Wednesday. However, if recent FOMC days are anything to go by, traders will be able to persuade themselves that Powell is dovish once he starts his press conference, no matter what he says. Christine Lagarde, unlike Powell, isn't for pausing or skipping. She's made that clear and a further rate hike this week is a certainty. After that, however, the possibilities are far more open. Klaas Knot, a hawkish Dutch member of the ECB's governing council, shifted expectations sharply last week when he told Bloomberg TV that a hike after this month would "at most be a possibility, and by no means a certainty." After this month, he said, the central bank must "carefully watch what the data tells us on the distribution of risks surrounding the baseline." Those words helped the two-year bund yield, trading as as high as 3.33% earlier in July, to drop below 3%. The yield has risen a little since then, but the shift in sentiment appears to be strong. The ECB faces an additional pressure toward dovishness from the most expensive euro on record, when judged in nominal effective terms. That can only put pressure on European exporters, at a time when the Chinese currency is cheap and the US dollar is weakening. If there's a reason Knot and his colleagues are sounding less vigilant, it comes from the euro:  An overvalued currency is a problem for the eurozone, and particularly for the export-led German economy. So the way the euro has by the ECB's own measure reached its strongest ever level is a big problem for them. This week's hike by 25 basis points, bringing the key rate to 3.75%, is baked in. But is there really good reason to think that the ECB will stop at that point? Deutsche Bank Research argues against. "The ECB wants the market to understand its commitment to the timely return of inflation to target and its willingness to go 'higher and longer' if necessary," strategists including Michael Kirker wrote. "There is data that supports a hike to 4% in September (such as the momentum in inflation, and rise in wages and margins). However, there is also data (such as the weakening growth picture from today's PMI numbers), that says the opposite too." Monday's PMI manufacturing numbers for France, Germany and the eurozone suggest a sharp slowdown, and sparked a further decline in European bond yields: Like the Fed, the ECB is probably near the peak of its hiking cycle. "Indeed, next week's hike could well prove to be the last," wrote Felix Feather, European economic analyst at abrdn. "We don't think the ECB is likely to commit either way regarding its decision at its September meeting at this stage." Also like the Fed, policymakers have stressed their data dependence and will likely look through recent economic releases. The uptick in inflation will be the main focus, according to Bloomberg Economics' David Powell, even as the deterioration in the euro-area economy is increasingly visible beyond the manufacturing sector, with services activity moderating in July. Unlike the Fed, with its dual mandate of price stability and maintaining high employment, the ECB only has the former to think about. This is why it's been much more prone than the Fed to make hawkish mistakes (as it did when hiking in 2008 and again in 2010). But the evidence of a dangerously slowing economy may now be too hard to ignore. If Kazuo Ueda, the new governor of the Bank of Japan, is to be believed, the long-running policy of "Yield Curve Control" (YCC), or intervening to hold 10-year yields down, has more life in it yet. With the BOJ effectively buying up all of the bonds at that tenor, and the decades-long war against deflation apparently won, many analysts have regarded a major change to YCC as inevitable this year, if not a total abandonment. The departure in April of long-serving governor Haruhiko Kuroda was viewed as the last missing element. Look at the latest core inflation print, and it's hard to see any need for extreme easy money: To many of us, that looks persuasive; there's no need to keep spending money keeping yields down to combat deflation when core price rises are running at more than 4%. But Ueda's comments at a conference in India last week seem to run counter to that: "We have patiently continued our ultra-loose monetary policy under YCC," he said. "If our assumption (that sustained achievement of 2% inflation remains distant) is unchanged, our overall narrative on monetary policy remains unchanged." Those words jolted assumptions and helped the yen weaken sharply against the dollar last week, from Y137.5 back to Y141.5. It's still hard to see how YCC can survive unaltered much longer. How big a difference would this make? For Andrew Balls, global CIO for fixed income at Pimco, it's been so well telegraphed to world markets that it would not have much impact — though he admits that there's disagreement about this even within his own firm. The biggest argument against might come from the performance of the yen carry trade — the speculative practice of borrowing cheaply in yen and parking in a currency with much higher interest rates. This is a great deal, unless the yen suddenly rises. When that happened in 2008, the carry trade unwound swiftly and fed into the implosion of broader financial assets. The extraordinary gains to be made by yen carry traders putting their money in Mexico and Brazil have over the last year dwarfed even the money to be made ahead of the Global Financial Crisis. That's circumstantial evidence that people have pushed out the boats on continuing low Japanese yen and minimal Japanese rates: Can it really be safe to stay in this trade, particularly as the BOJ has said that it won't signal changes in advance? To those who are confident, Bruce Kasman and his team of economists at JPMorgan Chase & Co. suggest Ueda must make a big change to YCC swiftly to avoid a serious policy mistake: With US recession risks receded and Japanese inflation data — including this week's June CPI report — indicating firming underlying inflation, the BOJ will likely revise up its inflation forecasts... Its argument that "the rise in inflation is temporary" is thus becoming untenable and we think an appropriate response would be to widen the 10Y YCC trading band to +/-100bp next week.

That would cause quite a mess on markets, and cut against the belief that doves are now in the ascendant. But not to do so, Kasman warns, would be a problem for the BOJ's credibility and put further downward pressure on the yen. Another passive BOJ meeting would be welcomed by many, but the JPMorgan team warns that it increases the chance of an abrupt adjustment, and even an undermining of financial stability, further into the future.  At the G-7: Ueda and Lagarde at left, Powell at far right, flanking OECD Secretary-General Mathias Cormann and Italian Finance Minister Giancarlo Giorgetti. Photographer: Shuji Kajiyama/AP It's not just the Big Three reporting. Other central banks are as well, as handily mapped out by Bloomberg colleagues. It's not quite like the conferences at Yalta, Tehran or Potsdam, but central banks can move the world this week. —Reporting by Isabelle Lee It turns out that there are lots of songs about precipitation. Astute readers have added immensely to my playlist of rainy day songs published in yesterday's Survival Tips. More or less every genre is included. So, maybe try listening to: Rain, Rain, Beautiful Rain by Ladysmith Black Mambazo, Kingdom of Rain by The The (featuring Sinead O'Connor in a lovely duet), Rain by Uriah Heep, Little April Shower from Bambi, It's Raining Again by Supertramp, Rain Is A Good Thing by Luke Bryan, When It Rains It Pours by Luke Combs, Crying in the Rain by Whitesnake, Early Morning Rain by the late Gordon Lightfoot (and later by Peter, Paul and Mary) and Rainy Day People by Lightfoot, Looks Like Rain and Box of Rain by The Grateful Dead, No Rain by Blind Melon, Rain by The Cult, Rain on the Scarecrow by John Mellencamp, The Sun and the Rain by Madness, The Sun and the Rainfall by Depeche Mode, Set Fire to the Rain by Adele, Waterfront ("Get in, get out of the rain") by Simple Minds, Tinseltown in the Rain by Blue Nile, A Rainy Night in Soho by The Pogues, It's Gonna Rain by The Waterboys, Blame It On The Rain by Milli Vanilli, Rainy Days and Mondays by The Carpenters, Raining Blood by Slayer, MacArthur Park ("Someone left a cake out in the rain") by Donna Summer, An Old Raincoat Won't Ever Let You Down by Rod Stewart, Kentucky Rain by Elvis Presley, Mandolin Rain by Bruce Hornsby and the Range, Raining in Memphis by Dan Penn, Memphis Rain by Parker McCollum, Sunshine on a Rainy Day by Zoe, Rain by SWV, Through the Rain by Mariah Carey, Rainy Day by Coldplay, Crying in the Rain by A-Ha, Rain by Simply Three, Tears in the Rain by The Weeknd, and Can You Stand the Rain by Boyz II Men (a cappella), or in its original version by New Edition, In the Pouring Rain by The Clash, Rain Rain Rain and Still Falls the Rain by Roxy Music and Rainy Day Man by Joey Molland, The Rain, the Park, and Other Things by the Cowsills, and Yesterday's Rain by Spanky & Our Gang. And, of course, Rihanna's Umbrella. Any more rain songs out there? We'll aim to put out a Survival Tips rainy day playlist tomorrow.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment