| Chinese regulators meet global investors. Musk plans to dump blue bird logo. New Zealand justice minister resigns after crash. Here's what you need to know today. Chinese regulators have met with global investors, stepping up the government's bid to boost market confidence as the country's economic recovery loses steam. The rare meeting came after President Xi Jinping's administration voiced its strongest support in recent years for private tech enterprises. Fund managers are tamping down expectations ahead of China's Politburo meeting, expected later this month, with many bracing for prolonged gloom in the stock market on bets that any policy support will lack potency. Beijing faces the dilemma of ensuring the economy hits its roughly 5% growth target, while refraining from the type of all-out stimulus that may yield asset bubbles. Here's how China is supporting its economy while stimulus is awaited. One of the world's most recognizable birds may be about to be made extinct, if Elon Musk is true to his word. The Twitter owner said the social media company will soon change it's logo to an 'X', getting rid of the blue bird that has long been its signature. Roughly six months after he acquired Twitter for $44 billion, he merged the company into an entity called X Corp. "Soon we shall bid adieu to the twitter brand and, gradually, all the birds," Musk wrote in a Twitter post. Musk's many changes to Twitter so far haven't worked out well for stakeholders. In May Fidelity said the platform was worth just one-third of what Elon Musk paid for it. Equities look primed for early gains in Japan and Australia, before sentiment turns more cautious when trading gets underway in China.

Futures for stocks in Tokyo indicate an advance of more than 1% following a report Friday that Bank of Japan officials see little urgent need to address the side effects of their ultra-loose monetary policy. Contracts for Australia's benchmark also rose. Earnings will be in focus this week as heavyweights including Alphabet, Exxon Mobil, Meta, Samsung and Rio Tinto are due to report, while traders are positioning for the Federal Reserve and the European Central Bank to raise interest rates once again. Dalian Wanda sold a stake in one of its entertainment units for 2.26 billion yuan ($314 million) on the cusp of a deadline to repay a maturing dollar bond, raising odds the Chinese conglomerate will avoid an imminent default. Concern over Wanda's ability to repay a $400 million note by Monday has rocked China's dollar bond market in recent weeks, driving wild price swings in the conglomerate's notes and those of some peers.

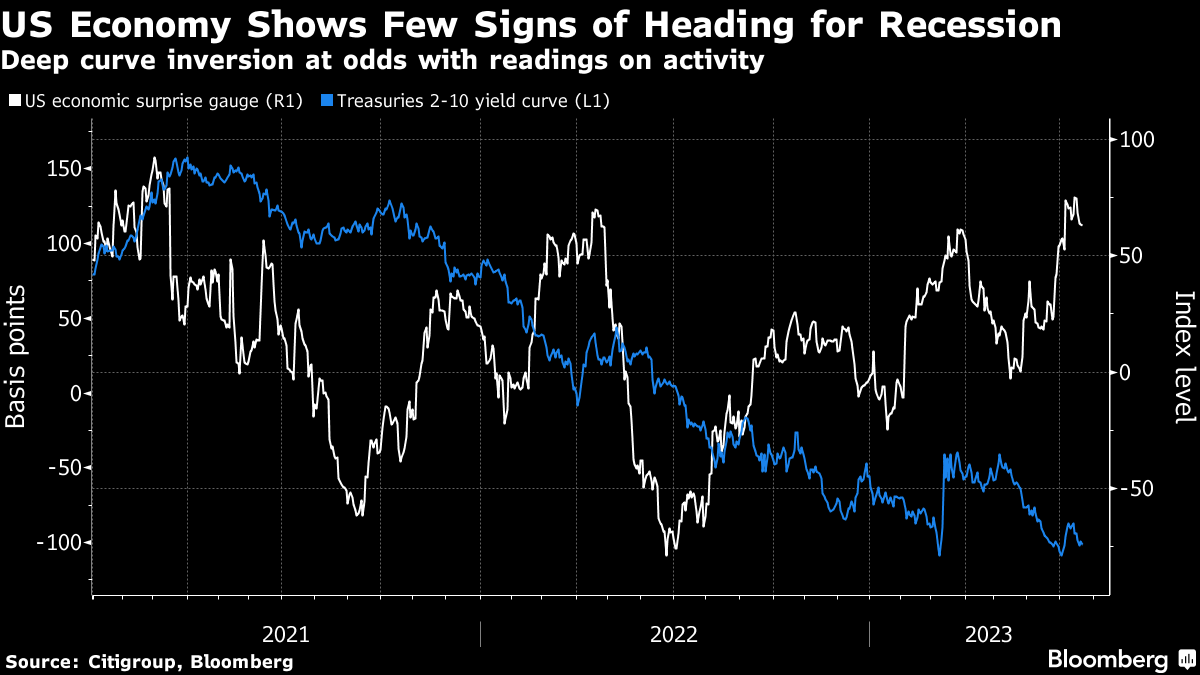

Wanda agreed to sell a 49% stake in a unit of Beijing Wanda Cultural Industry Group to China Ruyi Holdings, according to a Hong Kong exchange filing on Sunday. New Zealand Justice Minister Kiri Allan has resigned after being charged with reckless driving and resisting arrest following a car crash in Wellington late Sunday. Prime Minister Chris Hipkins said he had advised Allan that he did not believe she is in a fit state to hold a ministerial warrant. Allan becomes the fourth minister to leave Hipkins' cabinet since March, weakening the ruling Labour Party's claim to be a stable government ahead of the October general election. Labour is currently neck-and-neck with the main opposition National Party in opinion polls. Another Federal Reserve meeting, another seeming watershed moment for markets. Equities and bonds rallied strongly this month as optimism waxed that the US central bank's expected interest-rate hike on July 26 would be the final one for this cycle. Both asset classes faltered last week on concerns that Fed Chair Jerome Powell will follow June's hawkish hold with a hawkish hike after labor-market indicators underscored the potential that key cost pressures remain in play even as the pace of inflation slows.  The biggest problem for investors is that the US economy is busy defying the received wisdom that the steepest tightening cycle for 40 years would bring it crashing down. Which begs the question: Why should the Fed stop when inflation remains well above target and the economy is doing just fine? The economy's resilience may allow equities to shake off any harsher treatment from the Fed, what with profits expected to start growing again. Bond investors may be more vulnerable as they face the potential that the "last hike" — a keenly awaited rally trigger — gets pushed back once more. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment