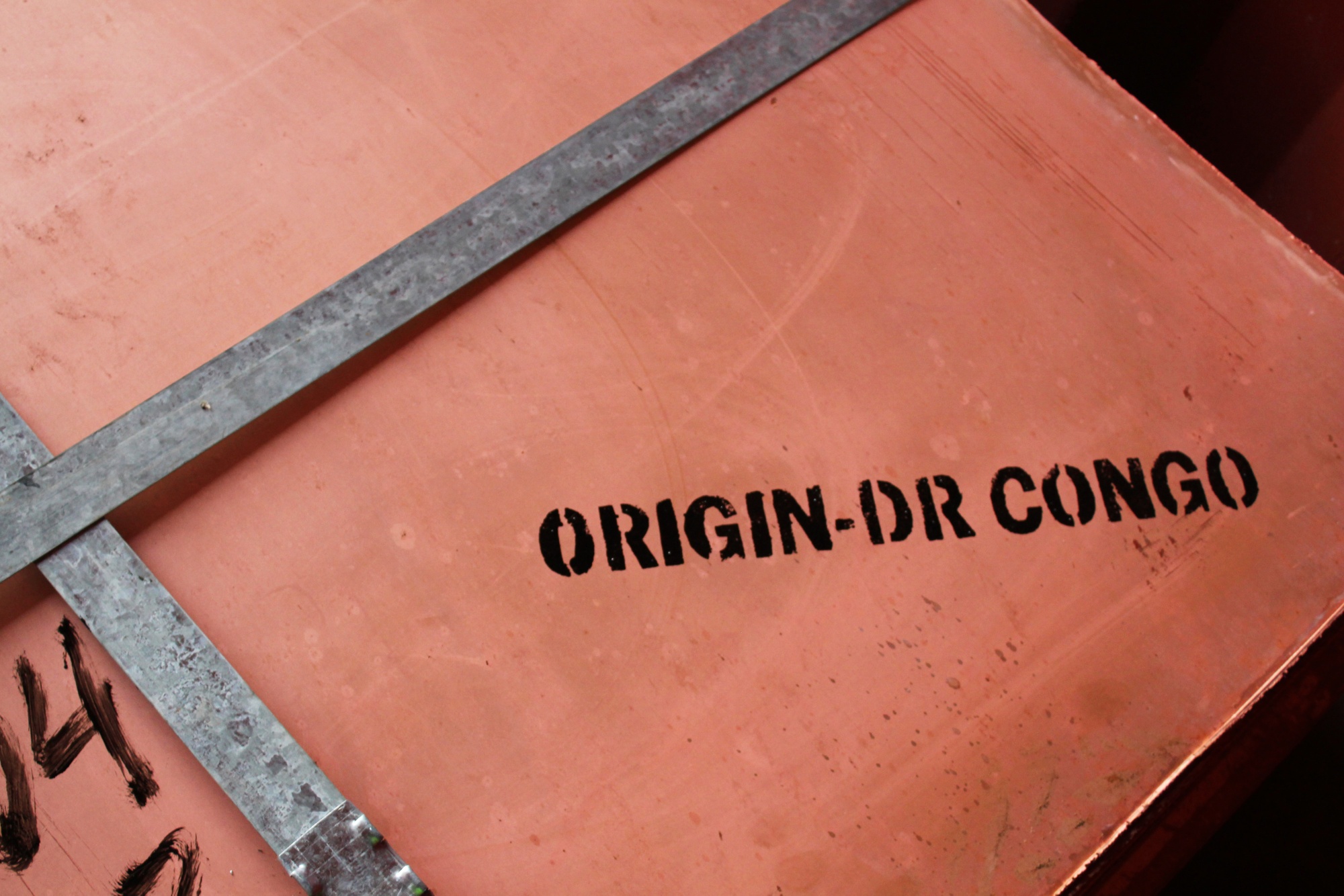

| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it's headed. Climate change-induced natural disasters have combined with surging interest rates to send some of Africa's poorest countries and their most vulnerable citizens into a debt trap. This year, cyclones and torrential rains lashed Mozambique, Malawi and eastern South Africa, destroying crops and infrastructure in what's becoming an annual pattern.  Sugar cane farmer Sabelo Shabangu walks along a dirt track damaged by heavy rains not knowing how he will get his crop to the mill. Photographer: Guillem Sartorio/Bloomberg In South Africa's eastern region of Nkomazi, half the historical annual rainfall in just two days damaged irrigation pumps and pipes and the roads needed to get the crop to mills. That drained savings and with interest rates at a 14-year high, farmers are loath to take out loans to finance future crops. "If you are owing somebody now, you are in big trouble," Evans Mashego, a business adviser at a sugar promotion agency, said of farmers in the area. Cash-strapped governments can't pay for better roads, bridges and other measures to guard against everything from more frequent floods and droughts to rising sea-levels — problems caused by emissions from industrialized nations elsewhere. The average cost of capital for 58 climate-vulnerable countries is 10.5%, according to a report from the Boston University Global Development Policy Center, compared with an average sovereign bond yield of 4.3% for emerging markets over the past decade. When they do try and borrow, the increased risk of natural disasters is pushing up the costs to dangerous levels. "At a time when they are fighting to address this climate emergency, there's simply no fiscal space," said Patrick Verkooijen, chief executive officer of the Center on Adaptation. "If it adds to the sovereign debt threat they simply refrain from making this investment." — Antony Sguazzin Bola Tinubu pledged to scrap a costly fuel subsidy and address widening insecurity as he took over as Nigeria's president, with the 71-year-old former state governor inheriting a daunting list of problems to tackle in the continent's most-populous nation. Nigerian dollar bonds rallied on news the $10 billion subsidy program is dropped and on his plans to adopt a uniform exchange rate. Separately, former Oil Minister Diezani Alison-Madueke filed a defamation lawsuit against the country's anti-corruption agency, demanding $215 million in damages.  Tinubu, center, in Lagos on Feb. 25. Photographer: John Wessels/AFP/Getty Images South Africa will provide diplomatic immunity to attendees of meetings of the BRICS group of countries — a practice the government said is routine — as it prepares to host Russian President Vladimir Putin at a summit in August. The decision comes as the central bank warned of dire consequences if Pretoria faces sanctions because of its stance on Russia's invasion of Ukraine. The New Development Bank, the lender created by BRICS nations (Brazil, Russia, India, China and South Africa) will widen its membership as it seeks to counter the influence of Western-dominated multilateral banks. Read about why countries are clambering to join BRICS. Ugandan President Yoweri Museveni signed into law legislation with harsher penalties for LGBTQ people, including death sentences and life in prison, despite widespread criticism and warnings the measure may deter foreign aid and investment in the East African nation. The US said it will implement visa restrictions against Ugandan officials. Click here to read an explainer on why Uganda's government is targeting the LGBTQ community. Zambia's decision to allow citizens to cash in part of their pensions early is having an unintended consequence: it's hitting a key source of government financing as the squeeze from a long-delayed debt restructuring continues to tighten. A new law letting people access 20% of their retirement savings has seen the National Pension Scheme Authority pay out about $300 million since April 17. That's curbed its ability to lend money to the state. Congolese President Felix Tshisekedi met with China's Xi Jinping in Beijing as the two countries seek to relaunch a partnership worth tens of billions of dollars in trade each year. China is the main destination for most of Congo's minerals, but Tshisekedi has become disgruntled by what he sees as the Democratic Republic of Congo's meager take from the arrangement. The Central African nation is the world's largest producer of key battery ingredient cobalt and one of the leading sources of copper.  Copper cathode sheets ready for export in Katanga province in December 2021. Photographer: Lucien Kahozi/Bloomberg A shakeup is brewing in the $1.6 trillion universe of emerging-market sovereign debt — whether Wall Street likes it or not. As government defaults rise to a record in the developing world, including in Zambia and Ghana, the debate is growing frantic over how to solve these debt crises. Restructuring talks are stalling, with some countries turning to old-school sweeteners and others calling to revamp the Group of 20's Common Framework. Kenya's outgoing central bank Governor Patrick Njoroge will leave the post with interest rates roughly where they were when he started. The MPC has raised rates four times in the last year to rein in inflation but left the benchmark unchanged this week — Njoroge's final rates decision after eight years at the helm. Former International Monetary Fund economist, Kamau Thugge, has been nominated to succeed him. Thanks for reading. We'll be back in your inbox with the next edition on Friday. Send any feedback to us at gbell16@bloomberg.net. |

No comments:

Post a Comment