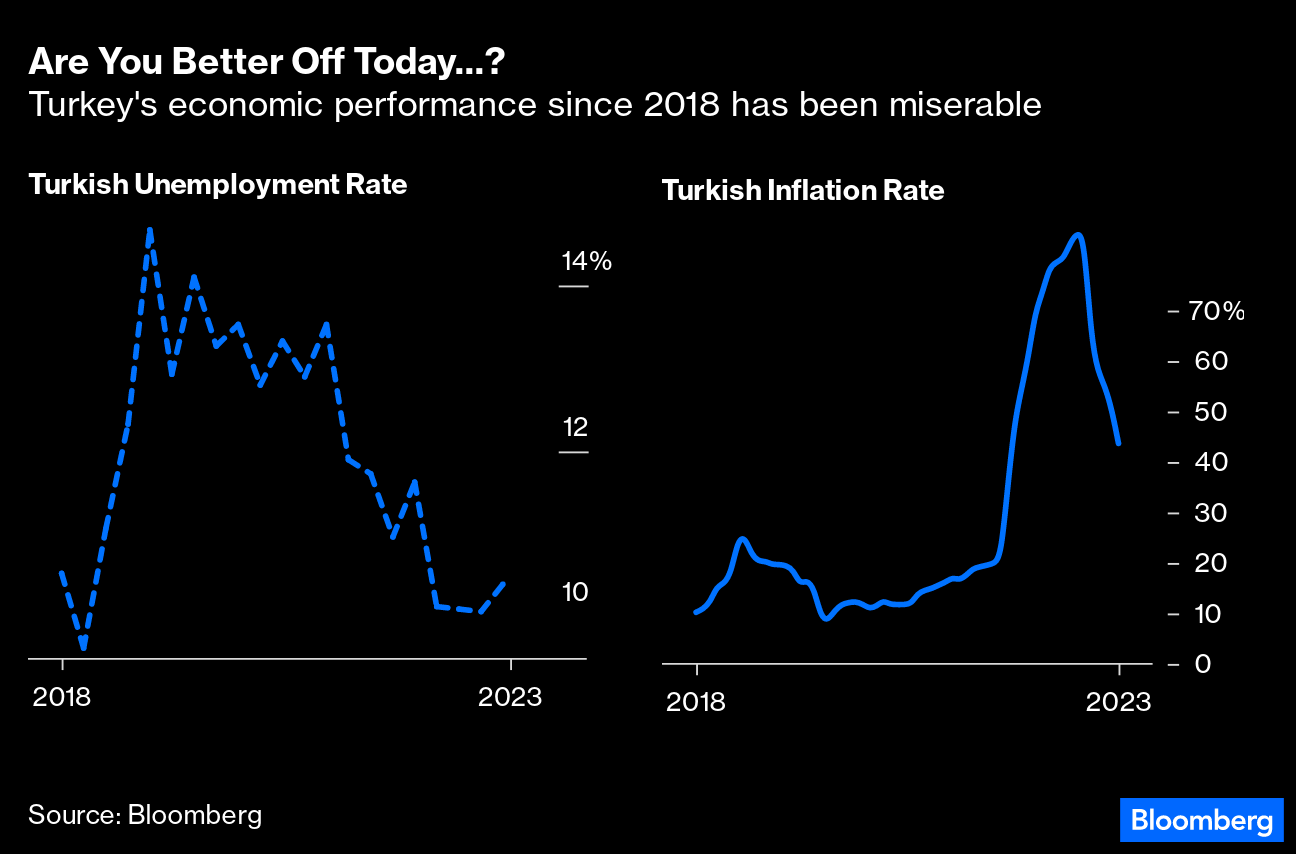

| For years, political scientists believed that elections were driven by "retrospective evaluation" of voters' economic consequences. In folksier terms, the key was Ronald Reagan's key question: "Are you better off than you were four years ago?" If the answer is "yes," then incumbents can expect to win reelection and if not, not. And if you're Recep Tayyip Erdogan, all bets are off. Over the weekend Erdogan, who has effectively ruled Turkey for two decades, was reelected for another term despite truly dreadful economic performance over the last five years. The number of Turks who feel better off since 2018 must be vanishingly small. But he managed to get back in. Erdogan has made a habit of attacking orthodoxies. The retrospective evaluation model of elections has to be added to the list. This is what has happened to Turkey's inflation and unemployment rates since he was last elected:  Erdogan has done almost everything that "Davos Man" would dislike. The consensus of those who meet at the World Economic Forum and create the globalized expression of elite thinking each year would come down overwhelmingly against the Erdogan monetary policy of cutting interest rates because raising them would increase inflation. It also seemed inevitable after one of the worst earthquakes in history, only a few months ago, that people would turn against a government that appeared to botch the response. Away from the narrowly economic, Erdogan's friendliness toward Vladimir Putin's Russia is also a finger in the eye for Davos Man. But Turks decided, even though forcing him to a second-round runoff for the first time, to give Erdogan another term. There are many dimensions to this. Erdogan's increasingly authoritarian rule and the restricting of press freedoms matter a lot. But the bottom line is that voters aren't obliged to make decisions based solely on the economy, and nobody outside the country has a right to tell Turks how they should vote. That said, Erdogan doesn't get to tell the rest of the world how much his currency should be worth. The cost for Turkey (which a majority of voters have now deemed worth paying) of Erdogan's eccentric economic policy has been a massive depreciation of its currency, the lira. Since Erdogan became prime minister 20 years ago, it has shed more than 90% of its value, both against the US dollar and a basket of currencies: If Erdogan can take it, and his populace can take it, then so be it. He didn't have to do what was expected of him. Meanwhile, Across the Aegean… In a fascinating conjunction, Turkey's ancient rival Greece also went to the polls last weekend. The government in Athens has of late done what Davos Man asked. And it emerged from the election as clearly the largest party. Kyriakos Mitsotakis, scion of a Greek political dynasty, has decided to call another election for June 25 to see if he can get an overall majority for his New Democracy party, but it's plain the electorate hasn't rejected him. After the last 15 years of Greek history, this offers a mind-blowing contrast with what is happening in Turkey. For decades, ND was the center-right party that alternated power with the center-left Pasok. In 2009, Pasok took over and discovered that the deficit was deeper than its ND predecessors had let on, putting the country in breach of its commitments as part of the eurozone. Two bailouts ensued, with increasingly stringent provisions to cut spending as eurozone banks desperately disentangled themselves from Greece. Pasok lost an election, to be replaced by ND after significant blocs of voters supported both Trotskyites and neo-fascists. In 2014, Alexis Tsipras of the radical left-wing Syriza grouping won on a platform to confront the European Union. What followed was the so-called "Grexit" crisis (brilliantly detailed by my colleague Viktoria Dendrinou in The Last Bluff). Everyone called everyone else's bluff, Greece's banks were forced to close for two weeks, and eventually the country consented to extremely austere terms that allowed it to stay in the euro. At all times, the Greek electorate has applied the Reagan question, booting out governments who had not made them better off during their time in power. Thus Mitsotakis won election for ND (even though the party can in a real sense be blamed for the whole crisis in the first place) over Syriza, and for the last few years Greece has done exactly what Davos Man wanted. And now, ND has easily beat the far-left and far-right forces that had massed against the EU. The comparison with Turkey is remarkable. In early 2010, Greek unemployment was a little lower than in Turkey. As forced austerity bit, it rose to more than 25%. Only now has it returned to its 2010 level. The two countries currently have more or less the same unemployment rate: The Greek experience during the decade from 2010 to 2020 was fully comparable to the US Great Depression of the 1930s. After half a decade of doing what they're told, however, Greek sovereign debt is back as a safe investment, while confidence in Turkish debt has steadily eroded. If you want to insure against the risk of a Turkish default in the credit default swaps market, it will now cost you far more than for a Greek one. Erdogan's successful election, note, has pushed up the perceived risk for Turkey:  Greece attempted confrontation, like Erdogan. It suffered a much greater penalty, gave up, and only now appears to be reaping any advantage. A positive spin on the Greek experience, if there is one, might be that its membership of the euro created the discipline to get its historically inefficient public sector under control and create a base for growth. A positive spin for Turkey is that Erdogan has delivered plenty of positive economic improvements, and whatever the international currency and credit markets did about it, the voters are still happy enough. What conclusions can we draw from this? The key is that Erdogan is not going to be disciplined by international markets. There is no reason to expect a change in Turkish economic policy, and so there is every reason to brace for a further decline in the lira. Taking advantage of this in investment terms, however, is difficult. Matt Gertken of BCA Research suggests a "Long MSCI Greece/Short Turkey" trade, capitalizing on the likelihood that Greece will now reap the benefits of its orthodoxy, while Turkish asset prices will be punished for unorthodoxy: The key is that voters have rewarded Erdogan's expansive monetary and fiscal policies, which means that inflation will continue to erode real returns over time. The election was competitive enough to cause lasting insecurity within Erdogan's administration, which means that the impetus to take populist, nationalist, or simply expedient measures to maintain political control will continue to outweigh the need for neoliberal structural reforms.

This is fair enough. What's less clear is whether there will be a payoff for investing in Greek equities. There have been some very big short-term profits on Athens' stock exchange at different times over the years, but in general there is yet to be a sustained reward. However, with Greek stocks now at last overtaking Turkey (in common currency terms, to take account of the devaluing lira), it does seem very reasonable to hope for Greek investments at last to flourish:  Remember, however, that Greek tragedies don't generally end with justice being done and the good being rewarded for their virtue. And for the future, just remember the critical difference between the two countries that allowed Turkey to go its own way while Greece could not; Greece no longer had its own currency, and had no monetary policy of its own. If it had not been part of the euro, Greece would have defaulted by means of a massive currency depreciation, much as has happened in Turkey. Judging by the electoral choices the two countries have made, that might have been the more popular option. From tragedy in Greece and Turkey to farce in Washington, DC. Barring some last-minute Congressional stratagems, we have a deal to raise the US debt ceiling. Uncle Sam isn't going to default next month. That's the good news. The deal as currently presented doesn't seem unreasonable, and will have minimal impact on projections for economic growth compared to what was already expected. This could have been far worse. That doesn't mean there's any great reason for celebration. If people are seriously going to threaten to force a US default, you'd expect profound matters of principle and policy to be at stake. Instead, this deal seems to achieve and change nothing. You can read all the sordid details elsewhere on Bloomberg but there's nothing in there that would be expected to move markets — or to affect the wellbeing of many Americans. In the welter of commentary that has come out since Saturday night, I commend this up-sum from Paul Donovan of UBS. I couldn't have put it better myself: This is not a "successful" conclusion to the nonsense. The issue will come up again, as the debt ceiling has not been abolished. While the economic impact of the compromise is limited, politicians' time has been wasted in creating a solution. Worse still, economists' time has been wasted in talking about this. Unnecessary risk and uncertainty has been added to a slowing economy.

Amen to that. What next? In the short term, we need to see how this is received. Peter Atwater of Financial Insyghts warns that the Nasdaq is overbought amid the excitement over artificial intelligence and that major political compromises "often mark peaks in sentiment." If that's the case, he says that "we should see a sharp selloff shortly." However, the immediate reaction appears to be that, to quote Dan Suzuki of Richard Bernstein Associates, a "negative tail risk is close to being taken off the table." That will allow everyone to refocus on the fundamentals, which are more or less unaltered by this budgetary compromise. The problem, Suzuki acknowledges, is that those fundamentals remain precarious. Asset prices might be helped if investors didn't refocus on them.  Business as usual in time for Memorial Day. Photographer: Ting Shen/Bloomberg And of course there's still some slight chance that opposition from right and left will scupper the deal. This comment from Steve Sosnick of Interactive Brokers still holds good: Even if President Biden and Speaker McCarthy emerge from a meeting singing "Kumbaya" together, a verbal agreement still needs to be approved by both houses of Congress and signed by the President. We don't have a deal until then. A verbal agreement does not avert a potential default.

Finally, assuming the limit does go away, we should expect a lot of issuance by the US Treasury. That will take cash out of the system and, all else equal, tighten liquidity. The mandarins will try to handle this so that yields don't spike and to avoid big shifts in the yield curve, but that will be tricky. Events so far, as markets return to normal after a long holiday weekend, suggest that all is calm for now, with the yield on four-week Treasury bills, the securities most obviously affected by a default, dropping about 25 basis points as trading opened in Asia. All's well that ends well, then.

— Reporting by Isabelle Lee Some thoughts on fandom. England's football (soccer) season ended over the weekend, and Brighton & Hove Albion will be heading into European competition next year for the first time in their history, which dates back more than a century. I first saw them when my uncle took me to a game at the age of 10. They were in the third flight, and beat Rotherham 3-1. I can remember it precisely. More than a decade later, I got to sit in the press box and report on a Brighton win over Portsmouth for the Evening Argus, Brighton's local newspaper, during a brief attachment there as a trainee reporter. Most of the time since then I spent watching, not always that diligently, from afar, although I have family who have been along through thick and thin. Meanwhile, Andy Naylor took over as the football reporter for the Argus a couple of years after my brief brush with sports journalism, and has covered them ever since. This is the beautiful piece he wrote for his current employer, The Athletic, about the experience. It's worth reading all the comments. His attitude, and that of more or less the entire fanbase, is of utter joy and a kind of innocence that something he never expected has come to pass, and happened in style, with players it was impossible to dislike. Fans of many other teams even seem pleased for us. Nobody had really ever remotely thought of this as a possibility.  Through thick and thin. Photographer: Jan Kruger/Getty Compare and contrast with the greatest love of my sporting life on the other side of the pond, the Boston Red Sox. They underwent an 86-year drought without winning the World Series, even though the total pool of possible winners was never much more than two dozen teams (Brighton had to compete against more than 100 league teams at one time or another). The Sox kept coming excruciatingly close, with several great players, but they always found a way to lose at the last, and they always pretty much deserved it. When they sold Babe Ruth to the upstart New York Yankees in 1919, Boston already had five World Series to its name, and the Yankees had none. By 2004, the Yankees had amassed 26 championships as the Red Sox' drought continued. A sense of long suffering, of being cursed but keeping the faith, suffused what it was to be a fan. In 2004, the Red Sox famously went down by three games to the Yankees in the league championship to decide who went to the World Series, and then won the next four. This was the only time that feat has ever been achieved. They captured the World Series that year, and another three times thereafter. This wasn't like being a small club in the lower reaches of the English league, to be surprised by joy when a great team qualifies for Europe; this felt like a curse, and a championship became something desperately desired. Nothing else would do. Winning was a release of tension, the belated satisfaction of a desperate yearning. On the eve of the Red Sox' breakthrough, this thread started on a site for hardcore fans called The Sons of Sam Horn. (Oddly enough, Sam Horn, a much-heralded prospect who didn't deliver as much as expected, was playing for the Red Sox the first time I ever went to Fenway Park in 1987.) Entitled "Win It For..." it came to be known as the Vietnam War Memorial for Red Sox fans, as ever more people attached the names of aging or deceased relatives who would want to see the Sox win at last. Like Naylor's piece on Brighton, it's strangely moving. Fandom isn't something we choose, and it isn't rational. It happens. You need to put up with the bad times, and if you do you just might be rewarded with joy like the Red Sox in 2004, or Brighton this year. Even then, the joy can be very different. And also, there's no need to be greedy; I still love watching the Sox, but it no longer matters desperately the way it once did. And I'd like Brighton to excite us even more and do great things in Europe next season, but even if they don't, it's been an unexpected joy. Fandom doesn't make sense but does help to make life worth living. I hope others have found the same thing. Have a great short week everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Tyler Cowen: Banking Is Slowly Getting Narrower — and Better

- Chris Hughes: At Last, Something Good Has Come Out of 2022's Gilt Crisis

- Jonathan Bernstein: McCarthy Won the Debt-Limit Deal. Biden Did, Too

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment