| US leaders ramp up lobbying campaigns for debt deal. Nvidia unveils new AI products. Japan's prime minister fires his own son. Here's what you need to know today. The White House and Republican congressional leaders are gearing up lobbying campaigns to win approval for a deal to avert a US default as environmentalists, defense hawks and conservative hard-liners condemn concessions. Backers of the deal have only a week to get the agreement through Congress before a possible June 5 default that could have catastrophic consequences. President Joe Biden has been personally calling lawmakers to support the bill and said he feels "very good" about it. Nvidia CEO Jensen Huang has unveiled a new batch of products and services tied to artificial intelligence, looking to capitalize on a frenzy that has made his company the world's most valuable chipmaker. In a two-hour presentation, Huang revealed a new robotics design, capabilities to make video game characters more realistic, a networking technology and an AI supercomputer platform called DGX GH200 that will help tech companies create successors to ChatGPT. Microsoft, Meta and Google are expected to be among the first users. President Joe Biden and his European allies have repeatedly stressed their desire to "de-risk," not "decouple," from the Chinese economy in recent months, as a way to explain a slew of new restrictions on trade with Beijing. But for China, there's no difference. Chinese state media, officials and academics have all publicly rejected the distinction in recent weeks, in a seemingly concerted effort to undermine the rhetorical shift. Meanwhile, China rejected a US request for their defense chiefs to meet in Singapore, in a setback for White House efforts to restore ties with key officials. Asian equities were poised for a cautious open as political wrangling to dodge a default continued in the US. Futures for Japan and Australia pointed to the slimmest of moves, while contracts for Hong Kong suggest more declines. A key gauge of Chinese shares is within a whisker of a bear market as a wobbling economic recovery, intensifying geopolitical tensions and a weaker yuan keep investors away. Bitcoin climbed to the highest level in more than two weeks. Buffeted by earthquakes and the potential for conflict with China, Taiwan's leaders want to accelerate plans to make the island more resilient to communications breakdowns and direct attacks on digital infrastructure. Audrey Tang, who heads Taiwan's Ministry of Digital Affairs, says she wants the island's $740 billion economy to be able to handle the possible collapse of all communications in the event of an emergency by the end of next year. Boats flying Chinese flags and earthquakes have been responsible for cutting undersea internet cables — harsh reminders of what could happen in a conflict or natural disaster. - Would you quit if your employer required you to spend more time at the office? Share your thoughts on work-from-home and the return-to-office in our latest MLIV Pulse survey.

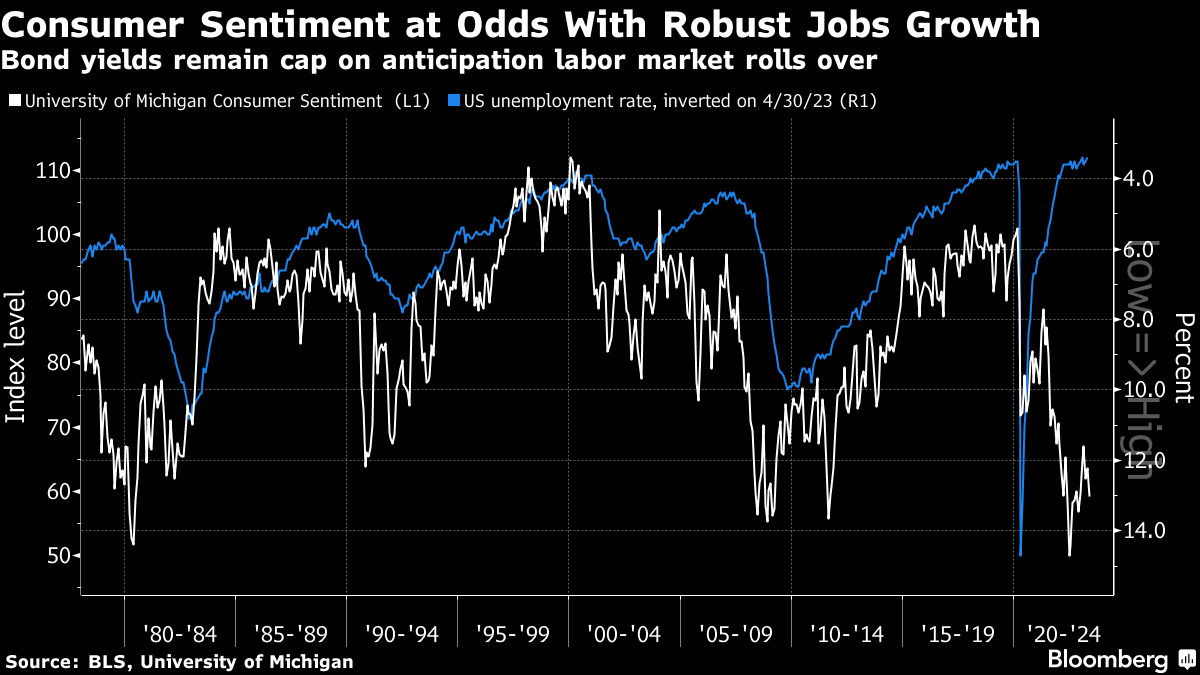

Friday's jobs report is expected to show a modest increase in the unemployment rate and solid growth in employment, belying bond-market expectations that the Federal Reserve's steep interest-rate hikes will send the economy tumbling toward recession. Indeed the odds would seem to be good that the jobless rate either holds at the lowest level since the 1960s or moves lower, given that seven of the last 10 releases showed a lower unemployment reading than economists forecast.  Economists and investors do have some justification for bemusement at the labor market's resilience. Consumer confidence remains extremely weak even after rebounding from the record low hit last June. The Fed's tightening cycle set off the sort of collapse in sentiment only previously seen at times when the jobless rate surged rapidly. The only exception was way back around 1980, when the initial drop in sentiment came before the jump in the employment rate rather than accompanying it. That was of course the last time the US central bank slammed the brakes on the economy this hard. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment