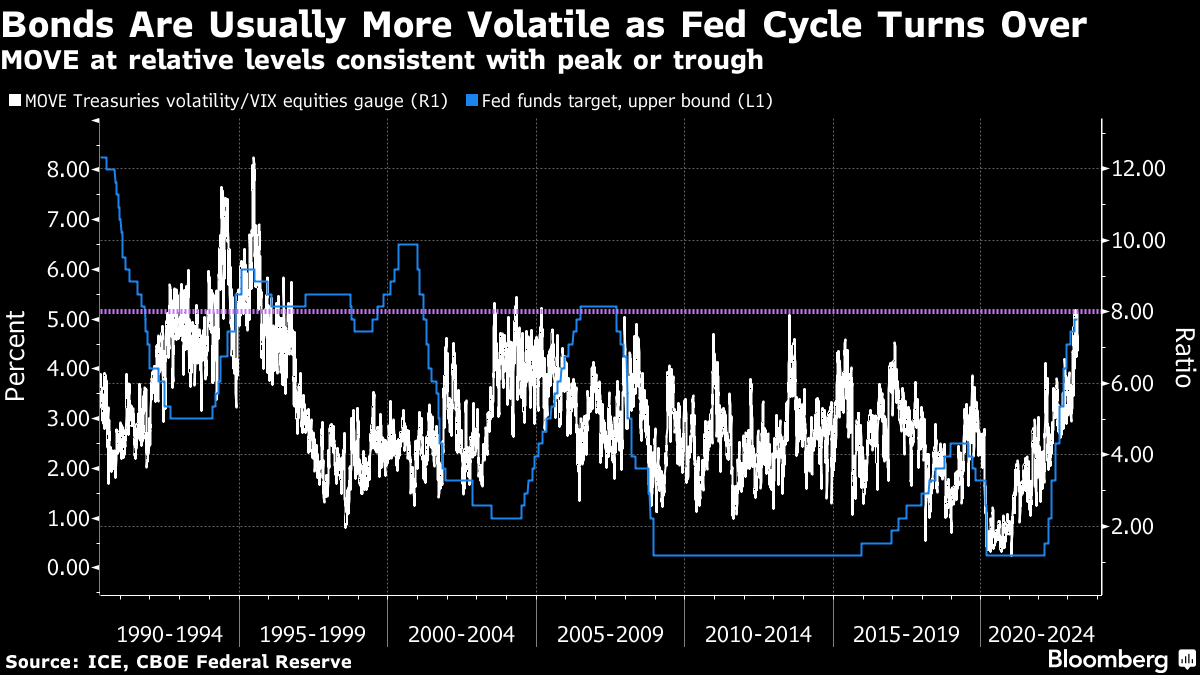

| JPMorgan to acquire First Republic Bank. IBM plans to replace thousands of jobs with AI. Qantas names its first woman CEO. Here's what you need to know today. JPMorgan agreed to acquire First Republic Bank in a government-led deal for the failed lender. The transaction, announced after First Republic was seized by regulators, makes the biggest US bank even larger, turbocharging CEO Jamie Dimon's wealth management ambitions. First Republic was the second-biggest bank failure in US history, and the fourth regional lender to collapse since early March. Read our Big Take on the jumbo mortgages that brought on the bank's failure, and how the collapse unfolded. Meanwhile, Morgan Stanley is planning to cut another 3,000 jobs. IBM plans to pause hiring for roles it thinks could be replaced with artificial intelligence in the near future. CEO Arvind Krishna said he envisages some 7,800 non-customer-facing roles could be automated within five years, marking one of the largest workforce strategies announced in response to the rapidly advancing technology, which has captured the public imagination for its ability to write text and generate code. Some 75% of companies said they expect to adopt AI tech over the next five years, eliminating up to 26 million jobs in record-keeping and admin, according to a new World Economic Forum study. Qantas Airways has named Vanessa Hudson as its new chief executive officer, making her the first woman to lead the airline. Hudson, currently the carrier's chief financial officer, will assume the top job in November, replacing Alan Joyce, who steps down after almost 15 years in the job. While Joyce is famed for turning around one of Australia's most iconic brands at least twice and enriching shareholders, he leaves behind a divisive legacy. Asian equity futures point to a mixed opening as trading resumes in most of the region's markets following a holiday on Monday. Investors are weighing the purchase of First Republic along with expectations that the Federal Reserve will hike interest rates again this week. Japanese stocks are poised to rise while Hong Kong is set to open little changed. US Treasuries sold off across the curve Monday, with yields on 30-year bonds climbing the most in 2023 and those on 10-year notes approaching 3.6%. US President Joe Biden said any attack on Philippine armed forces or vessels would trigger American defense commitments, in the face of heightened tensions with China. His comments came after a meeting with Philippines President Ferdinand Marcos Jr. at the White House. National Security Council spokesman John Kirby said the US would announce new efforts to modernize the Philippine military including providing additional C-130 planes and patrol vessels. Last week, the US accused China of harassing Philippine ships after a near collision in the South China Sea. There's a fair bit of hand-wringing about Treasuries being more volatile this year than the near-comatose VIX fear gauge for the S&P 500. In many ways though this should not be a surprise. The current level of ICE BofA's MOVE index of implied volatility relative to its equities peer is right around the sort of heights normally seen in periods where the Federal Reserve is at the end of a tightening or easing cycle.  True, March saw the MOVE index of expected yield swings hit its highest since the 2008 financial crisis, and that was also when actual volatility reached epic levels. But things look more normal now, including the MOVE's ratio over the VIX. It has hit fresh heights even as both gauges calmed down — investors seem to be losing their fears that a string of bank failures signal a repeat of the 2008 turmoil. Instead, even as it becomes clear the Fed will hike rates at least once more, markets are anticipating the end to the steepest tightening cycle in a generation. They are also showing plenty of confidence, perhaps verging on complacency, that peak rates means the worst is behind us for assets. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment