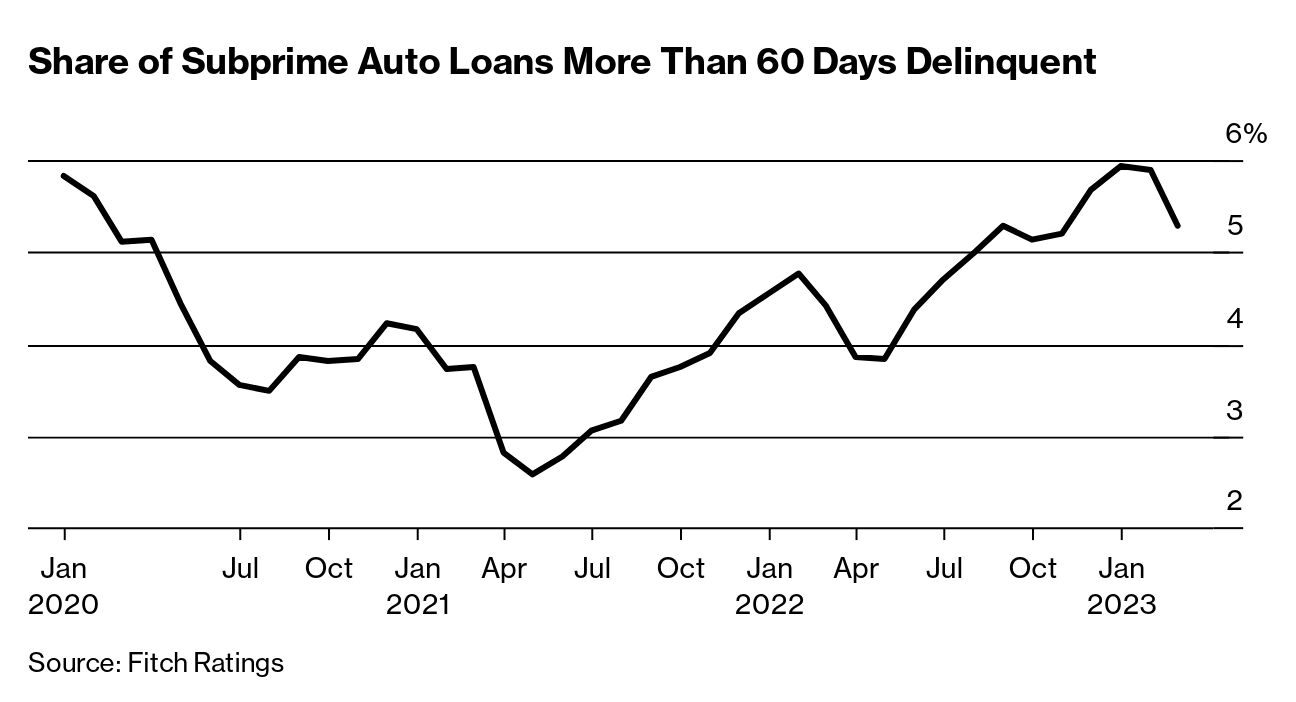

| Welcome to Bw Daily, the Bloomberg Businessweek newsletter, where we'll bring you interesting voices, great reporting and the magazine's usual charm every weekday. Let us know what you think by emailing our editor here! If this has been forwarded to you, click here to sign up. The repo folks have come to the land of Disney World, "The Happiest Place on Earth," with an unhappy message for America: Business—their business—is looking up. It's a recent Thursday morning in Orlando, just up the road from the Magic Kingdom, and a few hundred conventioneers are arriving for the North American Repossessors Summit. Here, license plate readers and tow trucks mix with sun and golf into a heady cocktail for these uneasy economic times. With more Americans struggling to pay their bills, the $1.7 billion industry for repossessing such assets as cars, trucks and boats is gearing up for a boom. The effects are expected to reverberate through countless ordinary lives and onto Wall Street, where car loans are packaged into bonds and sold to investors. It's a major shift from the pandemic years, when relief measures for consumers meant repos largely dried up, leaving many agents out of a job. Now repossession companies are struggling to find enough workers to meet repo requests. "As the economy curves down, our industry curves up," says Ben Deese, vice president at North Carolina-based Home Detective Co. and a member of the American Recovery Association, the industry group that hosted the Orlando conference. In March, the percentage of subprime auto borrowers who were at least 60 days late on their bills was 5.3%, up from a seven-year low of 2.58% in May 2021 and higher than in 2009, the peak of the financial crisis, data from Fitch Ratings show. While not all of those borrowers will face repossessions, the risk is high.  It's difficult to determine exactly how many repossessions occur each year, but Cox Automotive estimates that there were 1.2 million in 2022, up about 5.3% from 2021 but still down from 1.68 million in 2019. The Repossessors Summit made its debut in 2009, when there were a record 1.77 million repossessions. When a car owner falls behind on their loan, repo agents are dispatched to take the vehicle, towing it away to await auction. The industry itself dates to the 1920s, when car culture took hold, and lenders such as General Motors Acceptance Corp. and Ford Motor Credit Co. popped up to finance loans for Americans who desperately wanted vehicles. Repossession companies emerged soon after to track down those borrowers not making payments—in fact, one of the first was Home Detective, founded in 1922 and bought by Deese's father in the 1960s. The Great Depression provided ample opportunity for the industry and helped create its unsavory reputation for clawing back possessions from struggling Americans. The 1984 cult classic Repo Man further stoked the narrative of the tough, hard-hearted repo agent. More recently, the industry has taken advantage of technological advancements such as tracking features and license plate data, making seizures easier than ever. For more on the current wave of repossessions—by Claire Ballentine with Scott Carpenter—read the whole story here. |

No comments:

Post a Comment