| Hello. Today we look at indications that Americans are trimming their working hours, new analysis on the impact of US tariffs on China, and risks in nonbank financing. Americans live to work, and Europeans work to live, or so the adage goes. But new analysis suggests some US workers have been recalibrating priorities since the pandemic hit. The average US workweek has dropped by more than a half hour over the last three years, according to research by former Bureau of Labor Statistics Commissioner Katharine Abraham and her University of Maryland colleague Lea Rendell. That might not sound like a lot, but it actually adds up to the equivalent of 2.4 million employees, according to the economists. Three groups in particular have been scaling back their working hours, according to Yongseok Shin at the Washington University in St. Louis, who commentated on the new paper at a Brookings Institution event last week: - Educated young men

- High-earners – who cut their workweek by 1.5 hours

- Workaholics – who reduced time on the job to "only" 52 hours on average, from 55 in 2019.

People who have access to remote work or hybrid work are also more prone to shortening hours. "Nobody will notice if you call it a day a little bit earlier on a Friday," Shin explained. Though long Covid played a part in the shortened workweek, the authors of the study speculate that at least some of the explanation may lie in a re-examination of the work/life balance by many Americans.  A platform during evening rush hour in Washington in February. Photographer: Al Drago/Bloomberg For Federal Reserve policymakers, it's just one more labor headache. With the baby boom generation retiring, that's put downward pressure on labor force participation rates. Fewer hours worked means employers are left scrambling to fulfill their requirements — including by offering higher pay, which then risks adding to inflation. On the plus side, shorter workweeks could one day ultimately reflect a productivity boost. Nobel Prize-wining labor economist Christopher Pissarides told a conference today that artificial intelligence-backed chatbots may turn out to be transformative in that regard. For now, evidence of shortened workweeks take a little effort finding, and may not be apparent in Friday's headline on average weekly working hours, when the March employment report is released. That headline comes from the payrolls survey, which measures hours per job. Abraham and Rendell instead look at the household survey, and hours worked per person. What's going on with weekly hours is "a very significant part of the story why labor supply is so low," Stephanie Aaronson, a Fed staff official, said at last week's conference.

Read more on the study here. —Rich Miller US-China trade flows, on the surface, look unaffected by the two nations' geostrategic rivalry, but that masks some significant underlying trends. In sectors that former President Donald Trump hit with tariffs, there's been a notable shift, analysis by DBS Group — Singapore's biggest bank — shows. "The negative impacts of the tariff on Chinese imports were apparent" for the category hit with 25% levies, DBS economists Chris Leung and Samuel Tse wrote in a note Tuesday. - The share of US furniture imports that come from China dropped to 33% last year from 57% in 2018.

- The share of Chinese-made TV and video equipment imports plunged to 16% from 46%.

- The share of apparel and footwear from China — subject to a 7.5% tariff -- fell to 31% from 43%.

"These statistics reflect some relocations of manufacturing base from China to Vietnam, Cambodia and India are indeed happening for some sectors," the duo wrote. The widening in China's overall surplus with the US was mainly driven by shipments of items not subject to tariffs — such as computers, phones, and toys, they wrote. - Fed path | Fed Bank of Cleveland President Loretta Mester said policymakers should move their benchmark rate above 5% this year and hold rates at restrictive levels for some time to quell inflation.

- Rate wrap | New Zealand's central bank unexpectedly raised interest rates by 50 basis points, Chile stayed on hold, and Poland may do so too today. And Australia's decision this week to keep rates unchanged doesn't imply an end to tightening, Governor Philip Lowe said.

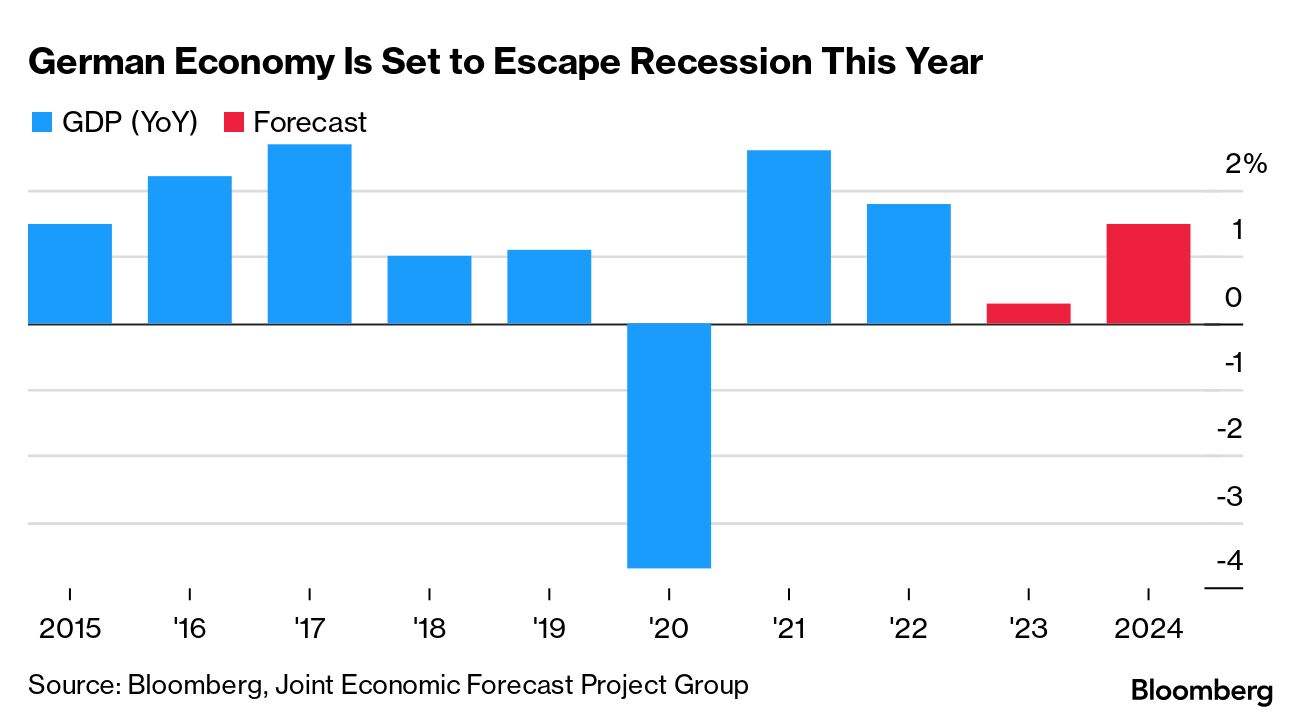

- Skirting recession | Germany may have just dodged a recession by recording a small increase in output at the start of the year, according to the country's top forecasters.

- Chip wars | Japan's decision to join the US and Netherlands in restricting exports of chipmaking gear to China is giving the allies powerful new weapons to deploy in the escalating technology war.

- China ties | Xi Jinping is pulling out all the stops for French President Emmanuel Macron as China's leader tries to create some distance between Europe and the US in their approaches toward Beijing.

- Confidence climbs | UK business confidence crept up in the first quarter, despite only a third of firms seeing an increase in sales. Meanwhile homes in Britain are taking almost twice as long to sell this year.

Ahead of next week's annual IMF/World Bank spring meetings, International Monetary Fund released its Global Financial Stability report, in which it did four case studies of recent financial turmoil. Staff looked at the UK pension fund stress late last year; debt strains in South Korea; commodity-trading firms and financial-stability risks; and vulnerabilities in private credit markets. Their takeaway: Policymakers should ensure that nonbank financial institutions better manage risks. Timely public data disclosures and governance requirements would help nonbanks themselves steer away from "excessive risk taking," the fund said. The IMF urged regulators to examine these dangers as financial risks could intensify in coming months, it said. Bloomberg New Economy Gateway Europe will be held in Ireland, April 19-20. Join us as leaders gather to discuss solutions to the most pressing challenges facing the European economy. Request an invitation. Read more reactions on Twitter here |

No comments:

Post a Comment