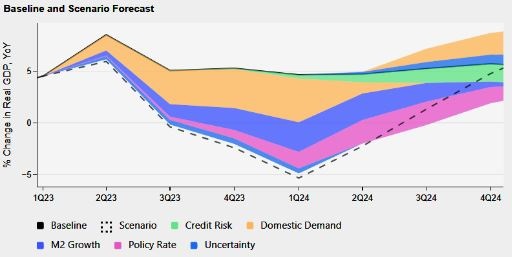

| Hello. Today we look at China's economic rebound, India's education sector and how AI tools can help interpret Fedspeak. China's economy has defied its bears yet again. GDP growth expanded 4.5% in the January-to-March period from a year ago, higher than the 4% forecast by economists in a Bloomberg survey. In March alone, retail sales soared 10.6%, the biggest gain since June 2021. For global businesses facing a grim outlook, the return of the Chinese consumer is unequivocal good news. It's little wonder then that at the same time as the statistics agency was releasing the data, carmakers such as Volkswagen and Mercedes Benz were unveiling new flagship electric vehicles in a quest for a larger slice of the Chinese auto pie. But beyond the consumer rebound — which should carry into the second quarter — there are lingering concerns that'll keep the bears salivating. The contraction in property investment worsened to 5.8% in March. That's a worry because housing fuels so much demand — globally for raw materials and domestically for labor and other inputs.  Bloomberg Economics Modelling from Bloomberg Economics shows a 15% drop in property investment over the next year would deliver a "devastating blow" and drag GDP growth to 2.9% this year. The base case is for an expansion of 5.8%. And property isn't the only area of concern. While you may expect economists would cheer China's immunity to the global inflation wave, instead they caution that subdued prices signal a lack of the kind of widespread demand needed to keep the post-Covid recovery going. Fu Linghui, a spokesman for the NBS, said a complex international environment and insufficient domestic demand mean the foundation for the economy's rebound is "not yet solid." What happens next is key for the rest of the world. China will be the top contributor to global growth over the next five years, with its share set to be double that of the US, according to the International Monetary Fund. The nation's slice of GDP product expansion is expected to represent 22.6% of total world growth through 2028, according to Bloomberg calculations using data the fund released in its World Economic Outlook last week. India follows at 12.9%, while the US will contribute 11.3%. —Malcolm Scott Bloomberg New Economy Gateway Europe will be held in Ireland, April 19-20. Join us as leaders gather to discuss solutions to the most pressing challenges facing the European economy. Request an invitation. Business is booming in India's $117 billion education industry and new colleges are popping up at breakneck speed. Yet thousands of young Indians are finding themselves graduating with limited or no skills, undercutting the economy at a pivotal moment of growth. Desperate to get ahead, some of these young people are paying for two or three degrees in the hopes of finally landing a job. They are drawn to colleges popping up inside small apartment buildings or inside shops in marketplaces. Highways are lined with billboards for institutions promising job placements. Read the full story in Bloomberg's BigTake here. - Wage worry | UK pay growth accelerated unexpectedly, adding to inflationary pressures that are concerning the Bank of England.

- Pay later | US consumers are increasingly using "buy now, pay later" apps to afford everyday items like groceries, highlighting the financial pain wrought by the worst inflation outbreak in four decades.

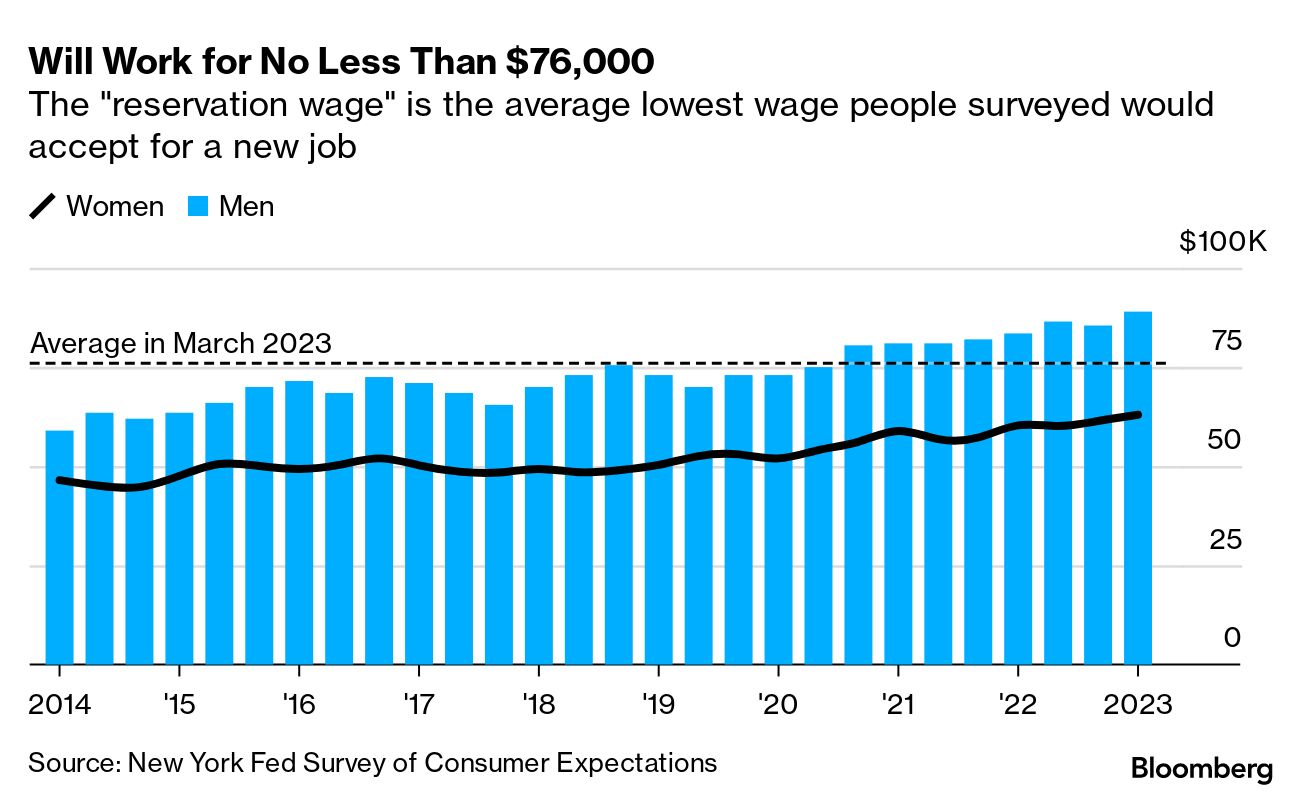

- Job minimum | US employers could face a bill of almost $76,000 to bring a new worker aboard in tight labor markets, according to research by the Federal Reserve Bank of New York.

- Singapore chief | Ravi Menon, the Monetary Authority of Singapore's longest-serving chief, is poised to leave the central bank this year and Chia Der Jiun, one of his former deputies, is tipped to be his successor.

- RBA minutes | Australia's central bank discussed the case for raising interest rates by 25 basis points at its April meeting before deciding there was a stronger argument to pause.

- Olive branch | Emmanuel Macron said he wants to work with unions to change French labor rules as the embattled president seeks to move past his controversial pension reform.

The first wave of academic research applying ChatGPT to the world of finance is arriving and judging by early results, the hype of the past few months is justified. Two new papers have been published this month that deployed the artificial intelligence chatbot in market-relevant tasks — one in deciphering whether Federal Reserve statements were hawkish or dovish, and one in determining whether headlines were good or bad for a stock. ChatGPT aced both tests, suggesting a potentially major step forward in the use of technology to turn reams of text from news articles to tweets and speeches into trading signals. Read Justina Lee's full story here. "Neither a borrower nor a lender be..." Read more reactions on Twitter here |

No comments:

Post a Comment