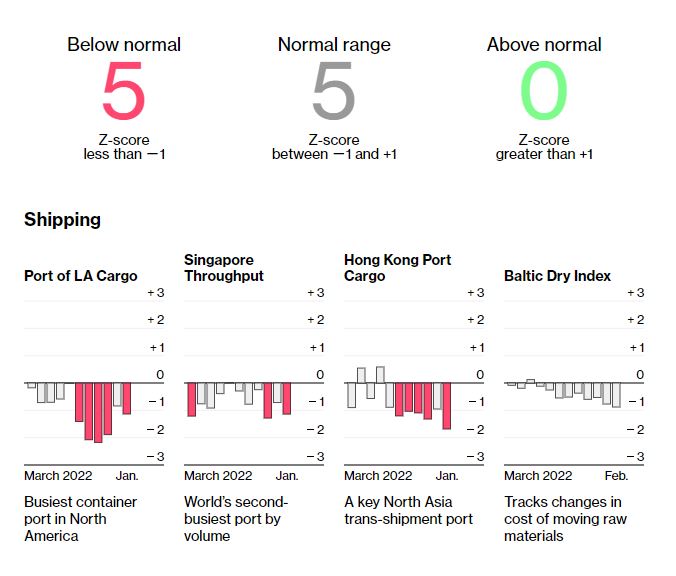

| For many weeks, anticipation has been running hot that China's reopening would bring a tangible economic lift across Asia and perhaps the rest of the world. That day seems to have finally have arrived, with purchasing managers' indexes — especially from China, but also beyond — showing the first glimpses that the world's No. 2 economy will start to lift orders in other corners of the globe. The Bloomberg Trade Tracker's four sentiment indicators all improved in February, and five of the Tracker's 10 gauges are now in line with their long-run averages, compared with just one at the start of the year.  Source: Bloomberg Trade Tracker A note of caution with trade and shipping indicators in the first quarter: Lunar New Year is one big special factor that always tugs on the data and makes for misleading reads. This year, with that holiday period landing unusually early in January, February's figures allowed for a cleaner read. China's new exports measure on the Tracker, which takes into account views on the outlook from about 3,000 manufacturing firms, shot up above its long-run average after being in the doldrums the prior two months. The parallel gauge for the US, which surveys more than 800 managers across 18 industries, also improved in February. More encouraging, there were brighter signs in Singapore and Germany. The Asian city-state's electronics gauge has shaken off a challenging tech cycle and improved for a second month, into average range on the Tracker. And the German expectations index from Ifo's survey of about 9,000 firms grinded higher for a fifth month. The broad uptick in the PMI and other sentiment measures bodes well for brighter readings from ports and key export markets on the Trade Tracker. Shipping watchers already were counting on some easing in logjams that should smooth supply chains further into the post-Covid era. China's official trade data for February are due out in coming days, and the numbers will be scrutinized for any post-Covid bounce. But already signs are emerging that some resilience in demand should help bolster goods trade in these uncertain times. Additional Reading: —Michelle Jamrisko in Singapore |

No comments:

Post a Comment