| Hello. Today we look at Fed Chair Jerome Powell's hearing in Congress, interest-rate decisions in Canada, Australia and Japan as well as Friday's US labor market report, and new research on what drives financial markets. A double-day dose of Federal Reserve Chair Jerome Powell before Congress this week will set expectations for the US central bank's policy meeting later this month. Policymakers will unveil fresh projections for the economy and for the Fed's benchmark interest rate at that March 21-22 gathering. Powell will have the chance of telegraphing how much more monetary tightening he thinks is needed when he testifies at Senate and House committees Tuesday and Wednesday. He's expected to echo some of his Fed colleagues' recent remarks suggesting rates will go higher than anticipated just weeks ago if economic data continue to come in hot, Jonnelle Marte reports here. "He's got to come in hawkish and land with a hawkish message," said Diane Swonk, chief economist at KPMG. "The bottom line is we're still at a position where the Fed is not going to allow inflation to become unmoored."

One question is whether Powell ought to open the door to a re-acceleration of rate increases, back to a 50 basis-point tempo, after officials stepped down to 25 last month. A challenge with that would be to avoid signaling any panicked reaction to strong data that might then undermine confidence that the Fed has a handle on the situation. Another option would be to suggest the tightening cycle will go higher and longer. Since Powell at the start of last month cheered evidence of disinflation, there's been a series of jolts indicating progress in reducing price pressures hasn't been as great as thought. Revisions by government statisticians removed evidence of a steady slowdown in core inflation in the final months of last year. Reports on price gauges, the job market and for consumer spending for January all came in strong. And that in turn has propelled yields on longer-term Treasuries higher, warning of higher inflation expectations becoming embedded in markets. Those higher rates are also worsening the federal government's budget deficit — another subject likely to come up in Powell's hearings. While the Fed chief will doubtless aim to steer clear of commenting on fiscal policy, both Republican lawmakers may press him to comment on whether the US debt burden needs to be reined in with spending cuts. Democrats may push Powell to warn against any effort to use the federal debt limit as political leverage, given the devastating consequences of Congress failing to increase or suspend the ceiling before the Treasury runs out of cash — as expected sometime in the third quarter. —Chris Anstey China's National People's Congress continues with all eyes on who will be handed key economic roles. Haruhiko Kuroda makes his final policy decision as Bank of Japan governor on Friday as a momentous decade-long tenure of unprecedented stimulus draws to a close. Bank of Canada Governor Tiff Macklem on Wednesday is set to become the first Group of Seven central banker to take his foot off the monetary brake. The Reserve Bank of Australia meets Tuesday and is expected to push ahead with another quarter percentage point rate increase, even after recent data showed slower-than-expected growth and a cooling of inflation. The week ends with the US nonfarm payrolls report for February, with economists anticipating a gain of around 215,000, down from 517,000 the previous month. See here for the rest of the week's economic events. - Blinder's bet | Former Fed Vice Chairman Alan Blinder said he does not expect the central bank to raise rates to 6%.

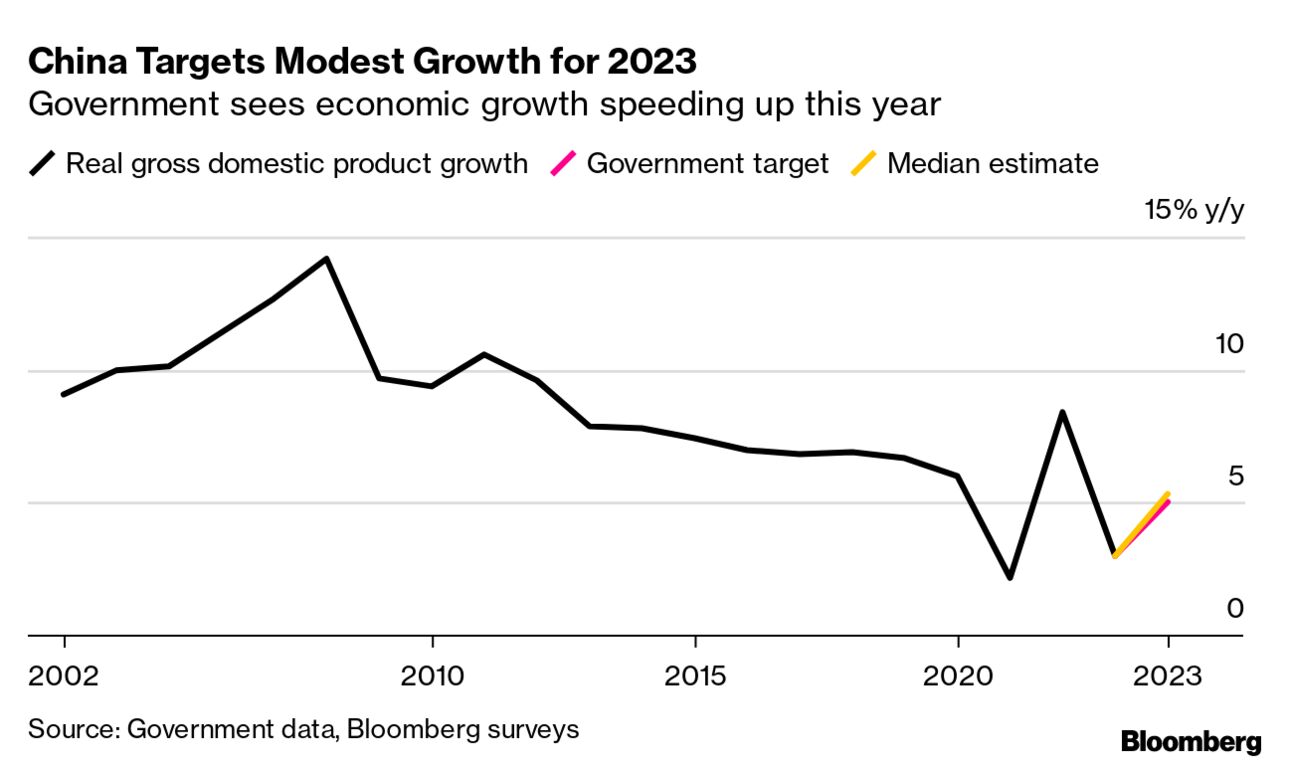

- China target | China set a modest economic growth target of around 5% for the year, with the nation's top leaders avoiding any large stimulus to spur a consumer-driven recovery already under way, suggesting less of a growth boost to an ailing world economy.

- Vulnerable economies | Shortages of dollars at a time of mounting debts are crimping access to everything from raw materials to medicine across several frontier economies.

- Pakistan loan | Pakistan expects to receive a $1.3 billion loan rollover from Industrial and Commercial Bank of China, taking the total relief to $2 billion for the nation that is seen at risk of a default.

- Inflation warning | Otmar Issing, a European Central Bank pioneer, has a stark warning about inflation. Meanwhile President Christine Lagarde said a half-point hike is "very, very likely" next week, and colleague Philip Lane sees more rate increases but is warning against policy on autopilot.

- Gender gap | A noticeably higher proportion of women than men would like to work but don't have a job, a global disparity that has barely budged in a new index dating back in 2005.

New research shows just how vulnerable markets are to easy monetary policy and the release of US economic data. One study published last week by the San Francisco Fed found that "when the stance of monetary policy is accommodative over an extended period, the likelihood of financial turmoil down the road increases considerably." That's often because loose money spurs credit creation and overheating in asset prices. Meantime, another paper circulated by the National Bureau of Economic Research. discovered "evidence for a causal link between the US economy and the global financial cycle." "We show that US macroeconomic news releases have large and significant effects on global risky asset prices," the authors said. "Stock price indexes of 27 countries, the VIX, and commodity prices all jump instantaneously upon news releases." Indeed, US macroeconomic news explains on average 23 percent of the quarterly variation in foreign stock markets. Read more reactions on Twitter |

No comments:

Post a Comment