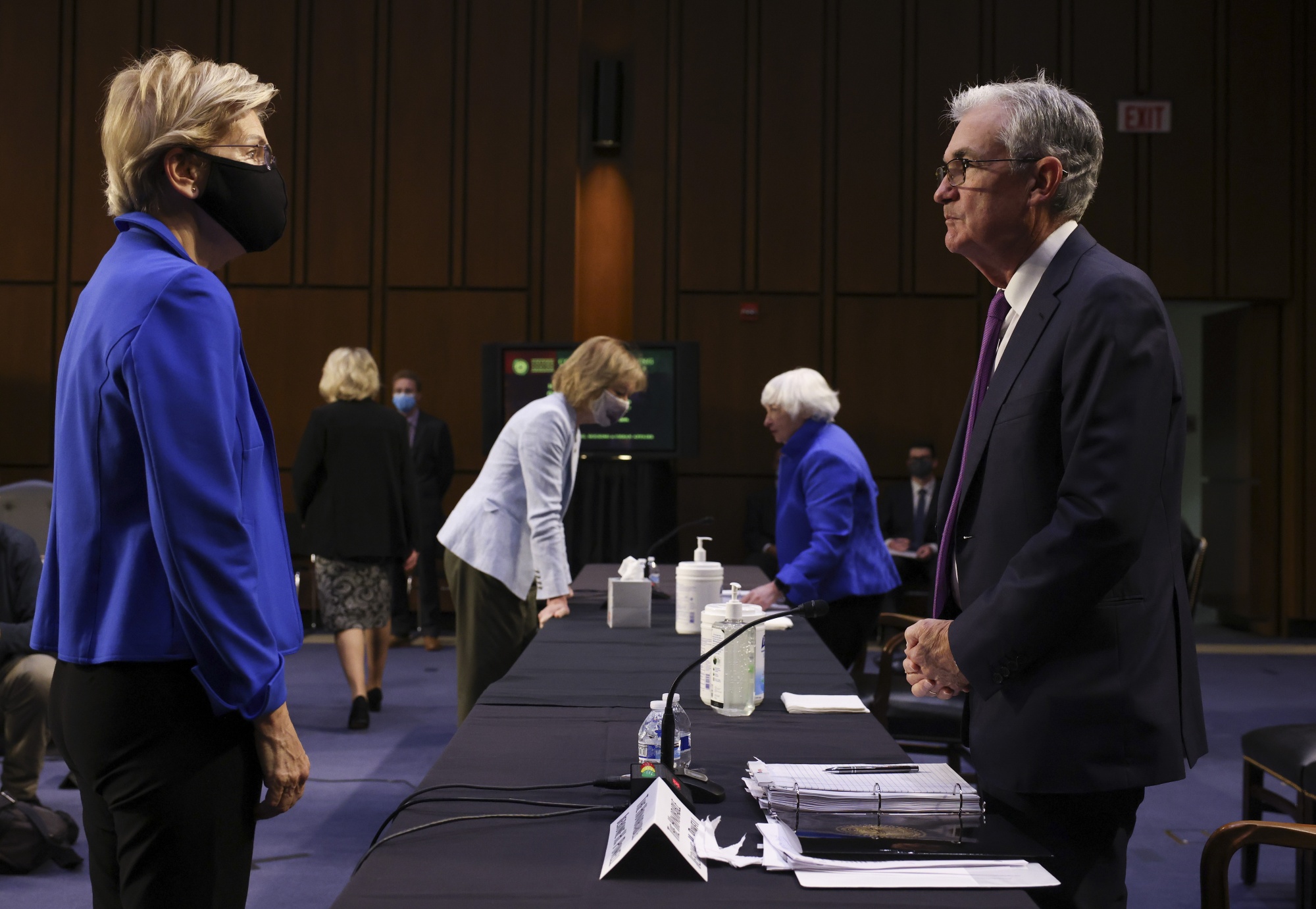

| Hello. Today we look at the political challenges flooding the Federal Reserve, why many senior-level women are bowing out of the workforce, and a cautionary note about Chinese household deleveraging. The Federal Reserve declares itself independent of politics, but it's getting harder to stay completely separated from the cut and thrust of Washington. Progressive Democrats are already warning President Joe Biden that his pick to serve as the central bank's vice chair will signal where he comes down on the debate between beating inflation or avoiding job losses and recession. It's a discussion that's heating up as policymakers lean into raising interest rates even further. As Steve Dennis reports here today, Senator Elizabeth Warren wants Biden to select a No. 2 to counter Chair Jerome Powell, who she says "has made clear that he will take extreme steps on interest rates and he's willing to put millions of people out of work."

Senator Elizabeth Warren, a Democrat from Massachusetts, left, speaks with Jerome Powell on Tuesday, Sept. 28, 2021. Photographer: Kevin Dietsch/Getty Images Two names on Biden's shortlist to replace Lael Brainard — Karen Dynan of Harvard University and Janice Eberly of Northwestern University — represent a choice between a hawk and a dove, according to Bloomberg's Chief US Economist Anna Wong. Dynan said last year that recession and "considerable" increases in unemployment would likely be needed to tame inflation. She would become one of the most hawkish — inclined toward tighter monetary policy — members of the rate-setting Federal Open Market Committee, Wong reckons. "Eberly, on the other hand, might be closer to Brainard in her optimism that the Fed can get inflation back to target without generating a significant slowdown in the labor market," Wong wrote in a report to Bloomberg readers.

Biden has also been urged by Senator Robert Menendez and others to nominate the first Latino governor in the Fed's history, with 34 lawmakers signing a letter last week calling for such a trailblazing appointment. Menendez said the administration is vetting some of his suggested picks, but it would be "a slap in the face" if one isn't picked. Other political challenges for the Fed are emerging. Craig Torres and Bill Allison reported this week that the recent appointment of a prominent Democratic economist to lead the Fed Bank of Chicago is fueling friction over political partisanship inside the institution. Austan Goolsbee became president of the Chicago Fed in January, but only after a contentious hiring process and a track record for criticizing Republican policies in the media. Craig also revealed late yesterday that the search firm hired by Chicago Fed employs Goolsbee's wife. The regional Fed said she played no role in the appointment and the search committee were aware of the link.  Photographer: Daniel Acker/Bloomberg "Regardless of the letter of the law about whether these issues count as conflicts, it is the perception of potential conflicts that raises red flags," said Sarah Binder, a senior fellow at the Brookings Institution who researches Fed governance. The presidential search process "needs to be beyond reproach," she said, if the Fed wants to protect its independence.

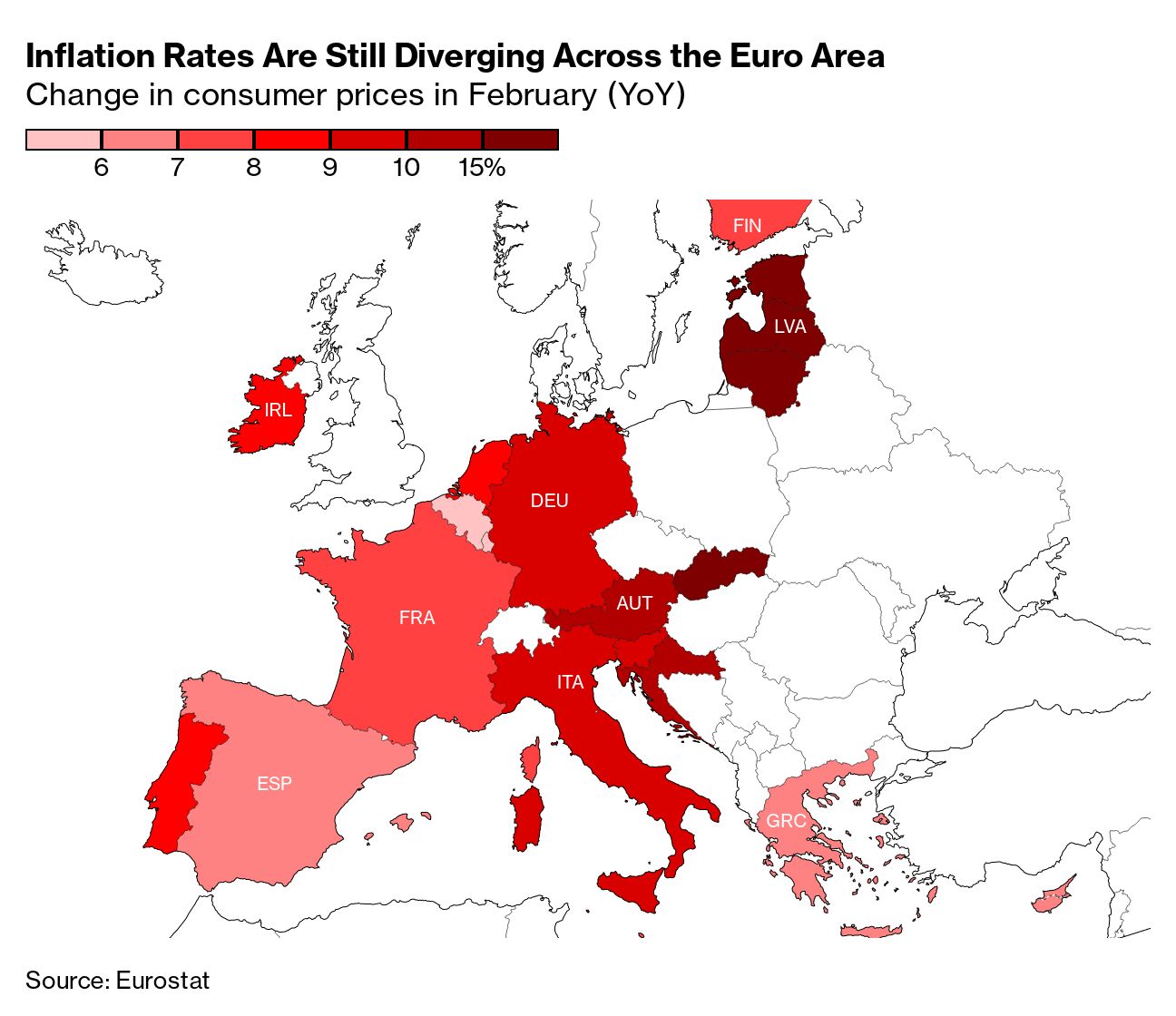

Sticking with politics, Powell, who testifies before Congress next week, is also likely to be pulled further into the debate on the looming battle over raising the US debt limit. He's already warned "there's only one way forward here, and that is for Congress to raise the debt ceiling so that the United States government can pay all of its obligations when due." In an interesting sidenote, Josh Wingrove this week detailed how when serving at a Washington think-tank in 2011, Powell criss-crossed Capitol Hill in 2011 to shoot down alternatives to boosting the debt limit at that time. —Simon Kennedy The female participation rate in the US is now steadily returning to pre-pandemic levels after falling to the lowest since 1987. Might that suggest a problem that alarmed employers and economists during the Covid-19 outbreak can be consigned to history? Not exactly. As Jonnelle Marte explains here, another one is festering below the surface: Many senior-level women, exhausted and torn between career ambitions and personal lives, are now bowing out. Some are switching to less demanding positions or changing industries, while others are giving up lucrative paychecks and simply walking away. The shift raises troubling issues for the decades-long national effort to diversify the top ranks of corporations. In the UK meanwhile, a report showed women are increasingly saying it doesn't make sense to hold a job when childcare costs are so unaffordable. - Price shock | Euro-area inflation slowed by less than anticipated while underlying pressures surged to a new record, reinforcing expectations the European Central Bank will have to push borrowing costs ever higher

- Hikes hurt | When borrowing costs rise, governments end up paying more interest. That fiscal blow is now landing faster than it used to.

- Demographic bust | China has lost about 41 million workers in the past three years as the population ages, ramping up pressure on Beijing to boost the retirement age.

- New trade era | The Biden administration is outlining an ambitious trade agenda for 2023, with a restructuring of old frameworks topping the list.

- Wartime consumer | Ukraine's households have been battered by Putin's war in worse manner than the pandemic era.

- CBDC rumblings | Some of Australia's top banks are getting into a central bank digital currency pilot project. Stateside, the Fed, Treasury and others are huddling on a similar experiment.

- Weak wages | Japan's wages remain too low for officials' comfort, though it's certainly not for lack of effort and experimentation.

China's economic reopening has encouraged not just analysts but even the nation's leaders. Amid all the exuberance, there's a sign of caution emanating from what households are doing with their mortgage payments that might be worth keeping an eye on. Homeowners have been paying down their mortgage debt in recent months, accelerating a trend that started last year, when prepayments surged to as much as 3.5 trillion yuan ($509 billion), according to Société Générale economists Michelle Lam and Wei Yao. "Weakening house-price expectations as speculative demand falters may prompt households to continue deleveraging, which could pose risks to recovery this year,'' they wrote. "Should weak sentiment linger, policymakers may need to double down on support to the housing and household sector to avoid a balance sheet recession."

Read more reactions on Twitter |

No comments:

Post a Comment