| Hello. Today we look at the next generation of China's economic officials, the economic loss from gender inequality and the US economy's vulnerability to the Fed's interest-rate increases. China is about to see its biggest reshuffle of economic policymakers in decades. Outgoing officials include major names such as Premier Li Keqiang, Vice-Premier Liu He, who led trade negotiations with the US, and central bank chief Yi Gang. Their replacements, to be announced over the next couple of weeks at the annual meeting of China's National People's Congress, are generally less internationally experienced, with lesser academic credentials, and are distinguished above all for their close ties to president Xi Jinping. That prospect had led to anxiety from Wall Street to Washington that the new lineup will prove to be Xi yes-men who take China further toward state intervention and tensions with the US and its allies. The stakes are high: Policies stifling competition, innovation and international exchanges could lower China's GDP growth to 2% on average over the next decade, according to Bloomberg Economics. But there's an alternative view, as outlined in today's Bloomberg Big Take. Trust from Xi, experience toughing it out in China's fierce political system and a pragmatic approach to policymaking may be more important than rigid adherence to economics textbooks. If that's the case, the new team may turn out to be better placed than their predecessors to push through the painful reforms — such as raising the retirement age and building a robust welfare state based on progressive taxation— which could unlock a decade of growth closer to 5%. The global economy is losing out on at least $7 trillion of economic gains each year due to a failure to reach gender parity in the workforce, according to a new analysis that comes as progress on equal pay stalls. "There has been progress, but it's not going nearly fast enough," said Dawn Holland, director of economic research at Moody's Analytics and co-author of the report. "There are a lot of complex sort of issues behind these gender gaps" such as social norms which take a long time to shift, she said. A recent report by Pew Research Center found that pay parity has stagnated in the US for the past two decades, with women in 2022 earning an average of 82% of what men earn. The comparative pay was 80% in 2002. Meanwhile in the European Union, women may be waiting until 2086 for equal pay. - Fed peak | Two Federal Reserve policymakers cautioned that recent stronger-than-expected readings on the US economy could push them to raise interest rates by more than previously expected.

- Easy does it | Michael Saunders, who was one of the most hawkish Bank of England policy makers until he finished his term in August, said he'd now vote to soften the pace of interest rate increases.

- China policy | China's central bank Governor Yi Gang signaled monetary policy will largely be stable this year, saying interest rates in the economy are appropriate and inflation will remain under control.

- BOJ shift | Almost two-thirds of Bank of Japan watchers now expect monetary policy change by June following the first extensive hearings of governor nominee Kazuo Ueda, according to the latest Bloomberg survey. Meantime, energy subsidies took the edge of inflation in February.

- Wait and see | The Bank of Canada will hold interest rates at current levels even as the US Federal Reserve pushes borrowing costs higher, economists say.

- Climate change | President Joe Biden's nominee to lead the World Bank said there's sufficient scientific evidence that burning fossil fuels contributes to climate change, seeking to address criticism about the lender's commitment to the issue under its outgoing chief.

- Brazil hurdle | President Luiz Inacio Lula da Silva promised to bring prosperity back if he returned to Brazil's top job. Two months into his presidency, the economy he inherited is cutting his honeymoon short.

- Labor participation | The quality and cost of early-years child care have important implications for a nation, from the size of its economy to the performance of students in high school and university.

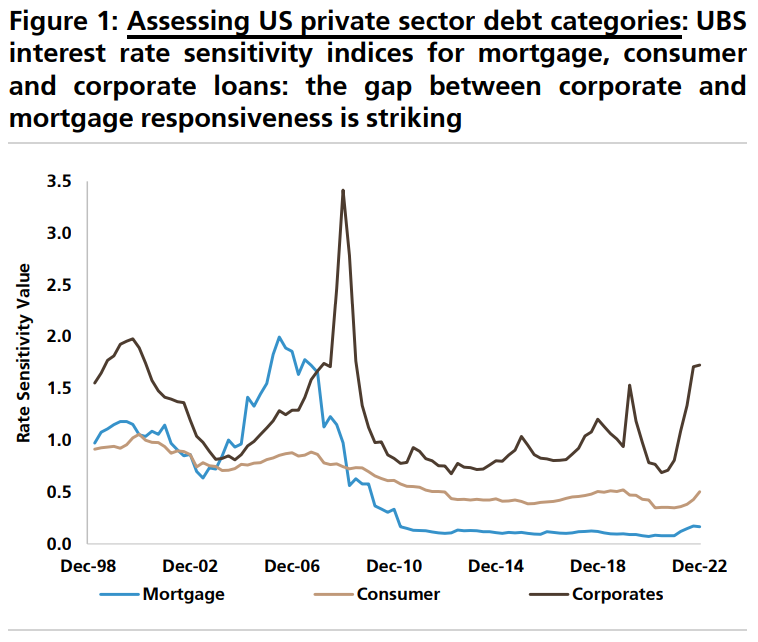

US economic resilience to a year of Fed rate hikes has focused attention on the role of many households and companies having locked in low borrowing costs during the pandemic. UBS analysts have now crafted some indexes aimed at gauging the sensitivity of mortgage, consumer and corporate debt to changes in rates. Bottom line: Sensitivity is indeed lower than it was at some points in the past, but it's been picking up lately and different types of borrowers are more vulnerable.  Sources: Federal Reserve Flow of Funds, UBS Group AG Lower-rated firms are more vulnerable as they didn't borrow so much in 2022, so they have proportionately greater refunding needs, UBS analysts including Matthew Mish wrote in a note this week. Households, meantime, are much less exposed — thanks in part to higher proportions of fixed-rate mortgages and a drop in the total amount of home loans relative to GDP. Camera ready... Read more reactions on Twitter |

No comments:

Post a Comment