| China sets GDP growth target of 5%. Softbank's Arm seeks $8 billion IPO. Apple prepares its new range of Macs. Here's what you need to know today. China set a modest economic growth target of around 5% for the year, with the nation's top leaders avoiding any large stimulus to spur a consumer-driven recovery already underway. Premier Li Keqiang announced the GDP goal at the Communist Party-controlled parliament's annual meeting, which kicked off on Sunday. Economists had expected a more ambitious target of above 5% after the end of coronavirus restrictions. Li also said the government would target disorderly expansion in the property sector. Here's everything you need to know after day one of the National People's Congress. SoftBank's Arm is seeking to raise at least $8 billion in a US initial public offering, Reuters reported. The British chip designer is expected to confidentially submit paperwork for its IPO in late April with the listing expected to take place later this year. The size of the listing would make Arm one of the largest IPOs in the US of the last decade. It ruled out the UK, despite having its HQ in Cambridge, England. Bankers had pitched a valuation of $30 billion to $70 billion for the listing, Bloomberg reported last week, a wide range that underlines the challenges of valuing the firm against a backdrop of volatile semiconductor equity prices. Recession warnings from some of Australia's biggest companies are piling up. More than 40% of the 158 companies on the benchmark S&P/ASX 200 Index that reported half-year results in February posted negative earnings surprises, according to data compiled by Bloomberg. That's up from 28% a year ago. That comes after data last week showed a surprisingly sluggish end to 2022, with economists boosting the probability of a recession. Still, in spite of the signs, government officials have expressed confidence that the nation will dodge a downturn. The message couldn't have been more stark. Japan will cease to exist if it can't slow a fall in its birth rate, according to an adviser to Prime Minister Fumio Kishida. If nothing is done, the social security system will collapse, industrial and economic strength will decline and there won't be enough recruits for the Self-Defense Forces to protect the country, Masako Mori warned, after the birth rate slumped to a new low. Last year there were fewer than 800,000 births and about 1.58 million deaths in the country. Meanwhile, the proportion of people 65 or over rose to more than 29%. Reversing the slide will be "extremely difficult," Mori said. The dollar rose in early Asian trading as the diminishing prospect of any significant stimulus from China damped appetite for risk taking.

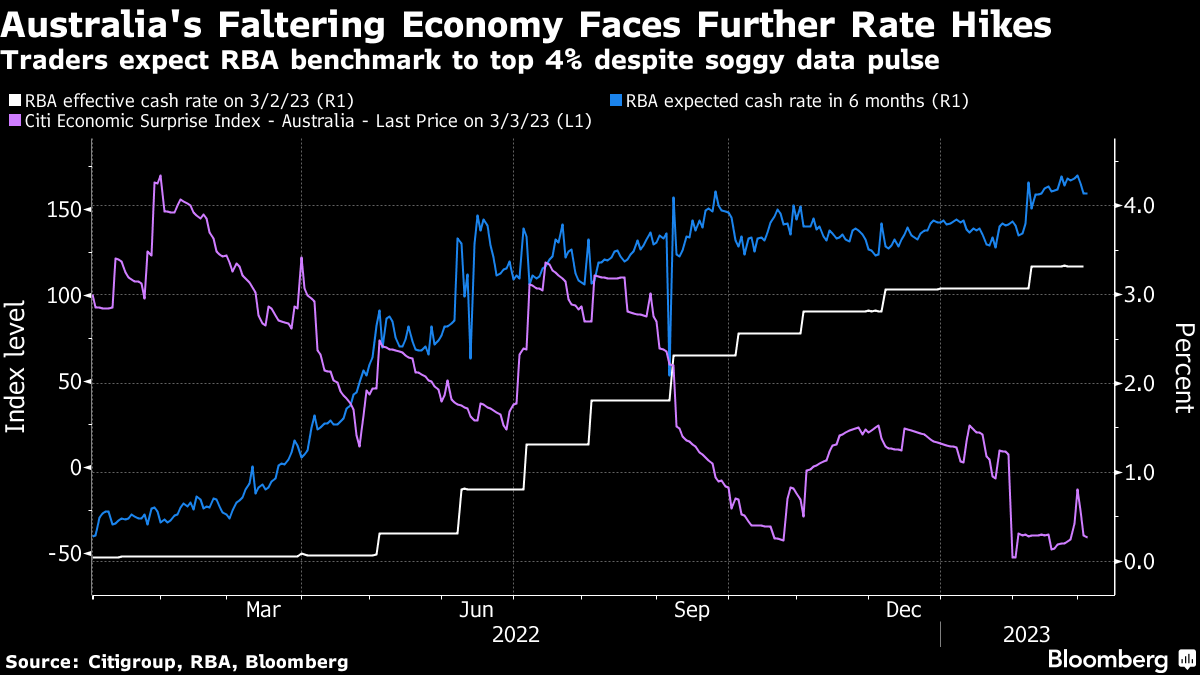

Government bond yields declined in Australia and New Zealand, tracking moves in Treasuries on Friday, when the rate on 10-year US debt closed back below the closely watched 4% level. While US stocks ended the week on a high note, driven by speculation that the Federal Reserve won't raise interest rates beyond peak levels already priced in, news from China over the weekend may sap enthusiasm. Australia's central bank is overwhelmingly expected to raise borrowing costs at Tuesday's meeting, but what it says about the path ahead could be key for both the local economy and beyond. Reserve Bank of Australia Governor Philip Lowe's surprisingly hawkish stance last month can be seen as part of the global watershed as markets were forced to drop their hopes for an early pivot by global policymakers toward pausing and then cutting interest rates.  Part of the reason why the RBA's forecast that it expected to hike several times to tame inflation made such an impression, was the way Australia's economic outlook was looking so vulnerable, outside of the jump in core CPI that so alarmed the central bank. The data since the meeting has underscored those concerns, with a second month of job losses, slowing wages growth and prices, and a weaker-than-expected GDP reading. The RBA's stance may say a lot about just how willing central banks around the globe are to risk sparking recessions in pursuit of their inflation goals. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment