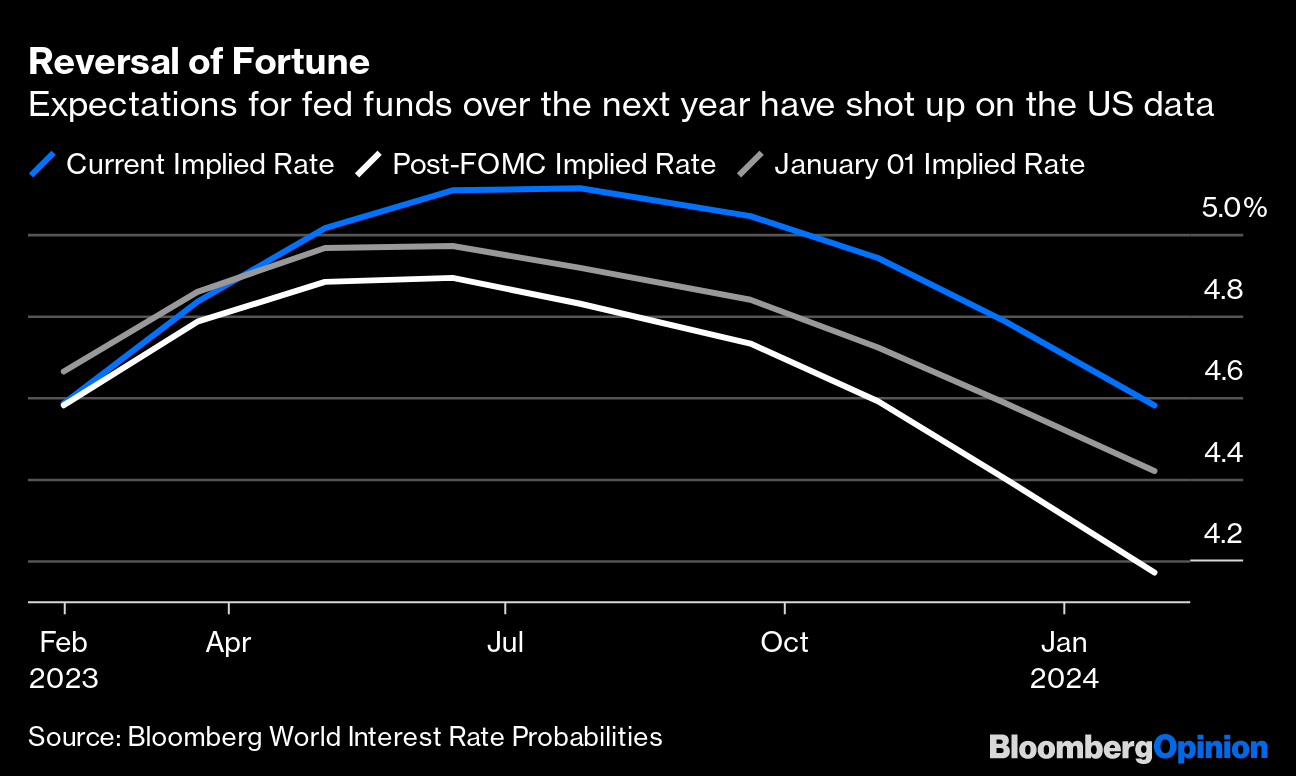

| Just how much has the world changed? US employment data at the end of last week revealed an economy in much better shape than had been widely thought, and prompted a big reappraisal in forecasts for the Federal Reserve's fed funds rate. After a weekend to think about it, traders are continuing to step back from their bets that the Fed will make significant interest-rate cuts by the end of this year. Indeed, they now seem resigned to the notion that the fed funds target rate will be no lower in 12 months' time than now. The following chart, generated by the Bloomberg WIRP (World Interest Rate Probabilities) function, shows the fed fund futures market's implicit forecast for the course of the target rate over the next 12 months, as it was at the beginning of this year, where it reached by the end of Wednesday trading after what was perceived as a dovish briefing by Fed Chair Jerome Powell, and where it is now. The market stands positioned for a more hawkish Fed than at the outset, having only days ago been predicting a more dovish one:  Meanwhile, the implicit judgment of the bond market grows ever more emphatic that the Fed will be cutting rates soon, even if it raises them more in the short term. Inverted yield curves, in which shorter-dated bonds yield more than longer-term ones, cannot last for long. The financial system can't sustain such conditions. Friday's data sent two-year yields up far more than 10-years, leaving the US yield curve as inverted as it has ever been in this cycle. (It has since rebounded somewhat at the time of writing, having almost matched the deepest inversion from December): What might matter more is the amount of time the curve has been inverted. Joe Lavorgna, chief US economist at SMBC Nikko, looked at the six inversions since regular two-year Treasury auctions started in 1976: The average duration of these half-dozen cycles is 13 months. At present, the curve has been inverted for seven months beginning last July. Eventually, the curve must normalize because the financial system cannot function if the cost of borrowing exceeds the rate of interest on issued loans. Every time curve inversion reversed, it was the result of falling interest rates. Yields on both two- and 10-year notes declined, with the former falling more than the latter. In no instance did the curve un-invert because the yield on the 10-year note went higher. This is important because some investors speculate that the yield on 10-year Treasury notes will go up from their present level, perhaps matching or piercing last October's 4.24% high.

Viewed in context, this inversion is now plainly the most significant since the early 1980s — which makes sense because inflation has not been so high, and neither has the Fed had to react so aggressively: The bottom line of Lavorgna's research is that we should brace for two-year yields to come down very sharply at some point in the next few months. "The Fed already has aggressively raised rates with more hikes still to come," says Lavorgna. "The yield curve is sending investors a powerful message, but are they listening?" A change this sharp will cause ripples across the financial world — and nowhere more directly than in emerging markets. Ever since they began to be viewed as a coherent asset class about 30 years ago, there has been a marked inverse relationship between the dollar and US rates on the one side, and the price of EM assets on the other. A strong dollar increases emerging-market interest costs, and generally leads to EM underperformance. That makes for a fascinating test. JPMorgan's index of emerging market currencies appeared finally to be in an upswing against the dollar — but the reaction to the latest US data has brought it right back to its 200-day moving average. This is a big test of the emerging rally.  Plainly, this year's emerging-market rally is already in danger of slowing, and the case for EM has weakened. But how much? Caesar Maasry, head of EM cross asset strategy research and managing director at Goldman Sachs, said by phone that he remains bullish about emerging market equities, but crucially sees this as depending in large part on resumed weakness for the dollar: When we quote EM stocks, it's obviously in US dollars. And a large portion of the reason we think the EM rally can continue is because we think the US dollar selloff can continue... Outside of China, EM is largely a short dollar trade. We think that can continue. China is an idiosyncratic story. It has outperformed meaningfully and we see a little bit more upside there.

James Lord and Gilberto Hernandez-Gomez at Morgan Stanley are more downbeat, and see the shift in US rate expectations as a reason to rein in their enthusiasm for emerging-market credit. However, the reason for increasing rate expectations in the US is, ultimately, that fears of an imminent recession there are receding. That should be good for beaten-up emerging markets. They said: Can we really argue that synchronized global growth is bad for EM currencies? Hardly, particularly when it is parts of EM that appear to be accelerating. Avoiding a US slowdown (or recession) is ultimately a good thing for risk assets. The performance of US equities in the aftermath of Friday's data is revealing.

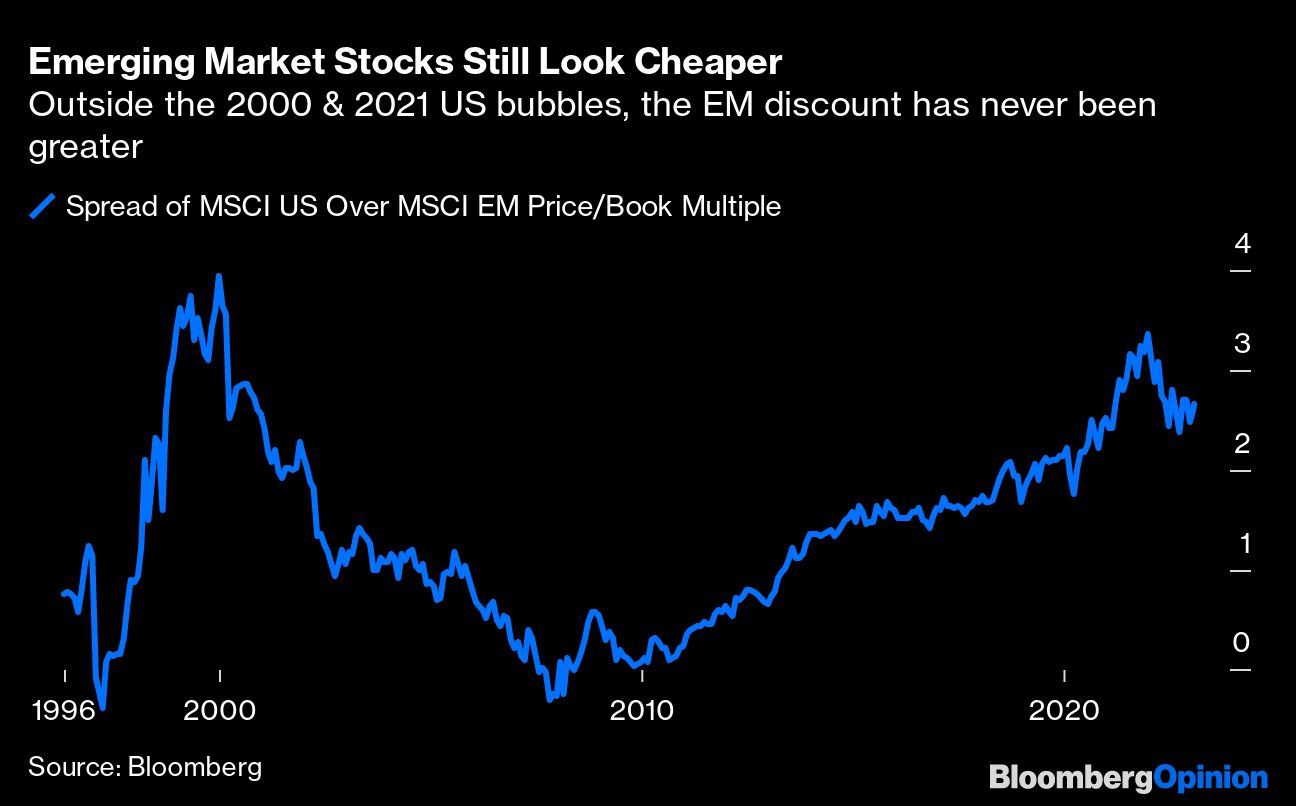

Despite the massive shift in rates markets, US equities have been fairly resolute over the last two trading days. The S&P 500 is down 1.64% over that time, nothing remarkable, and it is still exactly 1.0% higher than at the opening of last week. For equities, the good news for the economy and hence companies' revenues and profits does therefore appear almost to counterbalance the likelihood of higher rates for longer. That doesn't mean that EM can sail through unaffected. Their central banks have currencies to defend. If US rates are going to stay elevated, then the same will have to apply to many countries in the developing world which started their hiking process earlier. That's not likely to be great for their growth. As the economists at Morgan Stanley point out, real yields (calculated by the crude but simple measure of subtracting expected inflation over the next 12 months from government bonds) have dropped recently, while the spread of emerging real yields over US equivalents has narrowed drastically. That means they no longer recommend going overweight in EM bonds — although they are not suggesting selling, either. However, they're still positive about stocks. That's in large part because they look attractively cheap. In the longer run, the valuation of emerging stocks remains very appealing. To take a crude measure, this is the spread of the MSCI US index's price-to-book multiple over its EM index's book multiple. The two occasions when EM was actually slightly more expensive, 1997 and 2008, both turned out to be the eve of major crises. But the depth of the EM discount at present is as high as it has ever been, outside the US bubbles of 2000 and 2021. It's unlikely that we will see the spread in favor of the US increase any more from here:  Further, Maasry of Goldman Sachs points to the historical tendency for relative equity valuations to follow differentials in growth — when the emerging world is growing faster, expect their earnings multiple to improve relative to the US. A huge exception to this is when there's a really profound crisis; in both the GFC year of 2008 and in the Covid year of 2020, growth differentials rose in favor of the emerging world while valuations tanked. Absent a crisis on such a scale, it does look like a good argument for EM stocks: The big caveat is that the differential in growth may not be so great in the emerging world's favor if people really have underestimated American growth. At present, that looks very possible. But this further chart from Maasry shows that there's ample room for the growth differential to narrow while still leaving the emerging world looking cheap: One final argument for EM (these days, probably with the exception of China) is that they remain a geared play on the rest of the world. Whatever you think is going to happen to the US and western Europe will happen in spades to the developing world, in either direction. If we interpret the big selloff in bonds coupled with a much more muted adjustment in the stock market to imply that there is more optimism for the US economy, then that should translate into EM outperformance. This is the judgment of Yung-Yu Ma of BMO Capital Markets Corp.: We do think that overall emerging market valuations in aggregate are pretty reasonable, and that the growth trajectory looks good. And if global growth stabilizes by the second half of the year and resumes over trajectory by the end of the year, which we think it will, then we're going to see tight commodity markets. We're going to see demand return globally and emerging markets tend to be the end of the whip. So, if things are going well, they get a bigger upside. If things are struggling, they snap further to the downside. But we do think that China's being a big driver of emerging markets will really help that... upward trajectory going forward.

Inflation data in the US, not due until next week, will matter a lot. So will evidence on what's happening in China. The economy can only reopen from Covid restrictions once, so it's possible that Chinese assets will now pause until it's clearer what approach the authorities will take to guiding the economy into a post-pandemic world. But on balance, while the shock rippling through markets still clouds the picture and creates greater risks, the case for investing in emerging market assets for the longer term remains just about intact. —Reporting by Isabelle Lee First of all, in the interest of taste, I should say that survival is very much at issue for people in the area of eastern Turkey and Syria that has been hit by earthquakes. It has obviously caused unspeakable damage — and in the case of Aleppo, happened just as the tragic Syrian city might have hoped to rebuild from war. If you want to try donating something to the effort, a Turkish friend I trust recommends the Kahramanmaras Earthquake Emergency Relief Fund. One of my personal favorite charities, which also has a Turkish appeal up and running, is Medecins Sans Frontieres. Any other suggestions gratefully accepted. For something to aid survival in a much more figurative and less important sense, I have some suggestions for audio listening. They all involve former friends and colleagues, but they're all good. First, Cardiff Garcia interviewed the Financial Times' chief economic commentator, Martin Wolf, about his new book on democratic capitalism for The New Bazaar. It's a fascinating conversation with a fascinating man, and worth listening to the end because it moves a long way from economics. Then there's the first episode of The Closer, hosted by old colleague Aimee Keane, which is going to offer a series of deep dives into how some of the most significant deals happen. You might also want to listen to this Twitter Space featuring former Fidelity guru George Noble interviewing two of my favorite market pundits, Ian Harnett of Absolute Strategy Research and Mike Howell of CrossBorder Capital — if you have two hours to spare, give it a try. For a nine-minute treatment, my former Lex Column colleague Rob Armstrong, who I'm told writes a daily newsletter about markets these days, made his own attempt to explain Friday's confounding data for the FT Morning Briefing. And finally, the latest Opinion podcast covered Powell's very poorly received press conference of last week. It's already a little dated — if Powell had an inkling of the data that was coming, it's not surprising he soft-pedalled his complaints about easing financial conditions — but as always, I greatly enjoyed the conversation with Vonnie Quinn, and hope others will enjoy it, too.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more from Bloomberg Opinion? {OPIN <GO>}. Web readers click here. |

No comments:

Post a Comment