| Hello. Today we look at whether the Federal Reserve may seek to push back against market expectations, what labor-cost data are showing about the economy, and research showing that what US central-bank chiefs say isn't the only thing that matters — but also how they say it. While the Federal Reserve is fully focused on further tightening monetary policy, in financial markets it's all about when the turn to easing is coming. Not so long ago, traders were betting that the Fed could even have started cutting interest rates at its meeting today, Katherine Greifeld and Liz McCormick report here. They've come round, of course, and markets are aligned with economists in anticipating a 25 basis-point increase in the benchmark rate. But investors continue to be on the lookout for when the turn to easier policy comes. Expectations for rate cuts have only been pushed out in time — to later this year — not removed. Bolstered by evidence that price and wage pressures have peaked (see below for the latest piece of data), investors lately have been taken by an inflation-is-about-to-melt-away vibe. That's sparked sharp rallies in stocks, corporate bonds and even cryptocurrencies since the start of the year. Policymakers already picked up on the danger of over-optimism in their December gathering, worrying about "unwarranted easing" in financial conditions. That could undercut what the Fed is trying to do: slow the economy, introduce some slack in the job market and ensure that inflation indeed does come back to 2%. One of the focus points of Chair Jerome Powell's press conference Wednesday will be how much he pushes back against exuberance in markets. "I've spent enough time around Wall Street to know that they are culturally, institutionally, optimistic," Neel Kashkari, president of the Minneapolis Fed and a former investment banker and trader, told the New York Times recently.

Still, according to Fed policymakers' forecasts from December, Wednesday's rate hike will bring the benchmark ever closer to its ultimate peak. So one important element to look for in Wednesday's policy statement will be whether it still says "ongoing increases" in rates will be appropriate, as Jonnelle Marte writes in her decision-day guide here. —Chris Anstey A key gauge of US labor costs — highlighted as important by Powell back in December 2021 — showed some let-up in pressures last quarter. The employment cost index, a broad measure of both wages and benefits, increased 1% in the fourth quarter. That was the smallest advance in a year, though the index has now risen at least 1% for six straight quarters, extending what was already a record streak in data back to 1996. The data are consistent with other measures that show wage growth is slowing, though still not enough for the Fed to feel confident that such inflationary pressures have been quelled for good. The monthly reading on average hourly earnings is out on Friday, with economists penciling in a 4.3% annual gain for December — down from 4.6% in November, but still well above the 3% pace economists say would be in line with 2% inflation. - Coming up | After the Fed decision, Brazil will take the stage, with officials expected to keep their rate at 13.75% for a fourth month.

- Real-estate risk | Shaky property markets across much of the world pose another risk to the global economy as higher rates erode household finances. Meanwhile UK home values have suffered the longest string of declines since the financial crisis more than a decade ago.

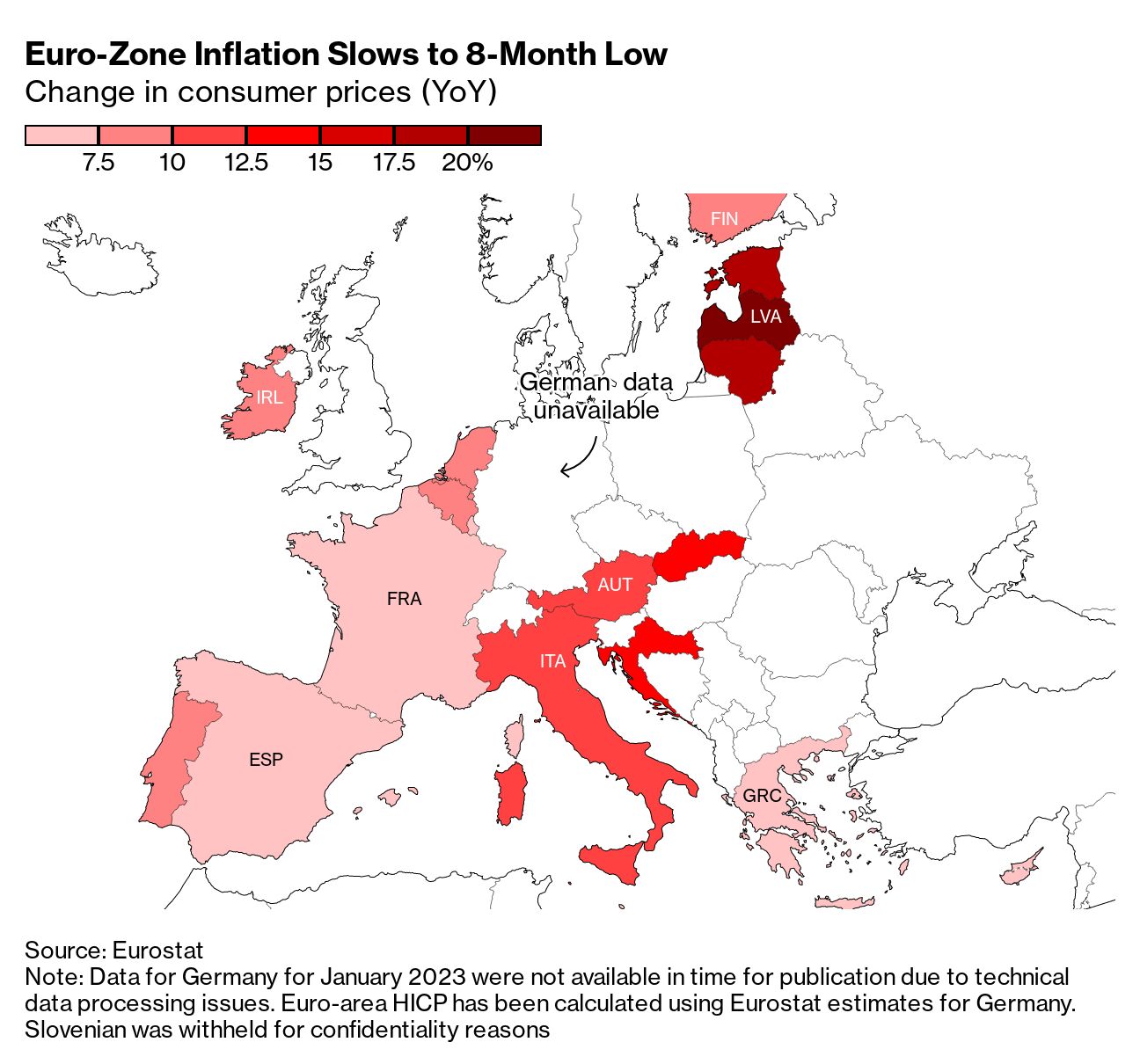

- Price surprise | Euro-area inflation slowed more than expected, suggesting a more heated debate to come at the European Central Bank over how much more rates must still rise.

- Spanish wages | The minimum wage will jump 8% after the Spanish government and unions struck an inflation-busting deal.

- Sizzling prices | It's getting costlier to throw another shrimp on the barbie, with an index of Australian summer food prices climbing. Meanwhile Peru's inflation rate may show damage wrought by unrest.

- Code of conduct | Fed officials quietly tightened internal restrictions on employees' political activities after several reserve banks ran afoul of Congress over real or perceived engagement on some issues.

- Factories fire up | Asia's manufacturers are improving at the start of the year as the region becomes more optimistic about the boost from China's reopening, while euro-area activity shows the downturn is softening. Meanwhile Russia's war machine is buoying its industrial sector.

- Budget boost | Prime Minister Narendra Modi's government unveiled a pre-election India budget that cut personal income taxes to boost consumption while ramping up infrastructure spending to spur growth.

It's not just what Fed chairs say that matters, but how they say it. A trio of academic economists has used machine learning technology to study the tone of Fed chiefs over 36 press conferences, from 2011 to 2019, to gauge the impact on investors and the public. Among the findings, a more positive tone could fuel a 75 basis-point jump in S&P 500 stock-index returns. Exchange rates and the public's view of future inflation also responded to tone, though the bond market did not, they found. "A certain level of acting skill may be helpful for ensuring that the public receives the policy message fully and accurately," Yuriy Gorodnichenko, Tho Pham and Oleksandr Talavera wrote in research published in the February issue of the American Economic Review.

Read more reactions on Twitter here |

No comments:

Post a Comment