| Hello and welcome to 2023. Today we look at the outlook for the US and global economies, this week's wave of economic data and a new study about the dollar from the Federal Reserve. All the best for the year ahead. It would surely be the most-anticipated recession in US history. - Forecasters surveyed by the Federal Reserve Bank of Philadelphia put the probability of a downturn in the next four quarters at more than 40%, the highest reading since at least 1975

- Economists polled by Bloomberg see the chance of a 2023 slump at 65%

- A model created by Bloomberg Economics puts the risk of 100% with a start date of September, while allowing for other forces still leaves the team led by Anna Wong pinning the chance at 80%

As we showed in a series of charts last week, it would be hard to avoid a contraction given the combination of the fastest inflation in two generations and the hikes in interest rates from the Federal Reserve, which are set to recommence in February. The rest of the globe is unlikely to do much better, as Sam Potter shows with his annual rundown of what Wall Street strategists are expecting. - Barclays Capital sees 2023 as one of the worst years for the world in four decades

- Ned Davis Research puts the odds of a severe global downturn at 65%

- International Monetary Fund Managing Director Kristalina Georgieva expects a third of the world, at least, to contract

As Dario Perkins of TS Lombard wrote in his 2023 outlook: "Given the massive distortions and uncertainties in the global economy, it is odd there is so little dispersion in views about 2023: The consensus expects stagnant growth (or mild recession), lingering inflation and tighter-for-longer monetary policy. To be a contrarian, you need to forecast either a much deeper downturn or Goldilocks returning."

An upbeat take is that it could be the mildest recession in history. Economists surveyed by Bloomberg still see US growth of 0.3% for the overall year. Even more optimistic are the economists at Goldman Sachs. They ended 2022 maintaining their call for a soft-landing in the US on the basis that a period of sub-par growth will be enough to rebalance the labor market and dampen wage and price pressures, while drags from monetary and fiscal policy will diminish. Weakness could nevertheless endure to the disappointment of investors. Investor Howard Marks of Oaktree wrote in his year-ending note to clients that a "sea-change" is underway in the US economy and markets, which will likely result in rates averaging 2% to 4% for the next several years. Good luck! — Simon Kennedy The bright spot for the US economy has been the labor market, and a report due Friday is likely to show the resilience lasted through December, providing the Fed with further reason to keep raising rates. - Payrolls are projected to have risen by about 200,000

- Average hourly earnings are seen rising 5% in December from a year earlier in Friday's jobs report, well above a pace that would be consistent with the Fed's 2% inflation goal

- The unemployment rate is seen holding at a historically low 3.7%

Elsewhere, euro-zone inflation will probably show some slowing, and central banks in Israel and Sierra Leone may deliver the first rate hikes of 2023. See our full guide to the week ahead here. - Coming up | Data in Germany will probably show inflation slowed for a second month, in a foretaste of the euro-area number on Friday. Earlier today, unemployment in Europe's largest economy unexpectedly fell.

- Trade outlook | Here are five ways that world trade will transform in 2023 at a time when the largest nations are stepping back from the founding principles of globalization.

- Fed's Collins | A profile of the first Black woman to lead a regional Federal Reserve bank, who told Bloomberg that her mission is achieving "an economy that works for all."

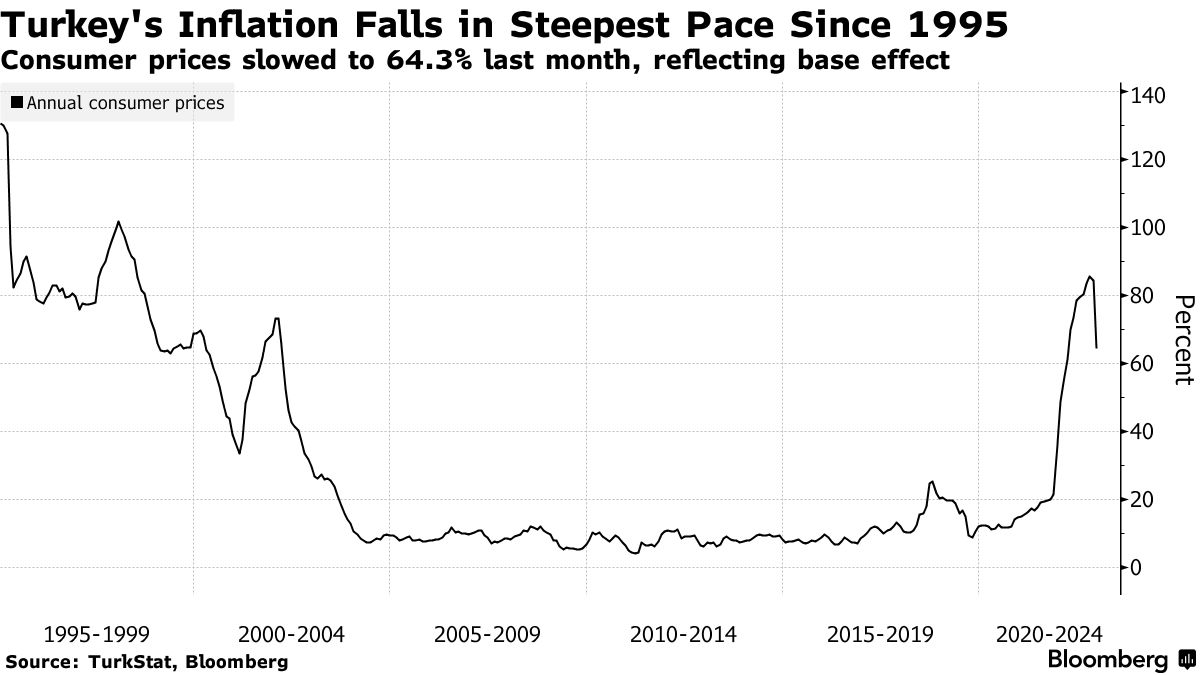

- Turkey inflation ebbs | Inflation decelerated at its steepest pace in more than a quarter century, a slowdown that may be at risk from a public spending splurge planned ahead of elections.

- Croatia joins | Croatia is now the euro zone's 20th member, completing its journey from the war-torn Balkans to the European mainstream.

- Alarm bells | Manufacturing indexes showed contraction across trade-heavy Asia, and an early indicator for regional growth, Singapore's GDP, was a warning for lingering factory pain into the new year. Australian home prices dropped by the most since 2008.

- Rampant walkouts | Strikes by UK rail workers, nurses and ambulance drivers are piling on Prime Minister Rushi Sunak's economic woes.

- Currency concern | Israel's central bank said a weaker shekel is stoking inflation, with its governor says signaling it's prepared to act if needed.

The US currency went on quite the surge in 2022, living up to its title of "King Dollar." A new paper from the New York Fed describes an "imperial circle" which leaves the greenback as a dominant driver of the world economy. "At the core of it, there is a fundamental asymmetry between the shrinking exposure of the 'real' US economy to global developments versus the growing global role of the US dollar," the authors wrote. "Dollar appreciation leads to a decline in global economic activity, which in turn benefits, in relative terms, the dollar itself, reinforcing the initial appreciation and its effects."

Read the full research here. Some books to look forward to…

See more of the thread on Twitter.

|

No comments:

Post a Comment