| Hello. Today we look at inflation at times of economic stress, how movie stars react to taxes, and what's happening in the world economy this week. December marks the moment when "words of the year" are declared. According to a recent report from Merriam-Webster, the choice of 2022 is "gaslighting." However, among the economics community there would be a good case to be made for "polycrisis." Mentioned by Jean-Claude Juncker during the euro crisis of the last decade, it's since been popularized by Columbia University's Adam Tooze, a prolific commentator on the recent swirl of global economic turmoil. The term refers to when the world faces multiple overlapping crises which, when combined, are more dangerous than the sum of the parts. So a pandemic or war, both of which we've witnessed lately, has many knock-on effects. Here's a chart Tooze used earlier in year to illustrate the thinking: Now, fresh from the printers and already proving popular on social media is an attempt to explain what happens to inflation in a world of "overlapping emergencies." Written by economists including Isabel Weber of the University of Massachusetts Amherst, the paper looks at how sector-specific shocks relate to overall price stability and so can be labeled systemically significant. A review of how prices performed over 71 sectors amid the pandemic and Russian war, finds these to be the most sensitive: - Energy

- Inputs other than energy

- Basic necessities

- Commercial and financial infrastructure

Among these, petroleum and coal products were the most sensitive to shocks. Oil and gas extraction, chemical products, farms, food and beverage and housing also featured highly.

What does that mean for policymakers? The authors argue that when emergencies are occurring and look like overlapping, stabilization of prices will require targeted and often upfront interventions rather than a reliance on monetary policy. Just what those policies are is for another paper, though:

—Simon Kennedy Wednesday marks the last chance for European Central Bank President Christine Lagarde and colleagues to guide investors on whether the upcoming hike in euro-area interest rates will be 50 basis points or more. After that, policymakers head into the blackout period before their Dec. 15 decision. Markets are pricing in a 50 basis-point move, with bets showing only a smaller chance of a third consecutive 75 basis-point hike. Bank of France Governor Francois Villeroy de Galhau spoke out in favor of the less aggressive option on Sunday, and his Irish colleague Gabriel Makhlouf suggested today that 50 basis points is indeed likely, though he wouldn't rule out more.

Elsewhere, further rate hikes from Australia to Canada, and US data showing a slowdown in producer-price inflation, will be among the events keeping investors busy. See here for more of the week's events. - Geopolitical rivalries | Reports of the death of globalization are looking greatly exaggerated. A series of charts shows cross-border commerce continues to boost the world economy.

- China call | Six prominent Chinese economists called for a relaxation of Covid rules. Authorities eased testing requirements across major cities over the weekend, and economists are now bringing forward projections for China's exit from the so-called Covid Zero policy.

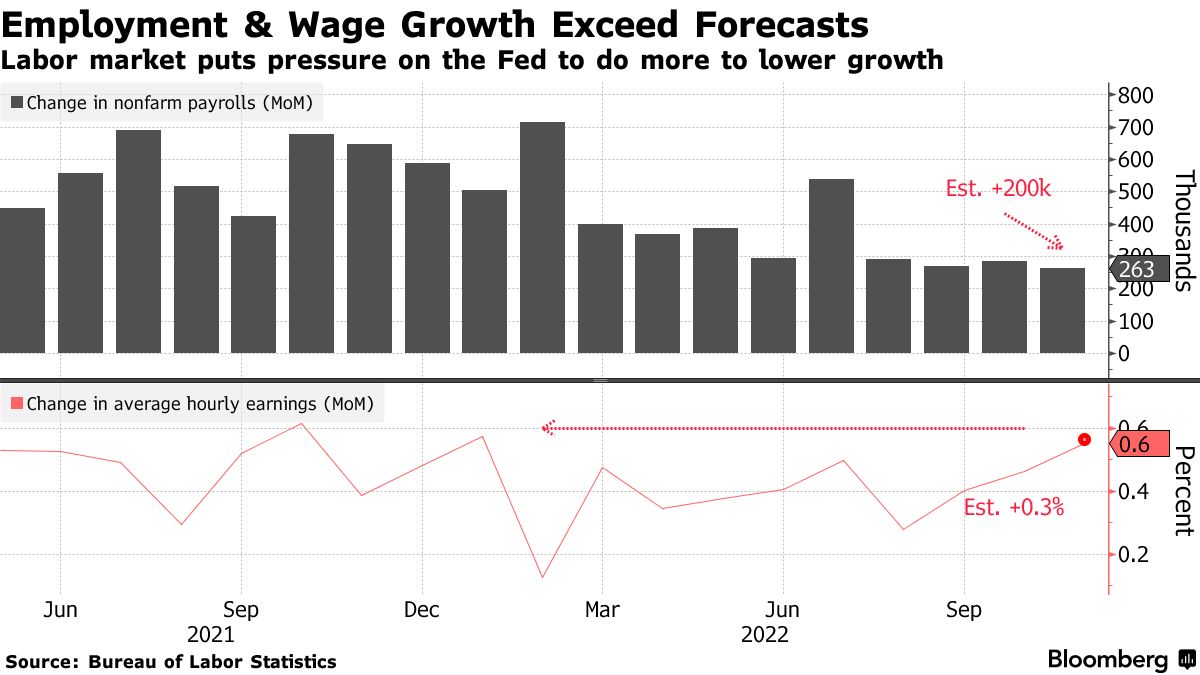

- US outlook | Federal Reserve officials have enough worrisome inflation data to consider raising rates to a higher peak than investors expect and potentially keep hiking by half-points beyond this month.

- Catch-22 | Emerging-market central banks face a conundrum with plunging growth meaning they can't keep monetary conditions tight, but elevated inflation preventing them from halting rate hikes.

- Towards the bottom | Britain's growth potential has fallen behind every large economy except Mexico due to collapsing productivity and severe labor market shortages, according to a former Bank of England official.

- Finally | Turkish inflation slowed for the first time in over a year and a half, though measures to revive the economy ahead of elections in 2023 may keep it elevated for some time.

When Ronald Reagan was a movie star he claimed he stopped making films at some point each year to avoid the top tax bracket. In a bid to see if gradually higher tax rates do impact the supply of labor, economists Daniel Keniston and Abigail Allison M. Peralta looked at Hollywood, home to consistently high-earning groups of workers. Contrary to Reagan's claim, they found no relationship between high-income taxes and the amount of movies shot by the stars. However, they did find that when taxes are high, actors make more "prestige" films, namely high-rated ones which involve collaborating with award-winning directors. "This pattern suggests that high taxes cause high-earning performers to value quality over more remunerative 'blockbuster' films," the authors said in the study circulated by the National Bureau of Economic Research.

Read more reactions on Twitter |

No comments:

Post a Comment