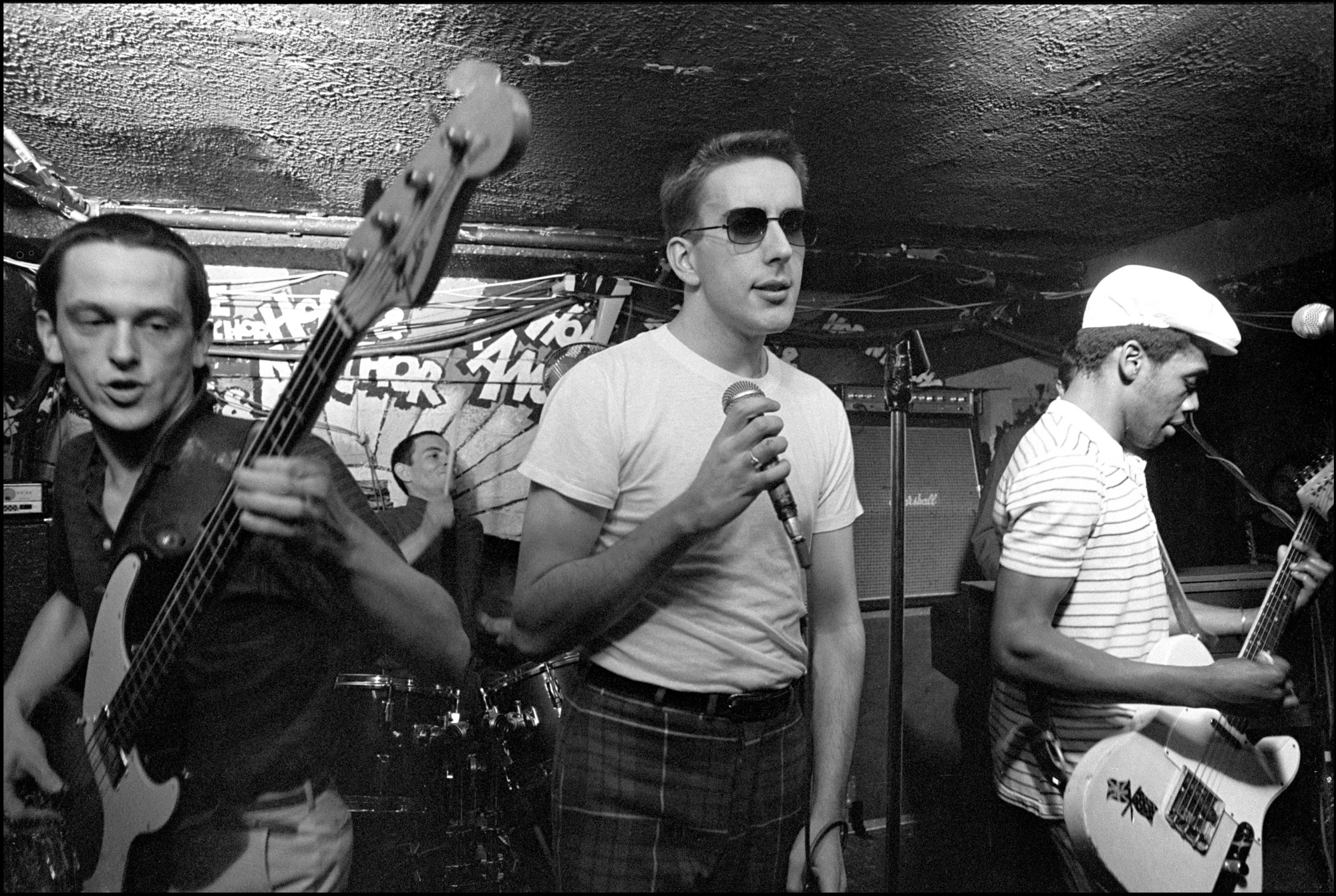

| The great 19th century Austrian diplomat Count Metternich is supposed to have reacted to the news of the death of his French opposite number Talleyrand with the words: "Whatever did he mean by that?" This story might be apocryphal. Some Googling revealed an equally confident assertion that it was Talleyrand himself who said this, on hearing the news of the death of his former boss Napoleon. But whoever said it, this anecdote accurately captures the reaction to 2022's last market curveball — the news that the Bank of Japan had decided to relax its "yield curve control" policy, so that 10-year Japanese government bond yields could now be allowed to reach as high as 50 basis points, rather than 25.  Sacha Guitry takes a calculating turn as Talleyrand in his 1955 film "Napoleon." Photographer: Keystone-France/Gamma-Rapho/Getty This doesn't sound terribly shocking. But the BOJ had done nothing to prepare the market for the news. Its long-term chairman, Haruhiko Kuroda, is due to stand down in April next year at the age of 78, and the widespread assumption was that his signature policy of pouring liquidity into the bond market even as the rest of the world was tightening would stay in place until then. One of the big unknowns penciled in for 2023 was whether the BOJ would attempt to persist with YCC. Instead, Kuroda decided to let yields rise now, months before his term ends. This was a big deal; here is what has happened to 10-year Japanese government bond yields since YCC (initially aiming to keep yields around zero, and subsequently setting 0.25% as an upper limit) was introduced in September 2016: Following on from Christine Lagarde's surprisingly belligerent assertion that the European Central Bank was not going to pivot (toward cheaper money), the growing assumption that central banks would soon start easing suddenly looks outdated. Just like a butterfly flapping its wings in Tokyo, the action has had effects around the globe. Betting against the yen in a so-called "carry trade" has been profitable this year — until now. This is how a policy of borrowing in yen and parking in US dollars and Brazilian reais has performed since Jan. 1: Note that carry traders still sit on some nice gains, but the way the yen is going into reverse effectively removes yet another important source of liquidity and leverage for speculators across the globe. The shift isn't necessarily all negative. Allowing the yen to strengthen means a weaker dollar. To an extent, Kuroda's big surprise underpins growing confidence that the dollar is heading downward, and that that will make life easier for the emerging world. But why do it now? One possible reason is that if a change is going to be made, it's as well for the outgoing team to make it, rather than leave the mess for a replacement who hasn't yet built up a store of credibility. For a very significant example, the Mexican crisis of 1994, which set off a chain of crises across the emerging world, came within weeks of a new government taking office and swiftly deciding that it needed to widen the band at which the peso could trade. It's doubtful that kind of move would have caused such a grave financial accident if it had happened months earlier under a treasury team that had been in place for almost six years. So Kuroda is responsibly reducing the risk of a later accident. After the brief implosion in the UK gilts market a few months ago demonstrated the dangers of letting yields rise too quickly, this makes sense. Beyond that, there are plenty of hopes that this means the BOJ is throwing in the towel on trying to intervene in the bond market altogether. On this argument, it was the first step that would make subsequent moves that much easier. More plausibly, I think, Kuroda is adjusting the yield target to a more defensible level that will be easier for his successors to maintain. The most important point is that widespread confidence that rates would soon head down has taken a knock. One good illustration is the 10-year Treasury Inflation-Protected Securities yield, representing the market's best guess at a real yield after inflation. This crucial measure had an upward shock for the ages over the first few months of 2022, but appeared to set a top last month. That's now in doubt, with real yields closing in on 1.5% again:  So the year ends as it started, with a debate over inflation and how to fight it overshadowing everything else, and central banks surprising everyone with a determination to be hawkish. Back in the first week of January, the shock was that the minutes of December's Federal Open Market Committee meeting showed that the Fed was ready to end quantitative easing bond purchases. In retrospect, it seems obvious that keeping QE going throughout 2021 was a very major mistake. But only 12 months ago, it was shocking to hear that Chair Jerome Powell would dare to rein in liquidity. When it comes to surviving, I'd like to advise that rehabilitation after knee-replacement won't always go in a straight line. It requires patience. So my apologies for falling quiet this week, and for writing much less than I would usually aim to do today. I hope to have a couple of special editions of the newsletter for you next week. Returning to normal business, I was very moved to hear this week of the passing of Terry Hall, lead singer of The Specials, at the very young age of 63. His bandmates have since revealed that pancreatic cancer, diagnosed barely two months ago, had claimed him. His voice in many ways summed up the angry and transitional Britain of my youth; whether you agree with his politics or not, four decades later we now know that the Specials' music has lasted. Their acknowledged masterpiece was Ghost Town; my personal favorite might have been Rat Race, an attack on the British school exam system; for really raw political anger, try a Bob Dylan song transformed in Maggie's Farm (further transformed to "Ronald's Farm" when performing in the US); and for a deceptively relaxed song, try Do Nothing.  The Specials performing at the Hope and Anchor in London, 1980. Photographer: David Corio/Redferns/Getty I'd also like to pay tribute to Scott Minerd of Guggenheim Partners, an ubiquitous presence on Bloomberg TV, who has shockingly died during a workout in the gym. He was 63, like Terry Hall — far too young to take his leave. He was a charming and courteous man, a brilliant analyst of the bond market, and an extremely successful investor. He was also a former competitive bodybuilder, a fact that was even more obvious in person than on the television screen. My best wishes to his husband and his family. Finally, there's a big holiday coming up. To get in the mood, I recently heard Thurl Ravenscroft sing You're a Mean One Mr. Grinch for the first time — it's brilliant. At first, I thought the singer was Paul Robeson. In Britain, we long had a custom of buying ludicrous novelty singles for Christmas; I'd like to recommend Nellie the Elephant by the Toy Dolls, which took the world by storm in 1984. For something that brings the meaning of Christmas to life a little more fully, try Bach's Christmas Oratorio, conducted here by Nikolaus Harnoncourt in a performance that makes every effort to play it as it would have been performed in Bach's time. OK. I'd like to wish a happy Christmas to all who celebrate it, and to send equally warm wishes to all those who don't. Thanks for all the interest and feedback in 2022; I'll try to keep up the good work next year.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? {OPIN <GO>} Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment