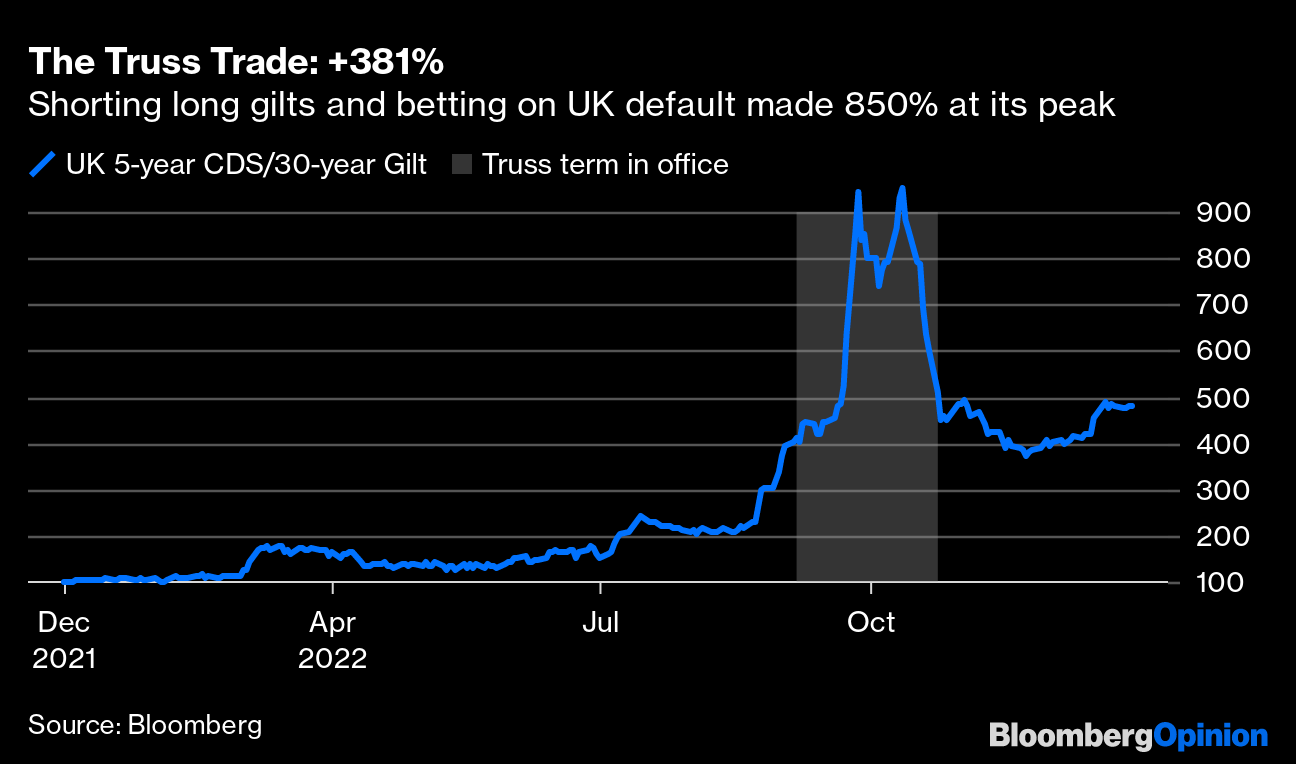

| On this last trading day of 2022, it's time to reveal the final trades placed by Hindsight Capital LLC. If you read yesterday's Points of Return, you'll find all the rules laid out for this strange and unfortunately non-existent hedge fund. It invests at the beginning of the year knowing that it will be judged over the next 12 months alone, and in full knowledge of how markets are going to perform. The managers do, however, need to be able to show that they had a sensible rationale for placing their chips as they did at the beginning of January. 2022 has been a terrible year for many famous investors, as both bonds and stocks have headed downward almost everywhere. For asset allocators, it's fair to call this one of the worst years ever. For those at Hindsight Capital, however, armed with all the knowledge that hindisght can bring, it was a truly great one. Here is the remainder of the trades they put on 12 months ago. All the charts below are set so that the trade starts at a notional 100; numbers are up-to-date at the time of publication. Waking From the Dream There are some things in life on which you can rely. Addiction is one of them. Over the entire 20th century, tobacco stocks were the single best sector in the US market. Even after decades of anti-smoking campaigns and declining use in rich countries, smokers keep buying their product, and the companies can keep paying dividends and compounding gains. It therefore made sense that tobacco stocks would grow in appeal during the difficulties of 2022, as defensive stocks with well-protected income suddenly looked much more attractive. The S&P 500 tobacco sub-index is up 3% for the year — quite an achievement in these conditions. Marijuana should on the face of it offer the prospect of tobacco on steroids — addictive properties to keep people coming back for more, big margins, and even the opportunity for growth as cannabis legalization spreads across the US and many other countries. But cheap money helped turn marijuana into an investment mania, making the sector obviously overvalued entering the year, with the Cannabis Index trading at 4.5 times sales (it had no profits so there was no p/e). That now stands just below 1.5 times sales. The index is down 93% since its inception in 2019, and fell 70% this year alone. Shorting cannabis and putting the money into tobacco made Hindsight Capital a 245% profit for the year. Fools' Gold On the subject of investment manias, Hindsight Capital could also see a screaming opportunity in Bitcoin. Cryptocurrencies are supposed, according to their still numerous enthusiasts, to be a form of "digital gold." With guaranteed scarcity, the hope has been that they can act as a store of value akin to precious metals, but with the added advantages that they can easily be traded, and can be operated from the comfort of your computer. This perception, despite no intrinsic worth, was of course strengthened by several years of stratospheric growth, latterly driven by the flow of easy money into the economy to deal with the pandemic. In 2022, that has turned dramatically into reverse, with falling Bitcoin prices helping to reveal the dangerous economics underpinning many of the companies that had come to dominate the crypto ecosystem. That culminated in the collapse of the FTX exchange, once the second largest, amid credible allegations of rampant fraud and embezzlement. Set all this in an environment of vanishing liquidity, and cryptocurrencies had no chance. Hindsight was barred from shorting some of the many minor cryptocurrencies that virtually ceased to exist, but Bitcoin itself dropped 64%, so no problem. Crypto's awful year was predictable; read Matt Levine's 40,000-word magnum opus for an assessment of its future. To balance the trade, Hindsight invested the proceeds from the Bitcoin short into actual precious metals. It's not been a good year for gold, which pays no yield and thus looks less attractive as rival investments start to offer positive rather than negative real yields. At the time of writing, the gold price is just below where it started the year. But platinum, rarer still, has done better, gaining 9%. Put the two trades together, and Hindsight Capital made 203%: A US Default What's the worst thing that could happen? In purely financial terms, the answer is probably a default on US Treasury bonds, relied on as the backbone of the global financial system. As Uncle Sam can always print more dollars, the only way a default can happen is by choice. This is very unlikely — but it means that only a slight rise in perceived risk can lead to a big percentage gain for anyone who has bought insurance against such an event on the credit default swaps market. The massive fiscal splurge since the pandemic obviously makes it harder to keep servicing all of the federal government's debt. But much more importantly, the chance that the country could choose to renege on its promises and stop paying is perceived to have risen since the midterm elections. The US "debt ceiling" will need to be raised some time next year. This should be a technicality, but the tiny Republican majority in the next House of Representatives could be a serious obstacle. The fear is that a determined group of Republicans will refuse to raise the limit under any circumstances. The votes of the remaining Republicans plus the Democrats would suffice, but would the new Republican speaker even feel able to present a bill to raise the ceiling? It would be incredibly stupid not to, but that doesn't mean that it couldn't happen. So, over the course of 2022, the cost of buying insurance against a default within the next 10 years rose by 69%; meanwhile, Turkey was one of the few countries whose financial position seemed slightly less terrifying at year's end, because it was mired in crisis at the end of 2021. The cost of insuring against default dropped 8% over the year. A Turkish default remains far more likely than one by Uncle Sam; but putting the trades together was enough to make 84%: The Money-Illusion Trade: Move to Japan Conversations with the Hindsight Capital team are fun at present, as they are now headquartered in Tokyo. Each year they roam the world, basing themselves in whichever country's currency will be the weakest. Among the majors, that title went to Japan this year, although December's surprise shift away from tight yield curve control by the Bank of Japan narrowed the gap somewhat. For much of the year, Japan stood alone in resolutely overseeing loose money. That made the yen the ideal base for carry traders — who borrow in a weak currency and park the money in one that pays higher yields. Some of the shine came off this by the end of 2022, but the results of a carry trade of selling yen and buying Brazilian reais (buoyed by the country's status as one of the first economies to start tightening) were still impressive. Up 56% in November, the trade is still up 38% — an amazing shift in the terms of trade between two big economies in such a short time:  Beyond that, Hindsight Capital enjoys the "money illusion" that comes with denominating returns in a weak currency. In years like 2022 when currency markets are active, it can make a big difference. For an example, an investment in the S&P 500 Utilities index is now almost exactly flat for the year, down a bit less than 1%. Denominated in yen, the same investment shows a profit of 15%: And Finally: Britain in Disarray Hindsight's best trade of the year profited from the serious economic problems already afflicting the UK as 2022 started, a good analysis of the deeply irresponsible trades that had been made by many large pension funds, and a shrewd assessment of the fratricidal urges that had taken over the ruling Conservative Party. It was obvious that Boris Johnson's days as premier were numbered. Revelations of the parties he had held in Number 10 while imposing a strict lockdown on everyone else had dealt a fatal blow to his credibility. But Johnson would not go easily, and the odds were that he could sway the party toward one successor or another. That meant the foreign secretary, Liz Truss, whose perceived loyalty to Johnson helped her cut through a crowded field to succeed him. Johnson's loyalty to her is harder to explain, but the conspiracy theory that he was promoting her because he knew she would be a disaster who would make him look good does look reasonable with hindsight. Truss's signature policy was to break away from austerity that has lasted more than a decade, and cut taxes — even though the energy crisis was forcing the government to spend ever more money. The result was predictable, and the bond market revolted. Less predictably, UK pension funds (which could not be allowed to fail) had for years built up derivative positions that effectively bet on rates to stay low. A sudden sharp rise in yields left them facing insolvency. During the worst of the crisis that hit Truss's short-lived administration, the cost of default insurance was up almost 400% from the beginning of the year. Meanwhile, 30-year gilts — among the safest investments on earth — had lost a staggering 52%. Hindsight could have banked profits of 850% in early October. Under the rules, it had to keep its position after Truss's forced resignation and replacement with Rishi Sunak. But very worryingly for the UK, the profits from this trade remain staggering. The acute crisis is over, but confidence in Britain remains sorely shaken. Hindsight Capital, however, is sitting on a gain of 381%; 30-year gilts have still lost 43% for the year, while the cost of five-year default insurance remains 177% above its price at the start of the year. This is sobering for Britain but great for Hindsight Capital:  So what?

What does all this tell us? To be clear, nobody should try doing this at home. Hindsight Capital effectively made the same bets many times over. If inflation had subsided obediently, and rates had remained low, these trades would have been ruinous. Everyone not gifted with the ability to see the future needs to take account of the risk that they might be wrong. That means hedging bets. That said, with the benefit of hindsight, all of these trades seem reasonably foreseeable 12 months ago. Getting right a few key assumptions on rates, the Russian invasion of Ukraine, and China's problems made it easy to make a lot of money. So, critically, did a grasp that large chunks of the market were in the grip of a speculative frenzy — we didn't even have time for the FANG stocks, with the NYSE Fang+ index down 40.2% for the year. As for 2023, those same calls have to be made. If rates are as high or higher in 12 months time, that's going to create real problems — but will they really be? That requires getting the inflation call right. That in turn requires some view of the resolution to the Ukraine conflict, and on China's chances of reopening smoothly. If you're not sure on any of these, it's best to hedge your bets and resign yourself to leaving money on the table. We can't all make profits to match like Hindsight Capital — and as ever, they refuse to tell me their trades for next year. I'll keep this brief. First, I'd like to honor the passing at 86 of the great British satirist John Bird. This skit, in which he plays a euroskeptic, was made more than two decades before the Brexit referendum. It was spookily on point. (Perhaps the best line: "I don't like the word xenophobic — it's a Greek word, and I detest Greeks.") As for the year gone, I'd like to nominate my favorite song of the year, which qualifies both because I like to listen to it a lot, and because it plays very directly to the troubles of our pandemic-shadowed age. The title is unwieldy but self-explanatory: Age of Anxiety II: Rabbit Hole. It's by my beloved Arcade Fire, who descended into an online rabbit hole of their own this year, but it's a great song. Listen to it; it'll grow on you. And with that, I suspect I'm not the only one who's deeply glad that we're about to reach the end of 2022. I'd like to send best wishes to everyone for a happier and maybe even more profitable 2023.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? {OPIN <GO>}. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment