| The end of the Federal Reserve's campaign to raise interest rates is approaching, according to Morgan Stanley strategist Michael Wilson, who until recently was a prominent bear who correctly predicted this year's slump in equities. Indicators including the inversion of the yield curve between 10-year and three-month Treasuries—a recession indicator with a perfect record—"all support a Fed pivot sooner rather than later," Wilson wrote in a note on Monday. "This week's Fed meeting is critical." —Natasha Solo-Lyons Retail traders returned in force on Monday, creating a volatile session for meme stock favorites including none other than GameStop. The Fed is getting an early taste of what it may face over the next two years as Democratic lawmakers warn it against pushing the economy into recession as the 2024 presidential election approaches. Stocks trimmed their monthly surge and bond yields jumped, with investors awaiting Wednesday's Fed rate decision and any clues on whether the central bank will dial back the pace of hikes—and when. Here's your markets wrap. President Joe Biden will call on Congress to consider tax penalties and other consequences for oil and gas companies accruing record profits as gasoline prices remain high.  Joe Biden Photographer: Chris Kleponis/CNP House Speaker Nancy Pelosi said her husband Paul Pelosi is recovering from surgery following an attack at their house in San Francisco on Friday. The intruder who allegedly beat her husband with a hammer was looking for Pelosi, authorities said. In addition to the state prosecution, David DePape was charged by federal prosecutors on Monday with assault and attempted kidnapping. Ukraine warned of widespread blackouts after a wave of Russian missile attacks on Monday damaged power and water supplies across the country, including in the capital Kyiv. The Republican-appointee controlled US Supreme Court is considering a radical overhaul of the college admissions process that could alter the country's most elite institutions. During oral arguments, Associate Justice Clarence—long an opponent of affirmative action—echoed the supermajority's skepticism when he said he doesn't "have a clue" what diversity means.  Clarence Thomas Photographer: Eric Lee/Bloomberg Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. - Supreme Court leaves intact ruling that lets US require masks on planes.

- The story of Lula's historic comeback to win back Brazil presidency.

- Common kids' antibiotic amoxicillin is in short supply in US.

- Bloomberg Opinion: Three reasons why midterm polls could be wrong.

- Bloomberg Opinion: It's not just the economy, stupid.

- Twitter offers to buy back bonds as Elon Musk consolidates power.

- Musk posts, deletes tweet of right-wing conspiracy on Pelosi attack.

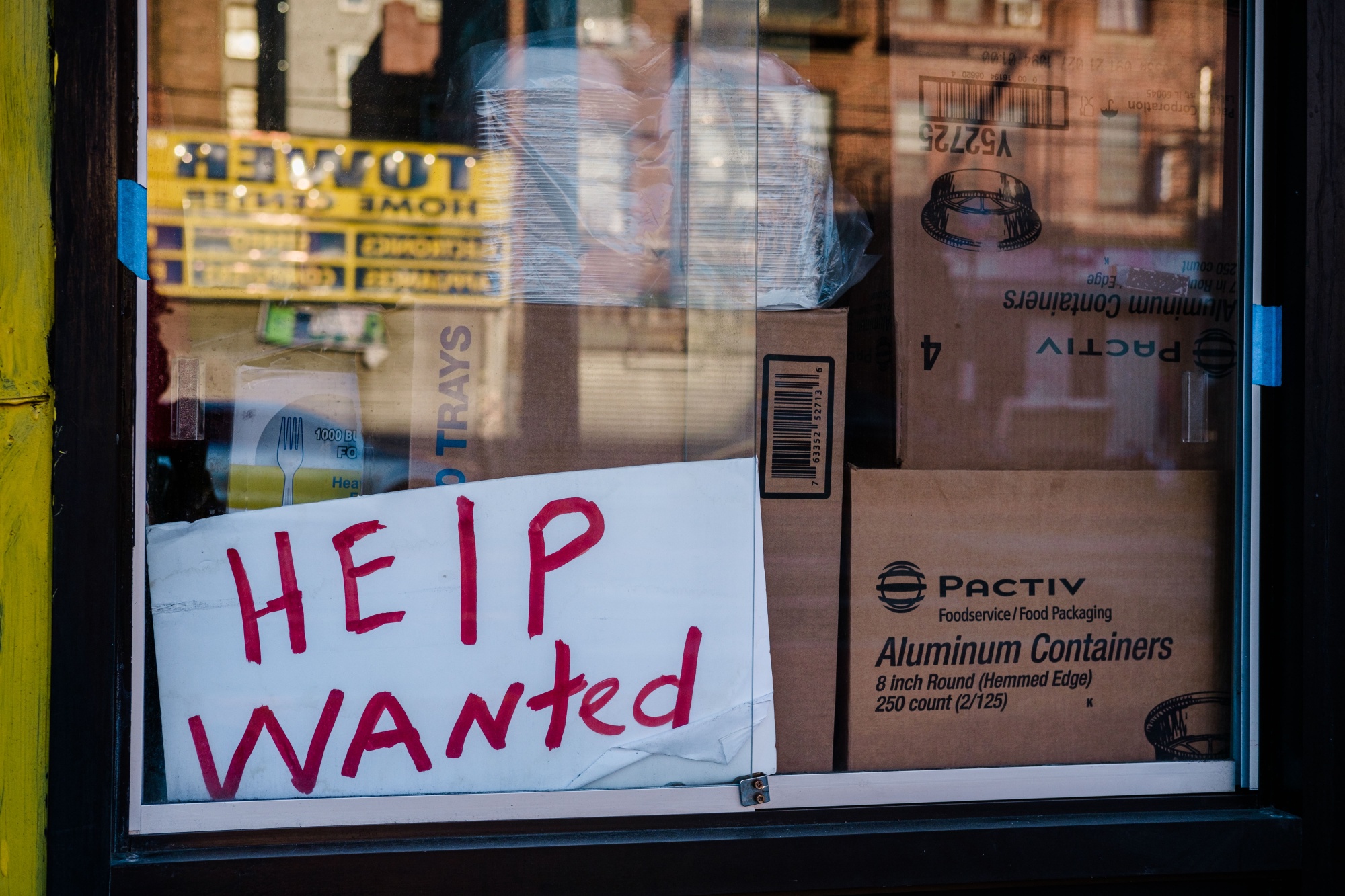

Most New York City businesses on Tuesday will be required by law to add salary ranges to job ads, escalating a frenzy among employees and job seekers asking for pay increases in line with new postings. Almost one third of companies are considering or planning to increase the frequency of pay bumps.  Photographer: Gabriela Bhaskar/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Growth Summit: Companies are finding they have to work harder to keep their customers and attract new ones. Join us in New York or virtually on Nov. 3 as top executives from some of the world's most exciting companies discuss how they are taking their businesses to the next level with customer-centric strategies. Register here. |

No comments:

Post a Comment