| Hello. Today we look at the political implications of rising misery indexes across the US, why the Bank of England is poised to join global counterparts and other economic events this week, plus a new study on a key plank of President Joe Biden's agenda. The state of the economy is looming large ahead of US midterm elections and that spells trouble for President Joe Biden's Democrats. With November's vote nearing, a new study by Bloomberg Economics assesses state-by-state misery indexes, which measure the sum of inflation and unemployment. Projecting the gauges through election day and taking past voting patterns into consideration, the economists suggest Democrats can expect to lose 30 to 40 seats in the House and a few in the Senate too. That would wipe out razor-thin Democratic majorities. Of course, economics is only one part of the calculation that voters make. Democrats will be hoping that anger over abortion and gun laws and the Jan. 6, 2021 attack on the US Capitol by a right-wing mob will energize their supporters. Still, the state-level numbers make gloomy reading for them. Some key battlegrounds like Ohio and Nevada have misery indexes higher than the national version. In Nevada, for example, the GOP has a chance for a comeback in a state Trump narrowly lost twice. There's a key tossup Senate race between incumbent Catherine Cortez Masto and her Republican challenger Adam Laxalt, as well as several competitive House contests. The soaring cost of housing is hitting especially hard. "I just got a raise and I still can't afford my rent," says Sierra Farley, a 31-year-old single mother of two, who says she'll have to move out of her rental home in the Las Vegas suburb of Summerlin by the end of August. "It's going up $450 a month."

—Simon Kennedy The Bank of England is poised to accelerate its inflation fight this week by joining 70 other central banks in raising borrowing costs by half a percentage point. The move on Thursday anticipated by most analysts and investors would mark the UK's biggest increase in interest rates in 27 years, but come at a time when the economy is weakening. Elsewhere, the US jobs report on Friday is unlikely to back a broader recession narrative with the median of forecasters pointing to a 250,000 gain in nonfarm payrolls and a 3.6% unemployment rate. Central banks in Australia, India and Brazil are among those predicted to hike interest rates. See here for more on the week ahead. - Manufacturing woes | China's factory activity unexpectedly contracted in July while property sales continued to shrink, highlighting the fragility of the economy's recovery amid sporadic Covid outbreaks. Activity gauges across the euro area also indicated contraction and Asian factory output continued to weaken.

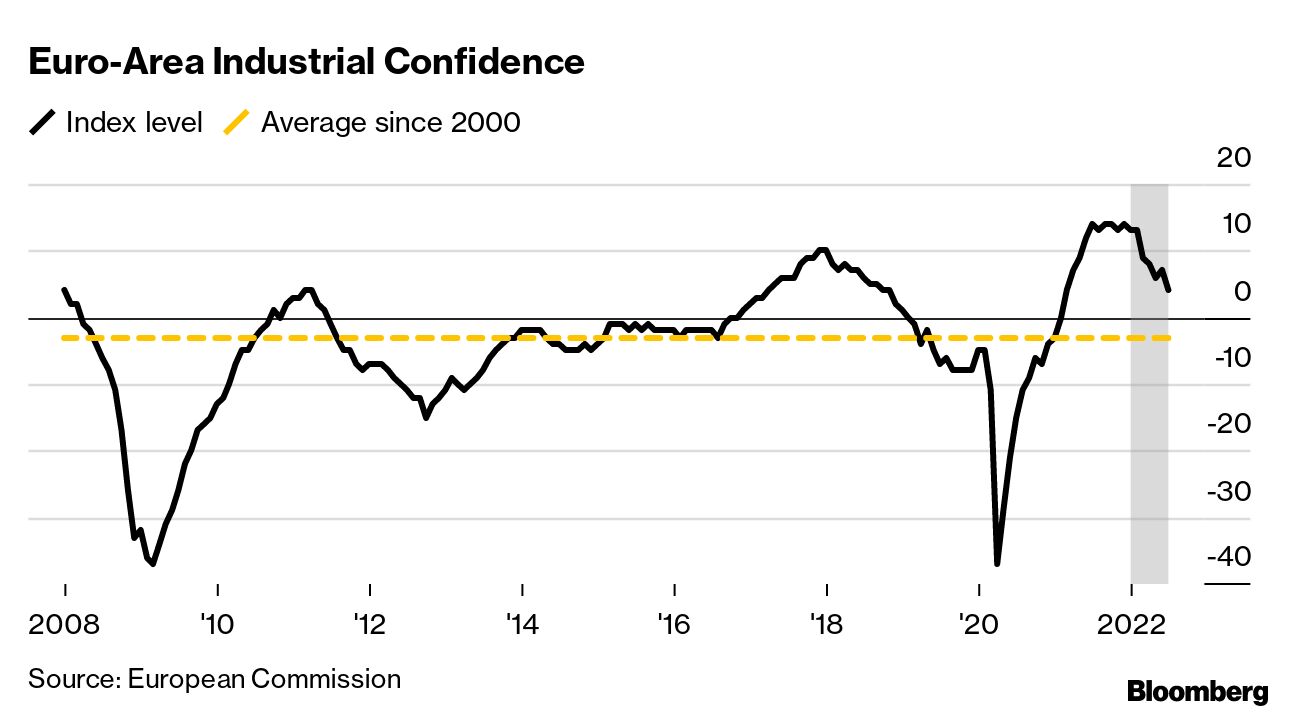

- Europe outlook | Manufacturers across the euro area are getting more worried about their prospects, as our package of charts shows.

- Sanctions architect | When sanctions made the Fortress Russia he helped build seem less impregnable, Maxim Oreshkin came up with a signature gambit to try and break the economic siege.

- The Truss economy | Liz Truss, the front runner to become the next UK prime minister, could have just three weeks to make her mark if she does win the leadership of the Conservative Party in September.

- Saudi strength | Saudi Arabia's economy expanded 11.8% in the second quarter, maintaining the fastest pace of growth since 2011 buoyed by higher oil prices and production.

- Fed inflation commitment | Federal Reserve Bank of Minneapolis President Neel Kashkari said the central bank is committed to doing what's necessary to bring down demand in order to rein in inflation.

The Inflation Reduction Act of 2022, the breakthrough US legislative deal on key parts of President Biden's agenda, likely won't reduce inflation at all, according to a study. The research, from the Penn Wharton Budget Model, estimates the act would cause inflation to "very slightly" rise until 2024 then slide after that. That's important because the study's authors are influential with the senator whose vote was crucial to sealing the deal — Joe Manchin of West Virginia. Overall, the researchers said in the report that there's "low confidence that the legislation will have any impact on inflation." Read more reactions on Twitter |

No comments:

Post a Comment