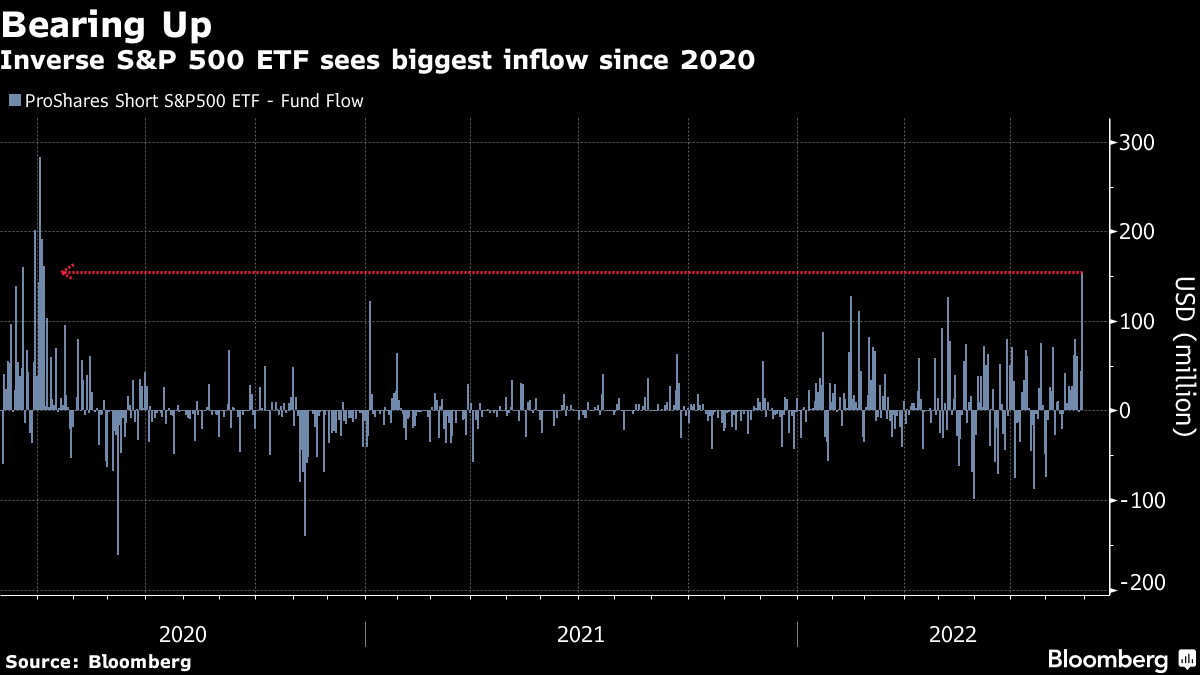

| Good morning. A price cap on Russian oil, global bond selloff, Liz Truss's final pitch for UK premiership, and bets for bigger ECB rate hike. Here's what people are talking about. Group of Seven finance ministers will hold talks this week on allowing global purchases of Russian oil at a capped price -- a gambit that the US hopes will ease energy market pressures and slash overall Russian revenues from crude. Treasury Secretary Janet Yellen and her counterparts will discuss the measure further Friday, US officials said. The plan would allow buyers of Russian oil under a capped price to continue getting crucial services -- like financing and insurance for tankers. The UK became one of the first US allies to publicly endorse the effort. Global bonds extended their selloff as hawkish central bank expectations intensified in the wake of Jackson Hole, sending yields on two-year Treasuries to a 15-year high. Swaps markets showed traders boosting the odds of a three-quarter point Federal Reserve rate hike this month to almost 70%, with bets paring on a rate cut next year. Australian and New Zealand bonds slumped and Japan's 10-year yield pushed higher. Data showing that euro-zone inflation jumped to a record in August, above expectations, also weighed on sentiment toward global bonds.  | Liz Truss ruled out introducing any new taxes or rationing of energy this winter if she becomes UK's next premier, two eye-catching pledges in her final pitch for the post. Truss made the commitments at the last Conservative Party leadership hustings in London, ahead of the victor being announced Sept. 5. She plans an emergency mini-budget within her first month in office but is yet to detail an extensive plan for how she'd ease the cost-of-living pain. The winner of the Conservative Party leadership formally becomes PM after seeing the Queen on Tuesday. Some of Wall Street's biggest banks boosted their forecasts for European Central Bank interest rates, saying faster-than-expected inflation will convince officials to react with even more aggression. Economists at Goldman Sachs, Bank of America and JPMorgan now predict a 75 basis-point increase at next week's meeting, which hawkish Governing Council members had floated as an option in recent days. Investors are also fully pricing such a move by October. The shift follows euro-area data on Wednesday that showed inflation at an all-time high of 9.1% in August. European shares are poised for heavy losses as hawkish messaging from central banks and another Covid-19 lockdown of a major Chinese city sapped global investors' risk appetite. US President Joe Biden plans to deliver a prime-time speech in Philadelphia. UK Nationwide house prices will show how quickly higher rates are cooling the housing market. Other expected data include Swiss CPI inflation and Italy GDP. Pernod Ricard, Broadcom, Lululemon are among companies on deck for earnings. This is what's caught our eye over the past 24 hours. Global investors enter September with a cacophony of bearish commentary ringing in their ears. Bank of America's derivative strategists are warning that equity traders are too complacent, underestimating the risk of a hawkish Federal Reserve. Morgan Stanley's Mike Wilson says US stock indexes haven't yet seen their lows for the year. And veteran investor Jeremy Grantham once more described a ``super bubble'' in financial markets that has yet to pop. As the pessimism mounts, there are signs that traders are listening. A popular exchange-traded fund for betting against the S&P 500 has seen 10 days of inflows over the last 11. It pulled in the most cash in two years one day this week, as noted by my colleague Emily Graffeo. The US stock benchmark has now given back more than half the rebound from its mid-June nadir. It's looking ever more like that bounce was a bear-market rally rather than the start of a new bull run.  Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. New from Bloomberg UK. Sign up here for The Readout with Allegra Stratton, your end-of-day guide to the stories that matter. |

No comments:

Post a Comment