| Hello. Today we look at the rising risk of a US recession, Argentina's return to crisis and what an easing of the US-China trade war may mean for inflation. There's a roughly one-in-three risk of a US recession over the next year. That's the call from Bloomberg Economics, which uses a probability model incorporating a range of factors including housing permits and consumer surveys. Its estimate of a 38% risk compares to a zero chance just a few months ago. Read more here. The rise in recession odds can largely be traced to two factors: a moderation in the corporate profit outlook and a significant deterioration in consumer sentiment. Both are taking place as the Federal Reserve turns increasingly aggressive in its campaign to restrain inflation. "The risk of a self-fulfilling recession — and one that can happen as soon as early next year — is higher than before," said Anna Wong, chief US economist at Bloomberg Economics. "Even though household and business balance sheets are strong, worries about the future could cause consumers to pull back, which in turn would lead businesses to hire and invest less."

Among the warning signs: - The Fed raised rates in June by 75 basis points, the most since 1994, and signaled further increases — potentially of a similar size — in the months ahead. That's lifting the cost of capital for businesses and living costs for households

- Financial conditions have tightened considerably in recent months

- Corporate profit margins, while still robust, are set to soften somewhat in the second quarter of the year

- Americans' views of future business conditions and consumer sentiment have declined

Things don't look much rosier elsewhere. In a separate report, Bloomberg Economics also said today that the war in Ukraine, China's Covid Zero policy and the Fed hikes are reshaping the global outlook. It now expects global growth of 2.9% this year, down from the 4.6% projected at the start of the year. And while worldwide inflation is set to slow, it could still end the year at 8.5%. —Simon Kennedy Argentina is back in crisis territory again. As its markets plunge following the resignation of Economy Minister Martin Guzman, successor Silvina Batakis vowed to continue the government's economic plans. In her first words since taking over the hot seat from Guzman, Batakis sought to reassure the public she wouldn't overhaul economic policy. "I believe in a balanced budget," Batakis said. "We're going to continue with the economic program."

Argentines, already battling 61% annual inflation, have yet to be convinced. The country's black-market exchange rate, widely used by the public due to tight capital controls, plunged on Monday as much as 15% to a record-low 280 pesos per dollar, before paring back some losses. - Natural gas shock | Shortages of the fuel are rippling throughout the global economy, threatening recessions and a further wave of inflation.

- Porky prices | China has largely escaped the crippling consumer inflation afflicting other economies, but that may changing as pork prices surge.

- Global gloom | The world economic outlook has "deteriorated materially" after surging commodity prices pushed up inflation, the Bank of England said in a report analyzing risks to financial stability.

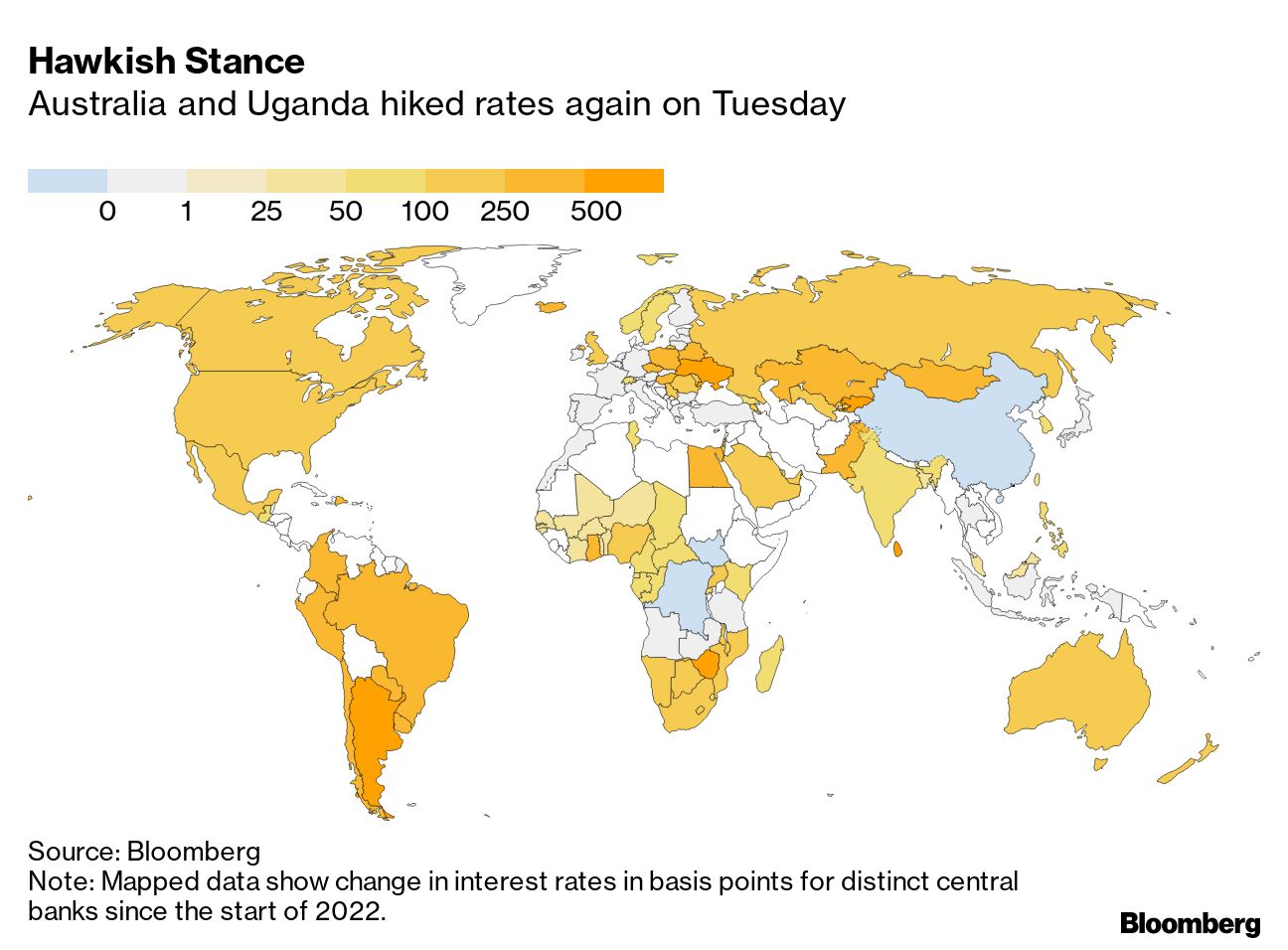

- Australia accelerates | The central bank delivered its first ever consecutive half-percentage point interest-rate hike. Meanwhile Uganda hiked by 100 basis points.

- Middle East relief | The two largest Gulf economies, Saudi Arabia and the United Arab Emirates, will set aside about $13 billion to support low-income citizens and stockpile key commodities amid surging inflation.

- Inflation pressures |President Emmanuel Macron's success in taming rampant inflation is reaching its limits as France's swelling debt and the loss of a governing majority curtails his room to keep spending.

- ECB split | The days of European Central Bank teamwork heralded by Christine Lagarde may be ending as a Bundesbank warning shot on her crisis policies evokes its prior role as a thorn in the presidency's side.

- Italy drought | A state of emergency was declared in five northern and central regions of Italy devastated by a recent drought, as a severe heat wave takes its toll on agriculture and threatens power supplies.

- Russia stabilizing | Russian imports picked up a bit in May, even from some nations that have joined the US and its allies in imposing sanctions over the invasion of Ukraine, as the economy showed signs of improving.

China's Vice Premier Liu He discussed US economic sanctions and tariffs in a call with Treasury Secretary Janet Yellen amid reports the Biden administration is close to rolling back some Trump-era trade levies. Whether any scrapping of tariffs would be enough to dampen US inflation or buoy China's economy remains to be seen.

Economists at Barclays said any rollback of the levies will have only a modest impact on US inflation and the yuan.

If there's a complete rollback of tariffs, the maximum direct effect on US inflation is a one-time reduction of 0.3 percentage point, Barclays' analysts including Jayati Bharadwaj wrote in a report. They cited the relatively small share of Chinese imports in the US consumption basket as a reason for the marginal change. Read more reactions on Twitter |

No comments:

Post a Comment