| Welcome to Next Africa, a weekly newsletter on where the continent stands now — and where it's headed. While much of Africa clamors for the funding to develop untapped deposits of oil and natural gas, OPEC-member Gabon is seeking to profit from climate change. By November, when the COP27 international climate conference is held in Egypt, the central African nation plans to have created 187 million carbon credits in recognition for protecting its section of the Congo Basin, the tropical forest that's behind only the Amazon in size.  Forest elephants in the Ivindo national park in Gabon. Photographer: AMAURY HAUCHARD/AFP The instruments, which can be sold to companies that emit climate-warming gases to offset their pollution or traded on an open market, could be worth hundreds of millions of dollars. If sold all at once, it would be the single-biggest issuance of the securities. Read this explainer on how carbon credits work. For Lee White, a British botanist and Gabon's environment minister, the logic is simple: Demand for oil — it's sub-Sharan Africa's fourth-biggest crude producer — is set to wane and the planet's second-most forested nation needs to find alternative sources of income. It's not just about preserving wilderness. Gabon wants to expand its logging industry but aims to do it in what it says is a sustainable fashion — selectively cutting down valuable hardwood trees at a pace slower than the forest can regenerate.  Creating a steady source of income from carbon credits is a gamble. To detractors, they are a sham and do little to cut the world's emissions of greenhouse gases. Still, for a small African nation almost entirely dependent on the sale of oil, it's a bold move worth taking. — By Antony Sguazzin In the Dark | South Africa's electricity utility Eskom extended the worst blackouts on record to a fourth day as it struggles to recover from a strike that prevented as many as 90% of staff at some power stations from going to work. Protests that included petrol bombs being thrown at the houses of senior officials forced Eskom to halt many of its coal plants and to cut 6,000 megawatts from the grid, leaving homes without power for more than eight hours a day. The rand fell to the weakest level since 2020.  Workers in a cafe use an emergency gas-powered lamp during a power outage in Johannesburg. Photographer: Waldo Swiegers/Bloomberg Border Dispute | Sudan's and Ethiopian forces exchanged fire at their disputed frontier after Sudanese soldiers were reportedly killed, an official said, escalating a feud between the African nations that risks turning into all-out war. Al-Fashqa, a stretch of fertile plains over which Sudan and Ethiopia have clashed repeatedly in the past two years, is seen as a potential powder-keg in a simmering dispute between the Horn of Africa's most populous countries already arguing over a giant Ethiopian dam. Backing Startups | Futuregrowth Asset Management is raising as much as 600 million rand ($37 million) this year to invest in startups with a strong developmental impact. The South African fixed-income money manager joins investors such as Naspers in backing the companies, which are seeing a revival in the country. Young Brides | The worst drought in 40 years is reversing decades of progress made in combating child marriage and female genital mutilation across swathes of Ethiopia, according to the United Nations Children's Fund. Impoverished families desperate for food are exchanging female children for dowries and because "it's one less mouth to feed for the family," said Andy Brooks, Unicef's child protection adviser for eastern and southern Africa.  Women next to a water well during a sand storm in a camp for internally displaced people in Adlale, Ethiopia. Photographer: Eduardo Soteras/AFP/Getty Images Bread Basket | USAID will arrange a $30 million package to help Zambia boost food exports to East African countries suffering from surging prices due to Russia's invasion of Ukraine. Two companies in Zambia, one of southern Africa's biggest corn producers, will start moving 17,500 metric tons of corn and soybeans to Rwanda and Kenya in coming days, with 30,000 more tons to come. Another Virus | Better African surveillance and laboratory diagnosis to detect monkeypox is needed to stop a silent spread of the disease, both the World Health Organization and the Africa Centres for Disease Control and Prevention said. The continent has reported 1,821 cases in 13 countries since the start of the year, and three African countries that hadn't previously had any human cases are now reporting the virus. Click here for this week's most compelling political images. Data Watch - Kenyan inflation breached its target range for the first time in almost five years, climbing to 7.9% in June from 7.1%. Bucking the global trend, though, Zambia's inflation rate dropped below 10% for the first time in almost three years.

- Senegal's economy shrank by 2.2% in the first quarter compared with the previous three months. Zambia's gross domestic product grew 2.4% from a year earlier, while Mauritius's surged 8.9%. Namibia's GDP expanded 5.3% in the first quarter, marking the first time its economy has grown for four consecutive quarters since 2018.

- Traders tempered expectations for a 75 basis point South African interest rate hike — which would be the biggest jump in almost two decades — after the head of the central bank told Bloomberg TV it may consider raising rates by only half a percentage point in July. Watch the interview here.

- Prosus is planning to sell more of its $134 billion stake in Chinese internet giant Tencent, reversing a pledge to hold onto the full shareholding. Shares of the company and majority owner Naspers surged in Johannesburg.

- China canceled the equivalent of $2.4 million worth of debt owed by Togo, that had been due for payment in 2021.

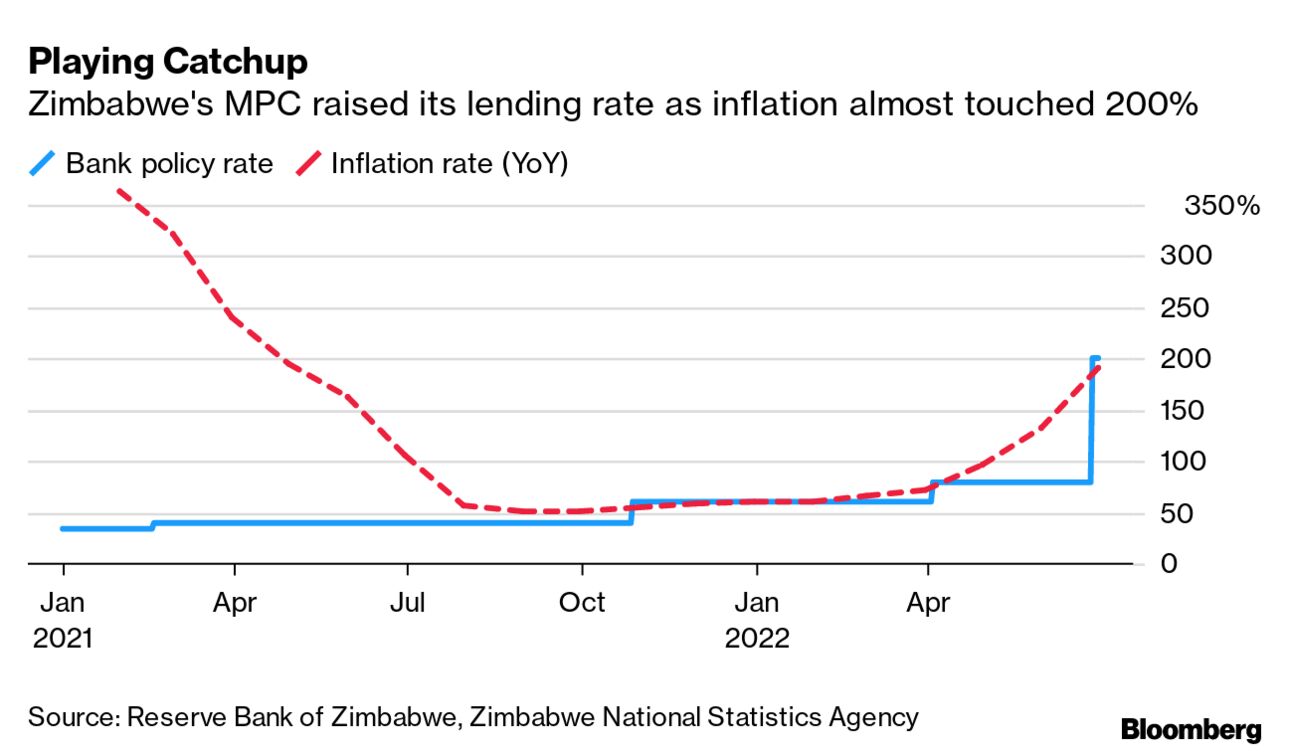

Zimbabwe's central bank raised its key interest rate to a record and the government officially reintroduced the US dollar as legal currency to rein in surging inflation and stabilize the nation's tumbling exchange rate. It more than doubled the rate to 200% from 80% — the biggest increase in the world this year — after inflation surged to 192%. Coming Up - July 3 Heads of state meeting of the West African bloc, Ecowas

- July 4 China's top diplomat, Yang Jiechi, starts visits to Zimbabwe and Mozambique

- July 5 PMI surveys for Ghana, Kenya, South Africa, Mozambique and Uganda for June

- July 7 South African reserves and central bank government bond holdings data, Zambia PMI survey, Mauritius inflation and reserves data for June, Seychelles inflation data for June

- July 8 Tanzania inflation for June

| Rihanna upended the cosmetics market five years ago when she launched a makeup brand for people of color. As Kemiso Wessie writes, now she's bucking convention again with a big bet on an often overlooked market: Africa. The star singer and her partner, luxury giant LVMH, are taking Fenty Beauty to a continent worth an estimated $2 billion in retail value across premium beauty and personal care, according to data from researcher Euromonitor International. The line is available in South Africa, Botswana, Ghana, Kenya, Namibia, Nigeria, Zambia and Zimbabwe. Global beauty brands had passed over African countries for years because of lower consumer spending power.  Performers at the launch party for Fenty Beauty in Johannesburg, South Africa. Photographer: Gallo Images/Gallo Images Editorial Don't keep it to yourself. Colleagues and friends can sign up here For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our editors know |

No comments:

Post a Comment