What happened today in crypto markets – and why Was this newsletter forwarded to you? Sign up here. |

|

|

Welcome to Market Wrap! Hi, I'm Glenn Williams Jr., here to take you through the day's crypto market highlights and news.

In today's newsletter: BTC finishes higher for the second consecutive week, despite challenging economic data. A look at weekly charts implies that traders added to positions at $20,000.

|

Would you like to receive a few of CoinDesk's other newsletters? Subscribe below! |

|

|

Bitcoin's (BTC) finished the week 5% higher, gaining ground for the second consecutive week. It was also the third positive week from the last four for the largest cryptocurrency by market capitalization. Bitcoin pushed higher even after the U.S. Commerce Department reported that the U.S. gross domestic product declined for the second consecutive quarter, which means the country is in a recession, according to the technical definition that two quarters in a row of a decline in GDP is a recession. BTC was recently trading at about $23,900, up 1% over the past 24 hours, although it jockeyed between positive and negative territory throughout the day. BTC's price is down 50% year to date. The 30-day correlations between BTC prices and equity indexes tightened over the past week, as both crypto assets and traditional financial instruments rose this week. The S&P 500 rose 1% on Friday, and the Dow Jones Industrial Average gained 0.9%. Ether's (ETH) price fell .30%, but finished the week up 12%. Altcoins were mixed with Chainlink (LINK) and Polkadot (DOT) rising 12% and 4.5%, respectively, while Decentraland (MANA) and Cosmos (ATOM) declined .87% and .13%. |

|

|

●Bitcoin (BTC): $23,891 +0.5% ●Ether (ETH): $1,725 −0.1% ●S&P 500 daily close: 4,130.44 +1.4% ●Gold: $1,778 per troy ounce +1.6% ●Ten-year Treasury yield daily close: 2.64% −0.04 Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices. |

|

|

A Look At BTC's Weekly Chart Shows a Pointed Reversal at $20K |

While daily charts tend to be the default standard for investors, longer time frames may offer more significant insights. For example, the most recent weekly BTC chart has indicated that investors are seeing a solid entry point at $20,000. The price of bitcoin fell for nine consecutive weeks starting on the week that ended on April 2, and dropped 10 out of 12 weeks overall (ended on June 17). The range of the downward move in the 12th week coincides with a decline in the relative strength index (RSI) to 19.43. The RSI is a technical tool that measures the speed and pace of change of price movements. Often used as a proxy for momentum, RSI levels that exceed 70 indicate that an asset is in an overbought range. Conversely, RSI levels below 30 often signal that an asset's price is oversold. |

Bitcoin/U.S. dollar (TradingView) The weekly RSI for BTC sits at 35, which implies that prices are neither overbought nor oversold, but rather are in a neutral range. BTC's Seven-Day Performance Shows Second Consecutive Week of Gains |

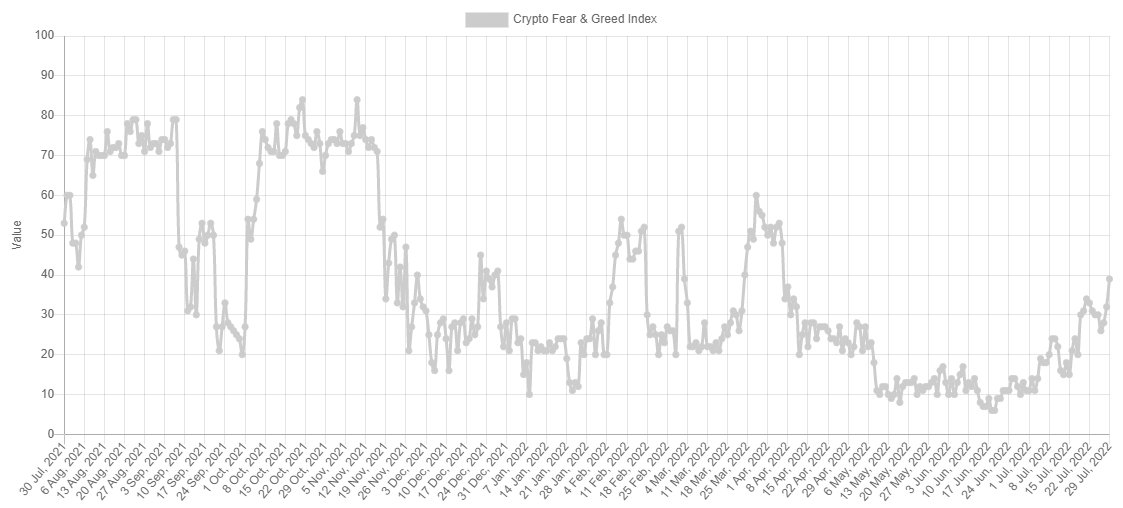

(CoinDesk Research and TradingView) Following last week's 10% gain, BTC finished the current week up 5%. Ether's performance was similar, with the price up 9% following a 19% gain in the week prior. ETH's price has increased for four weeks in a row, and bitcoin's price has risen for two weeks in a row. Ethereum's 10th "shadow fork" went into effect Tuesday, 26 hours earlier than expected, as the network continues to run tests ahead of the anticipated shift from using the energy-intensive proof-of-work protocol to proof-of-stake. As it approaches its software update known as "the Merge" in September, Ethereum has been undergoing a series of test, or shadow, forks that copy data from the main network to a test network. The shift to proof-of-stake is expected to have a deflationary impact on ETH prices and decrease overall supply. A decrease in the supply of an asset generally has a positive effect on prices. For BTC there's fear in the air … but not as much In acknowledging the role that emotions play in crypto investing, the "Fear and Greed" index gauges sentiment relative to the price of bitcoin. The index itself ranges from 0-100, with a value of 0 equaling "extreme fear," while values of 100 equate to "extreme greed." |

Crypto Fear and Greed Index (alternative.me) The index itself accounts for data from a variety of sources, including price, momentum, volatility, social media sentiment, and Google Search trends. While applicable to bitcoin alone, it is also a proxy for overall crypto market sentiment. As of Friday, the Fear and Greed Index has increased to 39, which falls within the "fear" category, but is demonstrably higher than the 6 – extreme fear level – of June 18. WIthin the last 12 months, the index's highest reading of 84 – extreme greed – came last October (8) when BTC prices exceeded $60,000. |

|

|

Biggest Gainers Biggest Losers |

|

|

- KuCoin Claims Bragging Rights as First Exchange to Offer NFT ETFs: The novel set of ETF products is denominated in USDT and offers fractional ownership of five blue chip NFT collections. Read more here.

- BNB, Solana Lead Gains in Majors; Traders Point to Dollar Strength for Further Upside: Market recovery will also be contingent on the wider macro environment, one trader said. Read more here.

- Cardano's Vasil Upgrade Is Delayed Again for More Testing: The hard fork has been pushed back by at least "a few more weeks" until testing is complete, developers said. Read more here.

|

|

|

Disclaimer: The information presented in this message is intended as a news item that provides a brief summary of various events and developments that affect, or that might in the future affect, the value of one or more of the cryptocurrencies described above. The information contained in this message, and any information liked through the items contained herein, is not intended to provide sufficient information to form the basis for an investment decision. The information presented herein is accurate only as of its date, and it was not prepared by a research analyst or other investment professional. You should seek additional information regarding the merits and risks of investing in any cryptocurrency before deciding to purchase or sell any such instruments. |

|

|

|

No comments:

Post a Comment