| Read in browser | ||||||||||||||

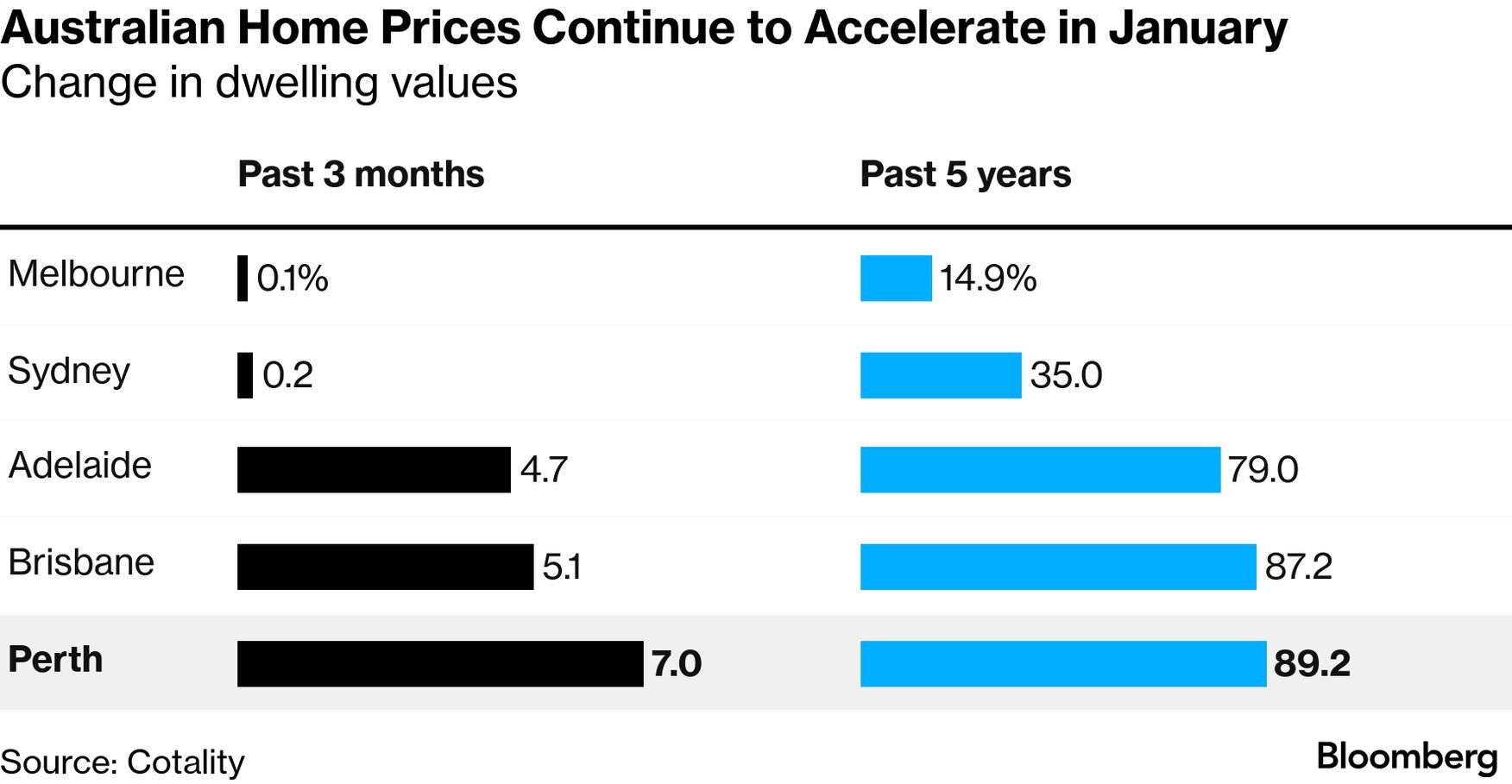

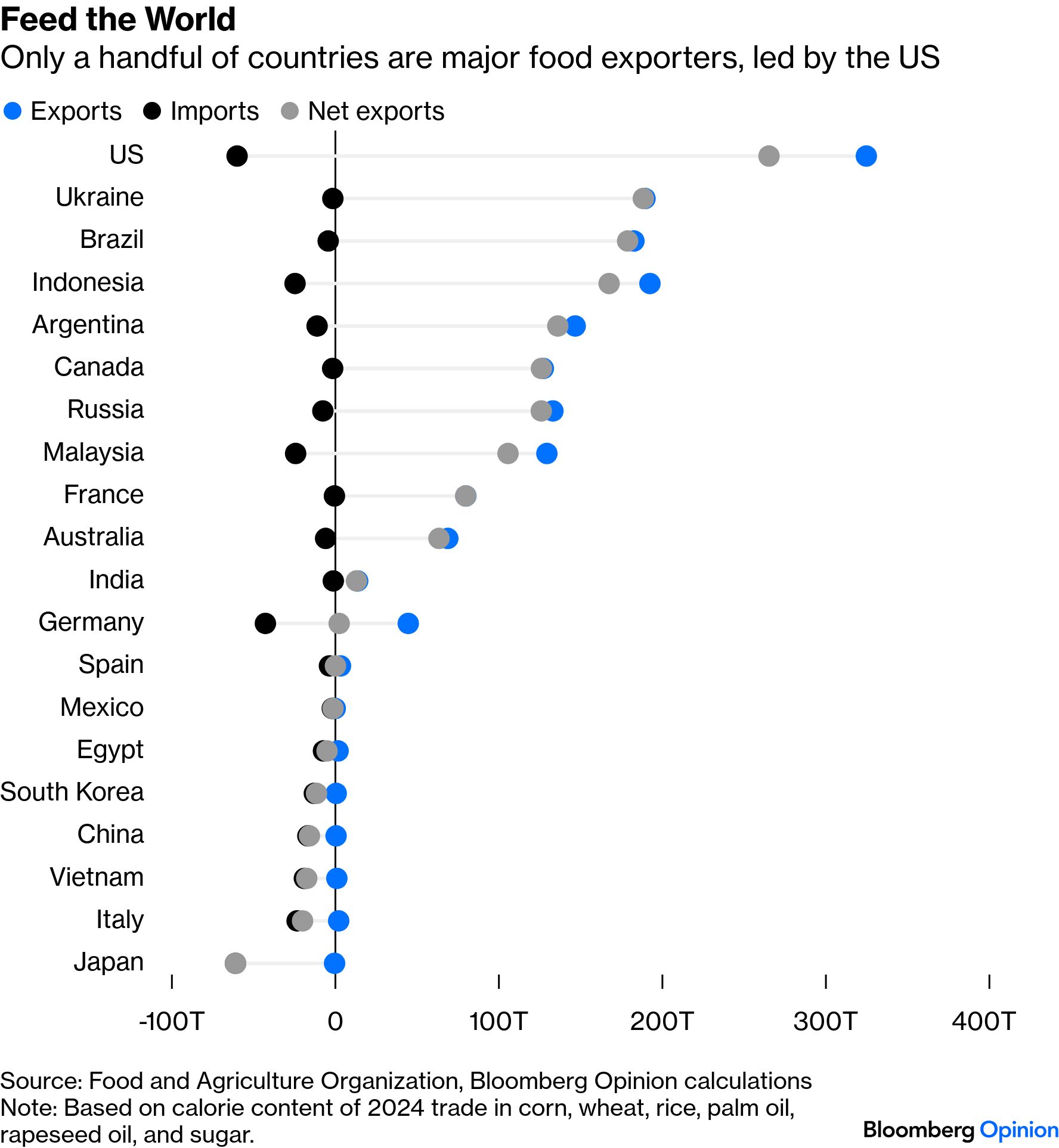

Good morning and welcome back. After a blockbuster Australian Open — that saw Carlos Alcaraz make history by becoming the youngest man to complete a career Grand Slam and Elena Rybakina stun world No.1 Aryna Sabalenka — we're moving on to a different kind of tension: where will Australian interest rates go next. The Reserve Bank faces the uncomfortable prospect of going against the global grain and switching back to raising interest rates tomorrow to keep inflation in check. Economists expect the RBA will increase its cash rate by a quarter percentage point to 3.85%. — Ainsley Thomson, Deputy Wealth Team Leader What's happening nowIn the housing market, home-price growth gathered pace in January — highlighting the challenge for RBA policymakers as they weigh interest-rate increases in a property market already grappling with stretched affordability. The Home Value Index advanced 0.8%, accelerating from a 0.6% gain in December, property consultancy Cotality said. Perth recorded the fastest price growth at 2%, followed by Brisbane's 1.6% and Darwin's 1.5%.  Rio Tinto and Glencore are poised to seek more time to work on a deal to create the world's biggest miner as they wrangle over the premium that Rio would need to pay, people familiar with the matter said. While both remain keen on a deal, more time will likely be needed to hash out a valuation — requiring the UK's Takeover Panel to extend a deadline — according to the people.  What happened overnightHere's what my colleague, market strategist Mike "Willo" Wilson says happened while we were sleeping… News confirming President Donald Trump's nomination of Kevin Warsh to lead the US central bank — a man who's seen as less supportive of deep rate cuts and more worried about inflation — saw the dollar surge the most since May. Gold dropped the most in four decades. The Kiwi and Aussie rallies were brought to an end, but both still posted strong monthly gains. The Aussie has eased this morning on weak China factory data. This week has the RBA probably hiking interest rates on Tuesday, while New Zealand's jobs data lands Wednesday. Local stocks are in for a tough start, assuming they track US peers lower, as indicated by ASX futures. While the trigger for Friday's gold and silver crash was the news that Trump planned to nominate Warsh to lead the Fed, many had been warning that the metals markets were overstretched and due for a correction following weeks of relentless surges. Still, the speed and scale of the drop was breathtaking, particularly for a market as large and liquid as gold. Here's a look at how Chinese speculators set the stage for what unfolded. Nvidia CEO Jensen Huang said the company's proposed $100 billion investment in OpenAI was "never a commitment" and that the company would consider any funding rounds "one at a time." The Wall Street Journal reported on Friday that the investment plan announced in September had stalled after some inside Nvidia expressed doubts.  Jensen Huang in Taipei. Bitcoin slipped below $76,000 in thin weekend trading, dropping about 40% from its 2025 peak and revisiting levels last seen in the aftermath of the "Liberation Day" tariff fallout. What began as a sharp crash in October has morphed into something more corrosive: a selloff shaped not by panic, but by absence of buyers, momentum and belief. There are five times as many people alive today as there were in 1900, yet humanity is better fed than at almost any point in its history, writes David Fickling for Bloomberg Opinion. That's thanks to three major developments that have made our planet far more resilient to the risk of starvation: yield improvements, water usage and trade. Worryingly, all are threatened right now.  What to watchAll times Sydney One more thing...Melania, a documentary about the first lady and the days leading up to her husband's second inauguration, took in a stronger-than-expected $7 million at US and Canadian theaters in its opening weekend, according to Comscore. The movie, which is distributed by Amazon.com's MGM Studios, focuses on Melania Trump during the 20 days before Trump's return to the presidency last year. It was released in 1,778 theaters in the US and Canada and in 27 territories. It scored just an 11% approval rating from professional critics and 99% from regular viewers, according to RottenTomatoes.  First Lady Melania Trump arrives for the world premiere of 'Melania' at the Kennedy Center in Washington on Jan. 29. Bloomberg

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Sunday, February 1, 2026

RBA set for rate hike U-turn, house prices rise

Subscribe to:

Post Comments (Atom)

Here's what I'm revealing Thursday at 7PM ET

February 01, 2026 | Read Online Hey, it's Blake Young. By now you've probably heard from Don about the all-new live session ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment