| Hello. Today we look at how the 25 years since the Asian Financial Crisis have positioned us for the next one, US recession calls blaring more loudly, and central bankers' latest struggles to manage a delicate inflation fight. The somber quarter-century anniversary of the Asian Financial Crisis is upon us, with investors, policy makers, and consumers across the region holding dark memories of the day Thailand devalued the baht in a move that ballooned into a regional and global emergency. On the up side, the message from central players in that calamitous time is clear: The world is very different now, and in many ways, Asian economies are far better off than in 1997.  Bangkok in 1994. The crisis triggered fresh questions on whether a golden period of rapid growth and admirably dynamic Tiger economies could carry on in some form. In the ensuing decades, though, China's skyrocketing expansion helped support economic vitality throughout the region with trade powerhouses collectively providing an engine to global growth. Governments stockpiled far more robust foreign reserves and central bankers bolstered their credibility through more clear and organized decision-making processes. The evolution of the continent's economies also has lent more respect for decisions around capital flows management that, at the time, were lambasted by multilateral institutions like the IMF. "It's pretty amazing that the same thing happened in Iceland, New York and elsewhere 10 years later, except that time the IMF realized that pushing up interest rates was not a good idea," Korn Chatikavanij, founder of Jardine Fleming Thanakom Securities and Thai finance minister (December 2008-August 2011) told Bloomberg. "Policy tightening like the IMF mandated for the bailouts in Asia wasn't the way out."

In more sobering tones, Piti Sithi-Amnuai, chairman of the board of directors at Bangkok Bank, reminds us that "there are always crises" and Joseph Yam, former chief executive of the Hong Kong Monetary Authority dreads the "next financial tsunami" even as he applauds "more prudent fiscal and monetary discipline" since the Asian Financial Crisis. Former World Bank Chief Economist Carmen Reinhart gives us a window on what that imminent tsunami could look like globally, and how it'll differ from previous crises. "The kinds of problems we're facing on the debt front have to do with stagflation, have to do with lack of recovery," she said. "This recovery has been exceptionally uneven — very different from the recovery of the Global Financial Crisis, in which the emerging markets recovered far more quickly than the advanced economies because China was providing an engine of growth, which it's not providing now."

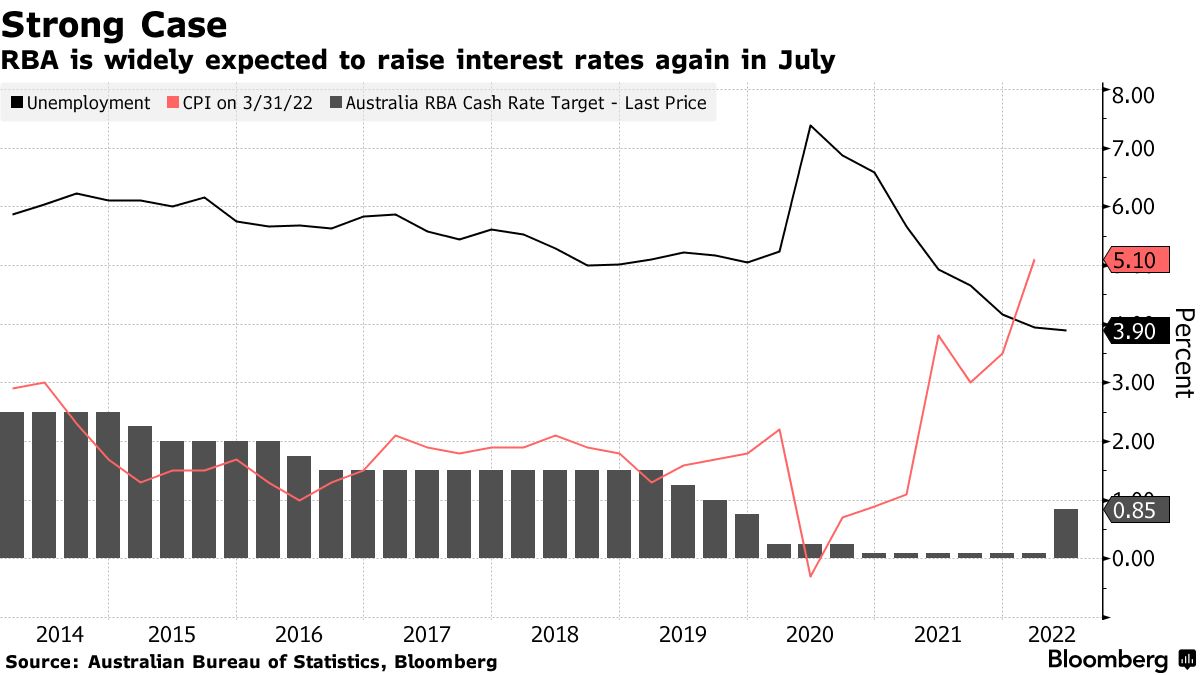

— Michelle Jamrisko Recession alarms are blaring as central bankers try to cut through the noise, manage inflation, and keep households stable enough to avert ugly downturns. In the US, calls for a recession by the end of 2023 are getting louder, with economists warning that this one likely would be long, moderate, and painful, as Rich Miller writes here. Federal Reserve Chair Jerome Powell maintains that the economy can endure a run-up rate hikes and avert crisis, while analysts are seeing that becoming less realistic as consumption and manufacturing show cracks. Labor markets remain relatively tight—we'll see how things hold up in the employment report out Friday in Washington—and the economy isn't showing the sort of excess leverage that predated other downturns. But the complicated nature of the inflation situation points to a longer recession when it does hit. In scheduled central bank decisions this week, brace for rate hikes from Australia, Poland, and Israel today, among others. The European Central Bank will also huddle this week ahead of a July 21 decision as they debate the size of a planned rate increase and the design of a fresh crisis tool. Click here for a rundown of the week ahead. - Argentina resignation | President Alberto Fernandez tapped leftist economist Silvina Batakis as economy minister after her predecessor's resignation deepened a political crisis boiling over into the economy.

- Turkish prices | One of the world's worst inflation crises is closing in on another grim milestone in Turkey, and government efforts to help the population cope with the fallout only threaten to make it worse.

- Indebted Australia | A rate hike Down Under to bring the benchmark to its highest in more than three years in a fight against inflation also risks tipping highly indebted households into recession.

- UK woes | The poorest families in the UK were left "brutally exposed" to the cost of living crunch after almost two decades of income stagnation, a think tank warned. Meanwhile a lobby group said more firms than ever before are expecting to increase prices in the next three months.

- Big decisions | As the ECB hones plans to keep bond markets from panicking at rate hikes, another governor called for the first move to be a quarter-point. Meanwhile officials will tilt corporate-bond holdings toward issuers demonstrating "better climate performance."

- Demand destruction | The global surge in fuel costs is starting to weigh on demand, according to the world's biggest independent oil trader. That may already be affecting German trade data, which showed a deficit.

- Putin and Africa | European governments have been alarmed by a Russian disinformation campaign that President Vladimir Putin's war with Ukraine risks leaving millions of people in Africa facing famine.

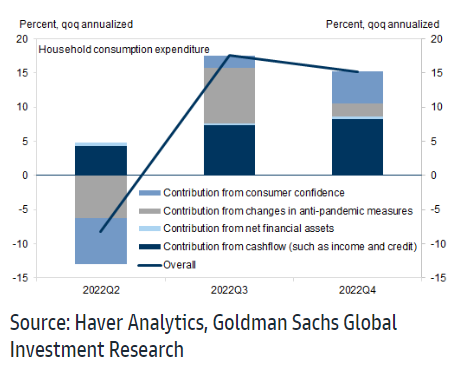

As the world's No. 2 economy navigates a widely watched slowdown and looks to ease Covid restrictions further, Chinese households remain in "still sluggish" shape, Goldman Sachs analysts wrote in a report published Monday. The analysts led by Maggie Wei take a deeper look at household assets, income, and confidence and find that consumer health probably will look a bit worse before it gets better. While net financial assets are "healthy" around 220% of disposable income, cash flows have been slower and Covid restrictions have weighed on sentiment and services consumption.  Goldman Sachs Goldman Sachs "The relaxation of Covid restrictions and recovery of cashflow growth on the back of overall growth recovery could support households' consumption growth to rebound in 2H of this year," rebounding to a 4.5% year-on-year pace in the second half after a 1.5% drop in the second quarter, they write. "Should policy makers gradually retire the 'Dynamic Zero Covid' policy in 2023 as we expect, real household consumption could see double-digit year-over-year growth in 2023." Read the tweet here and our story here |

No comments:

Post a Comment