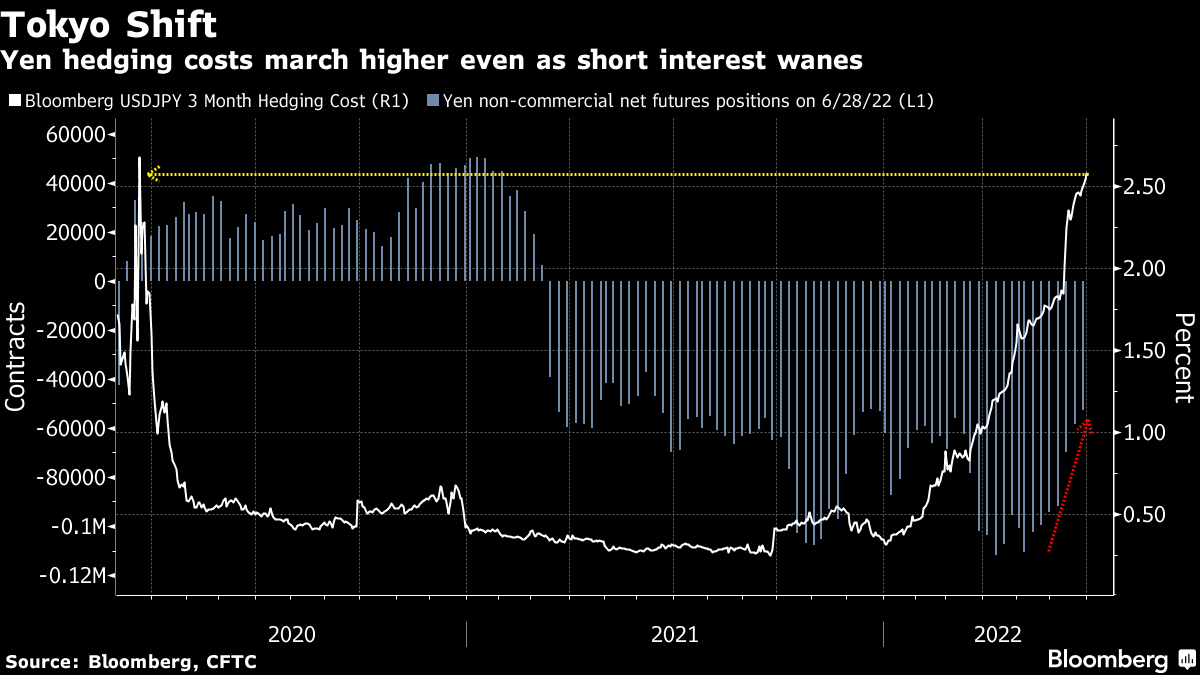

| Good morning. Recession looms, Ukraine loses an urban holdout, Boris Johnson is in hot water again and European banks may just have to say goodbye to extra profits. Here's what people are talking about. Recession fears are sweeping across some of the world's key economies and financial markets are bracing for impact. Nomura expects many major economies from the euro area to Australia to Canada to fall into recession along with the US over the next 12 months amid tightening government policies and rising living costs, pushing the global economy into a synchronized growth slowdown. The US retrenchment may be moderate but still long and painful — elevated inflation may hold the Federal Reserve back from rushing to reverse the downturn. Ukrainian troops have withdrawn from the eastern Ukrainian city of Lysychansk, the last urban holdout under Kyiv's control in the embattled Luhansk region as Vladimir Putin's Russian forces come closer to their goal of capturing the province. Having failed to seize the capital Kyiv after its invasion in February, the Kremlin has narrowed near-term goals to grabbing the heavily industrialized Donbas, made up of the eastern Luhansk and Donetsk regions. Meanwhile, Ukraine plans to put forward a blueprint — around 2,000 pages — for rebuilding the country, which could mobilize hundreds of billions of euros.  | UK Prime Minister Boris Johnson is under pressure to explain what he knew and when after a string of allegations surfaced over the weekend about the past sexual behavior of Chris Pincher, the Conservative MP who quit last week as one of Johnson's enforcers, citing his own drunken antics. Parliament's Independent Complaints and Grievance Scheme is now probing the matter, and there are growing calls for Johnson to spell out why he named Pincher as deputy chief whip in February. That adds to troubles already piling up for Johnson after his party lost two special elections last month. The European Central Bank is exploring ways to prevent banks from earning windfall profits from the subsidized lending program it launched during the pandemic, once it raises interest rates later this month, according to a report Sunday by the Financial Times. The ECB provided €2.2 trillion of subsidized loans to banks during the Covid-19 crisis to avoid a credit crunch. With rates set to hike, that will provide extra profits worth up to €24 billion for euro area lenders, the FT said, citing analysts. The ECB's governing council is planning to discuss how to curb the extra margin banks could earn, by placing them back on deposit at the central bank. European equity futures are holding onto modest gains after US contracts fell and Asian stocks trimmed gains. Trading could be quieter than usual due to the Independence Day holiday in the US. Economic data releases today include Swiss inflation and Spanish unemployment. Spain's Repsol is scheduled to report sales results. This is what's caught our eye over the past 24 hours. The air is slowly being let out of one of the biggest global macro trades of the year. Traders are backing away from betting against the yen, with net-short non-commercial positions down to the lowest this year, according to the latest data from the Commodity Futures Trading Commission. Speculators have cut bearish wagers for seven straight weeks — the longest streak since 2019 — even as the cost to hedge against swings in the currency continues to march higher. The moves suggests market participants are becoming more wary of a rapid surge in the currency even as it remains under pressure from Japan's stark monetary policy gap to the rest of the world. A yen rebound could come from concern about a global economic downturn while it would likely see a sharp rally should there be a hawkish policy shift from the under-pressure Bank of Japan. Speculation on both could help the yen pull back some of this year's losses -- it has been the worst performing Group-of-10 currency, down some 15% against the dollar.  Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. New from Bloomberg UK. Sign up here for The Readout with Allegra Stratton, your end-of-day guide to the stories that matter. |

No comments:

Post a Comment