| Hello. Today we look at the economic weather bearing down on the US, Japan's new capitalism, and the sustainability of debt costs as interest rates rise. The late former Treasury Secretary Paul O'Neill once agonized over a discrepancy between solid US economic data and the gloom evident in business executives' commentary in the wake of the 2001 recession. His solution, he joked, was for CEOs to stop talking to each other and convincing themselves things were bleak. In that vein, a "mute button" might be useful for Jamie Dimon. The JPMorgan Chase chief's comments Wednesday were so dire as to help send US stocks tumbling. He updated a May comment about "storm clouds" looming over the economy to say that a "hurricane is right out there down the road coming our way." He has plenty of company in expecting turbulence. A survey of CEOs last month showed the vast majority anticipate at least a short, mild recession. But Goldman Sachs economists highlighted that the same poll showed that almost two-thirds plan to expand their workforce. Recent signs "suggest a growing disconnect between perceptions of the economy and actual business conditions," Goldman economists Spencer Hill and Manuel Abecasis wrote Monday. "We remain optimistic that a recession and related sharp rise in the unemployment rate can be avoided."

Minutes before Dimon's quip, a benchmark gauge of the outlook for US manufacturing was released. The ISM index beat almost all forecasts, helped by a pickup in new orders. And that index is a so-called soft indicator, not a "hard" one like retail sales or industrial output that measures money spent or widgets made. Soft indicators have been underperforming hard ones lately. Hard Data Holding Up Hard data "remain stronger, and we are tracking second-quarter GDP rising at a 4.2% annual rate," UBS economists wrote Tuesday. That would be a notable improvement from the trade-affected 1.5% drop last quarter, and well above the sub-2% longer-term growth trend for the US. The Federal Reserve's latest Beige Book survey — one of those soft indicators — suggested a slowing, but still solid, economy. A similar picture is expected in Friday's key US jobs report — very much a hard data-point. Payroll gains are forecast at something above 300,000 for May. That would be the weakest in just over a year, but above the pre-pandemic average. Or, as Barclays economists put it, "still in a robust range that we would regard as consistent with little-to-no recession risk in the near term." —Chris Anstey Japan's Prime Minister Fumio Kishida is promoting a "new form of capitalism" that he says will address inequality and climate change. So far, Kishida's new capitalism remains a broad set of ideas in which the government plays a bigger role in creating incentives for the private sector to address social problems. Possible solutions include tax incentives to encourage companies to raise wages, invest in training a more diverse workforce, and spend more on research and development. The new capitalism also envisions more investment in startups as well as green and digital initiatives. Kishida and his supporters say the fresh approach will be fairer and more inclusive than the free-market "neoliberalism" that's dominated since the 1980s. If more people in society benefit from economic expansion, growth will be more sustainable, they say. The results will serve as a better model to counter the growing power of authoritarian states, they add.  | - Fed path | Fed officials from both the hawkish and dovish wings confirmed their determination to raise interest rates, even as business contacts report US economic growth shifting into a lower gear.

- Labor slowdown | The likely moderation of US job growth in coming months will reflect a combination of hiring challenges in a remarkably tight labor market, shifts in spending patterns and outright soft spots.

- China spending | Beijing ordered state-owned policy banks to set up an 800 billion-yuan line of credit for infrastructure projects as it leans on construction to stimulate the economy.

- EV economics | Falling battery prices have propelled the shift toward electric vehicles for years, but the industry's economics have changed.

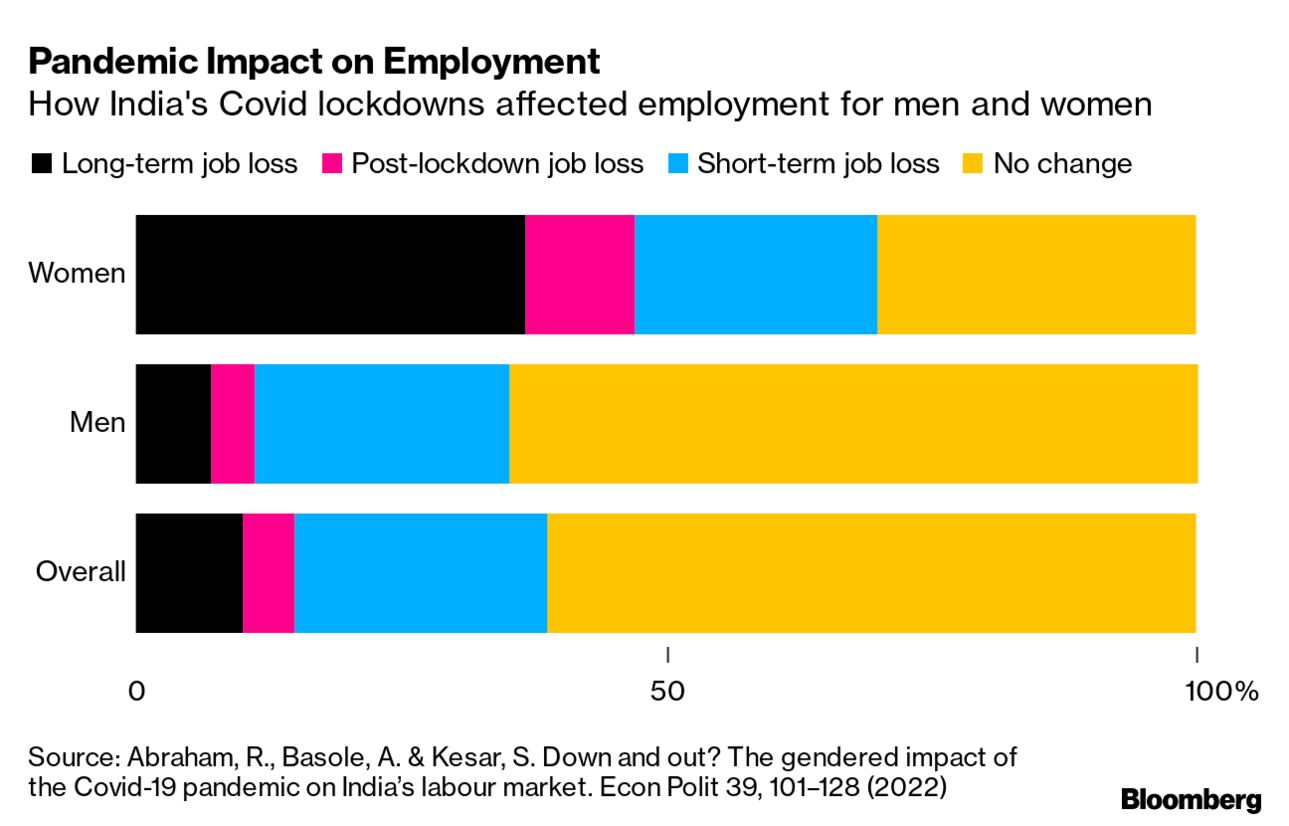

- Female employment | As the world climbs out of the pandemic, failing to restore jobs for women — who have been less likely than men to return to the workforce — could shave trillions of dollars off global growth.

- German gloom | Europe's biggest economy is at risk of a contraction in the current quarter, according to some of the gloomiest forecasts warning that its manufacturing base is vulnerable to disruption.

- Seven decades | As Queen Elizabeth II celebrates 70 years on the throne, here's a look at how the UK economy of 2022 is barely recognizable from the onset of her reign in the postwar gloom of 1952.

Debt loads have been on the rise around the world, and Covid has only added to government and private-sector burdens in many economies. So, with interest rates now on the rise, how pressing an issue is debt sustainability? JPMorgan Chase analysts led by Nikolaos Panigirtzoglou did some sleuthing, in a note on Wednesday. The bad news: total credit extended to the nonfinancial sector globally climbed to the equivalent of 250% of GDP by September 2021, from 200% a decade earlier. The good news is that interest burdens have tumbled thanks to years of ultra-low — sometimes negative — interest rates. Just looking at bonds, they've come down to around 1.7% of GDP from 2.5%. So borrowers have a strong starting point to contend with rising rates. The JPMorgan team's analysis suggests that "if interest rates settle at current levels for a prolonged period, debt costs as a share of GDP could return to 2011 levels over time though not quite approach pre-Lehman crisis levels." Read more reactions on Twitter -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

No comments:

Post a Comment