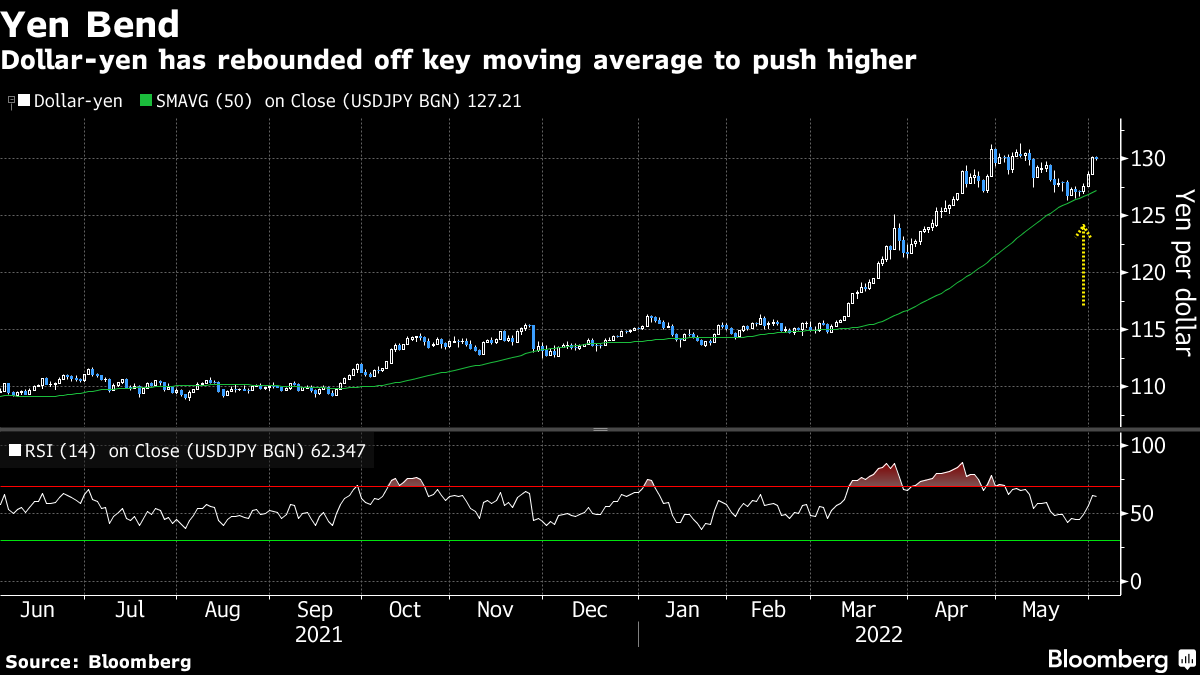

| Goldman executive echoes Dimon's pessimistic outlook. Fat finger trader cost Citi $50 million. Shanghai residents clash with police. Here's what you need to know today. A top Goldman Sachs executive has echoed Jamie Dimon's pessimistic tone, warning of tougher times ahead amid a string of shocks rattling the global economy. President John Waldron said: "The confluence of the number of shocks to the system to me is unprecedented." His comments come a day after JPMorgan CEO Dimon warned of an "economic hurricane" ahead, while BlackRock CEO Larry Fink said he expects inflation to remain elevated for several years. Meanwhile, the Federal Reserve's Vice Chair Lael Brainard said the case for a September pause in interest rate hikes was "very hard to see." Citigroup may record losses of at least $50 million following a London staffer's fat-finger trade that caused a flash crash in European stocks, wiping out 300 billion euros ($322 billion) at one point. A trader in the firm was working from home in the UK on May 2 when they incorrectly added an extra zero to a trade, wreaking havoc and sparking a five-minute selloff in bourses stretching from Paris to Warsaw. The trader has been placed on leave while Citi reviews the incident.  | For millions of people still locked down in Shanghai, listening to officials tout the city's victory over Covid-19 — a report on the front page of the People's Daily newspaper Thursday was headlined "Great Achievements Have Been Made in the Defense of Shanghai" — is infuriating. More than two million people are still living under various forms of lockdown, and some are so frustrated with being confined that conflicts with police have broken out. While the number of new local cases has fallen to just over a dozen a day from a peak of 27,000 in April, apprehension among residents about the possibility of a new wave remains. In other China news, Beijing warned the US that a law banning imports from Xinjiang unless companies prove they're free of forced labor would "severely" damage ties. Asian shares looked set to advance after US equities snapped a two-day slide ahead of a key jobs report, with the S&P up 1.8%. Futures for Japan and Australia pointed higher. Markets will be closed in Hong Kong and mainland China. Investors remain on edge as some fear the pace of US monetary tightening could throw the world's largest economy into a recession. Friday's May labor report is likely to show the smallest gain in jobs since April 2021 alongside a downshift in average hourly earnings growth Pakistan's foreign exchange reserves fell below $10 billion, threatening to spill over into a fullblown economic crisis unless policy makers secure a loan from the International Monetary Fund. Authorities have raised fuel and electricity prices, a key condition to unlock the remaining $3 billion of an existing loan by the multilateral lender. Also seeking cash is Sri Lanka, which has been dealt a fresh blow with news that it can't tap a $1.5 billion credit line from China as the Chinese are concerned the IMF may force delays in repayment. At least one bear market rally in global markets looks to be over — that in the yen. After a brief recovery that lasted just under a month, a fresh wave of selling has re-emerged in the Japanese currency as Treasury yields push higher. The dollar-yen rebounded off a key technical support level — its 50-day moving average — and is back heading toward a fresh 20-year high.  A gauge of momentum in the move — the relative strength index — is still in neutral territory, bolstering speculation that the yen could soon hit the closely-watched 135 per dollar level. That would once again heap pressure on Japanese officials to intervene in the currency market, as in the current environment the weak yen is seen as a drag on the economy, rather than a traditional boost. Still, much will depend on the path of Treasury yields, which many commentators have suggested have seen a peak. Yen traders will watch closely if benchmark US yields can climb much past the 3% level, which would increase pressure on the Japanese currency — still the worst of the majors this year. Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. |

No comments:

Post a Comment