| Hong Kong starts locking up mild Covid cases again. Dimon warns of an "economic hurricane." Sheryl Sandberg steps down at Meta. Here's what you need to know today. Hong Kong is reviving one of its toughest Covid Zero measures, forcing patients with even mild infections caused by the new omicron sub-variants and their close contacts into centralized quarantine. People with sub-variants including BA.2.12.1 who are not severely sick, as well as their close contacts, will be sent to specially-built facilities. One family spoke of being separated from their nine-year-old daughter who was admitted to hospital with a fever, while the rest of the family was ordered into isolation. The return of the strict measures has the potential to drive even more residents from the Asian financial hub, where curbs like seven-day quarantine for returning travelers still exist. Jamie Dimon warned investors to prepare for an economic "hurricane" as the economy struggles against an unprecedented combination of challenges, including tightening monetary policy and Russia's invasion of Ukraine. "We don't know if it's a minor one or Superstorm Sandy. You better brace yourself," Dimon warned. But his comments appeared at odds with JPMorgan strategist Marko Kolanovic, who on the same day wrote in a note to clients that the US stock market is poised for a gradual recovery and that "there will be no recession." Mind you, Kolanovic hasn't had much success with his calls in 2022. Find out why here.  | China ordered state-owned policy banks to set up an 800 billion yuan ($120 billion) line of credit for infrastructure projects as it leans on construction to stimulate an economy battered by coronavirus lockdowns.

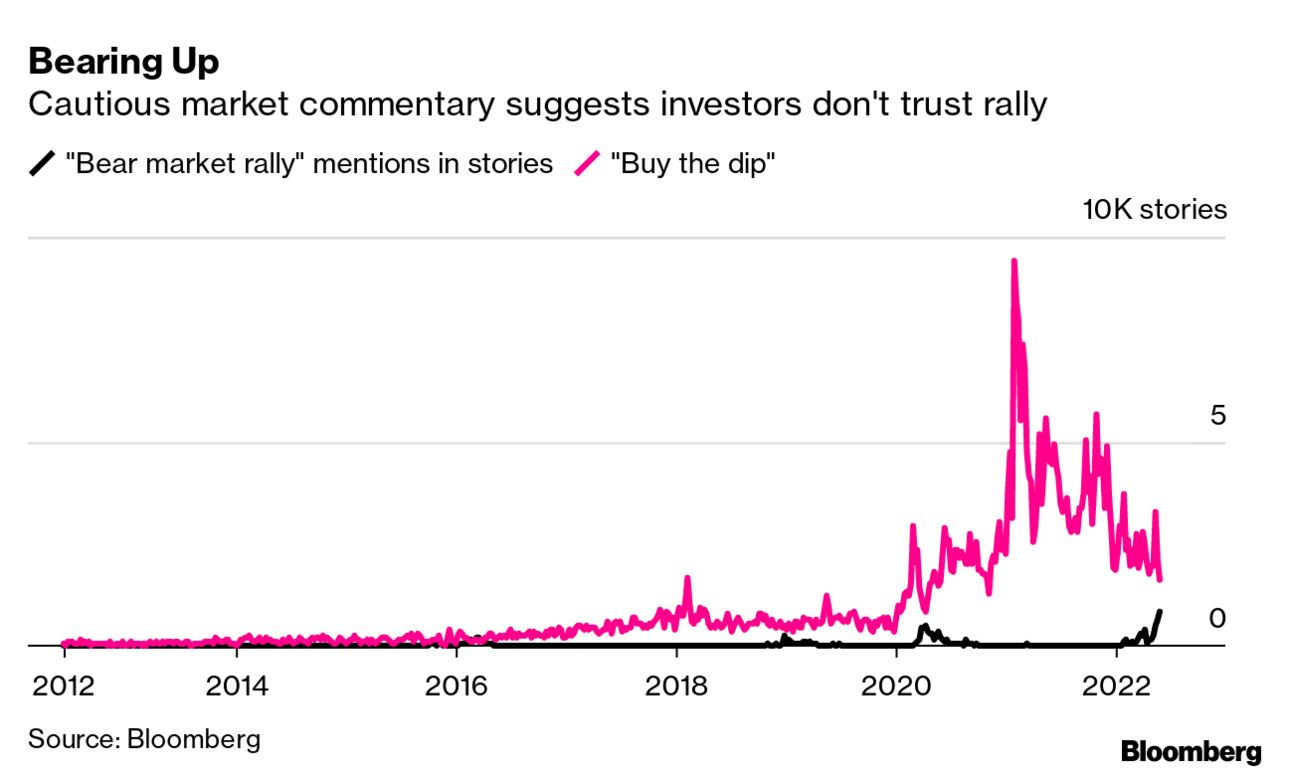

The announcement, made at a State Council meeting chaired by Premier Li Keqiang, comes a month after Xi Jinping ordered an "all-out" infrastructure push. In other China news Shanghai is braced for months of slow recovery from two months locked down; China's top diplomat said Beijing will work with Moscow to promote "real democracy"; and Beijing accused the US of sabotaging China's development. Meta's Sheryl Sandberg, who became one of the most recognized figures in global business after helping Facebook transform from a startup into a multibillion-dollar business, is stepping down as chief operating officer. Javier Olivan, who has led the company's growth efforts for years, will take her place. In an interview with Bloomberg, Sandberg said she wanted to "make more room to do more philanthropically." Shares of Meta slipped 2.6% to $188.64 in New York. The stock has declined 44% this year. (On that, this bearish analyst says now's the time to snap up big tech bargains). Meanwhile the company will ditch its FB stock ticker on June 9, switching it for META and completing a rebranding that began with the new name last year. When the US and its allies unleashed a wave of sanctions on Russia in retaliation for Russia's invasion of Ukraine, President Joe Biden stood in the White House and said they wanted to deal a "powerful blow to Putin's war machine." Well, it hasn't exactly panned out that way. As the war in Ukraine approaches its 100th day, Russia is raking in a flood of cash that could average $800 million a day this year — and that's just from oil and gas. Read our Big Take here, on how the world is funding Putin's war in Ukraine. Distrust of any tentative rebound in global stocks is at the highest in a decade. News story mentions of "bear market rally" are at the most since at least 2012, while those containing "buy the dip" have slumped to the lowest since 2020. That's according to articles from all sources that have appeared on the Bloomberg Terminal. Risks to the global economy and corporate earnings from stubbornly high inflation are the most commonly cited reasons for the pessimism, with analysts from banks and investment firms including Morgan Stanley, Bank of America and Oppenheimer expecting more losses in stocks ahead.  For Gavekal's Anatole Kaletsky, Russia's invasion of Ukraine was the tipping point for triggering a new investment era, turning him "from a permabull to an unequivocal bear," according to a note this week. Stock bulls will counter that "buy the dip" stories still outnumber "bear market rally" ones by about two to one. And bear-market rallies can be intense. But the wall of worry global equities need to climb looks to be rising faster than the stocks themselves. Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. |

No comments:

Post a Comment