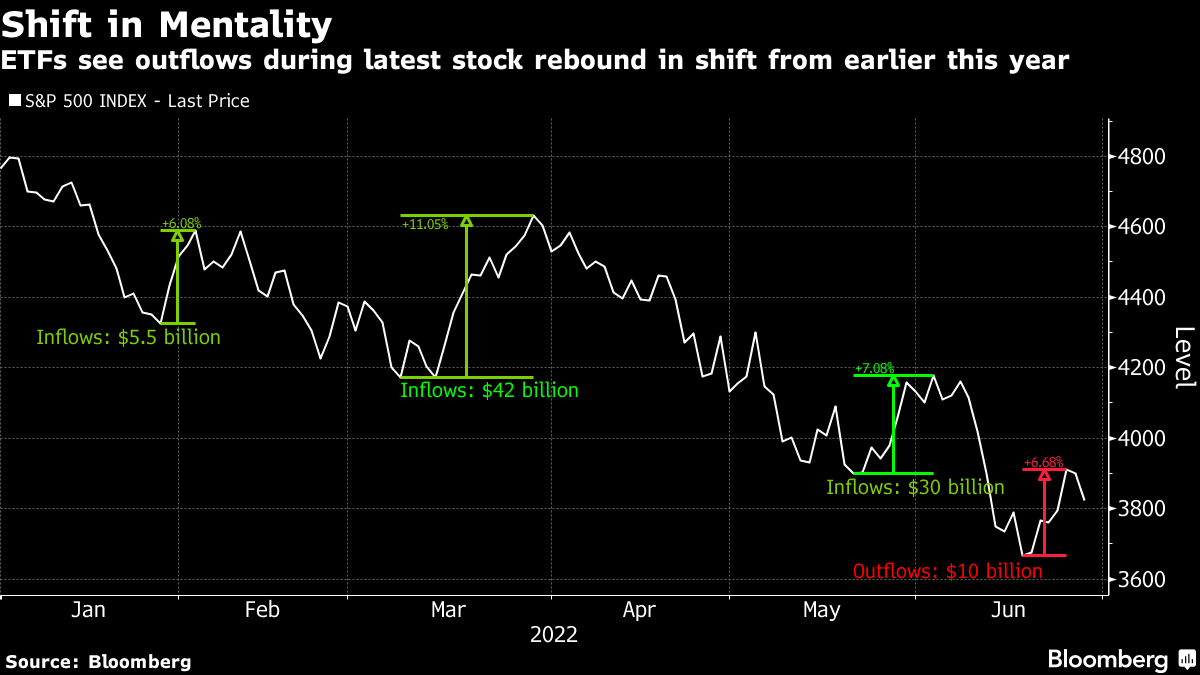

| Good morning. Finland, Sweden closer to NATO entry, end of internal combustion engine era draws closer, Tesla lays off staff, and Scotland ratchets up independence push. Here's what people are talking about. Finland and Sweden took a major step on their way to NATO membership after Turkey dropped its opposition to their bids, all but ensuring the military alliance's expansion on Russia's doorstep. The move "sends a very clear message to President Putin,'' NATO Secretary General Jens Stoltenberg said at the start of an alliance summit in Madrid. Turkey agreed to support inviting the two Nordic countries into the military alliance, after receiving pledges from Finland and Sweden addressing its security concerns. Meanwhile, Ukraine says it's not wanted by NATO. European Union countries endorsed a push to eliminate carbon emissions from new cars by 2035, effectively heralding the end of the era of the internal combustion engine. Environment ministers struck a deal on the proposal after Italy, home to Ferrari and Automobili Lamborghini, gave up demands for a five-year delay in the EU's plan for automakers to clean up their fleet. The agreement defines member states' negotiating stance for further talks with EU lawmakers on the final shape of a landmark greenhouse gas-reduction package. With EU lawmakers in favor of giving up fossil fuels in the auto industry, it's highly likely that most car companies will have to shift to producing electric models in little more than a decade.  | Tesla laid off hundreds of workers on its Autopilot team as the electric-vehicle maker shuttered a California facility. About 200 workers were let go in total. Tesla is trimming its ranks amid a bleak economic environment, after a surge in hiring in recent years. As recently as last week, Chief Executive Officer Elon Musk had outlined plans to cut 10% of salaried staff but said he'd be increasing hourly jobs. The majority of those who were let go were hourly workers. Scotland will seek the legal backing for a referendum on independence next year, escalating a standoff with the government in London that risks throwing the UK into constitutional turmoil. First Minister Nicola Sturgeon is accelerating the process of getting the necessary legislation for a vote tested in court before it heads to the Scottish Parliament. The referendum bill, which envisages a vote on Oct. 19 next year, was referred to the UK Supreme Court by Scotland's chief legal officer. European futures are down after stocks dropped in Asia on renewed worries about a gloomy economic outlook. H&M is scheduled to report earnings on Wednesday. Expected data include Swedish manufacturing and consumer confidence, as well as inflation from Spain, Belgium and Germany. Stateside, US GDP is due. Federal Reserve Chair Jerome Powell, European Central Bank President Christine Lagarde, Bank of England Governor Andrew Bailey and Bank for International Settlements General Manager Agustín Carstens are due to speak on a panel at the ECB forum in Portugal. This is what's caught our eye over the past 24 hours. Veteran stock traders are still waiting for the big capitulation that often comes at a bear-market bottom but at least a few signs are emerging of a shift in investor mentality that suggests we may be be closer to that point. Last week's rebound in the US stock market was accompanied for the first time this year by a wave of exchange-traded fund selling -- a departure from the buy-the-dip inflows that greeted previous rallies. As my colleagues Lu Wang and Vildana Hajric noted, roughly $10 billion was pulled out of equity funds, compared with $30 billion poured in during a bounce in May and $42 billion in a rebound in March, data compiled by Bloomberg show. The flip to a sell-the-rally stance from buy-the-dip bullishness is one indication of a bear market, but purging investors of positivity can counter-intuitively help build a floor. The problem is we could still be early in that process and have yet to see an ``all hope is lost'' washout that could help bring it to an end. Until we do -- or at least see signs of larger more sustained outflows -- it's prudent to expect more downside.

Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo.

|

No comments:

Post a Comment